0/ In today’s Delphi Daily, Top Performing Layer Ones, #Ethereum Gas Price Analysis, and @AxieInfinity’s Sharp Growth

For the full analysis 👇 👇

delphidigital.io/reports/delphi…

For the full analysis 👇 👇

delphidigital.io/reports/delphi…

1/ Quick Market Update-

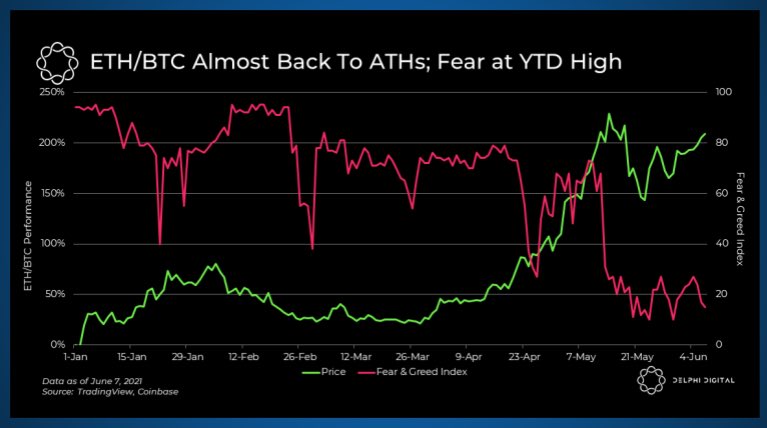

🔹This past weekend saw the bulls come out on top, indicating retail sentiment is recovering.

🔹Bullish sentiment is making a comeback as @MicroStrategy’s $500 million debt raise settles today.

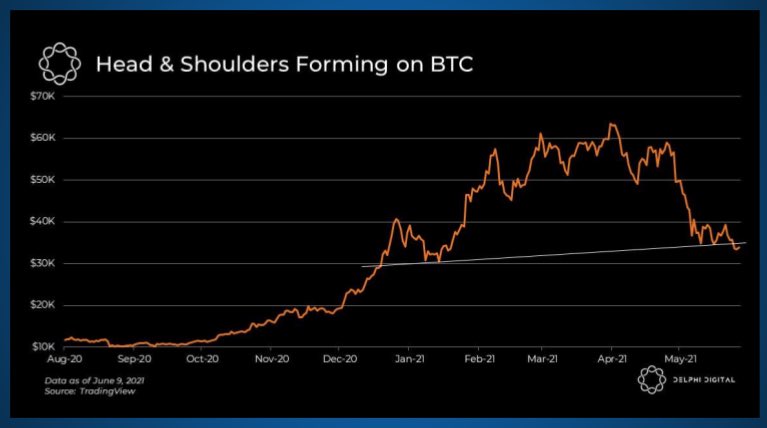

🔹 $BTC is at its current range high.

🔹This past weekend saw the bulls come out on top, indicating retail sentiment is recovering.

🔹Bullish sentiment is making a comeback as @MicroStrategy’s $500 million debt raise settles today.

🔹 $BTC is at its current range high.

2/ @0xPolygon ($MATIC), @solana ($SOL), and @FantomFDN ($FTM) are the three best performing Layer 1 smart contracts platforms in 2021 so far.

$LUNA was performing on par with these assets but suffered a much sharper decline during the latest market downturn.

$LUNA was performing on par with these assets but suffered a much sharper decline during the latest market downturn.

3/ The easiest trade of 2020 was to buy BTC from crypto exchanges and deposit it in the Grayscale BTC Trust, requiring a 6 month BTC lock up but allowing them to sell for a premium.

As the premium eroded and flipped into a discount, a major source of BTC buying dried up.

As the premium eroded and flipped into a discount, a major source of BTC buying dried up.

4/ Average gas prices are sitting at their lowest levels in over a year as Ethereum usage dwindles.

There are several reasons that could explain gas prices trending down. The most obvious is the drop in Ethereum usage as evidenced by falling DEX volume.

There are several reasons that could explain gas prices trending down. The most obvious is the drop in Ethereum usage as evidenced by falling DEX volume.

5/ @AxieInfinity’s growth over the past few months has been astounding.

Users of Axie Infinity were largely priced out of playing the game, but the team migrated most essential features to Ronin, an Ethereum sidechain built by the Axie team.

Users of Axie Infinity were largely priced out of playing the game, but the team migrated most essential features to Ronin, an Ethereum sidechain built by the Axie team.

6/ Tweets of the day!

@iearnfinance strategists game the @PoolTogether_ no-loss lottery.

@iearnfinance strategists game the @PoolTogether_ no-loss lottery.

https://twitter.com/bantg/status/1403863030094499843

7/ Hedge fund magnate Paul Tudor Jones on Bitcoin.

https://twitter.com/DocumentingBTC/status/1404417546816831495

8/ @AlphaFinanceLab breaks down the implications of its native launchpad.

https://twitter.com/AlphaFinanceLab/status/1404439461685907463

9/ Get the most in-depth crypto research sent straight to your inbox. For Free!

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh