For now #Bitcoin remains stuck in a drawdown that has lasted 53 days and bottomed -53% below the latest ATH.

That’s a big one if you compare it to BTC history.

But all assets have to deal with that. So let's put those Bitcoin corrections in context.

Time for a 🧵

That’s a big one if you compare it to BTC history.

But all assets have to deal with that. So let's put those Bitcoin corrections in context.

Time for a 🧵

1/ Spoiler alert, all assets have to deal with periods of drawdowns.

So if we take say gold and some of the largest stocks by market cap the only question is: does Bitcoin stand out?

Let’s take a look. 👇

So if we take say gold and some of the largest stocks by market cap the only question is: does Bitcoin stand out?

Let’s take a look. 👇

2/ #Bitcoin, Apple, Amazon, JPMorgan... everyone has had large drawdowns.

Take Apple. It is now the largest stock by market cap but that wasn’t a smooth ride.

Over its long history, the stock had to endure several corrections of more than 75%...

Check it out 👇

Take Apple. It is now the largest stock by market cap but that wasn’t a smooth ride.

Over its long history, the stock had to endure several corrections of more than 75%...

Check it out 👇

3/ Actually most of the companies that have produced large total returns have had to deal with at least one very large drawdown.

Among those, #Bitcoin does not stand out.

Among those, #Bitcoin does not stand out.

4/ For sure #Bitcoin is more volatile than other assets.

That means it tends to have more sizeable corrections. But that also means it recovers faster.

All in all, BTC doesn’t really look like an outlier.👇

That means it tends to have more sizeable corrections. But that also means it recovers faster.

All in all, BTC doesn’t really look like an outlier.👇

5/ Right now #Bitcoin is in a drawdown similar to the long pause of the 2013 bull market.

Nobody knows how long that will last.

But at least, the 4-year halving cycles are there to make sure you won’t have to wait 27 years for some action (yes, I’m looking at you gold).

Nobody knows how long that will last.

But at least, the 4-year halving cycles are there to make sure you won’t have to wait 27 years for some action (yes, I’m looking at you gold).

