.@RBI Governor @DasShaktikanta will announce the bi-monthly monetary policy statement today

Watch LIVE, from 10 AM:

#RBI

Watch LIVE, from 10 AM:

#RBI

📡Live Now📡

@RBI Governor's address to cover:

Monetary policy decision and rationale

Assessment of growth and inflation

Guidance on liquidity and financial markets

Additional measures

and

Broad approach of RBI going forward

Live Now :

@RBI Governor's address to cover:

Monetary policy decision and rationale

Assessment of growth and inflation

Guidance on liquidity and financial markets

Additional measures

and

Broad approach of RBI going forward

Live Now :

Policy Repo Rate to remain unchanged at 4%

Accommodative stance of monetary policy to continue as long as necessary to revive & sustain growth, to mitigate impact of #COVID19 on economy, ensure inflation remains within target

- @RBI Gov. @DasShaktikanta

Accommodative stance of monetary policy to continue as long as necessary to revive & sustain growth, to mitigate impact of #COVID19 on economy, ensure inflation remains within target

- @RBI Gov. @DasShaktikanta

👉Marginal Standing Facility rate and bank rate remain unchanged at 4.25%

👉Reverse Repo Rate remains unchanged at 3.35%

- @RBI Governor @DasShaktikanta

👉Reverse Repo Rate remains unchanged at 3.35%

- @RBI Governor @DasShaktikanta

Provisional estimates of National Income released by NSSO on 31 May, placed India's real GDP contraction in 2020-21 at 7.3%, recalls @RBI Governor, @DasShaktikanta

Live Now

Live Now

Normal monsoon, resilience of agriculture and farm economy, adoption of #COVID-compatible business models and gathering momentum of global recovery can help revive domestic economy when 2nd wave abates

- @RBI Governor, @DasShaktikanta

Live Now

- @RBI Governor, @DasShaktikanta

Live Now

Spread of #COVID19 infection in rural areas and reduction in urban demand are downside risks

Ramping up #Vaccination drive and bridging health care infra gaps can mitigate the devastation wrought by the #Pandemic

- @RBI Governor

🎥

Ramping up #Vaccination drive and bridging health care infra gaps can mitigate the devastation wrought by the #Pandemic

- @RBI Governor

🎥

Monetary Policy Committee adopted the view that policy support from all sides is required to gain growth momentum and to nurture recovery after it takes root

Hence policy rate has been left unchanged and accommodative stance has been decided to be continued

- @RBI Governor

Hence policy rate has been left unchanged and accommodative stance has been decided to be continued

- @RBI Governor

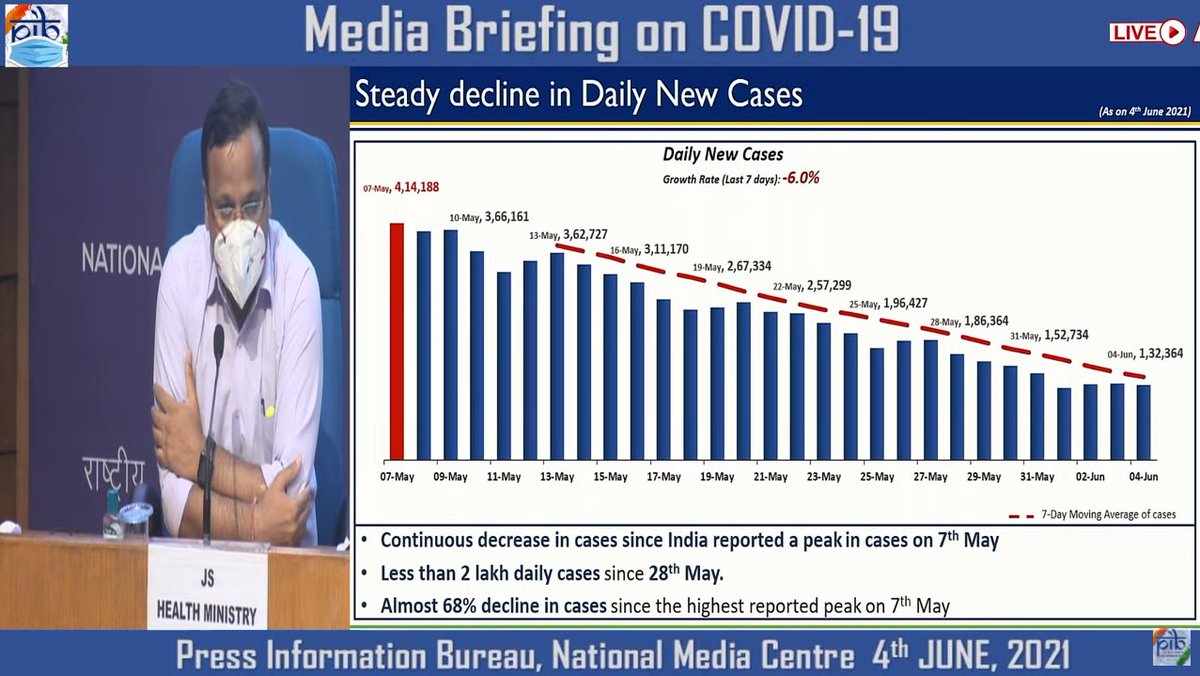

Unlike 1st #COVID19 wave, impact on economic activity due to 2nd wave is expected to be relatively contained, with restrictions on mobility being nuanced & regionalized

- @RBI Governor

- @RBI Governor

With external demand strengthening, a rebound in global trade is taking hold, which should support India's export sector

- @RBI Governor

- @RBI Governor

India's exports in March, April and May 2021 have been on an upswing, conducive external conditions are forming for a durable recovery beyond pre-pandemic levels, targeted policy support for exports is need of the hour

- @RBI Governor

- @RBI Governor

Rural demand is expected to remain strong thanks to forecast of normal monsoon

Increased spread of #COVID19 infection in rural areas is a downside risk

- @RBI Governor

Increased spread of #COVID19 infection in rural areas is a downside risk

- @RBI Governor

Real GDP growth is projected to grow at 9.5% in 2021-22

18.5% in Q1

7.9% in Q2

7.2% in Q3

6.6% in Q4

- @RBI Governor @DasShaktikanta

18.5% in Q1

7.9% in Q2

7.2% in Q3

6.6% in Q4

- @RBI Governor @DasShaktikanta

Consumer Price Index inflation is projected at 5.1% during 2021-22

5.2% in Q1

5.4% in Q2

4.7% in Q3

5.3% in Q4

- @RBI Governor @DasShaktikanta

5.2% in Q1

5.4% in Q2

4.7% in Q3

5.3% in Q4

- @RBI Governor @DasShaktikanta

Focus of @RBI turning from systemic liquidity to its equitable distribution

Enduring lesson from #COVID19 experience in Indian context has been the deployment of unconventional monetary policy measures that distribute liquidity among all stakeholders

- RBI Gov. @DasShaktikanta

Enduring lesson from #COVID19 experience in Indian context has been the deployment of unconventional monetary policy measures that distribute liquidity among all stakeholders

- RBI Gov. @DasShaktikanta

Auctions under Government Securities Acquisition Programme (G-SAP)1.0 have evoked keen interest from market participants

Positive externalities associated with this operation are reflected in other financial market segments too such as corporate bonds, debentures

@RBI Governor

Positive externalities associated with this operation are reflected in other financial market segments too such as corporate bonds, debentures

@RBI Governor

During current year so far, @RBI has conducted regular Open Market Operations and injected additional liquidity to the tune of Rs. 36,545 Crore till May 31, in addition to Rs. 60,000 Crore under G-SAP 1.0

- #RBI Governor @DasShaktikanta

- #RBI Governor @DasShaktikanta

Another operation under G-SAP 1.0 for purchase of Govt. Securities worth Rs. 40,000 Crore to be conducted on 17 June 2021

G-SAP 2.0 to be conducted in Q2 of 2021-22 for secondary market purchase operations worth Rs. 1.20 Lakh Crore to support market

- @RBI Gov. @DasShaktikanta

G-SAP 2.0 to be conducted in Q2 of 2021-22 for secondary market purchase operations worth Rs. 1.20 Lakh Crore to support market

- @RBI Gov. @DasShaktikanta

As of May 28, 2021, the country's Foreign Exchange Reserves had touched 598.2 billion US dollars, so we are at a striking distance of reaching $ 600 billion of Forex reserves, announces @RBI Governor @DasShaktikanta

🎥

🎥

Amidst prevailing all-pervasive uncertainty in the face of the #Pandemic, @RBI will continue to use all instruments at its command and work to revive and sustain growth on a durable basis

