#DeFi was battle-tested in last week's dip, that would have sent TradFi into turmoil.

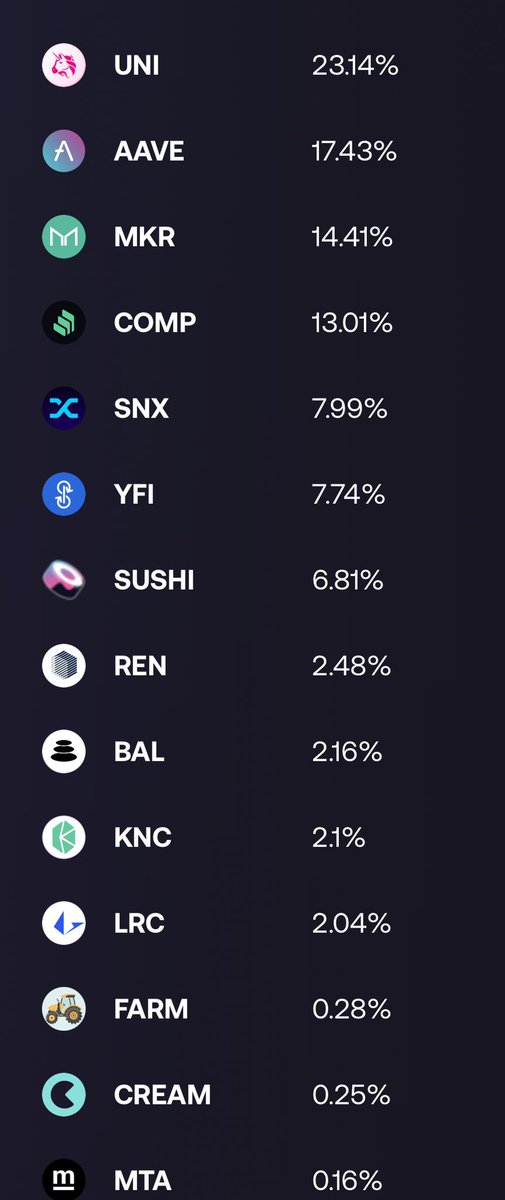

DeFi Pulse Index $DPI gives broad market-cap weighted exposure to blue-chip protocols in the DeFi space.

14 DeFi tokens wrapped into ONE!

Current $DPI allocations 👇 1/16

Video: @earth_maze

DeFi Pulse Index $DPI gives broad market-cap weighted exposure to blue-chip protocols in the DeFi space.

14 DeFi tokens wrapped into ONE!

Current $DPI allocations 👇 1/16

Video: @earth_maze

2/16

$AAVE - #Aave - 21.09%

@AaveAave is a decentralized money market protocol where users lend and borrow crypto using crypto as collateral. Lenders earn interest by providing liquidity, borrowers borrow by collateralizing their crypto to take out loans from the liquidity pools.

$AAVE - #Aave - 21.09%

@AaveAave is a decentralized money market protocol where users lend and borrow crypto using crypto as collateral. Lenders earn interest by providing liquidity, borrowers borrow by collateralizing their crypto to take out loans from the liquidity pools.

3/16

$UNI - #Uniswap - 20.38%

@Uniswap is a DEX that allows users to swap ERC-20 tokens on #Ethereum with no centralized intermediary. Traders are not exposed to the security risks of a centralized exchange. V3 allows for "concentrated liquidity" which limits impermanent loss.

$UNI - #Uniswap - 20.38%

@Uniswap is a DEX that allows users to swap ERC-20 tokens on #Ethereum with no centralized intermediary. Traders are not exposed to the security risks of a centralized exchange. V3 allows for "concentrated liquidity" which limits impermanent loss.

4/16

$MKR - #Maker - 15.76%

@MakerDAO is a smart contract lending platform where users borrow funds by locking-in collateral in exchange for Dai. Functions similar to a bank. It provides loans and charges interest on borrowings denominated in its native stablecoin, Dai.

$MKR - #Maker - 15.76%

@MakerDAO is a smart contract lending platform where users borrow funds by locking-in collateral in exchange for Dai. Functions similar to a bank. It provides loans and charges interest on borrowings denominated in its native stablecoin, Dai.

5/16

$SNX - #Synthetix - 10.23%

@synthetix_io is a synthetic asset issuance protocol. Synthetic assets are derivatives that provide exposure to real world assets. Forex, Commodity (Gold, Silver, Oil), Crypto, Index, Inverse are types of synthetic assets offered by the platform.

$SNX - #Synthetix - 10.23%

@synthetix_io is a synthetic asset issuance protocol. Synthetic assets are derivatives that provide exposure to real world assets. Forex, Commodity (Gold, Silver, Oil), Crypto, Index, Inverse are types of synthetic assets offered by the platform.

6/16

$COMP - #Compound - 9.82%

@compoundfinance is a protocol that allows users to lend or borrow cryptocurrencies. It establishes money markets by pooling assets together and algorithmically setting interest rates based on supply and demand of assets.

