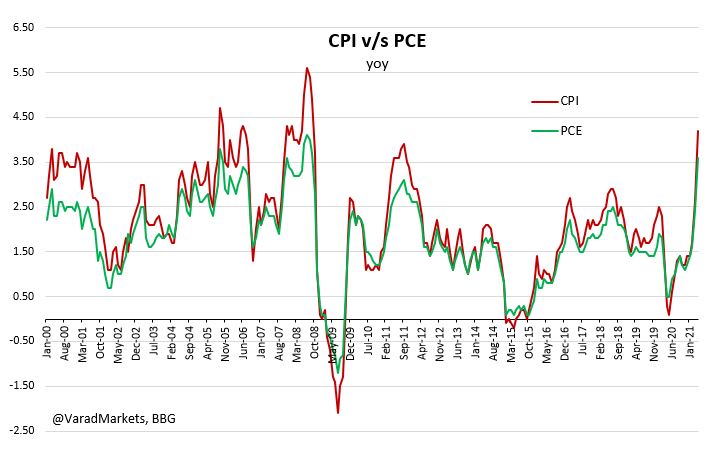

US #Inflation #DiveIn: CPI v/s PCE

Also why FED follows PCE?

▪️ Attached Summary of differences

▪️ Since 2000, overall CPI ~11% higher than PCE

▪️ Definition:

🔹 CPI: Out-of-pocket spending by non-institutional Urban Consumers

🔹 PCE: Includes Rural & all personal sector

1/12

Also why FED follows PCE?

▪️ Attached Summary of differences

▪️ Since 2000, overall CPI ~11% higher than PCE

▪️ Definition:

🔹 CPI: Out-of-pocket spending by non-institutional Urban Consumers

🔹 PCE: Includes Rural & all personal sector

1/12

Four Sources of differences: Scope, Formula, Weight, Others Effects

1⃣ Scope Effect:

🔹 CPI: Consumer Price Index => Survey of Households

🔹 PCE: Personal Consumption Expenditure => Survey of Businesses

▪️ 25% of PCE spending not captured by CPI

2/12

1⃣ Scope Effect:

🔹 CPI: Consumer Price Index => Survey of Households

🔹 PCE: Personal Consumption Expenditure => Survey of Businesses

▪️ 25% of PCE spending not captured by CPI

2/12

▪️ PCE includes spending by Govt, Firms, Non-Profits on behalf of Households

- E.G: Medical spending = Direct purchases by Consumers + Spending on medical goods & services by Medicare OR Employer's Health Insurance

- E.G: Public school education not an out-of-pocket spending

3/12

- E.G: Medical spending = Direct purchases by Consumers + Spending on medical goods & services by Medicare OR Employer's Health Insurance

- E.G: Public school education not an out-of-pocket spending

3/12

- E.G: Imputed cost of fin servs that do not involve out-of-pocket spending => not in CPI

2⃣ Formula Effect:

- PCE's Fisher Ideal Formula better reflects consumer behaviour of substituting away from products with rising prices

- CPI's Laspeyres holds weights fixed for 2yrs

4/12

2⃣ Formula Effect:

- PCE's Fisher Ideal Formula better reflects consumer behaviour of substituting away from products with rising prices

- CPI's Laspeyres holds weights fixed for 2yrs

4/12

3⃣ Weight Effect:

- PCE's broader scope implies smaller weight to items common to both

- Housing ~33% weight in CPI but ~16% in PCE

- Gasoline/Energy heavier in CPI than PCE

- Rent/Gasoline Inflation would tend to lift CPI above PCE inflation

@chigrl

5/12

- PCE's broader scope implies smaller weight to items common to both

- Housing ~33% weight in CPI but ~16% in PCE

- Gasoline/Energy heavier in CPI than PCE

- Rent/Gasoline Inflation would tend to lift CPI above PCE inflation

@chigrl

5/12

4⃣ Other Effects: Seasonal Adjustments & Revisions

🔹 CPI: Methodological improvements not applied to historical data => in a way good as CPI is used for Indexing, Social Security benefits, financial instruments

🔹 PCE: Improvements/Revisions applied to entire history

6/12

🔹 CPI: Methodological improvements not applied to historical data => in a way good as CPI is used for Indexing, Social Security benefits, financial instruments

