I'll get hate for this thread.

Satoshi disappearing was best thing for #bitcoin. He knew it, he wanted TRUSTLESS system. No generals.

Seeing the cheer for every large institutional purchase, new wrapped products or centralizing custody of bitcoin, all run counter to Satoshi

Satoshi disappearing was best thing for #bitcoin. He knew it, he wanted TRUSTLESS system. No generals.

Seeing the cheer for every large institutional purchase, new wrapped products or centralizing custody of bitcoin, all run counter to Satoshi

I don't care if these institutions onboard people.

If they're not prepared to be involved the way it was intended, through a completely private and self-sovereign method, then the cheer-leading is not about bitcoin, but the price of bitcoin.

If they're not prepared to be involved the way it was intended, through a completely private and self-sovereign method, then the cheer-leading is not about bitcoin, but the price of bitcoin.

Same goes for the elevating of individuals like Saylor - Elon. Good or bad intentions, why build points of failure. Somebody leveraging their balance sheet to buy bitcoin is a stupid idea. That's only about a self-serving interest. What happened to coin for everyone.

I respect somebody trading for the return. They're honest at least.

But institutions want returns, not a new ideology to worship. And they exert influence to protect it.

When time comes their allegiance is to their returns and gains they can boast on a glossy color pitch deck.

But institutions want returns, not a new ideology to worship. And they exert influence to protect it.

When time comes their allegiance is to their returns and gains they can boast on a glossy color pitch deck.

The fact is, people talk about "this fixing everything" and changing the world, but 90% in the space actually don't give a shit about that no matter how many times they say it. That's because new entrants are not on-boarded for the same reasons anymore. ($$)

If only the community could bring the same passion they have for the technical decentralization elements of bitcoin (1mb block e.g) when it comes to the proliferation of bitcoin at all costs. Sadly, the community passed that fork some time ago.

Just like 2017 block wars, one more about the technology, this future fight is a natural consensus path Bitcoin must undertake.

Bitcoin represents money after all, and therefore a power struggle over money is inevitable.

That event or outcome represents risk to me.

Bitcoin represents money after all, and therefore a power struggle over money is inevitable.

That event or outcome represents risk to me.

I get this is not the most articulate thread or cryptic to some. Not intended.

Maybe it's the risk fanatic in me just over-pricing risk. My views focus on time.

But as a large and growing consensus based network, history shows majority consensus can be bought or influenced.

Maybe it's the risk fanatic in me just over-pricing risk. My views focus on time.

But as a large and growing consensus based network, history shows majority consensus can be bought or influenced.

Just stating that outcomes vary exponentially the more complex the system and further in time.

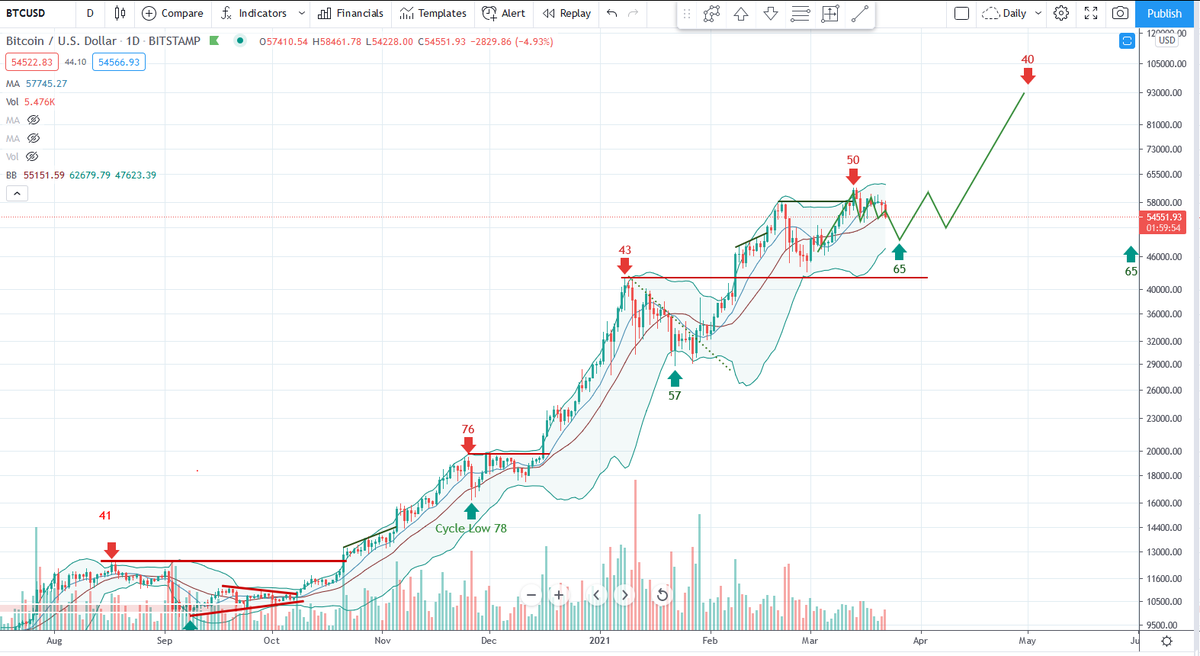

Not an observation on price, a mania phase of the current cycle I doubt can be aborted.

Not an observation on price, a mania phase of the current cycle I doubt can be aborted.

But Cycles over time eventually change and morph, they're not constant in character. As a complex and growing ecosystem, we should expect the same of Bitcoin. Massively disruptive periods are common in nature.

As an investor, freedom should not lie in any one single answer or solution, but by all means to be taken advantage of where there is opportunity.

Don't box yourself into one outcome, blinded by a promise. Have an option on the outcome, but not at total expense.

Don't box yourself into one outcome, blinded by a promise. Have an option on the outcome, but not at total expense.

• • •

Missing some Tweet in this thread? You can try to

force a refresh