Yesterday we published a special State of the Network: 100 Insights for the 100th issue.

Mega-🧵 part one:

Here's part two!

1/25

Mega-🧵 part one:

https://twitter.com/coinmetrics/status/1387044921366900737

Here's part two!

1/25

Excluding Coinbase, over the last 100 days, the average daily BTC inflow to major exchanges was about $1.41B.

The average daily BTC outflow over the last 100 days was $1.46B.

2/

The average daily BTC outflow over the last 100 days was $1.46B.

2/

There are:

- 9.14M addresses with at least 0.01 BTC.

- 816.8K addresses with at least 1 BTC.

- 2,242 addresses with at least 1K BTC.

3/

- 9.14M addresses with at least 0.01 BTC.

- 816.8K addresses with at least 1 BTC.

- 2,242 addresses with at least 1K BTC.

3/

There are (cont):

- 14.86M addresses with at least 0.01 ETH.

- Over 1.23M addresses with at least 1 ETH.

- 1,308 addresses with at least 10K ETH

4/

- 14.86M addresses with at least 0.01 ETH.

- Over 1.23M addresses with at least 1 ETH.

- 1,308 addresses with at least 10K ETH

4/

The top 1% of BTC addresses (including exchanges) hold about 91% of total supply.

The top 1% of ETH addresses (including exchanges) hold about 97% of total supply.

Addresses holding less than 1 BTC collectively hold about 5% of total BTC supply.

5/

The top 1% of ETH addresses (including exchanges) hold about 97% of total supply.

Addresses holding less than 1 BTC collectively hold about 5% of total BTC supply.

5/

There's currently 156.94K wrapped BTC (WBTC) on Ethereum.

6/

6/

It took about 2.5 years for stablecoin supply to grow from 1B to 10B. It took less than a year to grow from 10B to over 75B.

7/

7/

Total stablecoin supply is on pace to pass 100B before the end of 2021.

8/

8/

In 2021 so far:

The amount of Tether on Ethereum has increased from 13.54B to 24.42B.

The amount of Tether on Tron has increased from 6.8B to 26B.

9/

The amount of Tether on Ethereum has increased from 13.54B to 24.42B.

The amount of Tether on Tron has increased from 6.8B to 26B.

9/

In 2021 (cont):

USDC supply has increased from 4.1B to 13.7B.

DAI supply (ERC-20) has increased from 1.2B to 3.5B.

10/

USDC supply has increased from 4.1B to 13.7B.

DAI supply (ERC-20) has increased from 1.2B to 3.5B.

10/

In the last year:

Addresses with at least $1 worth of stablecoins are over 5.48M, up from 1.25M.

Addresses with ≥$100 worth of stablecoins are up to 5,258 from 766.

11/

Addresses with at least $1 worth of stablecoins are over 5.48M, up from 1.25M.

Addresses with ≥$100 worth of stablecoins are up to 5,258 from 766.

11/

Millionaire's club:

4,035 addresses hold ≥$1M of Tether, 894 hold at least $1M of USDC, and 219 hold at least $1M of DAI.

12/

4,035 addresses hold ≥$1M of Tether, 894 hold at least $1M of USDC, and 219 hold at least $1M of DAI.

12/

Bitcoin miners have earned a total of $26.75B.

Ethereum miners have earned a total of $13.71B.

Bitcoin Cash miners have earned a total of $1.24B.

Ethereum Classic miners have earned a total of $408.16M

13/

Ethereum miners have earned a total of $13.71B.

Bitcoin Cash miners have earned a total of $1.24B.

Ethereum Classic miners have earned a total of $408.16M

13/

Smart contracts:

- ERC-20: 318.50K

- ERC-721: 20.18K

There's currently 25.83M ETH held by smart contracts, about 22% of total supply.

An average of 3.96M ETH has been transferred by smart contracts per day over the last 100 days.

14/

- ERC-20: 318.50K

- ERC-721: 20.18K

There's currently 25.83M ETH held by smart contracts, about 22% of total supply.

An average of 3.96M ETH has been transferred by smart contracts per day over the last 100 days.

14/

BTC hash rate has grown by 20% since the start of 2021.

ETH hash rate has grown by 89% since the start of 2021.

Bitcoin accounts for about 98% of the total combined hash rate generated by miners of Bitcoin, Bitcoin Cash, and Bitcoin SV.

15/

ETH hash rate has grown by 89% since the start of 2021.

Bitcoin accounts for about 98% of the total combined hash rate generated by miners of Bitcoin, Bitcoin Cash, and Bitcoin SV.

15/

Bitcoin miners collectively hold 4.57M BTC, about 25% of total supply.

About 27.45% of Bitcoin hash rate is contributed by Antminer S9 hardware.

16/

About 27.45% of Bitcoin hash rate is contributed by Antminer S9 hardware.

16/

Over the last 100 days, Bitcoin has had an average of 601.77 seconds between new blocks.

Over the same period Ethereum has had an average of 13.30 seconds between new blocks.

17/

Over the same period Ethereum has had an average of 13.30 seconds between new blocks.

17/

BTC perpetual futures open interest hit an all-time high of over $3.8B on Binance in April, 2021.

BTC perpetual futures funding rate has averaged 50.85 APR over the course of 2021.

18/

BTC perpetual futures funding rate has averaged 50.85 APR over the course of 2021.

18/

An all-time high of over $2B worth of BTC longs were liquidated on April 18th, 2021.

An all-time high of over $500M worth of BTC shorts were liquidated on February 8th, 2021.

19/

An all-time high of over $500M worth of BTC shorts were liquidated on February 8th, 2021.

19/

About 18% of BTC transactions have been sent to exchanges over the last 100 days (excluding Coinbase).

BTC transactions to exchanges peaked at 56% of total transactions on January 4th, 2018.

20/

BTC transactions to exchanges peaked at 56% of total transactions on January 4th, 2018.

20/

At least 1.49M BTC is currently held on major centralized exchanges (excluding Coinbase).

The amount of BTC held on centralized exchanges peaked at 1.69M on March 12th, 2020.

21/

The amount of BTC held on centralized exchanges peaked at 1.69M on March 12th, 2020.

21/

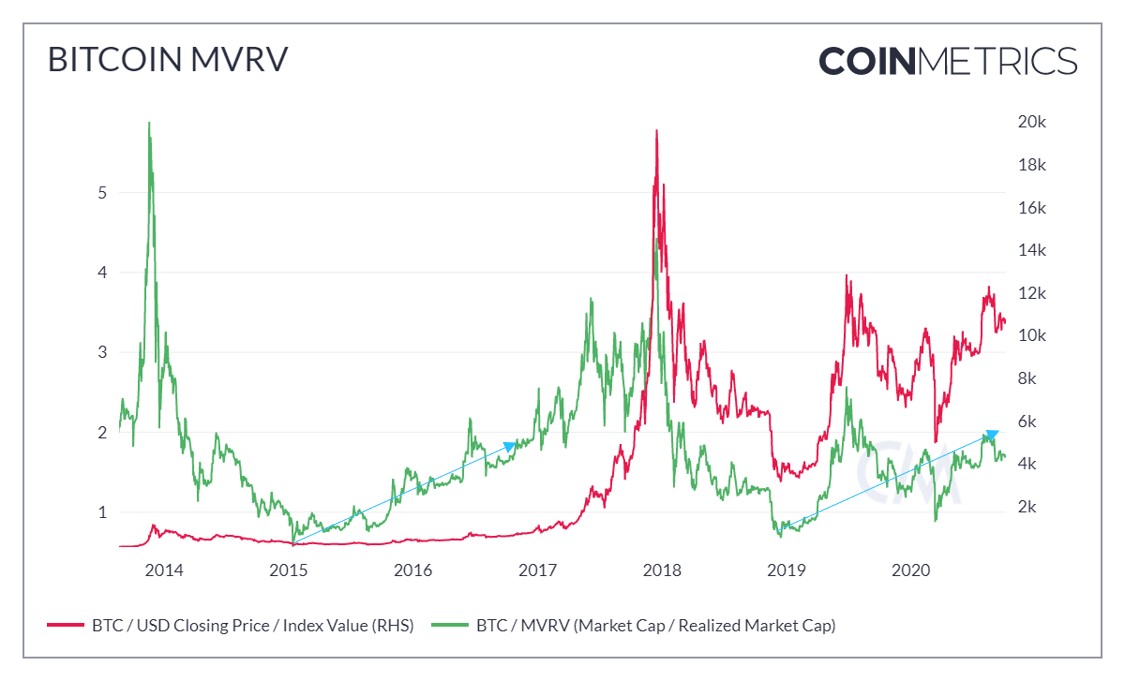

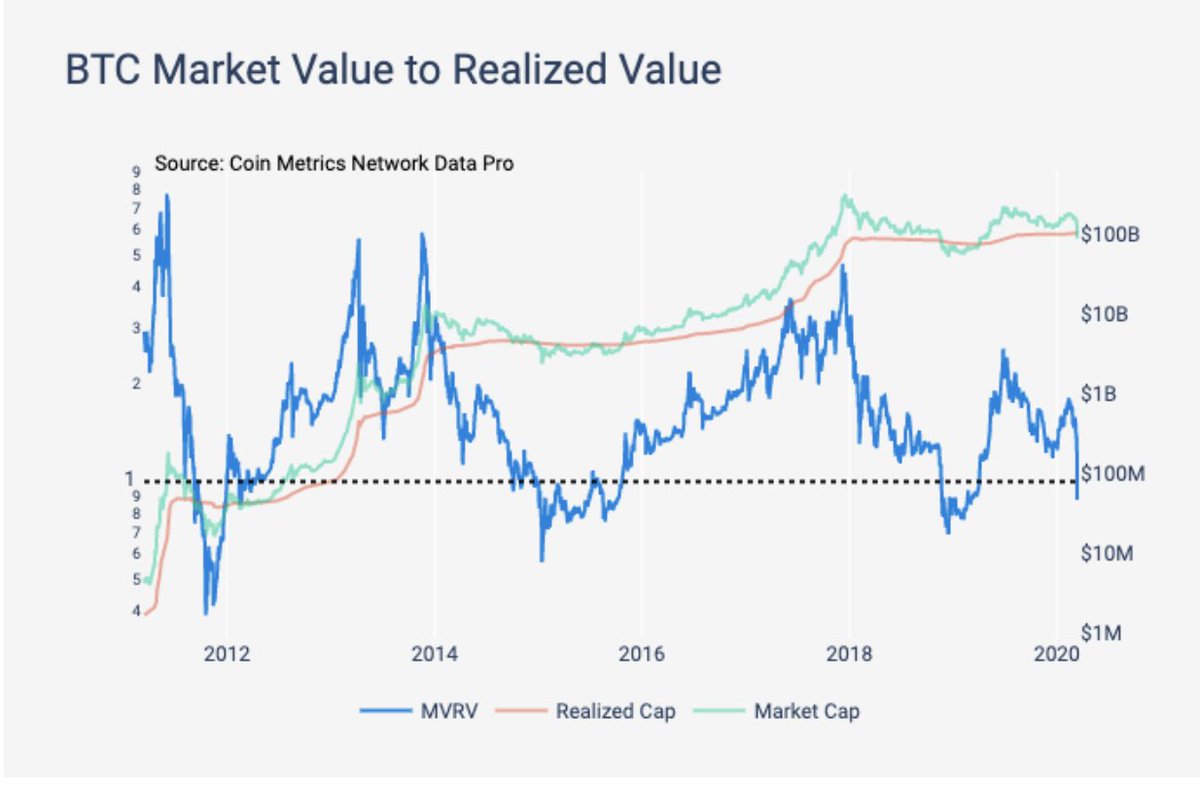

Bitcoin market value to realized value ratio (MVRV) has dropped below 1.0 only six times over the last two years...

22/

22/

...if you had bought $100 of BTC each of those six days ($600 total investment) it would be worth over $5,600 today.

23/

23/

The last time you could buy 1 BTC for less than $100 was August 18th, 2013.

24/

24/

It's been our pleasure to bring you 100 issues of data-driven insights in State of the Network!

Read the full 100th issue online and subscribe to get the latest in network trends & analysis in your inbox every Tuesday.

25/25

coinmetrics.substack.com/p/coin-metrics…

Read the full 100th issue online and subscribe to get the latest in network trends & analysis in your inbox every Tuesday.

25/25

coinmetrics.substack.com/p/coin-metrics…

• • •

Missing some Tweet in this thread? You can try to

force a refresh