$COMP - #Compound - 9.82%

@compoundfinance is a protocol that allows users to lend or borrow cryptocurrencies. It establishes money markets by pooling assets together and algorithmically setting interest rates based on supply and demand of assets.

7/16

$SUSHI - #SushiSwap - 7.76%

@SushiSwap is DEX and Automated Market Maker through which automated trading liquidity is set up between any two cryptocurrency assets. BentoBox (token vaults) and Kashi Lending innovations help diversify from competitors.

$SUSHI - #SushiSwap - 7.76%

@SushiSwap is DEX and Automated Market Maker through which automated trading liquidity is set up between any two cryptocurrency assets. BentoBox (token vaults) and Kashi Lending innovations help diversify from competitors.

8/16

$YFI - #YearnFinance - 7.33%

@iearnfinance provides lending aggregation, yield generation, and insurance. Automates the process of switching capital between lending platforms in search of the best yield offered, as the lending yield is a floating rate rather than fixed rate.

$YFI - #YearnFinance - 7.33%

@iearnfinance provides lending aggregation, yield generation, and insurance. Automates the process of switching capital between lending platforms in search of the best yield offered, as the lending yield is a floating rate rather than fixed rate.

9/16

$REN - #RenProtocol - 1.89%

@renprotocol is a permissionless protocol that allows users to transfer tokens across different blockchains. It's core product, RenVM is focused on building an interoperability solution for DeFi. $RenBTC allows $BTC to be leveraged on #Ethereum.

$REN - #RenProtocol - 1.89%

@renprotocol is a permissionless protocol that allows users to transfer tokens across different blockchains. It's core product, RenVM is focused on building an interoperability solution for DeFi. $RenBTC allows $BTC to be leveraged on #Ethereum.

10/16

$LRC - #Loopring - 1.81%

@loopringorg is a DEX built on #Ethereum Layer-2 (L2) utilizing zkRollups. It has both Automated Market Maker-based and orderbook-based exchanges on L2. zkRollup is an #ETH L2 scaling solution that migrates computations off the blockchain.

$LRC - #Loopring - 1.81%

@loopringorg is a DEX built on #Ethereum Layer-2 (L2) utilizing zkRollups. It has both Automated Market Maker-based and orderbook-based exchanges on L2. zkRollup is an #ETH L2 scaling solution that migrates computations off the blockchain.

11/16

$KNC - #KyberNetwork - 1.68%

@KyberNetwork is a decentralized protocol that facilitates the exchange of tokens and provides liquidity for DeFi applications, decentralized applications (dApps), as well as users. Has integrated with 100+ apps, and powers KyberSwap, it's DEX.

$KNC - #KyberNetwork - 1.68%

@KyberNetwork is a decentralized protocol that facilitates the exchange of tokens and provides liquidity for DeFi applications, decentralized applications (dApps), as well as users. Has integrated with 100+ apps, and powers KyberSwap, it's DEX.

12/16

$BAL - #Balancer - 1.57%

@BalancerLabs is a DEX functioning as a self-balancing weighted portfolio protocol. Compared to a typical constant product AMM model, it uses a generalization formula that could be adjusted to any number of tokens at any amount of weightage.

$BAL - #Balancer - 1.57%

@BalancerLabs is a DEX functioning as a self-balancing weighted portfolio protocol. Compared to a typical constant product AMM model, it uses a generalization formula that could be adjusted to any number of tokens at any amount of weightage.

13/16

$CREAM - #CREAM - 0.36%

@CreamdotFinance is a decentralized lending protocol and DEX (CREAM Swap) that resides on both on #Ethereum and Binance Smart Chain (#BSC). Lending protocol was created as a Compound Finance fork, while CREAM Swap exchange is based on Balancer code.

$CREAM - #CREAM - 0.36%

@CreamdotFinance is a decentralized lending protocol and DEX (CREAM Swap) that resides on both on #Ethereum and Binance Smart Chain (#BSC). Lending protocol was created as a Compound Finance fork, while CREAM Swap exchange is based on Balancer code.

14/16

$FARM - #HarvestFinance - 0.20%

@harvest_finance is an automatic yield farming protocol that helps users take advantage of the latest #DeFi platforms with the highest yield. It aims to help less-savvy users yield farm and get the highest DeFi yield, saving time and money.

$FARM - #HarvestFinance - 0.20%

@harvest_finance is an automatic yield farming protocol that helps users take advantage of the latest #DeFi platforms with the highest yield. It aims to help less-savvy users yield farm and get the highest DeFi yield, saving time and money.

15/16

$MTA - #mStable - 0.11%

@mstable_ is a protocol that unites stablecoins, lending, and swapping into one robust standard, making it a stablecoin infrastructure. $mUSD is a stablecoin backed by $USDT, $USDC, $sUSD, and $TUSD. Users can convert $mUSD to $imUSD to earn returns.