- #RBIGovernor @DasShaktikanta

🎥

#Unite2FightCorona

- #RBIGovernor @DasShaktikanta

🎥

#Unite2FightCorona

#RBIGovernor announces additional measures in wake of the #Pandemic

1️⃣On-Tap Liquidity Window of Rs. 15,000 Cr. to mitigate adverse impact on certain contact-intensive sectors, till 31 March 2022, tenures up to 3 years, at repo rate

#Unite2FightCorona

1️⃣On-Tap Liquidity Window of Rs. 15,000 Cr. to mitigate adverse impact on certain contact-intensive sectors, till 31 March 2022, tenures up to 3 years, at repo rate

#Unite2FightCorona

#RBIGovernor announces additional measures

Banks can give fresh lending support to hotels, restaurants, travel agents, tour operators, aviation ancillary services & other services including bus operators, event organizers, spa clinics, beauty parlors, saloons

#Unite2FightCorona

Banks can give fresh lending support to hotels, restaurants, travel agents, tour operators, aviation ancillary services & other services including bus operators, event organizers, spa clinics, beauty parlors, saloons

#Unite2FightCorona

2⃣Special Liquidity Facility of Rs. 16,000 Cr. to @sidbiofficial, for on-lending/refinancing through novel models; at repo rate, for up to 1 year

To further support credit requirements of #MSMEs, including those in credit-deficient and aspirational districts

#RBIGovernor

To further support credit requirements of #MSMEs, including those in credit-deficient and aspirational districts

#RBIGovernor

3️⃣Expansion of coverage of borrowers under Stress Resolution Framework 2.0, by

Enhancing maximum aggregate exposure threshold from Rs. 25 crore to Rs. 50 crore for #MSMEs

Non-MSME small businesses and loans to individuals for business purposes

- #RBIGovernor @DasShaktikanta

Enhancing maximum aggregate exposure threshold from Rs. 25 crore to Rs. 50 crore for #MSMEs

Non-MSME small businesses and loans to individuals for business purposes

- #RBIGovernor @DasShaktikanta

4️⃣Permission given to Authorized Dealer banks to place margins on behalf of FPI clients for transactions in Govt. securities within banks' credit risk management framework

To ease operational constraints faced by FPIs & promote ease of doing business

- #RBIGovernor

To ease operational constraints faced by FPIs & promote ease of doing business

- #RBIGovernor

5️⃣Regional Rural Banks can now issue Certificates of Deposit (CDs)

Further, all issuers of CDs will be permitted to buy back their CDs before maturity, subject to

certain conditions

Will facilitate greater flexibility in liquidity management

- #RBIGovernor @DasShaktikanta

Further, all issuers of CDs will be permitted to buy back their CDs before maturity, subject to

certain conditions

Will facilitate greater flexibility in liquidity management

- #RBIGovernor @DasShaktikanta

6️⃣National Automated Clearing House to be available on all days of week (currently available only on bank working days), effective from 1 Aug, 2021

Will enhance customer convenience

(NACH is a prominent mode of Direct Benefit Transfer to large number of beneficiaries)

- @RBI

Will enhance customer convenience

(NACH is a prominent mode of Direct Benefit Transfer to large number of beneficiaries)

- @RBI

The sudden rise in #COVID19 infections and fatalities has impaired the nascent recovery that was underway, but has not snuffed it out

Growth impulses are still alive

Aggregate supply conditions have shown resilience in face of 2nd #COVID wave

- #RBIGovernor

Growth impulses are still alive

Aggregate supply conditions have shown resilience in face of 2nd #COVID wave

- #RBIGovernor

The measures announced today, in conjunction with other steps taken so far, are expected to reclaim growth trajectory from which we have slid

- #RBIGovernor @DasShaktikanta

- #RBIGovernor @DasShaktikanta

A policy package to consolidate India’s position as #Vaccine capital of the world with leadership in production of pharma products can change the #COVID19 narrative

- #RBIGovernor @DasShaktikanta

- #RBIGovernor @DasShaktikanta

Need of the hour is not to be overwhelmed by current situation, but collectively overcome it

“I have never lost my optimism. In seemingly darkest hours hope has burnt bright within me" - #RBIGovernor @DasShaktikanta concludes address, recalling words of the Father of the Nation

“I have never lost my optimism. In seemingly darkest hours hope has burnt bright within me" - #RBIGovernor @DasShaktikanta concludes address, recalling words of the Father of the Nation

• • •

Missing some Tweet in this thread? You can try to

force a refresh