Some interesting surveys from the manufacturing report this morning.

Let’s get started with some charts first.

👇👇👇

Let’s get started with some charts first.

👇👇👇

Here is the % of participants that claimed supplier deliveries were slower than usual.

This survey data just reached its highest level in history.

This survey data just reached its highest level in history.

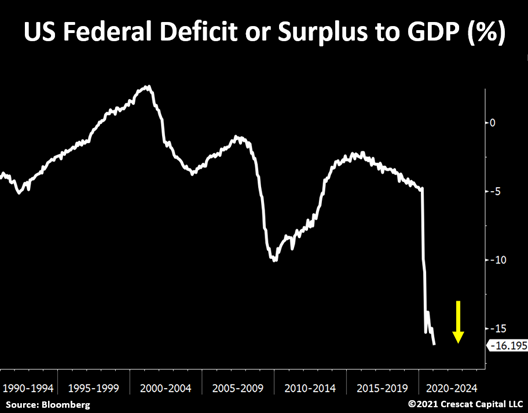

It’s hard to fix the supply issues when the government continues to discourage folks to return to the labor market.

Companies will be pressured to step up and increase wages and salaries.

A major upward shift in labor cost is upon us.

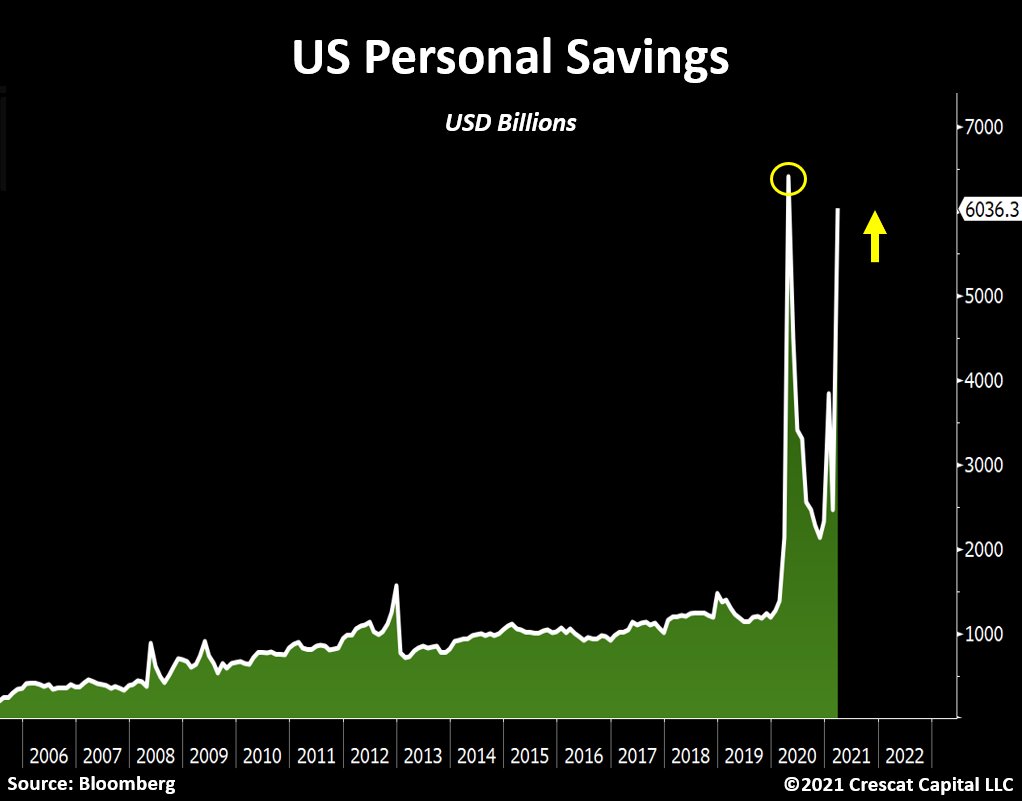

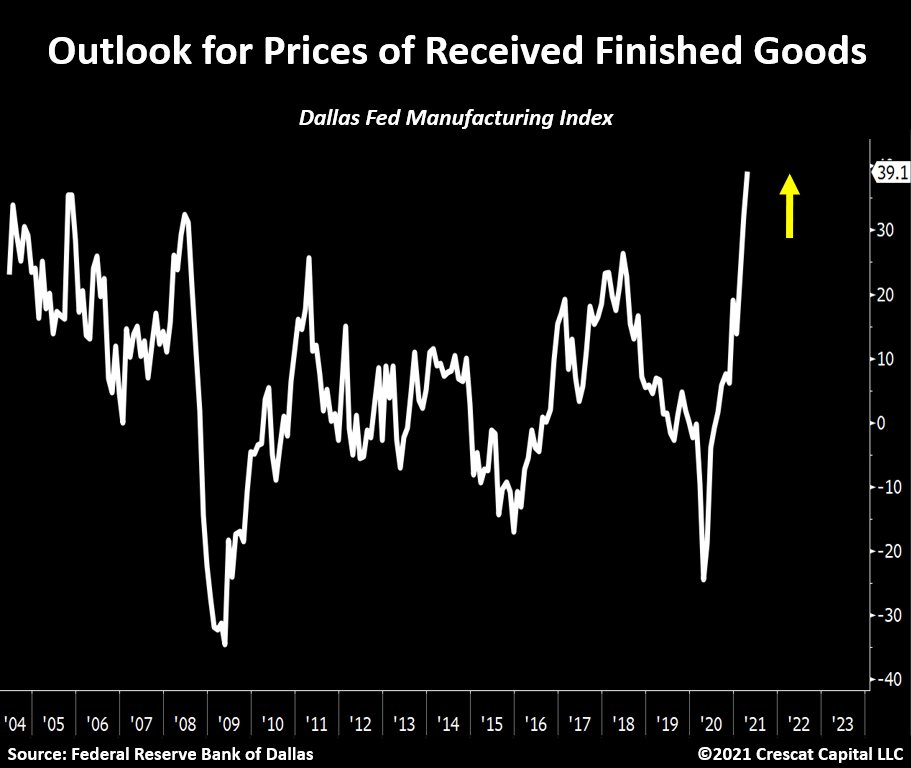

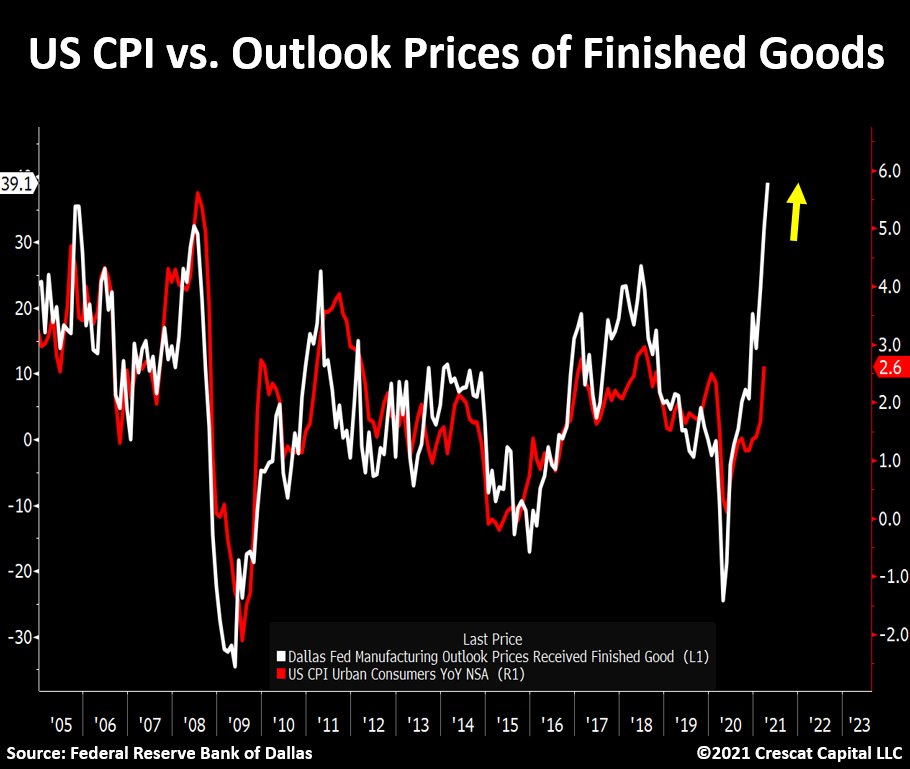

The inflation story keeps building.

Companies will be pressured to step up and increase wages and salaries.

A major upward shift in labor cost is upon us.

The inflation story keeps building.

Lastly, let’s take a look at some important commentaries from manufacturing executives.

“Continued strong sales; however, we have had to trim some production due to the global chip shortage.

Hasn’t affected inventories greatly yet, but a continued decrease will begin to reduce available inventories if we don’t recover chip supply shortly.”

Hasn’t affected inventories greatly yet, but a continued decrease will begin to reduce available inventories if we don’t recover chip supply shortly.”

“It’s getting much more difficult to supply production with materials that are made with copper or steel.

Lots of work on the floor, but I am worried about getting the materials to support.”

Lots of work on the floor, but I am worried about getting the materials to support.”

“The metals markets remain very challenging at best. Shortages of raw materials have increased, especially in aluminum and carbon steel.

Prices continue to rapidly increase.

Transportation and trucking [are] also a big challenge.”

Prices continue to rapidly increase.

Transportation and trucking [are] also a big challenge.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh