Last week #Bitcoin had five red candles in a row...

In those times you can choose to do one of two things:

Panic sell as if you were equipped with paper hands.

OR

Think rationally about what’s behind the price drop and act accordingly.

Time for a thread 🧵

In those times you can choose to do one of two things:

Panic sell as if you were equipped with paper hands.

OR

Think rationally about what’s behind the price drop and act accordingly.

Time for a thread 🧵

1/ In a downturn, only two questions matter:

i. Is this correction the result of some event that is invalidating your investment thesis?

ii. Is this correction different than anything else we’ve seen in the past?

Indeed...

i. Is this correction the result of some event that is invalidating your investment thesis?

ii. Is this correction different than anything else we’ve seen in the past?

Indeed...

2/ If your investment thesis is wrong, then there is no point staying in your position. Sell and move on.

If the correction is completely unheard of, then you need to dig deeper on the first question to see if you haven’t missed anything.

But...

If the correction is completely unheard of, then you need to dig deeper on the first question to see if you haven’t missed anything.

But...

3/ ...if you answer no to these two questions then you are better served by either buying the dip or sitting on your hands.

So which is it?

So which is it?

4/ What triggered the correction?

I'm not sure.

Take some over leveraged long positions, a bit of sell the news after Coinbase got listed and a rumour about an 80% crypto tax in the US.

Shake well, add a drop of fear, a pinch of doubt and you get a selloff.

I'm not sure.

Take some over leveraged long positions, a bit of sell the news after Coinbase got listed and a rumour about an 80% crypto tax in the US.

Shake well, add a drop of fear, a pinch of doubt and you get a selloff.

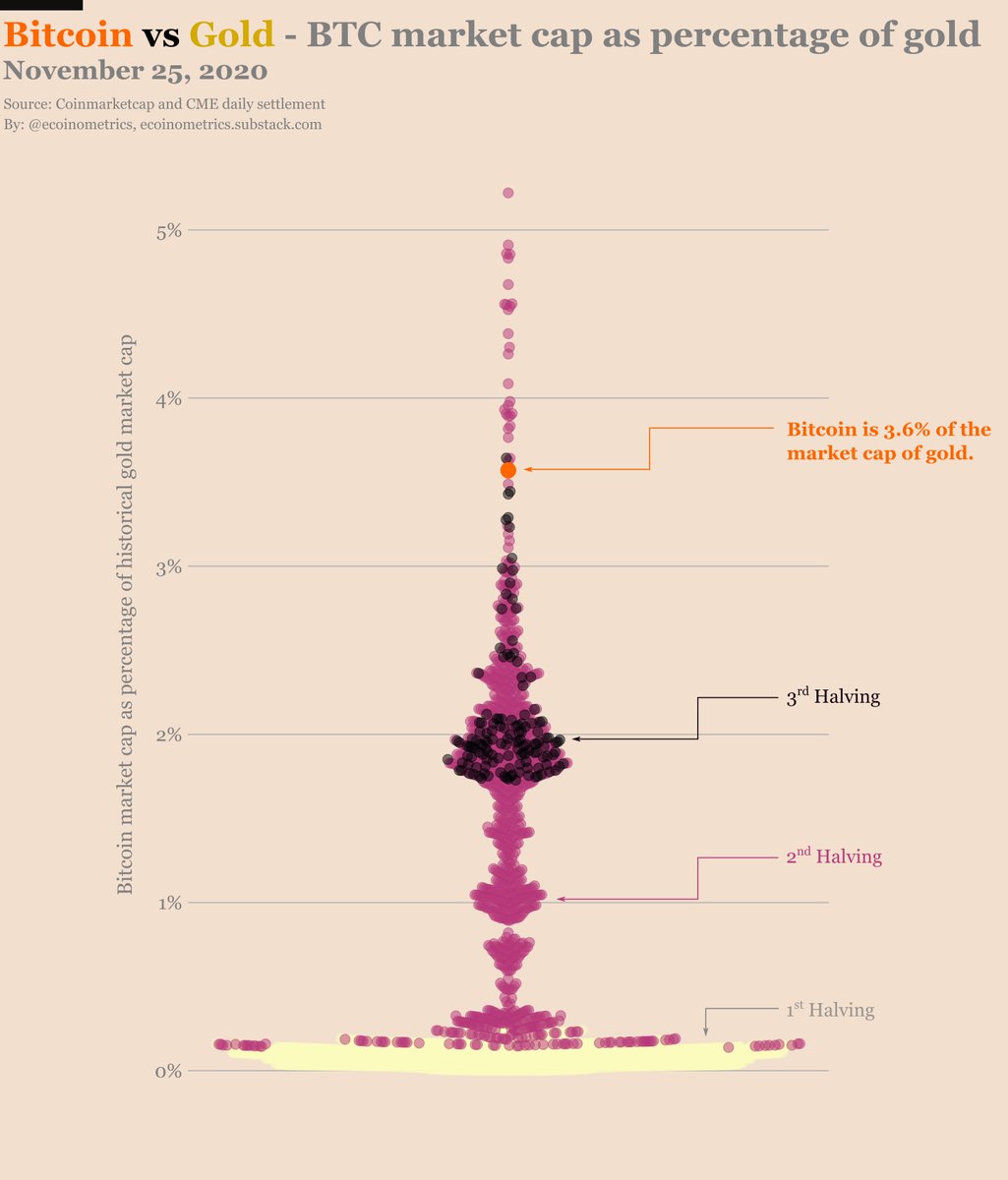

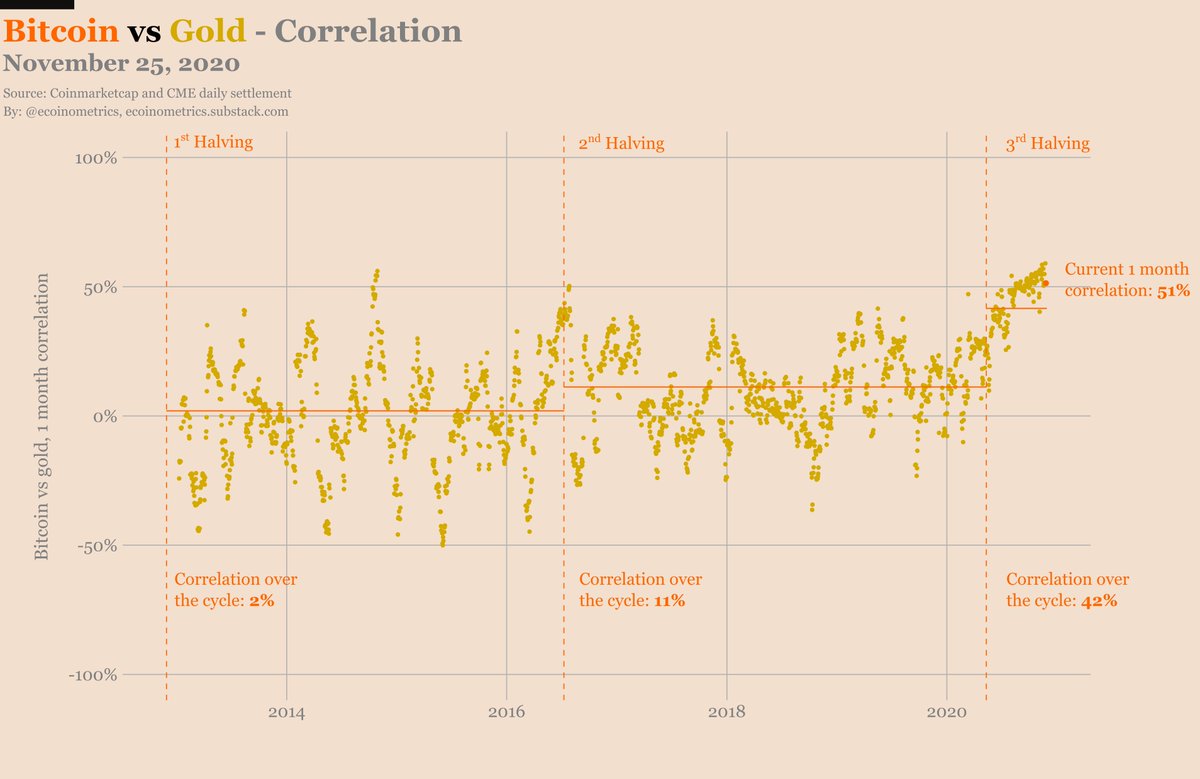

5/ Now say your investment thesis looks something like: #Bitcoin is digital gold and in the foreseeable future growth is driven by adoption.

