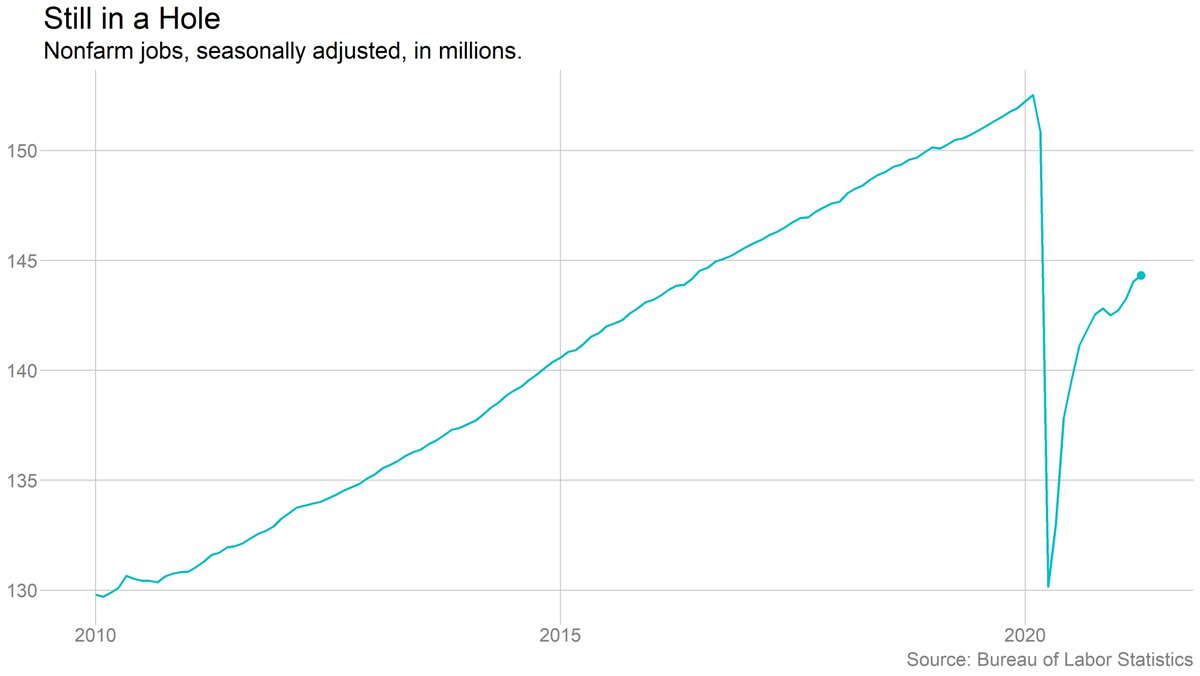

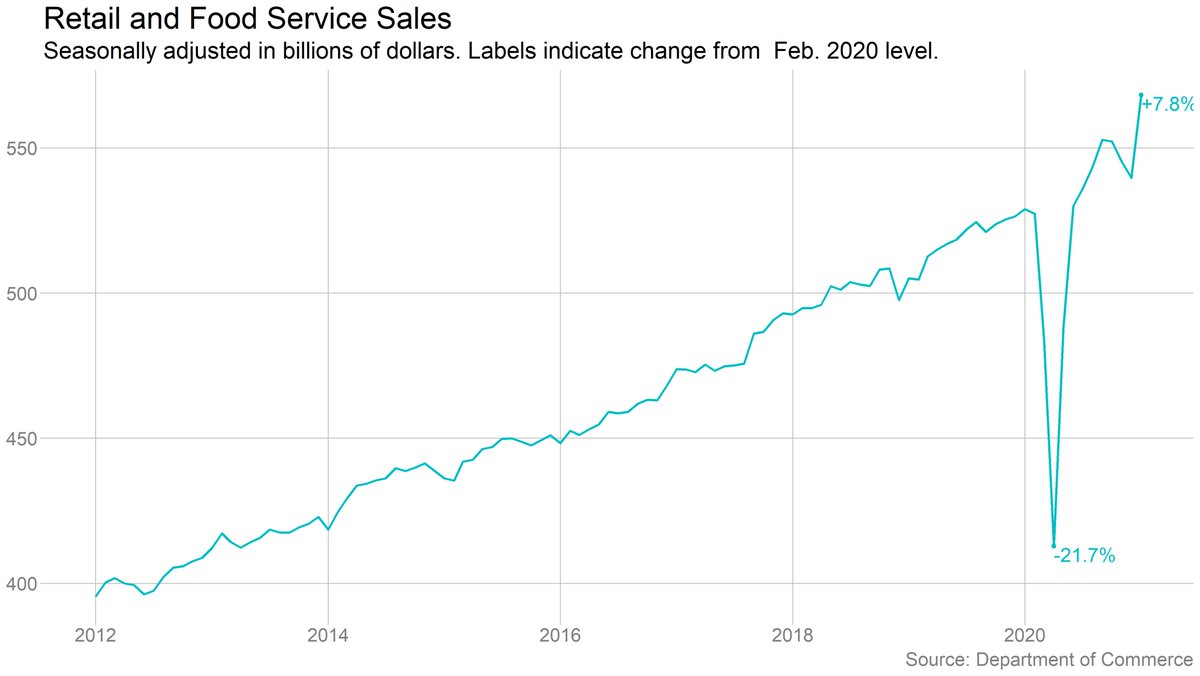

U.S. employers added 559,000 jobs in May. The unemployment rate fell to 5.8%.

nytimes.com/2021/06/04/bus…

nytimes.com/2021/06/04/bus…

Very small upward revisions to March and Aril. Net gain of 27,000 jobs vs previous estimates.

Unemployment rate fell for "good" reasons in that employment was up, unemployment was down. But labor force was basically flat (actually down slightly), which will add fuel to "labor shortage" concerns.

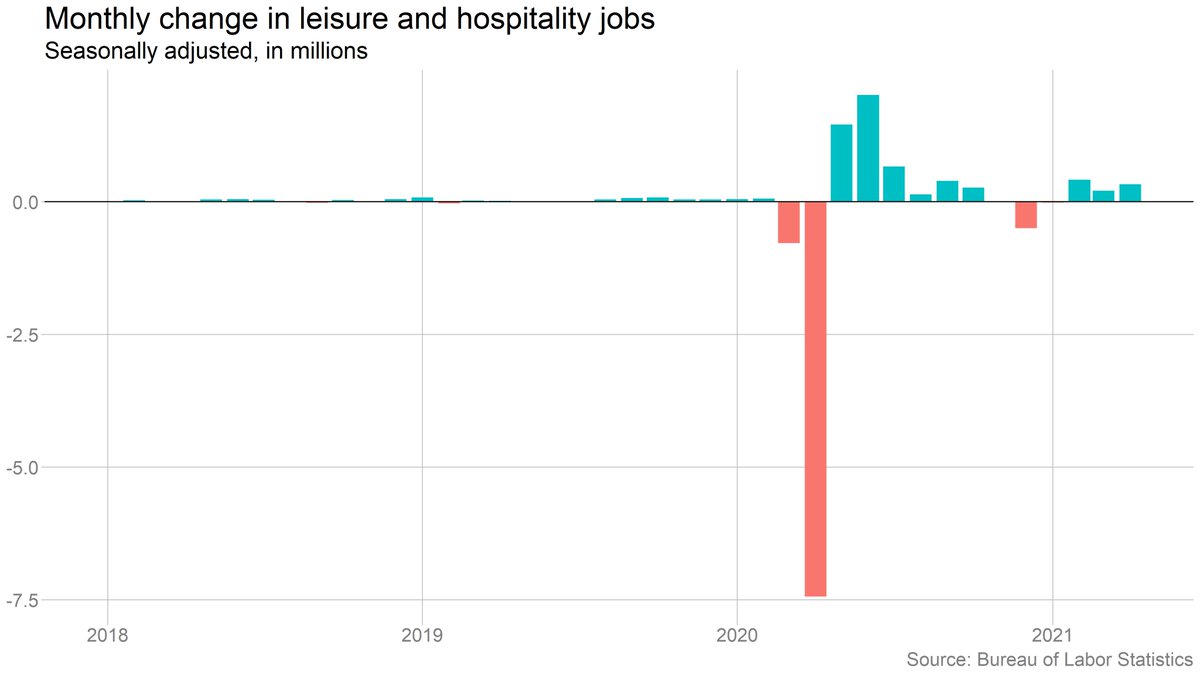

Gains once again concentrated in leisure and hospitality (+292k). Mixed bag in other sectors. Some rebound in manufacturing, transportation/warehousing, but losses in construction, retail.

Moving to my usual charts thread. Picks up here:

https://twitter.com/bencasselman/status/1400794985272954882?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh