Many traders i meet place all their capital and energy into trading alone.

Yet many long term investors play too safe and ignore - miss out on the trading opportunities that exist.

I think you can focus on both (independently) so you take on more quality opportunities.

Yet many long term investors play too safe and ignore - miss out on the trading opportunities that exist.

I think you can focus on both (independently) so you take on more quality opportunities.

It can also be more rewarding from a development standpoint, moving away from trading as a need/addiction to trading and investing for the freedom. They can feed off each other.

Trust me, when you're young you think you have an eternity, but it's a flash in the pan.

The long term stuff may seem unrewarding, but a good mix of yield/growth will compound and really surprise you, if patient and diligent.

The long term stuff may seem unrewarding, but a good mix of yield/growth will compound and really surprise you, if patient and diligent.

Lot of questions on how. Easy answer is completely separate accounts.

But goes much further, it's mindset/discipline. Willing to sacrifice something today for more tomorrow.

Different process and expectations for both buckets. Book Atomic Habits @JamesClear is great.

But goes much further, it's mindset/discipline. Willing to sacrifice something today for more tomorrow.

Different process and expectations for both buckets. Book Atomic Habits @JamesClear is great.

Respecting the power of time is also very important too.

Generally younger people are impatient and still seeking the thrill of the game. Realizing this and working towards treating trading/investing as your own business is important.

Respect your time and hard earned capital

Generally younger people are impatient and still seeking the thrill of the game. Realizing this and working towards treating trading/investing as your own business is important.

Respect your time and hard earned capital

Then there is a different learning curve with investing.

Trading is more emotional and sentiment driven, feeling the tape.

Investing you need to understand how to read financial statements and build a financial model. Understand macro, be generally more versed/read.

Trading is more emotional and sentiment driven, feeling the tape.

Investing you need to understand how to read financial statements and build a financial model. Understand macro, be generally more versed/read.

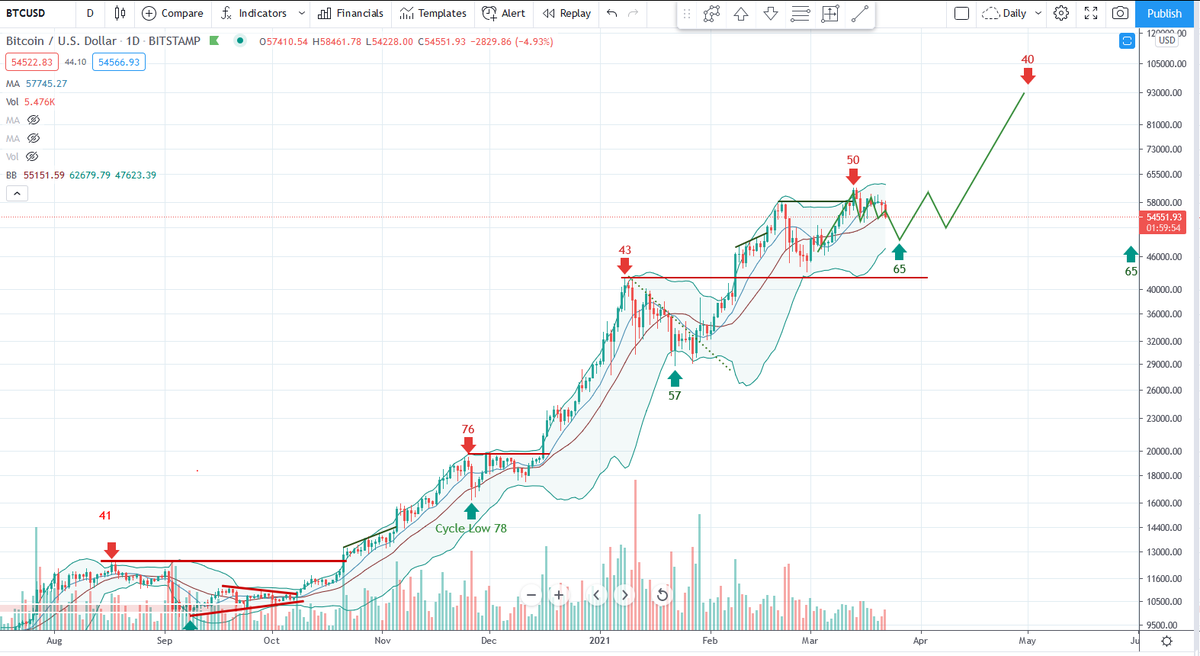

Many of you are Crypto followers, that's great, it's an amazing opportunity. But it will mature eventually, and the gains will normalize. And if you're new to investing you will quickly realize those gains were extraordinary and few/far between.

If you make a boatload in crypto, please don't assume another boatload is coming right behind it. If you made some, you don't need to be all-in. Bank some into other producing assets and start learning that craft.

Just like the 2017 top when paper wealth vanished, the same will eventually occur. Nobody can time a Cycle perfectly, but understanding there is a time and place is important. You want this era to have long lasting impact, not just an experience.

Some (of many) good books:

The Battle for Investment Survival

The Perfect Speculator

Reminiscences of a stock operator

How to make money in stocks.

trading in the zone.

Thinking, Fast and Slow (heavy read).

The Battle for Investment Survival

The Perfect Speculator

Reminiscences of a stock operator

How to make money in stocks.

trading in the zone.

Thinking, Fast and Slow (heavy read).

• • •

Missing some Tweet in this thread? You can try to

force a refresh