1/15

#LetsTalkMoney by @monikahalan is all about US understanding OUR Needs & Wants, & constructing OUR Money Box.

It helps BUILD a system in place , rather than focusing on a (non existent ) single shot solution.

MUST READ FOR ALL !

#BookRecommendation

A 🧵 on it .

👇

#LetsTalkMoney by @monikahalan is all about US understanding OUR Needs & Wants, & constructing OUR Money Box.

It helps BUILD a system in place , rather than focusing on a (non existent ) single shot solution.

MUST READ FOR ALL !

#BookRecommendation

A 🧵 on it .

👇

2/15

Firstly, build your own system to manage Cash Inflows & Outflows .

Find a way that's least troublesome but automatically separates the 2.

#Budgeting & #Allocation must not be a cumbersome task !

Easy bifurcation helps in Better mapping.

A bird's eye view on the same 👇

Firstly, build your own system to manage Cash Inflows & Outflows .

Find a way that's least troublesome but automatically separates the 2.

#Budgeting & #Allocation must not be a cumbersome task !

Easy bifurcation helps in Better mapping.

A bird's eye view on the same 👇

3/15

Moving onto Emergencies . This pandemic has made so many of us realise the importance of it .

Another interesting facet :

Unwillingness to take risks comes from the FEAR of not having money when needed - typically why Bank F.Ds are preferred.

Hence the EMERGENCY fund.

Moving onto Emergencies . This pandemic has made so many of us realise the importance of it .

Another interesting facet :

Unwillingness to take risks comes from the FEAR of not having money when needed - typically why Bank F.Ds are preferred.

Hence the EMERGENCY fund.

4/15

*It shall DIFFER from person to person.

*Understand HOW to go about it & BUILD up your fund.

*It takes 2-3 months time to figure out our expenses & 6 months - 1year atleast to build up this fund.

*So be patient ! 🤷

Don't jump the gun .

#EmergencyFund pointers:

*It shall DIFFER from person to person.

*Understand HOW to go about it & BUILD up your fund.

*It takes 2-3 months time to figure out our expenses & 6 months - 1year atleast to build up this fund.

*So be patient ! 🤷

Don't jump the gun .

#EmergencyFund pointers:

5/15

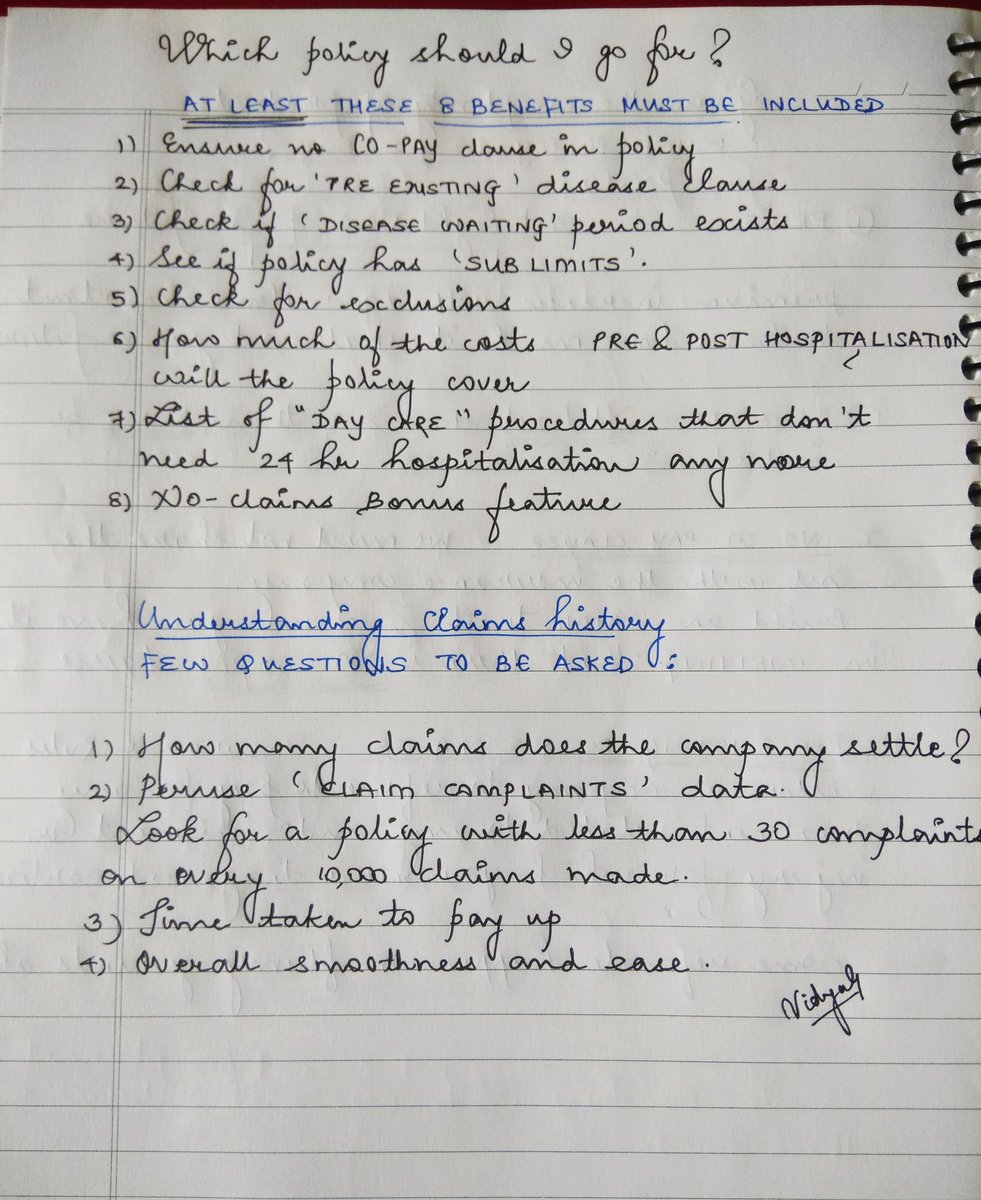

Moving onto #HealthInsurance .

It takes just one Hospital visit to realise the importance of a comprehensive Health cover . 🙄🤷

Sharing a few points that must not be missed prior to taking a policy .

The book explains EVERY POINT in DETAIL along with examples.

Moving onto #HealthInsurance .

It takes just one Hospital visit to realise the importance of a comprehensive Health cover . 🙄🤷

Sharing a few points that must not be missed prior to taking a policy .

The book explains EVERY POINT in DETAIL along with examples.

6/15

The book also talks about

* Strategies for older people who purchased insurance years ago

* On the Importance of Critical Illness & Personal Accident cover .

HIGHLY underrated !!

Despite being into investing since over 10+ yrs, I haven't done it yet 😐 🤦

#NoteToSelf

The book also talks about

* Strategies for older people who purchased insurance years ago

* On the Importance of Critical Illness & Personal Accident cover .

HIGHLY underrated !!

Despite being into investing since over 10+ yrs, I haven't done it yet 😐 🤦

#NoteToSelf

7/15

Moving onto Necessity for a #LifeInsurance Cover .

Required ? 🤔

YES. VERY MUCH! 🙄

An untimely death would make us leave many things midway , including leaving our loved ones in a financial lurch .

It's best to separate investment from insurance products .

Moving onto Necessity for a #LifeInsurance Cover .

Required ? 🤔

YES. VERY MUCH! 🙄

An untimely death would make us leave many things midway , including leaving our loved ones in a financial lurch .

It's best to separate investment from insurance products .

8/15

The book then explains :

* The amount of cover required

* The time to go in for such a life cover

* Which policy to go in for

* When to terminate a life cover

All this and more in EXTREMELY simple words .

Understand it and build a base to research on the net !

The book then explains :

* The amount of cover required

* The time to go in for such a life cover

* Which policy to go in for

* When to terminate a life cover

All this and more in EXTREMELY simple words .

Understand it and build a base to research on the net !

9/15

* Some other pointers especially for Beginners.

