Was this the top for #Bitcoin? Or just the start of something bigger?

A thread.

I will look at different factors (fundamentals & TA) for $BTC as well as #cryptocurrency in general and come to my own conclusions at the end.

(1/15)

A thread.

I will look at different factors (fundamentals & TA) for $BTC as well as #cryptocurrency in general and come to my own conclusions at the end.

(1/15)

First, the bull case:

- EIP 1559 coming up in Jul/Aug for #Ethereum.

Markets usually don’t crash before such a highly anticipated fundamental driver.

Counterpoint: could also see the complacency shoulder coming right into this event.

(2/15)

- EIP 1559 coming up in Jul/Aug for #Ethereum.

Markets usually don’t crash before such a highly anticipated fundamental driver.

Counterpoint: could also see the complacency shoulder coming right into this event.

(2/15)

- Big players have bought the dip (or keep #HODLing) and seem positive about upside price potential.

Be it @michael_saylor, @CathieDWood, @novogratz or @elonmusk… just to name a few.

(3/15)

Be it @michael_saylor, @CathieDWood, @novogratz or @elonmusk… just to name a few.

(3/15)

- This sell-off was one giant liquidation event. Leveraged positions got wiped, patient spot buyers got their fills.

Counterpoint: any $BTC macro top is a huge liquidation event, simply due to its volatility

(4/15)

Counterpoint: any $BTC macro top is a huge liquidation event, simply due to its volatility

(4/15)

- Nothing has really changed in the bigger picture for #Crypto.

Economic outlook stays the same, stock market is still in tact. Everything bubble keeps bubbling.

(7/15)

Economic outlook stays the same, stock market is still in tact. Everything bubble keeps bubbling.

(7/15)

- #Google searches for #Bitcoin don’t exceed 2017 madness, yet market cap does.

Counterpoint: Google searches can’t grow exponentially forever, increases will become smaller over time.

(8/15)

Counterpoint: Google searches can’t grow exponentially forever, increases will become smaller over time.

(8/15)

Now on to the bear case:

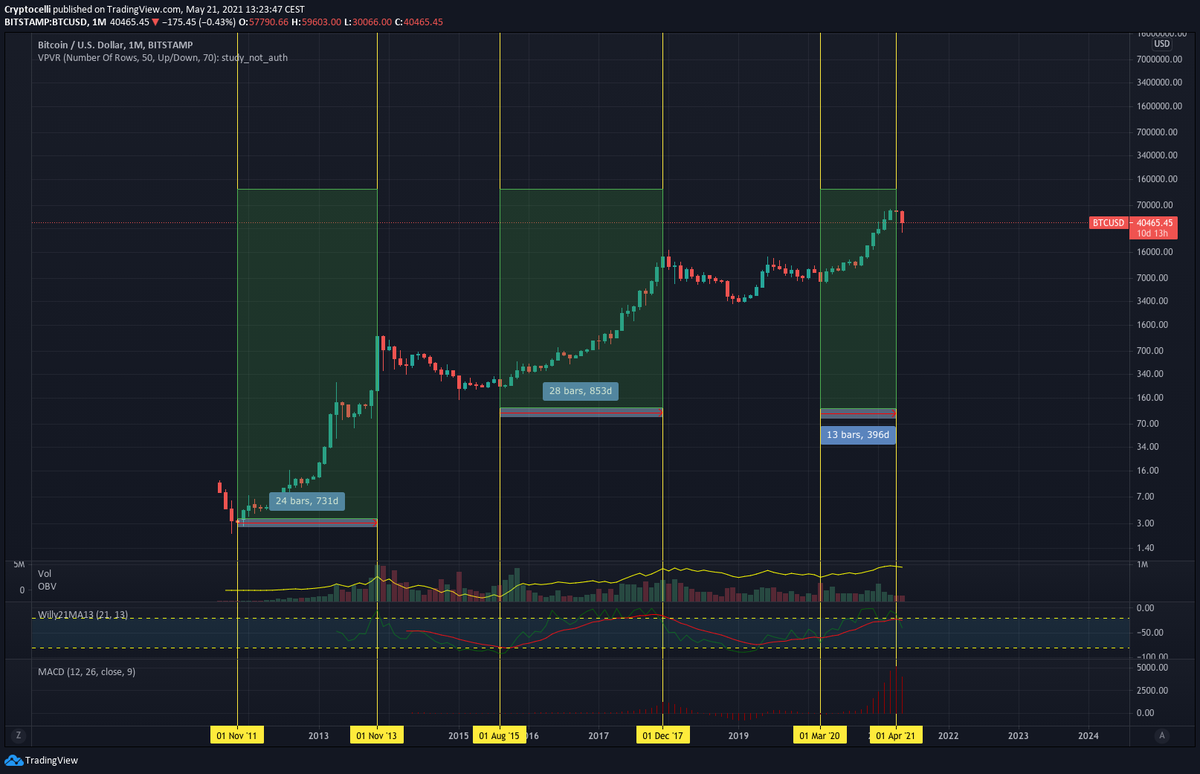

- In the last 2 out of 3 cases, drops of 60% after breaking ATHs has marked a local top on $BTC.

(9/15)

- In the last 2 out of 3 cases, drops of 60% after breaking ATHs has marked a local top on $BTC.

(9/15)

Counterpoint: From a psychological stand point this 60% correction on #Bitcoin had the same emotional effect those 40% corrections had in 2017:

Fear the top was in.

(10/15)

Fear the top was in.

(10/15)

As everyone was expecting the same 40% corrections again, the emotional impact of such a $BTC sell-off would've been muted at best.

However, the main purpose of these bloodbaths is to scare participants out of their positions.

Or cringely put: is 60% the new 40%?

(11/15)

However, the main purpose of these bloodbaths is to scare participants out of their positions.

Or cringely put: is 60% the new 40%?

(11/15)

- #tiktokers turning 100 dollars into a million on meme coins.

Counterpoint: last cycle’s top things usually won’t be the next cycle’s top thing.

#shibainu, #CumRocket and #SAFEMOON all felt like peak 2017/18 but not like a blown up version of it.

(12/15)

Counterpoint: last cycle’s top things usually won’t be the next cycle’s top thing.

#shibainu, #CumRocket and #SAFEMOON all felt like peak 2017/18 but not like a blown up version of it.

(12/15)

- #Google trend fractal on #Ethereum...

...looks eerily similar to last cycle’s top in 2017/18.

(13/15)

...looks eerily similar to last cycle’s top in 2017/18.

(13/15)

My two cents:

I don't think we’ve seen the top yet.

Institutions bought the dip. We’re a mere 3x from old ATHs on $BTC and nothing’s changed in the bigger picture.

What I can say, this is not like 2017, however. But then again, 2017 has been nothing like 2013 either.

(14/15)

I don't think we’ve seen the top yet.

Institutions bought the dip. We’re a mere 3x from old ATHs on $BTC and nothing’s changed in the bigger picture.

What I can say, this is not like 2017, however. But then again, 2017 has been nothing like 2013 either.

(14/15)

So #hodl on, frens.

$BTC and $ALTS may need time to clean themselves up, but in #Crypto good things always come to those who wait.

🙏

(15/15)

$BTC and $ALTS may need time to clean themselves up, but in #Crypto good things always come to those who wait.

🙏

(15/15)

• • •

Missing some Tweet in this thread? You can try to

force a refresh