Does increase in Inflation & hence interest rates lead to a fall in equity? While theoretically yes, practically the last 20 years of data shows otherwise

Please ‘re-tweet’ 🧵& help us educate more retail investors

#Investing

Please ‘re-tweet’ 🧵& help us educate more retail investors

#Investing

Lets start with basic, y does inflation ⬆️?

Most feel bcoz of higher demand & lower supply but that’s nt the only factor. Imagine there is a shortage of laptops wrt the demand, but there is no liquidity in the market (people don’t have monies) will the price of laptop ⬆️? No

Most feel bcoz of higher demand & lower supply but that’s nt the only factor. Imagine there is a shortage of laptops wrt the demand, but there is no liquidity in the market (people don’t have monies) will the price of laptop ⬆️? No

So, Inflation takes place because the demand supply situation is accompanied by high liquidity, people have the monies to spend and hence the price goes up. Inflation does not take place only because of the demand supply gap (3/n)

Its RBI’s job to keep inflation under check. What role does RBI play? RBI is comfortable keeping Inflation between 2-6% currently. So if Inflation is increasing, how can RBI control it? Can RBI do anything to demand & supply? Nothing (4/n)

So the only tool available with RBI to control inflation is controlling liquidity. If RBI is able to reduce liquidity in the market, less money will chase the goods and hence Inflation can be expected to stabilize. (5/n)

What does RBI do? As liquidity is provided to the market by banks as loans, RBI tries controlling banks by increasing interest rates (Repo Rate). It expects that if Repo Rate goes up, the spiraling effect will reduce liquidity in the market. (6/n)

How?

Repo rate is the rate @ which banks borrow 4m RBI. If Repo⬆️, the cost at which banks borrow is expected to ⬆️. Also the MCLR/Base rate 4 banks includes the repo rate 4 calculation & hence it is expected that if Repo ⬆️, banks will ⬆️ their lending rates. (7/n)

Repo rate is the rate @ which banks borrow 4m RBI. If Repo⬆️, the cost at which banks borrow is expected to ⬆️. Also the MCLR/Base rate 4 banks includes the repo rate 4 calculation & hence it is expected that if Repo ⬆️, banks will ⬆️ their lending rates. (7/n)

So, if inflation goes up, efforts are made to increase interest rates by which expectation is that individuals will take lesser loans and hence demand for products will reduce and hence inflation will stabilise. (8/n)

So increasing inflation & rate is theoretically negative for equities. You take lesser loans, -ve for banking & NBFC; Expensive loans reduce demand for Real Estate, Auto & hence ancillary products like steel, cement, tyre etc. (9/n)

Expensive loans ⬆️ cost for debt heavy sector like Infra, Power, etc. which many nt b able 2 pass the cost 2 the consumer & hence ⬆️ rates r generally considered negative 4 many sectors apart from the technical reason of future cash flow getting discounted at higher rate (10/n)

So is currently inflation going up? Yes but any growth focused central bank like RBI understands the same and hence makes efforts to not increase rates in a way that it creates panic in the markets. Fed also is talking about increasing rates only in the end of 2023 (11/n)

Central banks may not increase rates but markets know rates have to go up and hence they start factoring that in which is reflected in yields of the 10 years g-sec (more on this in some other thread) So yields are a good proxy to increase in rates to judge the sentiments (12/n)

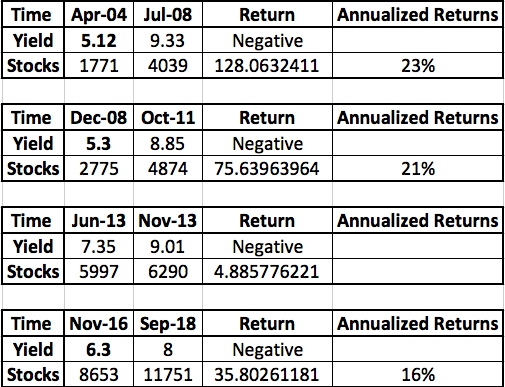

So now, if yields go up (proxy to interest rates going up), equity should fall right? But the last 20 years of data shows otherwise. I looked at all periods where yields had bottomed out & started rising (Like today) & compared it with equities & found 4 such instances (13/n)

(a) 04-08, rates went up but equity also generated 23% CAGR

(b) 08-11, rates went up, equity generates 21% CAGR

(c) 2013, too small a time frame but the same reading

(d) 16-18, rates went up, equity generated 16% CAGR

#investing (14/n)

(b) 08-11, rates went up, equity generates 21% CAGR

(c) 2013, too small a time frame but the same reading

(d) 16-18, rates went up, equity generated 16% CAGR

#investing (14/n)

Now ofcourse the question will be the fundamental logic

(a) In lower interest rate scenarios, corporates can raise loans at considerably low rates and redeploy it to generate higher ROCE’s till rates actually start rising much later (15/n)

(a) In lower interest rate scenarios, corporates can raise loans at considerably low rates and redeploy it to generate higher ROCE’s till rates actually start rising much later (15/n)

(b) Higher disposable investor income which is not going to fixed income investing because of lower rates is also invested in growth assets like Equity & commodities (16/n)

Ofcourse this will lead to reversal some time in the future but the transition does not happen over night. Markets see knee jerk reactions in the near term but till the time inflation is held under control, this phase can be navigated (17/n)

#investing

#investing

This is not an investment advice because you also have to look at other data points to invest or sell from the market. I am writing another thread later covering all points included to judge market movements (18/n)

This is my 37th thread, 'do re-tweet',

Have earlier written on,

Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar, Steel

- Macro

- Debt Markets

- Equity

- Gold

- Personal Finance etc.

You can find them all in the link below,

Have earlier written on,

Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar, Steel

- Macro

- Debt Markets

- Equity

- Gold

- Personal Finance etc.

You can find them all in the link below,

https://twitter.com/KirtanShahCFP/status/1337953717274832896?s=20…… (**END**)

• • •

Missing some Tweet in this thread? You can try to

force a refresh