The format of UEFA’s competitions will change next season with the addition of the Europa Conference League to the existing Champions League and Europa League, so I thought it might be interesting to see how this will impact the revenue distributions in 2021/22.

UEFA estimate gross revenue will increase by €250m (8%) from €3.25 bln to €3.5 bln. €323m is deducted to cover competition-related costs, while €105m (3%) is set aside for qualifying rounds, €140m (4%) for non-participating clubs and €10m for Women’s Champions League.

That leaves €2.92 bln net revenue, of which €190m (6.5%) is reserved for European football and remains with UEFA, while €2.732 bln is distributed to the participating clubs, split Champions League €2.032 bln (74%), Europa League €465m (17%) and Europa Conference €235m (9%).

Total revenue distribution increases by €192m (8%) from €2.540 bln to €2.732 bln. This growth has funded the Europa Conference €235m, along with a €95m (17%) decrease in Europa League (albeit down from 48 to 32 clubs), while Champions League will be €52m (3%) higher.

As a result of COVID-19, revenue in 2019/20 was reduced by €531m with €416.5m impact on participating clubs. This will be deducted in equal shares over five seasons (from 2019/20 to 2023/24) in proportion to each competition. This works out to around 3% of each club’s revenue.

Clearly, the Champions League retains the lion’s share of UEFA revenue with its €2.032 bln being nearly 3 times as much as the Europa League and Europa Conference combined (€700m). The difference is particularly stark for the UEFA coefficient (based on 10-year rankings).

The importance of distribution elements varies by competition. In the Champions League prize money and UEFA coefficient lead the way (both 30%), while in the Europa Conference participation and prize money are most significant (both 40%). TV pool very high (30%) in Europa League.

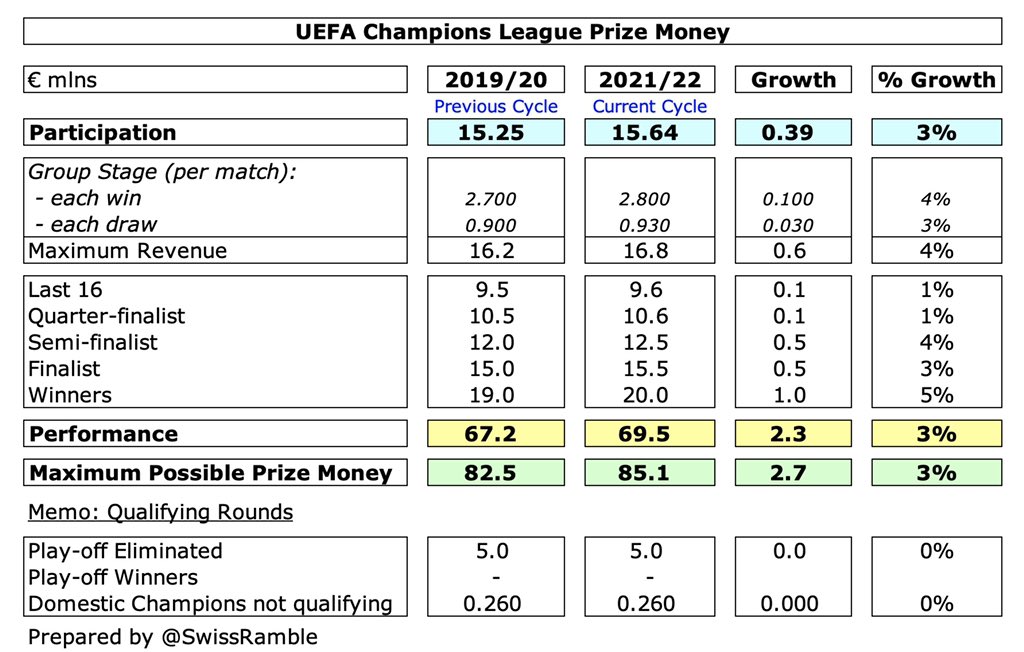

In 2021/22 each of the 32 clubs in the Champions League group stage get €15.64m plus €2.8m for a win and €930k for a draw. Additional prize money for each further stage reached: last 16 €9.6m, quarter-final €10.6m, semi-final €12.5m, final €15.5m and winners €20m.

The 2021/22 Champions League prize money has therefore risen by 3% over the current cycle with the highest increase (5%) reserved for the winners. The maximum amount that a club could earn (excluding TV pool & coefficient) is up €2.6m from €82.5m to €85.1m.

Each of the clubs in the Europa League group stage get €3.63m plus €630k for a win and €210k for a draw. Additional prize money: win group €1.1m (runners-up €550k), knockout round €500k, last 16 €1.2m, quarter-final €1.8m, semi-final €2.8m, final €4.6m & winners €8.6m.

The 2021/22 Europa League prize money has risen by 10% over current cycle with the highest increase (24%) in the participation fee, but only 1% more for the winners. The maximum amount that a club could earn (excluding TV pool & coefficient) is up €2.1m from €21.3m to €23.4m.

Each of the 32 clubs in the Europa Conference group stage get €2.94m plus €500k for a win and €166k for a draw. Additional prize money: win group €650k (runners-up €325k), knockout round €300k, last 16 €600k, quarter-final €1m, semi-final €2m, final €3m & winners €5m.

The Europa Conference has a decent participation fee of €2.9m, but the big money (€5m) is reserved for the tournament winners. The maximum amount that a club could earn (excluding TV pool & coefficient) is €15.5m.

The Champions League prize money overall is 3.6 times the Europa League and 5.5 times the Europa Conference, but this varies by round. In general, the difference becomes smaller the further a club progresses, e.g. last 16 it’s 8x and 16x, while for winners it’s only 2.3x and 4x.

The UEFA coefficient payment was introduced in 2018/19, based on performances in UEFA tournaments over the past 10 years, including bonus points for winning UEFA tournaments, so it benefits the traditional big clubs like Real Madrid, Barcelona & Bayern Munich.

The Champions League €600.6m UEFA coefficient pot is divided into shares worth €1.137m, so the highest ranked club gets €36.4m, while the lowest gets €1.1m. In the Europa League payments range from €4.2m to €132k, while the Europa Conference goes from €1.4m to €45k.

Champions League clubs clearly benefit most from the UEFA coefficient payments, as these are nearly 9 times as much as the Europa League and no less than 26 times as much as the Europa Conference. Some have argued that this is UEFA’s way of trying to prevent a Super League…

Champions League TV pool distribution: (a) first half is based on position in previous season’s Premier League – winners 40%, 2nd 30%, 3rd 20%, 4th 10%; (b) second half based on progress in current season’s Champions League. After the 3% increase, England up from €68m to €70m.

Europa League TV pool distribution: (a) first half based on previous season’s domestic competitions – cup winners 60%, league 40% (if cup winner does not qualify, split equally); (b) second half based on progress in current season’s Europa League. Down 17% over previous cycle.

Europa Conference TV pool distribution follows the same model as the Europa League, albeit with smaller amounts. My estimate of €5.2m for England is based on applying the overall split of the TV pool between Europa League and Europa conference to the previous English amount.

Based on these assumptions, we can estimate the maximum that English clubs could earn from Europe. Taking the highest ranked qualifier (based on league position), #MCFC would earn €133m from Champions League, #LCFC €44m from Europa League and #THFC €21m from Europa Conference.

It is worth noting the impact of exchange rates on the amounts received by English clubs. In our illustrative example, #MCFC €133m would be £114m at current rate of 1.17, but it would be up to £117m if the rate were the 1.14 used in the 2019/20 Deloitte Money League.

These figures underline the importance of qualifying for Europe, especially the lucrative Champions League, as the financial difference in the three competition is evident. Once again, it’s a case of “the rich getting richer”, posing more questions about competitive balance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh