Thread: In a factory somewhere on the outskirts of Birmingham sits a machine which tells you rather a lot about the UK economy & where it's heading. It cuts & presses little bits of copper alloy, which are then sent on to another company which puts them into car rear view mirrors

If you buy a car with a heated rear view mirror anywhere in the world, chances are it’ll be powered by those copper electrodes made just outside Birmingham by @CBrandauer - in that very machine. It’s a crucial cog in an automotive supply chain that bestrides the world.

But the reason it’s worth focusing on that machine is not so much what it does but why it’s there. @CBrandauer bought it in part because of the new Super Deduction policy introduced by @RishiSunak in March’s Budget. The deduction could be a v big deal indeed.

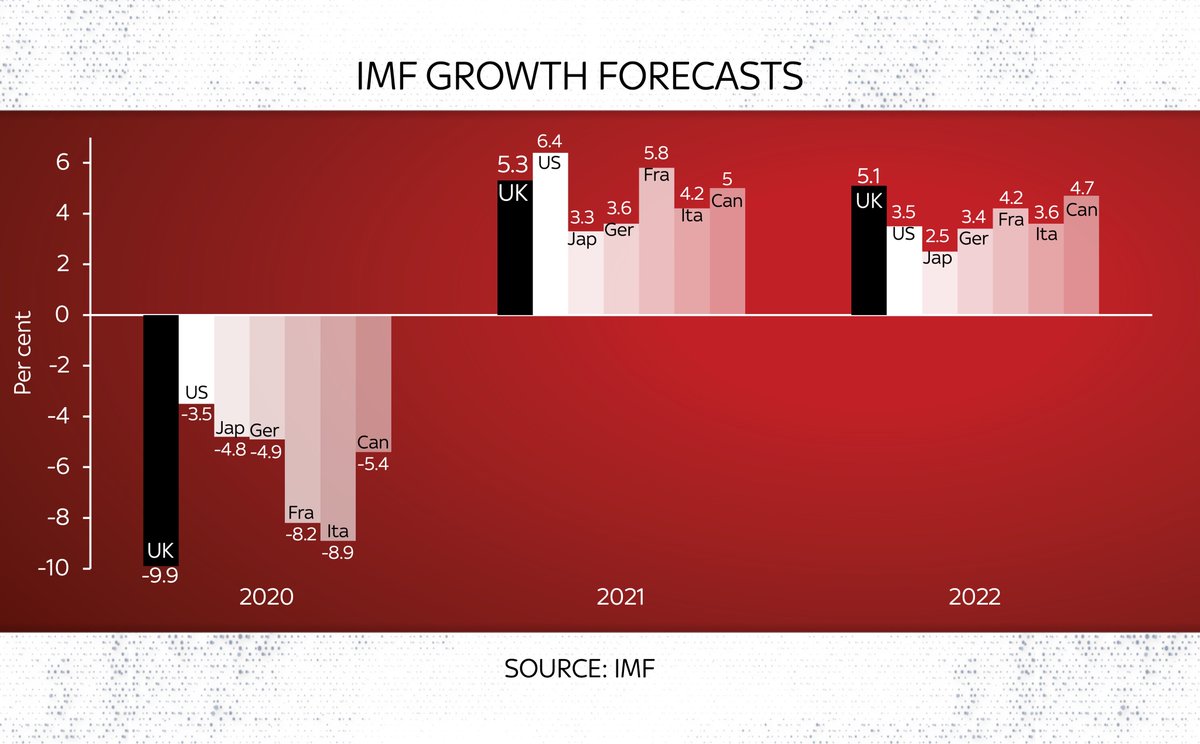

It was partly the super deduction which prompted the @bankofengland to raise their growth forecast for this year to the fastest peacetime rate since 1927. Economists think total business investment this year could exceed 10%. That’s a v high number (esp by recent standards).

Here’s how the policy works (bear with me - bit complicated but as you’ll see a bit further down, the details matter). Most companies investing in machinery can currently deduct up to 100% of the value against tax. This policy means they can deduct 130% of the value. An example:

Worth adding: there is an Annual Annual Investment Allowance, which means if you’re a big company you won’t be able to write off 100% of your investments - maybe only a fraction - but the broad point is super deduction means you can write off 30% extra corporation tax. Hurrah!