$MTA - #mStable - 0.11%

@mstable_ is a protocol that unites stablecoins, lending, and swapping into one robust standard, making it a stablecoin infrastructure. $mUSD is a stablecoin backed by $USDT, $USDC, $sUSD, and $TUSD. Users can convert $mUSD to $imUSD to earn returns.

16/16

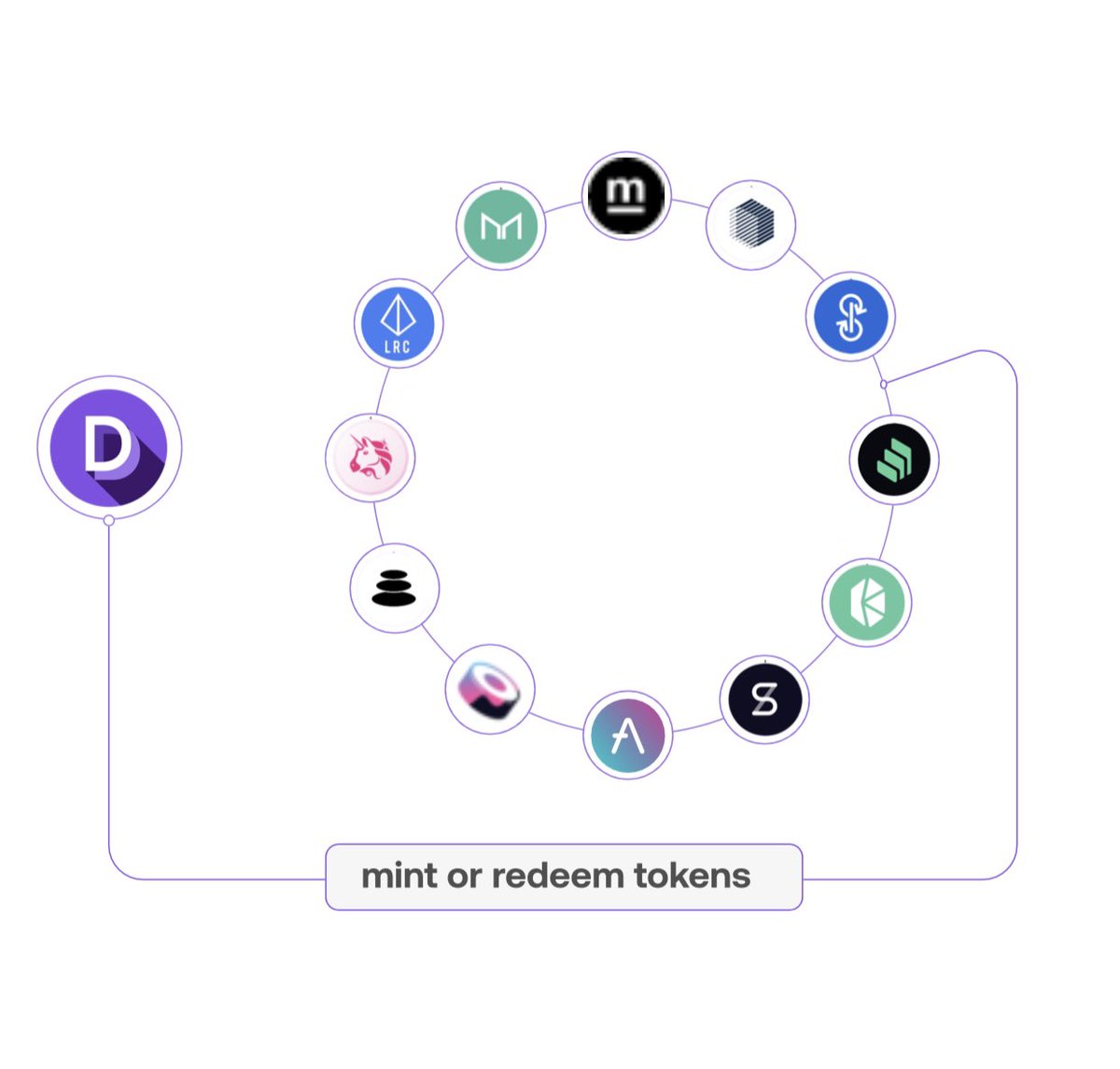

14 DeFi Tokens all wrapped into ONE

- S&P 500 of DeFi

- Strict/transparent token inclusion criteria

- Redeem underlying tokens any time

- Market-cap weighted index

- Auto-rebalance monthly

- Eliminate costly transactions

- Diversified #DeFi Portfolio

DeFi Pulse Index $DPI

14 DeFi Tokens all wrapped into ONE

- S&P 500 of DeFi

- Strict/transparent token inclusion criteria

- Redeem underlying tokens any time

- Market-cap weighted index

- Auto-rebalance monthly

- Eliminate costly transactions

- Diversified #DeFi Portfolio

DeFi Pulse Index $DPI

• • •

Missing some Tweet in this thread? You can try to

force a refresh