Then nothing related to this correction is a serious problem.

So what about the technicals of the dip?

Then nothing related to this correction is a serious problem.

So what about the technicals of the dip?

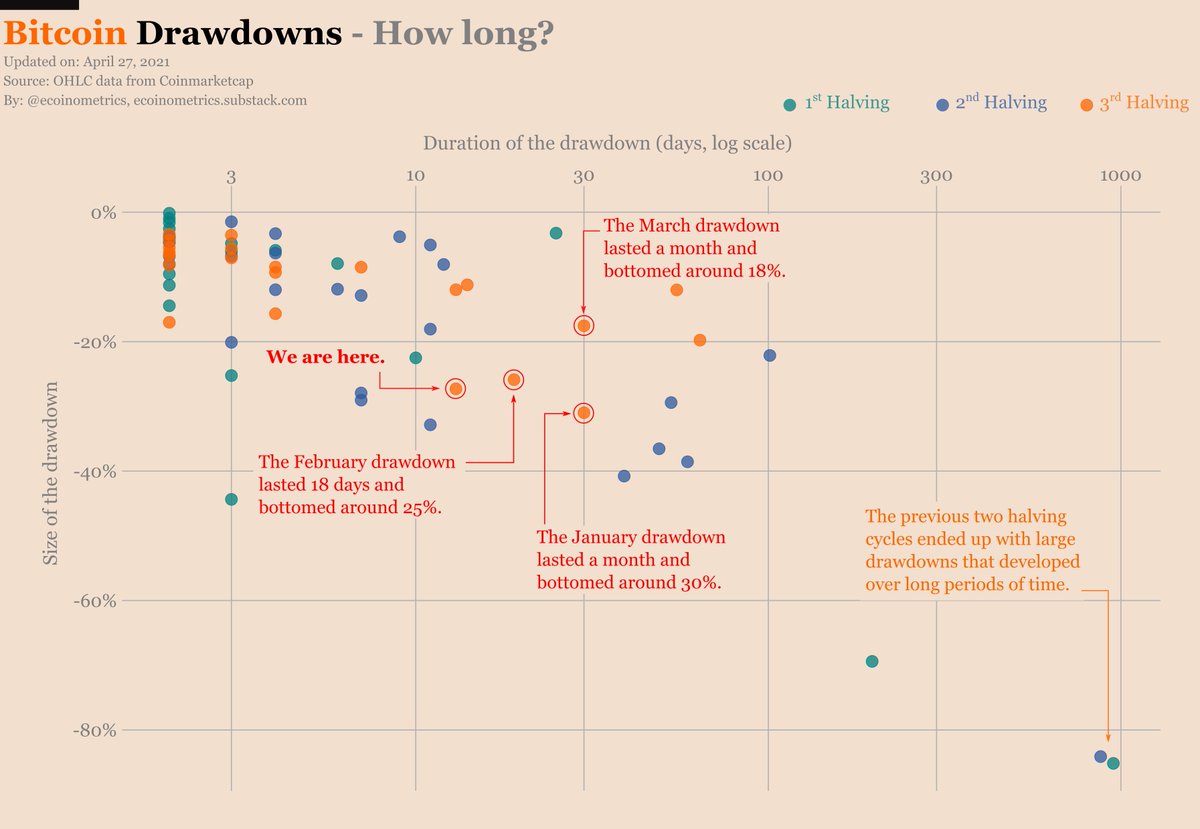

6/ #BTC dropped 27% over two weeks. In terms of duration and intensity there is nothing special about that.

Actually the drawdowns of this halving cycle are very similar to what happened four years ago.

See for yourself.

Actually the drawdowns of this halving cycle are very similar to what happened four years ago.

See for yourself.

7/ And when it comes to the price trajectory, this correction does not stand out among the previous ones either.

If anything, it looks like for each new cycle the dips are getting more shallow.

Check it out.

If anything, it looks like for each new cycle the dips are getting more shallow.

Check it out.

8/ So there is nothing indicating that this time is different for #Bitcoin.

Conclusion: stack sats and move on.

If you want to learn more on the topic then go check out the latest issue of the Ecoinometrics newsletter.

👇👇👇

ecoinometrics.substack.com/p/ecoinometric…

Conclusion: stack sats and move on.

If you want to learn more on the topic then go check out the latest issue of the Ecoinometrics newsletter.

👇👇👇

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh