0/ In today’s Delphi Daily, @0xpolygon garnering attention, long term $BTC holders are accumulating, and an analysis of @uniswap’s price and volume.

Check out the full analysis below! 👇

delphidigital.io/reports/delphi…

Check out the full analysis below! 👇

delphidigital.io/reports/delphi…

1/ Market Update-

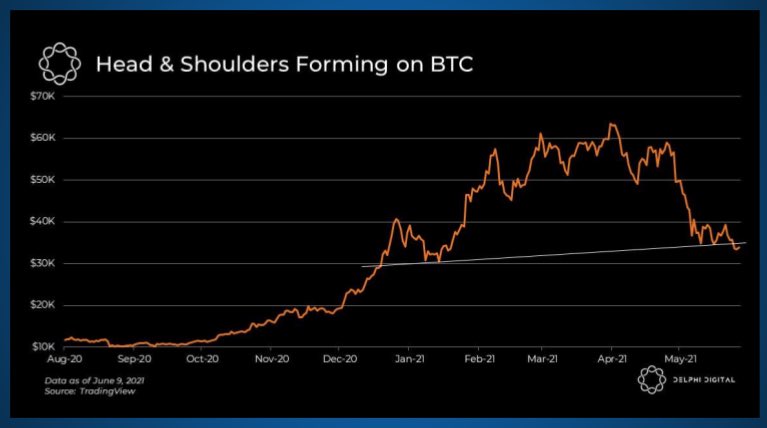

🔹BTC and ETH had been ranging from the Asia session into the London session, with a short bout of weakness emerging at New York open.

🔹BTC currently sits near its range high and traders are awaiting confirmation of either bearish continuation or an uptrend.

🔹BTC and ETH had been ranging from the Asia session into the London session, with a short bout of weakness emerging at New York open.

🔹BTC currently sits near its range high and traders are awaiting confirmation of either bearish continuation or an uptrend.

2/ Google trends indicates @0xPolygon is garnering attention from retail users as 1.4 million searches were made for Polygon/MATIC in May alone.

While “DeFi” and “Yield Farming” are growing in search volume as well, users are currently tilted towards Polygon.

While “DeFi” and “Yield Farming” are growing in search volume as well, users are currently tilted towards Polygon.

3/ According to @Glassnode, the number of BTC held with long-term holders has been on the incline over the past few weeks after months of offloading BTC.

The sharp rise in long-term holder accumulation is a positive sign for those with mid to long term time horizons for BTC.

The sharp rise in long-term holder accumulation is a positive sign for those with mid to long term time horizons for BTC.

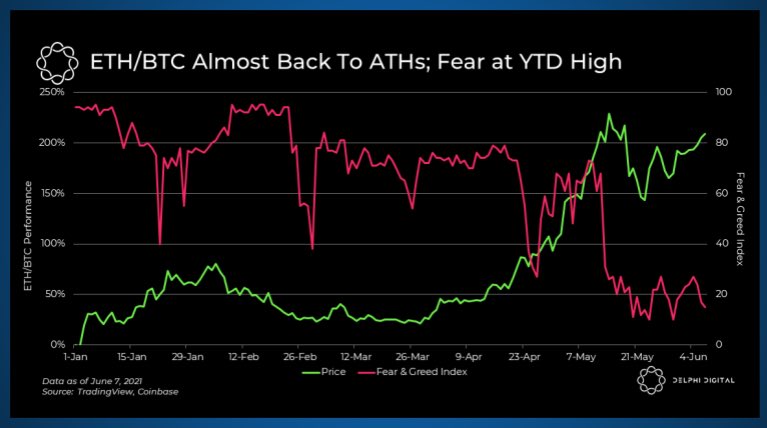

4/ Bitcoin futures OI is starting to tick up. Meanwhile, bitcoin’s streak of fading dominance also appears to be over.

Bitcoin dominance is rising beside OI, as is normal when the market emerges from a spell of intense fear.

Bitcoin dominance is rising beside OI, as is normal when the market emerges from a spell of intense fear.

5/ While DeFi assets are following the majors on this bounce, DEX volume has yet to recover. As a result of declining usage and a rising price, assets like $UNI have seen their cash flow derived valuations shoot up in the last 2 weeks.

6/ One would think that for assets like $UNI and $SUSHI, price would follow its volume.

Their correlation to BTC is a stronger influence given the current state of the market. As DeFi decouples from BTC, we likely see the relationship between fundamentals and price grow stronger

Their correlation to BTC is a stronger influence given the current state of the market. As DeFi decouples from BTC, we likely see the relationship between fundamentals and price grow stronger

7/ Tweets of the day!

Delphi Labs introduces a new interest rate model for DeFi.

Delphi Labs introduces a new interest rate model for DeFi.

https://twitter.com/Delphi_Digital/status/1404821875339845636

8/ The inventor of the internet is selling a 1/1 NFT of his original code.

https://twitter.com/Sothebys/status/1404756540280672256

9/ The United States House of Reps formed a cryptocurrency working group.

https://twitter.com/TheBlock__/status/1404821537933430792

10/ Get the most in-depth crypto research sent straight to your inbox. For Free!

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh