How to get more from your DeFi Pulse Index $DPI

A THREAD

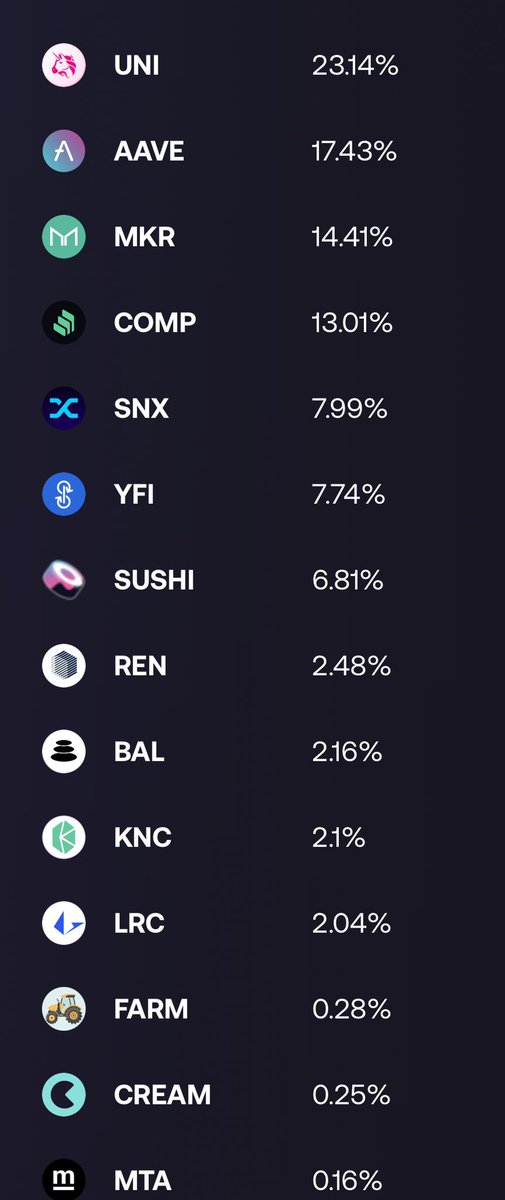

#1/8 Broad Exposure to DeFi - $DPI is used to give users diversified exposure to the top #DeFi blue chips.

14 top DeFi protocols in ONE token.

Article credit:@Mringz @davidesilverman

Details👇

gov.indexcoop.com/t/what-you-can…

A THREAD

#1/8 Broad Exposure to DeFi - $DPI is used to give users diversified exposure to the top #DeFi blue chips.

14 top DeFi protocols in ONE token.

Article credit:@Mringz @davidesilverman

Details👇

gov.indexcoop.com/t/what-you-can…

#2/8

Liquidity Providing (LPing) - LPing for $DPI / $ETH on a DEX like @Uniswap, @loopringorg or @SushiSwap enables DPI holders to earn a portion of the trading fees.

$SUSHI - Onsen program = extra rewards in SUSHI

$UNI - Largest pool for DPI

$LRC - ZK roll-up = less gas fees

Liquidity Providing (LPing) - LPing for $DPI / $ETH on a DEX like @Uniswap, @loopringorg or @SushiSwap enables DPI holders to earn a portion of the trading fees.

$SUSHI - Onsen program = extra rewards in SUSHI

$UNI - Largest pool for DPI

$LRC - ZK roll-up = less gas fees

#3/8

Liquidity Mining - In addition to the trading fees earned by providing liquidity to DEX pools, LPers can earn additional rewards by staking their $DPI / $ETH LP tokens via the @indexcoop website to receive rewards in $INDEX tokens.

Index Coop - Est. target APY: 12% (INDEX)

Liquidity Mining - In addition to the trading fees earned by providing liquidity to DEX pools, LPers can earn additional rewards by staking their $DPI / $ETH LP tokens via the @indexcoop website to receive rewards in $INDEX tokens.

Index Coop - Est. target APY: 12% (INDEX)

#4/8

Yield Farming - $DPI LPers can stake their LP tokens into yield aggregators like @harvest_finance to earn extra rewards. Yield aggregators harvest reward tokens, $INDEX, plus reward stakers in their native token, $FARM.

Harvest Finance - APY: 1.0% (FARM), 7.0% (INDEX)

Yield Farming - $DPI LPers can stake their LP tokens into yield aggregators like @harvest_finance to earn extra rewards. Yield aggregators harvest reward tokens, $INDEX, plus reward stakers in their native token, $FARM.

Harvest Finance - APY: 1.0% (FARM), 7.0% (INDEX)

#5/8

Leveraged yield farming - Protocols like Alpha Homora V2 and Impermax allow users to deposit $DPI or the $DPI / $ETH LP token to earn leveraged liquidity rewards. Rewards are auto-compounded to generate additional yield.

APYs - 70% - 200%

@AlphaFinanceLab

@ImpermaxFinance

Leveraged yield farming - Protocols like Alpha Homora V2 and Impermax allow users to deposit $DPI or the $DPI / $ETH LP token to earn leveraged liquidity rewards. Rewards are auto-compounded to generate additional yield.

APYs - 70% - 200%

@AlphaFinanceLab

@ImpermaxFinance

#6/8

Lending and Borrowing Protocols - Users can also lend their $DPI tokens on lending and borrowing protocols, like $CREAM and $ALPHA, to earn yield from borrowing demand on the protocol.

@CreamdotFinance

APY: 3%

@AlphaFinanceLab

APY: 5%

Lending and Borrowing Protocols - Users can also lend their $DPI tokens on lending and borrowing protocols, like $CREAM and $ALPHA, to earn yield from borrowing demand on the protocol.

@CreamdotFinance

APY: 3%

@AlphaFinanceLab

APY: 5%

#7/8

Collateral Debt Positions (CDP) - Borrowing stable coins against $DPI frees up liquidity w/o having to sell the asset. Beneficial as the stable coins borrowed can be used for various cases inside and outside #crypto.

@unitprotocol $COL

LTV: 64%

@SushiSwap $SUSHI

LTV: 75%

Collateral Debt Positions (CDP) - Borrowing stable coins against $DPI frees up liquidity w/o having to sell the asset. Beneficial as the stable coins borrowed can be used for various cases inside and outside #crypto.

@unitprotocol $COL

LTV: 64%

@SushiSwap $SUSHI

LTV: 75%

#8/8

RISKS - This is not financial advice. Purely for informational/educational purposes. Do your own research #DYOR.

Some examples of risks (but not all) - Smart-contract risk, liquidation risk, financial risk, multi-sig risk, impermanent loss, interest rate risk, market risk.

RISKS - This is not financial advice. Purely for informational/educational purposes. Do your own research #DYOR.

Some examples of risks (but not all) - Smart-contract risk, liquidation risk, financial risk, multi-sig risk, impermanent loss, interest rate risk, market risk.

• • •

Missing some Tweet in this thread? You can try to

force a refresh