( Also served as a good reminder for me , as I need to rejig my Asset Allocation )

* A short reality check on other

#DebtProducts

#Gold

#RealEstate

Gotta read the book to know more ! 🤓🤷

#NoSpoonFeeding

* Some other pointers especially for Beginners.

( Also served as a good reminder for me , as I need to rejig my Asset Allocation )

* A short reality check on other

#DebtProducts

#Gold

#RealEstate

Gotta read the book to know more ! 🤓🤷

#NoSpoonFeeding

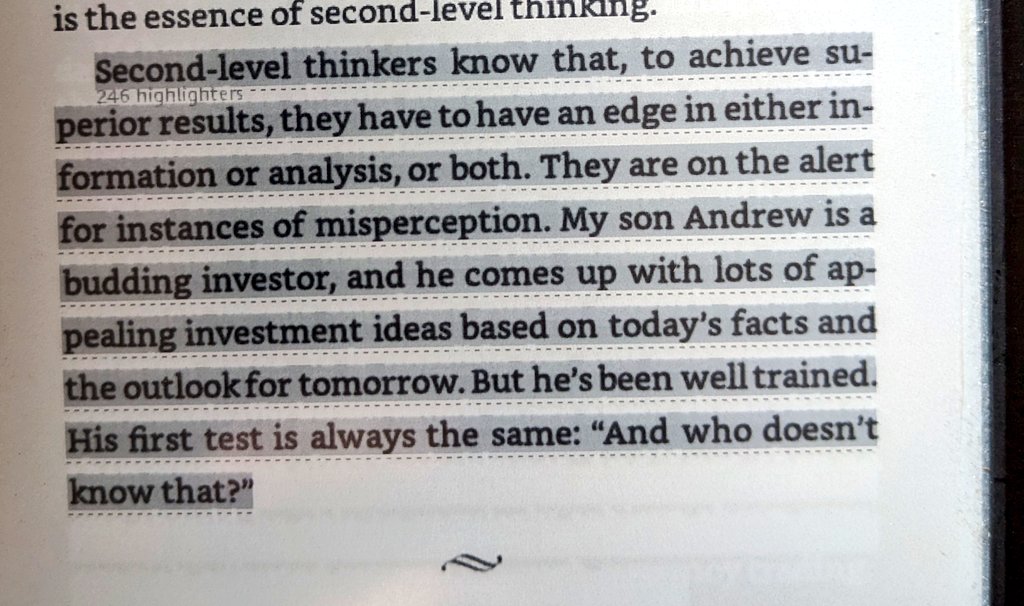

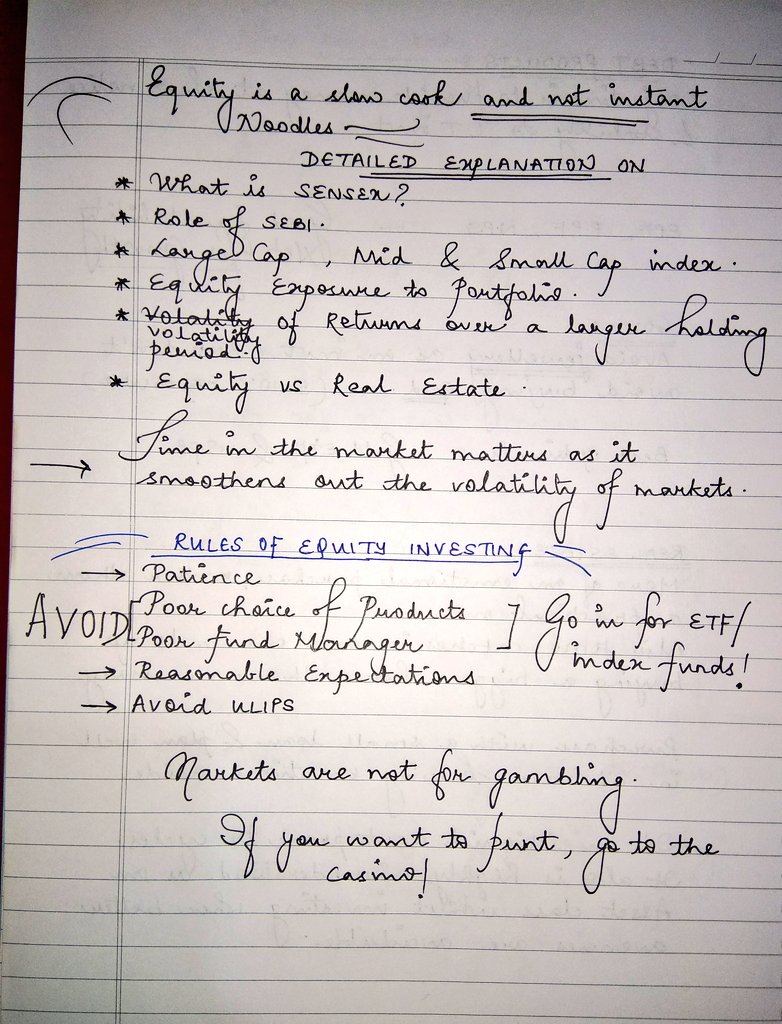

10/15

Moving onto - The most misunderstood Asset class aka #Equity !

* The book helps understand the difference between getting an Equity exposure vs Direct investment in stocks .

The following is explained extremely well in this chapter

👇

Moving onto - The most misunderstood Asset class aka #Equity !

* The book helps understand the difference between getting an Equity exposure vs Direct investment in stocks .

The following is explained extremely well in this chapter

👇

11/15

The book then explains #MutualFunds , terms associated to it & the asset classes one can purchase via MF in detail along with the sub divisions

* Debt

* Gold

* Equity

* Real Estate ( REIT)

All this in common parlance, thereby ensuring EVERYONE understands it !! 😎

The book then explains #MutualFunds , terms associated to it & the asset classes one can purchase via MF in detail along with the sub divisions

* Debt

* Gold

* Equity

* Real Estate ( REIT)

All this in common parlance, thereby ensuring EVERYONE understands it !! 😎

12/15

Systematic Investment Plan ( #SIP)

is making periodic Investments .

* Keep SIP target first , then spend rest.

* Allows us to average out our price over a period & cushions volatility .

, as no one can time markets .

* Builds discipline

Use it correctly !

👇

Systematic Investment Plan ( #SIP)

is making periodic Investments .

