Looking to get up to speed on changes taking place in the global economy and the impact they will have on #gold?

Drawing on content from our #IGWT report–including contributions from @Breedlove22 and Russell Napier–the five threads below are a good place to start.👇🧵

Drawing on content from our #IGWT report–including contributions from @Breedlove22 and Russell Napier–the five threads below are a good place to start.👇🧵

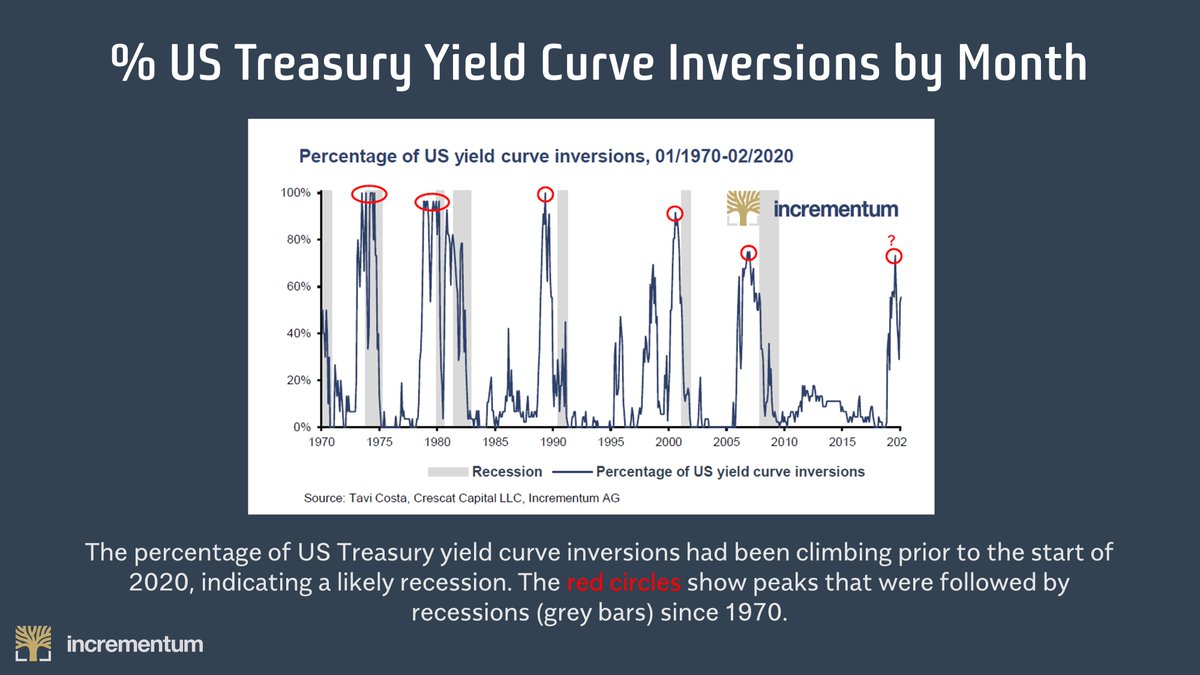

1/ Our report tackles the economic status quo and explains why "monetary climate change" is on its way.

This thread outlines gold’s performance over the past year, explains how this relates to macroeconomic trends, and gives our forecasts for the future.

This thread outlines gold’s performance over the past year, explains how this relates to macroeconomic trends, and gives our forecasts for the future.

https://twitter.com/IGWTreport/status/1397853169753939969?s=20

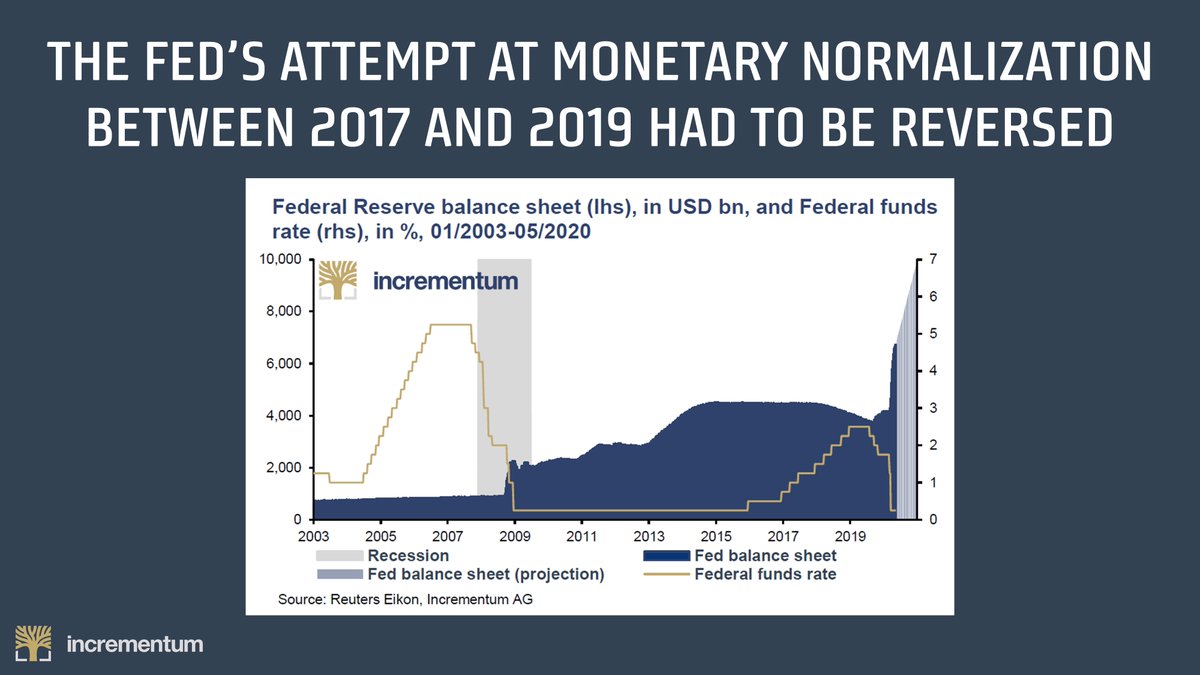

2/ Structural economic changes are taking place around the world, and these changes make higher inflation more likely.

Russell Napier has been a deflationist for decades. He now sees inflation ahead… but not for the reasons you might expect.

Russell Napier has been a deflationist for decades. He now sees inflation ahead… but not for the reasons you might expect.

https://twitter.com/IGWTreport/status/1372656999184412672?s=20

3/ Since 1990 the value of exported goods has risen from 15% to 25% of global GDP as the world has globalized.

China, buoyed by favorable demographics, has played a huge role in supporting growth in trade, but things are now starting to change...

China, buoyed by favorable demographics, has played a huge role in supporting growth in trade, but things are now starting to change...

https://twitter.com/IGWTreport/status/1398171109560889347?s=20

4/ A chapter by guest author @Breedlove22 takes a step back to ask the question “What is Money?”

This thread gives an overview of some of Robert’s key insights, but the chapter itself is a must-read.

This thread gives an overview of some of Robert’s key insights, but the chapter itself is a must-read.

https://twitter.com/IGWTreport/status/1397916790156451850?s=20

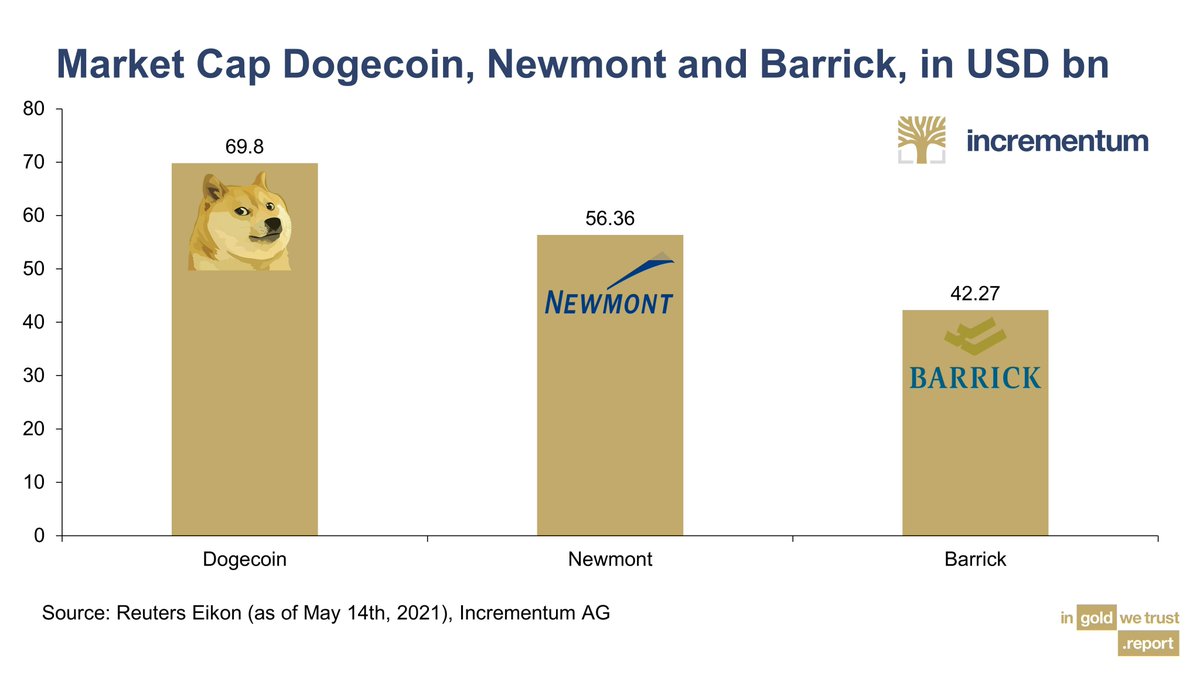

5/ Given the price of gold, inflationary macroeconomic trends, and healthy balance sheets within the industry, we see gold mining stocks as highly undervalued.

This thread, drawing on multiple data sources, explains why.

This thread, drawing on multiple data sources, explains why.

https://twitter.com/IGWTreport/status/1398683899086114820?s=20

These five threads give you a flavor of what to expect from our 2021 #IGWT report.

Much more, including analysis by @lynaldencontact, FOFOA and Hans Hansen, can be found inside.

Download for free here: bit.ly/3fpQEeT

Thanks for reading— @RonStoeferle & @MarkValek

Much more, including analysis by @lynaldencontact, FOFOA and Hans Hansen, can be found inside.

Download for free here: bit.ly/3fpQEeT

Thanks for reading— @RonStoeferle & @MarkValek

If you found the insights shared in this thread valuable, please help us reach a wider audience by retweeting the first tweet.

https://twitter.com/IGWTreport/status/1407324071554060289?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh