#BarnsleyFC 2019/20 accounts covered the club’s first season back in the Championship following promotion from League One, when they narrowly avoided relegation by finishing 21st. Head coach Daniel Stendel was replaced by Gerhard Struber, since succeeded by Valerien Ismael.

#BarnsleyFC are owned by a group of international investors, led by Chien Lee of NewCity Capital and Paul Conway of Pacific Media Group, who follow the “Moneyball” approach of fellow investor, Billy Beane. They bought 80% from former custodian, Patrick Cryne, in December 2017.

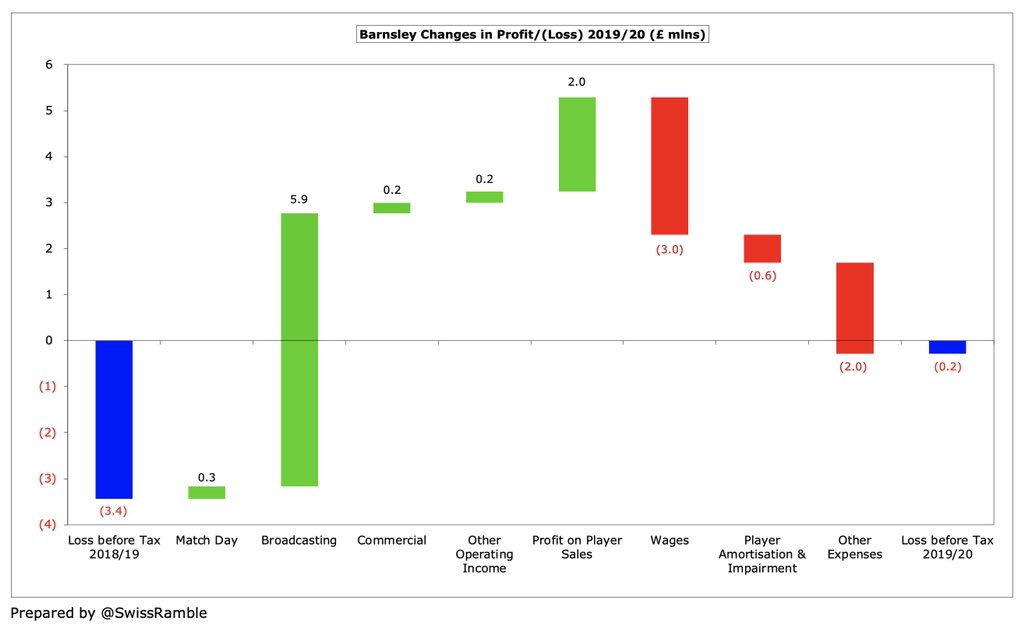

Following promotion to the Championship, #BarnsleyFC reduced their loss from £3.4m to just £0.3m, as revenue increased £6.4m (83%) from £7.8m to £14.2m and profit on player sales rose £2.0m to £5.8m, partly offset by expenses growing £5.6m (37%) to £20.5m.