🔹 PCE: Improvements/Revisions applied to entire history

6/12

▪️ Weight & Scope Effect dominant drivers followed by Formula Effect

▪️ Weight Effect (+ve) has tended to push CPI above PCE

▪️ Q4'08-Q1'09 saw collapse in Energy prices => pushed down CPI more than PCE given Energy's heavier weight in CPI; similar in 2014-15 & dip in 2020

7/12

▪️ Weight Effect (+ve) has tended to push CPI above PCE

▪️ Q4'08-Q1'09 saw collapse in Energy prices => pushed down CPI more than PCE given Energy's heavier weight in CPI; similar in 2014-15 & dip in 2020

7/12

Four Items leading to key differences:

🔹 Healthcare=>PCE has third party expenses

🔹 Housing=>methodology & definition differences

🔹 Education=>PCE has third party expenses

🔹 Vices (Alcohol, etc)=>Consumers (CPI) may not admit, while Businesses not shy of reporting (PCE)

8/12

🔹 Healthcare=>PCE has third party expenses

🔹 Housing=>methodology & definition differences

🔹 Education=>PCE has third party expenses

🔹 Vices (Alcohol, etc)=>Consumers (CPI) may not admit, while Businesses not shy of reporting (PCE)

8/12

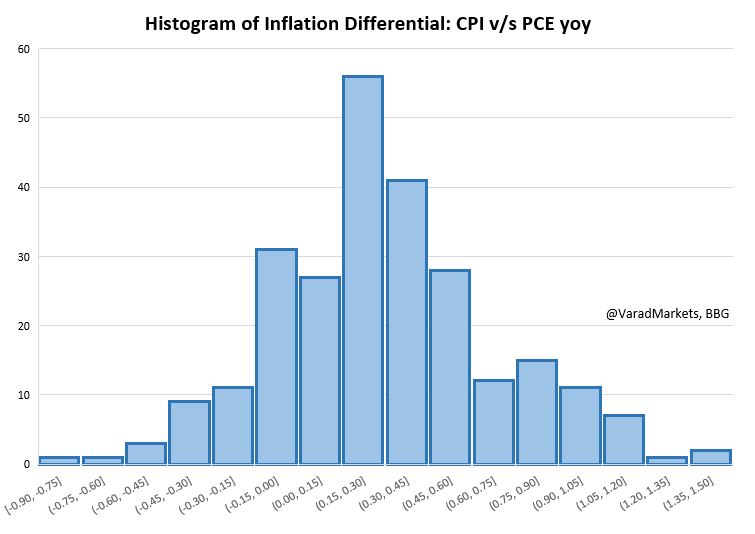

▪️ Median Difference b/w YoY Inflation Rates (CPI v/s PCE) has come off recently since COVID

▪️ But in April, CPI again spiked above PCE given massive jump in CPI-heavy Energy prices

Median Difference:

21yr history: 0.30%

5yr history: 0.30%

Post-COVID: 0.05%

9/12

▪️ But in April, CPI again spiked above PCE given massive jump in CPI-heavy Energy prices

Median Difference:

21yr history: 0.30%

5yr history: 0.30%

Post-COVID: 0.05%

9/12

So why Fed likes PCE over CPI?

Three key reasons summarized in report to Congress in 2000 when switch was made

1⃣ PCE's better substitution effect v/s fixed weight CPI (Ref 4/12 above)

2⃣ PCE's broader coverage (Ref 2-3/12)

3⃣ Ability to revise historical PCE (Ref 6/12)

10/12

Three key reasons summarized in report to Congress in 2000 when switch was made

1⃣ PCE's better substitution effect v/s fixed weight CPI (Ref 4/12 above)

2⃣ PCE's broader coverage (Ref 2-3/12)

3⃣ Ability to revise historical PCE (Ref 6/12)

10/12

Fed actually like "Core" PCE even more (excludes Food/Energy) as Headline more volatile => another debate (may require another thread) whether Fed should focus on Headline or Core

Since 2000, Headline CPI v/s Core PCE Median difference = 0.40% (handy conversion guide)

11/12

Since 2000, Headline CPI v/s Core PCE Median difference = 0.40% (handy conversion guide)

11/12

Wow, look at the volatility of Energy Inflation => have to go in favour of Core

But, have fun with Bullard's (St Louis Fed) counter view: "The Core is Rotten"

files.stlouisfed.org/files/htdocs/p…

But, have fun with Bullard's (St Louis Fed) counter view: "The Core is Rotten"

files.stlouisfed.org/files/htdocs/p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh