Are you a Mutual Fund investor? Heard about Fund of Fund (FOF) lately in a couple of NFOs?

This 🧵 talks about some interesting insights you should have about FOFs as an investor

Do ‘Re-tweet’ & help us educate more investors (1/n)

#investing

This 🧵 talks about some interesting insights you should have about FOFs as an investor

Do ‘Re-tweet’ & help us educate more investors (1/n)

#investing

First thing first, do read about our Index vs ETF thread and come back -

https://twitter.com/KirtanShahCFP/status/1328565065625128965?s=20(2/n)

What is an FOF?

This category of scheme, invests the money in existing schemes of own or other mutual funds & not directly in securities

There are primarily four kind of FOF

1) Wrapper around ETF

2) Multi Manager within same asset class

3) Multi asset classes

4) Feeder Funds

This category of scheme, invests the money in existing schemes of own or other mutual funds & not directly in securities

There are primarily four kind of FOF

1) Wrapper around ETF

2) Multi Manager within same asset class

3) Multi asset classes

4) Feeder Funds

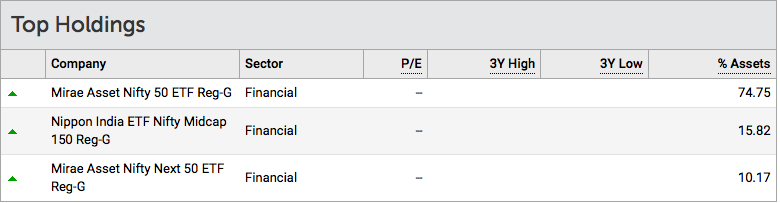

1) Wrapper Around ETF

It’s a fund which helps you invest in other existing ETF, it can be gold ETF or an ETF replicating a benchmark like NASDAQ, junior bees, Bharat Bond, bharat22. Eg. HDFC Gold Fund, Motilal Oswal NASDAQ 100 FOF (4/n)

It’s a fund which helps you invest in other existing ETF, it can be gold ETF or an ETF replicating a benchmark like NASDAQ, junior bees, Bharat Bond, bharat22. Eg. HDFC Gold Fund, Motilal Oswal NASDAQ 100 FOF (4/n)

AMC launches these FOFs to tap on to the investors who doesn’t have demat account (required for ETF) and who want to enter into systematic transactions like SIP, STP and SWP as these features are not available in ETF. (5/n)

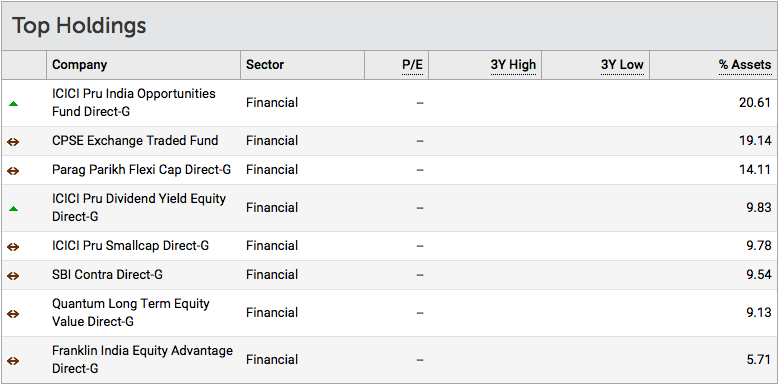

2) Multi Manager within same asset class. Here the fund manager has the mandate to invest in different strategies, within or outside the fund house but within the same asset class. Ex: ICICI Prudential India Equity FOF, this FOF is allocating mainly into equity strategies (6/n)

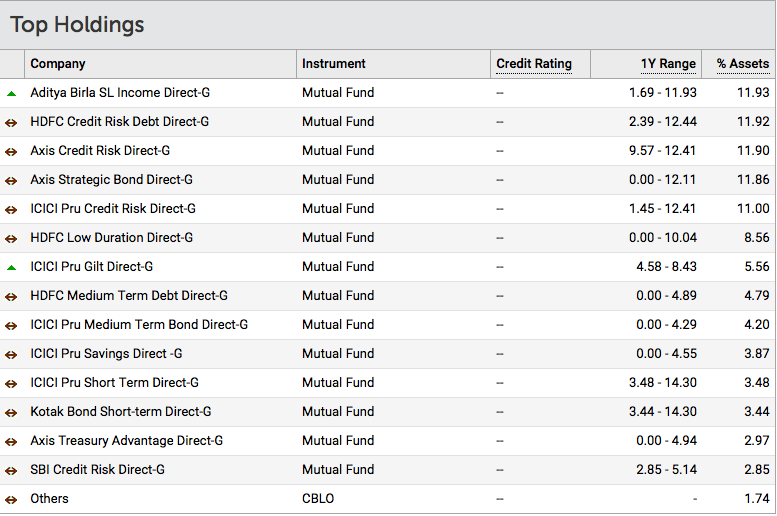

Axis All Seasons Debt Fund of Funds is another example, instead of equity, it is allocating in fixed income strategies (7/n)