“We’ve never tried this before!

Bold, unprecedented action!”

said @RishiSunak when unveiling the policy in the Budget (in which he also said corporation tax would go up from 19% to 25% in 2023 - also an unprecedented % increase in this business tax)

Bold, unprecedented action!”

said @RishiSunak when unveiling the policy in the Budget (in which he also said corporation tax would go up from 19% to 25% in 2023 - also an unprecedented % increase in this business tax)

And for @CBrandauer and many companies around the country the super deduction is already incentivising them to invest. The machine costs about £230,000 and thanks to the super deduction they’ve been able to write off £70k in taxes. It helped encourage a big investment decision

But many other companies we’ve spoken to say while the deduction helps, it’s mostly just meaning they’re making investments they might have made eventually, but a little bit earlier. Given investments often generate extra income that might be a good thing economically. But…

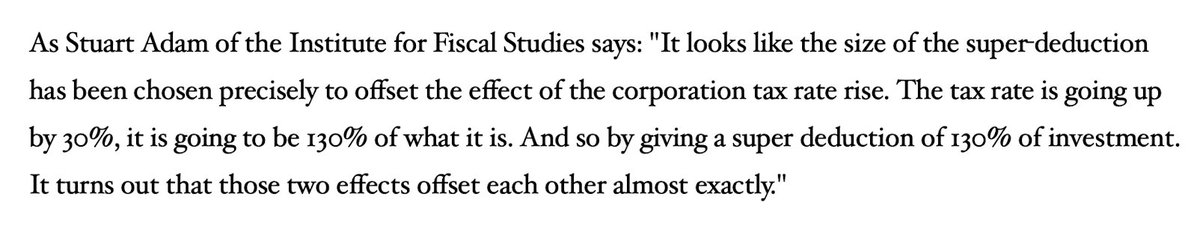

Here’s the thing: the super deduction isn't happening in isolation. And it’s not permanent. It only lasts until 2023. When corporation tax also rises to 25%. Why? Well if you spend enough time contemplating the numbers, as boffins at @TheIFS have, you find something intriguing.

Think about it: the amount you can deduct against your investments doesn’t just depend on the cost of the investment and the investment allowance/deduction, but the RATE OF TAX. Paradoxically, the higher the tax rate the more, proportionally, you can deduct…

…so if you make an investment under a low tax rate and suddenly the tax rate goes up (so you’re paying a higher rate on your profits than the rate at the time of the investment/deduction) then you lose out.

Think about that example of the scissors earlier. You buy them for £100. You expect to make £105 from that investment.

But, post deduction and tax, you’re putting in £81 (£100 with 19% written off) and earning £78.75 (£105 minus 25% corp tax).

Investment not worth it.

But, post deduction and tax, you’re putting in £81 (£100 with 19% written off) and earning £78.75 (£105 minus 25% corp tax).

Investment not worth it.

Anyway. What is the percentage change from 19% to 25%? Answer: just over 30%. Or, to put it another way, in 2023 the corp tax rate will be about 130% of its current level.

Hmm.

What is the super deduction rate?

130%

Hmm…

Hmm.

What is the super deduction rate?

130%

Hmm…

Here’s Stuart Adam of @TheIFS. Far from being a “bold, unprecedented” move, the super deduction might be better described as a clever policy reverse engineered to prevent a catastrophic fall in investment as corp tax rises.

Now that’s all fair enough. And worth making a couple of points: some smaller companies won’t see corp tax rise. So they’ll benefit both ends. And even if this has simply shifted forwards investment, that’s not necessarily neutral. It could boost growth.

But it does indicate that the super deduction might not be quite as super as the branding might have had you believe. To be clear: this is not a criticism. But there’s more going on beneath the surface than you might have thought: news.sky.com/story/why-rish…

Also worth bearing in mind there are plenty of other things boosting biz investment right now: post-COVID investments (change in working patterns). Companies also now finally investing post-Brexit uncertainty. All of this will help boost GDP this year and next

Here's my TV report on the super deduction. Certainly big. Certainly a part of the story of rising investment spending. But not, perhaps, quite as super as you might have been led to believe

• • •

Missing some Tweet in this thread? You can try to

force a refresh