1. Straddle vs Triple Straddle: Is there a benefit?

Data says, yes. Small benefit but there is some benefit. Especially when it comes to sharp moves on one side (Gap UP/Down) - Triple straddle stands better than a single straddle.

Data says, yes. Small benefit but there is some benefit. Especially when it comes to sharp moves on one side (Gap UP/Down) - Triple straddle stands better than a single straddle.

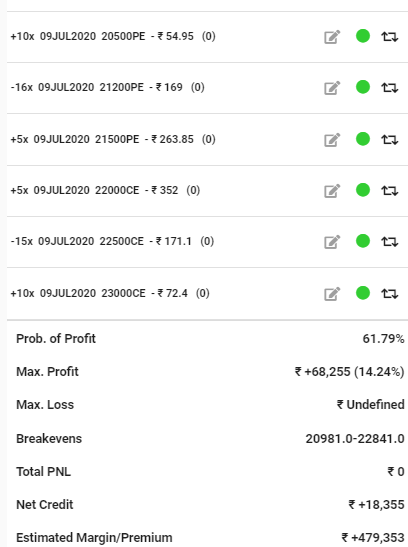

2. Single straddle at 32200 for May 20 expiry : 6Lots

Triple straddles at 32200, 32600 and 31700 : 2 Lots each.

At the center there is not much diff between the two. Similar Greeks (Theta & Vega mainly)

But look at the payoff profile. Triple straddle provides a much ...

Triple straddles at 32200, 32600 and 31700 : 2 Lots each.

At the center there is not much diff between the two. Similar Greeks (Theta & Vega mainly)

But look at the payoff profile. Triple straddle provides a much ...

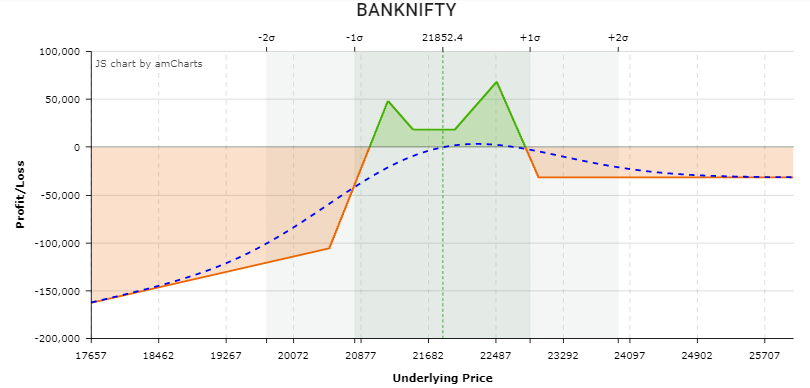

3. ...Distributed profile which means the payout at expiry is not concentrated at one single point like a single straddle, but is spread over a range. Something like a strangle.

Psychologically, that gives comfort during a little extra volatility in the markets, ...

Psychologically, that gives comfort during a little extra volatility in the markets, ...

4. avoiding a couple of adjustments...

But a little more comfort comes from the fact that if market move too fast in one direction, or gaps up/down, MTM loss will be lower in triple straddles as compared to single straddle. Why? ...

But a little more comfort comes from the fact that if market move too fast in one direction, or gaps up/down, MTM loss will be lower in triple straddles as compared to single straddle. Why? ...

5. I think thats because of how gamma behaves in case of an ITM option.

Lower MTM loss is a psychological comfort I tell you.

And look at the theta at this point. Almost same.

I have created this today (Friday),so, see how weekend decay looks like for the two system.

...

Lower MTM loss is a psychological comfort I tell you.

And look at the theta at this point. Almost same.

I have created this today (Friday),so, see how weekend decay looks like for the two system.

...

6. One issue that is rightly raised is regarding higher slippages. I agree that would be the case if you are going too deep in the option chain.

Practically, 500 points ITM on Banknifty is not too deep to create too much issue with slippages.

Practically, 500 points ITM on Banknifty is not too deep to create too much issue with slippages.

7. Yes, handling multiple strikes could be an issue. However, personally, I have been doing this using Sensibull, and it does make it a lot easier to handle.

8. At the end, trade the system with which you are comfortable. If you cant handle triple straddle, it does not matter even if its the best system in the world. Same goes for single straddle or any other setup.

• • •

Missing some Tweet in this thread? You can try to

force a refresh