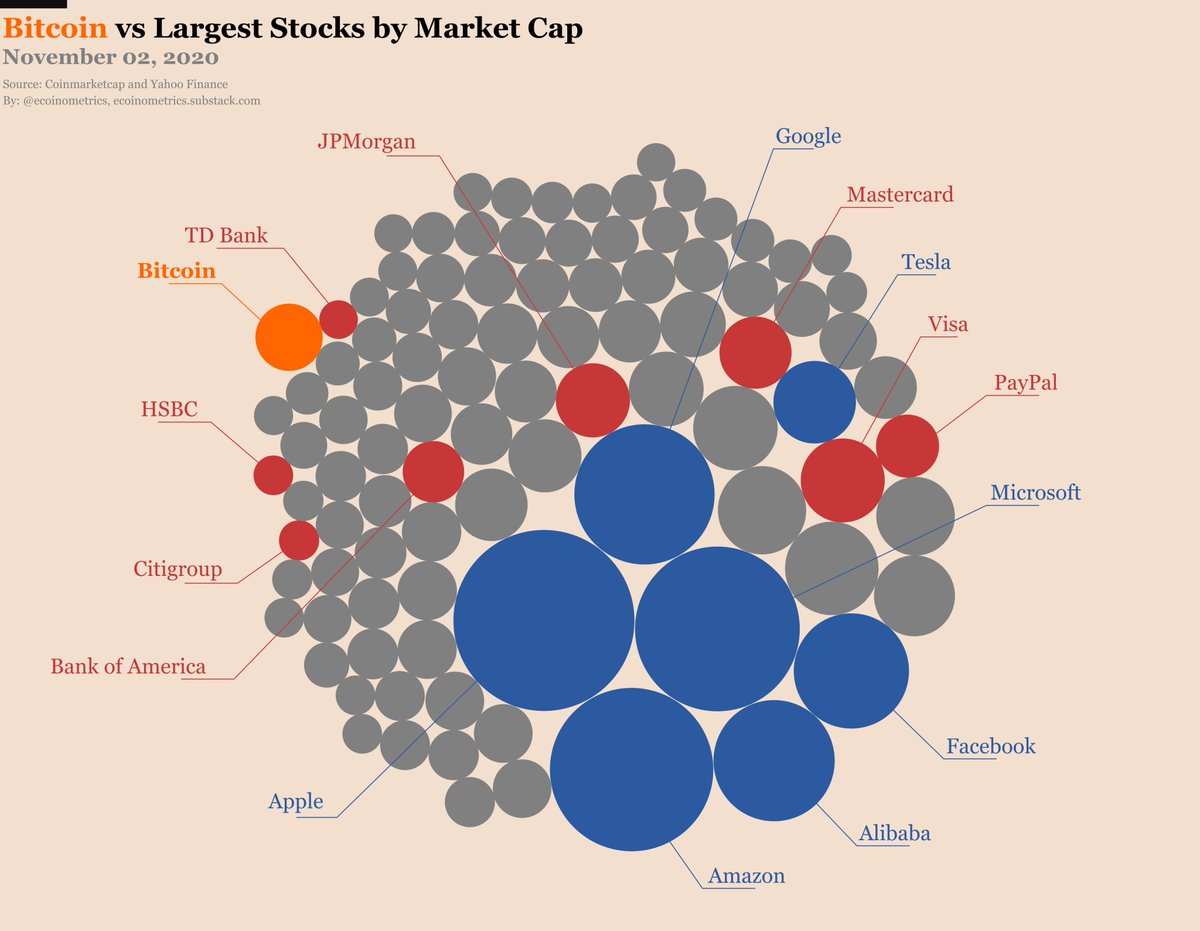

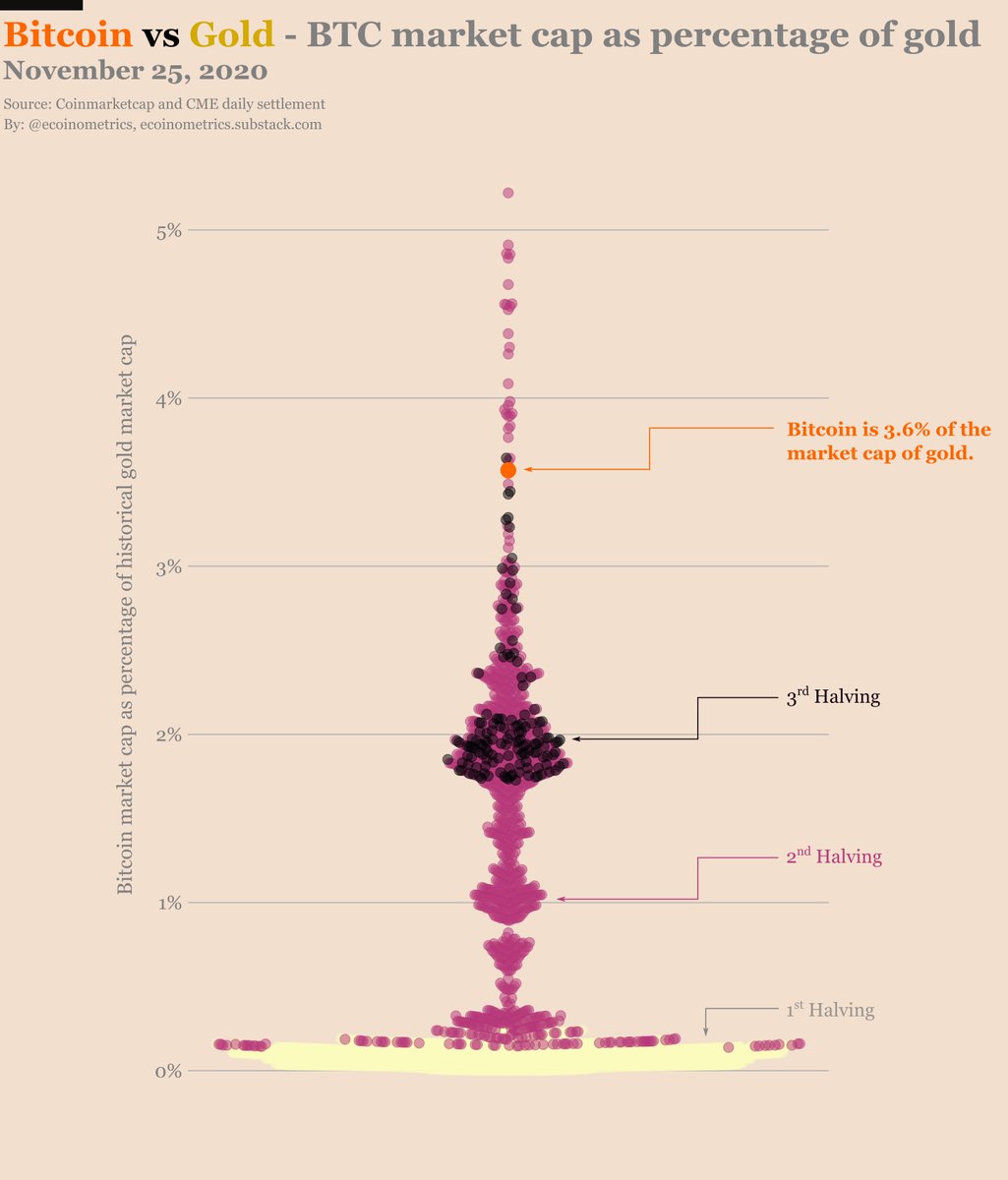

6/ In the grand scheme of things, the narrative of #Bitcoin as digital gold has just started to play out.

At this point Bitcoin is still smaller than Apple, only a fraction of the gold market and simply a drop in an ocean of bonds...

You are still early. 👇

At this point Bitcoin is still smaller than Apple, only a fraction of the gold market and simply a drop in an ocean of bonds...

You are still early. 👇

END/ If you want to learn more about #Bitcoin and its place in the future of global finance, there is just one thing to do, go subscribe to the Ecoinometrics newsletter. 👇

ecoinometrics.substack.com/p/ecoinometric…

ecoinometrics.substack.com/p/ecoinometric…

• • •

Missing some Tweet in this thread? You can try to

force a refresh