* Keep SIP target first , then spend rest.

* Allows us to average out our price over a period & cushions volatility .

, as no one can time markets .

* Builds discipline

Use it correctly !

👇

13/15

Each product in our money box MUST justify its space & be chosen out of logic & not out of ignorance.

A few important pointers WRT evaluating the financial product .

Note: Since I am familiar with most concepts I haven't elaborated them .

The book explains them.

👇

Each product in our money box MUST justify its space & be chosen out of logic & not out of ignorance.

A few important pointers WRT evaluating the financial product .

Note: Since I am familiar with most concepts I haven't elaborated them .

The book explains them.

👇

14/15

#FinancialFreedom needs to be planned out well .

It is a journey wherein we need to factor in our ever evolving requirements , inflation and future uncertainty.

The sooner we begin,the better it shall be.

This needs to be rejigged at times depending on circumstances.

👇

#FinancialFreedom needs to be planned out well .

It is a journey wherein we need to factor in our ever evolving requirements , inflation and future uncertainty.

The sooner we begin,the better it shall be.

This needs to be rejigged at times depending on circumstances.

👇

15/15

Lastly,

Few books have been written in such a simplistic ,yet wholesome manner. 👏👏

IT'S A NO BRAINER THAT ONE HAS TO BUY THIS BOOK !

Knowledge is the best investment that one could ever make & this book is full of it !

Thanks for this, @monikahalan !

*THE END*

Lastly,

Few books have been written in such a simplistic ,yet wholesome manner. 👏👏

IT'S A NO BRAINER THAT ONE HAS TO BUY THIS BOOK !

Knowledge is the best investment that one could ever make & this book is full of it !

Thanks for this, @monikahalan !

*THE END*

• • •

Missing some Tweet in this thread? You can try to

force a refresh