3) Multi Asset classes

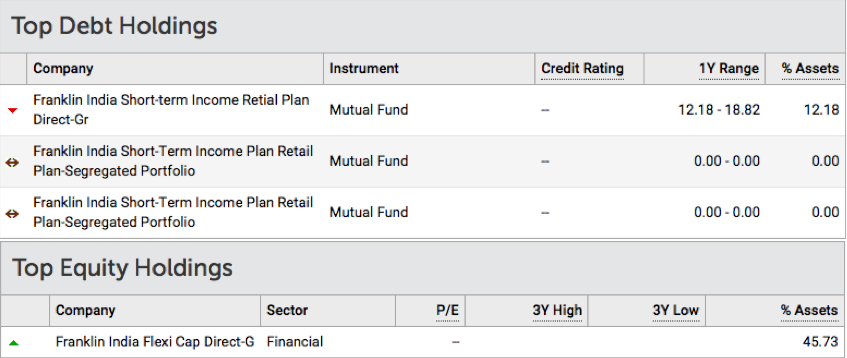

This FOF invests in different asset classes like Equity & Debt. Some manage the allocation between debt & equity dynamically (FT dynamic asset allocation FOF) & some keep it static (FT life stage FOF 40s) (9/n)

This FOF invests in different asset classes like Equity & Debt. Some manage the allocation between debt & equity dynamically (FT dynamic asset allocation FOF) & some keep it static (FT life stage FOF 40s) (9/n)

4) Feeder Funds

These FOFs invest in schemes of international funds. This could help in geographical and currency diversification or help invest in themes not available in India (10/n)

These FOFs invest in schemes of international funds. This could help in geographical and currency diversification or help invest in themes not available in India (10/n)

Edelweiss has a tie up with JP Morgan (Edelweiss Greater China Equity Off-shore fund), DSP has a tie up with BlackRock (DSP world mining fund) but global AMCs operating in India like Franklin/HSBC, prefers to choose the underlying scheme of their parent company only (11/n)

Advantages of FOF

1) Unlike an ETF, FOF does not require demat & allows SIP, STP, SWP.

2) One fund can give exposure to multiple schemes in the same asset or multiple assets

3) Investment opportunities in themes that don’t exist in India (12/n)

1) Unlike an ETF, FOF does not require demat & allows SIP, STP, SWP.

2) One fund can give exposure to multiple schemes in the same asset or multiple assets

3) Investment opportunities in themes that don’t exist in India (12/n)

Disadvantages

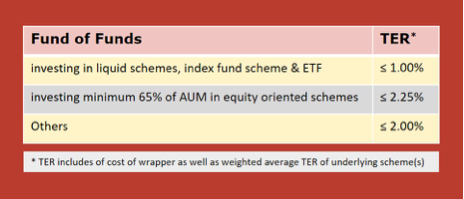

1) Cost of the fund can be higher because of the additional wrapper of FOF over the original scheme. The total expense ratio for FOF is subject to following limits (13/n)

1) Cost of the fund can be higher because of the additional wrapper of FOF over the original scheme. The total expense ratio for FOF is subject to following limits (13/n)

2) If the FOF invests in debt schemes and there is segregation, the recovery is not paid to the unit holders of FOF when the segregation happened (like in a debt fund); it is paid to the unit holders holding FOF when the recovery happens from the segregated portfolio (14/n)

3) Taxation - Only FOFs that invest greater than or equal to 90% in ETFs (Active funds not allowed) & these underlying ETFs also invest greater than 90% in domestic equity, it's taxed as an equity-oriented fund. In all other cases, FOF will get taxed as debt funds (15/n)

Important observation

If you have read the Index vs ETF thread you know the prime reason to not invest in ETF is the difference between the funds iNAV and the market-traded price as they can be very different (16/n)

If you have read the Index vs ETF thread you know the prime reason to not invest in ETF is the difference between the funds iNAV and the market-traded price as they can be very different (16/n)

FOFs having ETF as underlying funds calculate NAVs differently. SEBI says Traded Securities shall be valued at the last quoted closing price on the stock exchange i.e. the closing price on the exchange should used to calculate the NAV of FOF (17/n)

But some AMCs use the above and some uses the iNAV of the ETF to calculate the NAV of the FOF (18/n)

Using iNAV to calculate the NAV of FOF looks like a better option as closing price can be manipulated bcoz of the low liquidity & hence SEBI says the AMC valuation committee if feels that the closing price on the exchange is not fair, they can consider the iNAV that day (19/n)

The point is, why not take the iNAV always instead of exchange closing NAV price? Well, I don’t have the answer ☺ (20/n)

You would be interested in reading a blog post written by @stepbystep888 for some detailed analysis on how NAVs can be tempered and some more insights on Taxation & Segregation of the portfolio. Link - fpa.edu.in/blog/ (21/22)

This is my 36th thread. Have written on,

- Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar, Steel

- Macro

- Debt Markets

- Equity

- Gold

- Personal Finance etc.

You can find them all in the link below

- Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar, Steel

- Macro

- Debt Markets

- Equity

- Gold

- Personal Finance etc.

You can find them all in the link below

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20… (**END**)

• • •

Missing some Tweet in this thread? You can try to

force a refresh