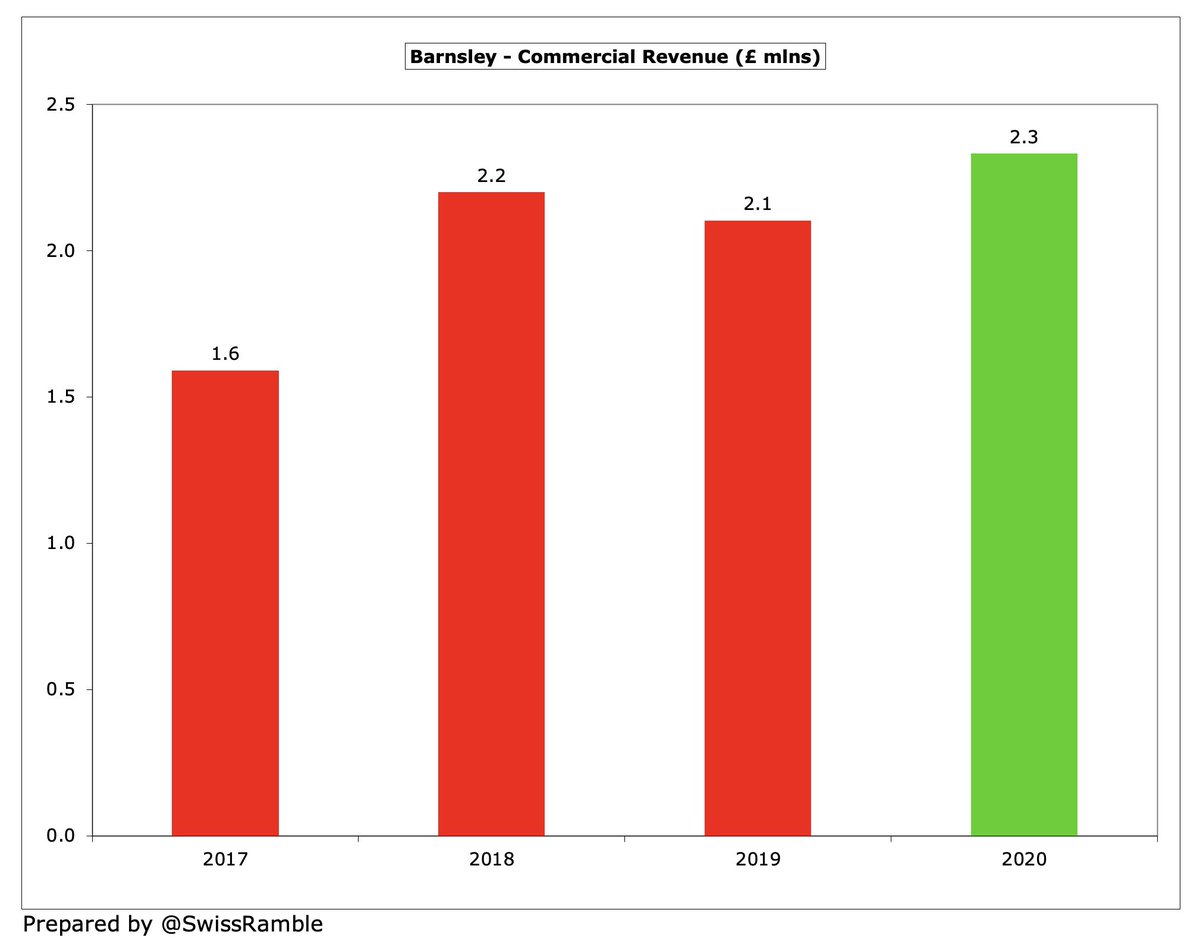

The #BarnsleyFC revenue increase was mainly driven by broadcasting income rising £5.9m from £2.6m to £8.2m, due to higher central TV distributions in the Championship, while match day increased £0.3m (9%) to £3.4m and commercial grew £0.2m (11%) to £2.3m.

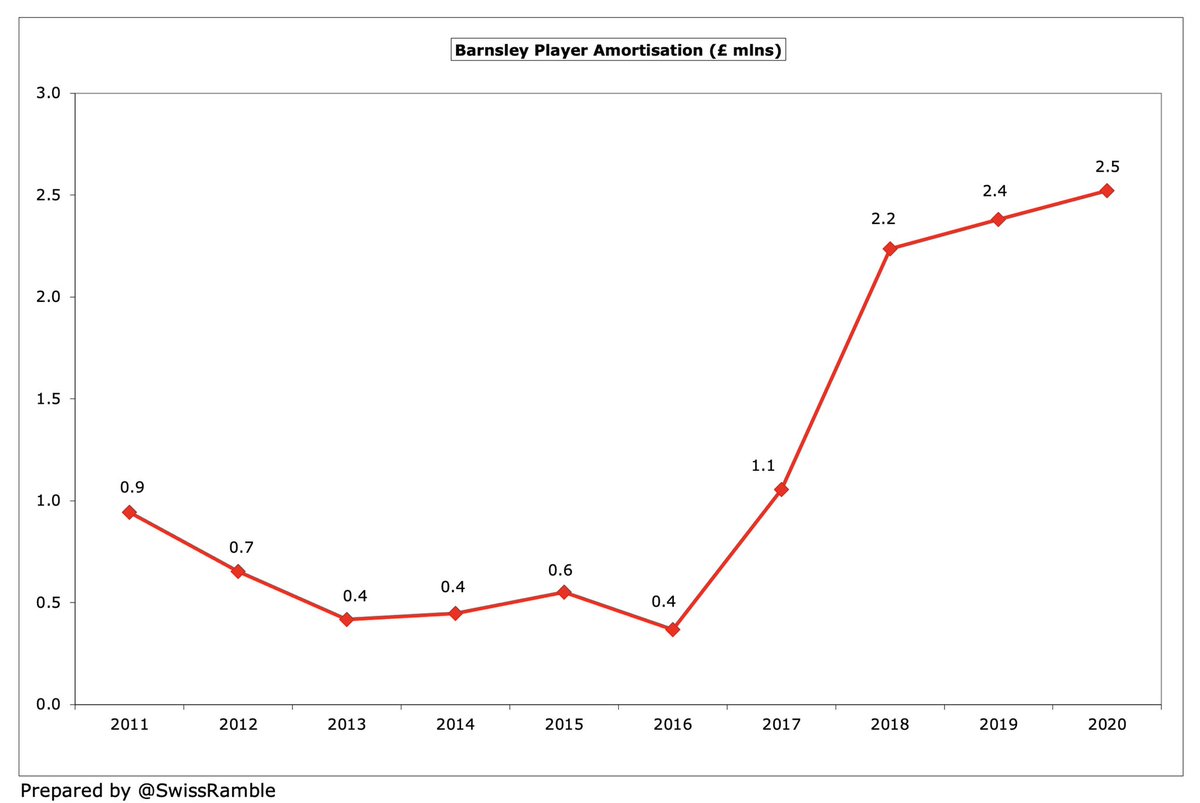

However, #BarnsleyFC saw a fair bit of cost growth, as significant activity in the transfer market meant that wages rose £3.0m (37%) from £8.1m to £11.1m and player amortisation/impairment increased £0.6m to £3.0m. Other expenses were also up £2.0m (46%) to £6.3m.

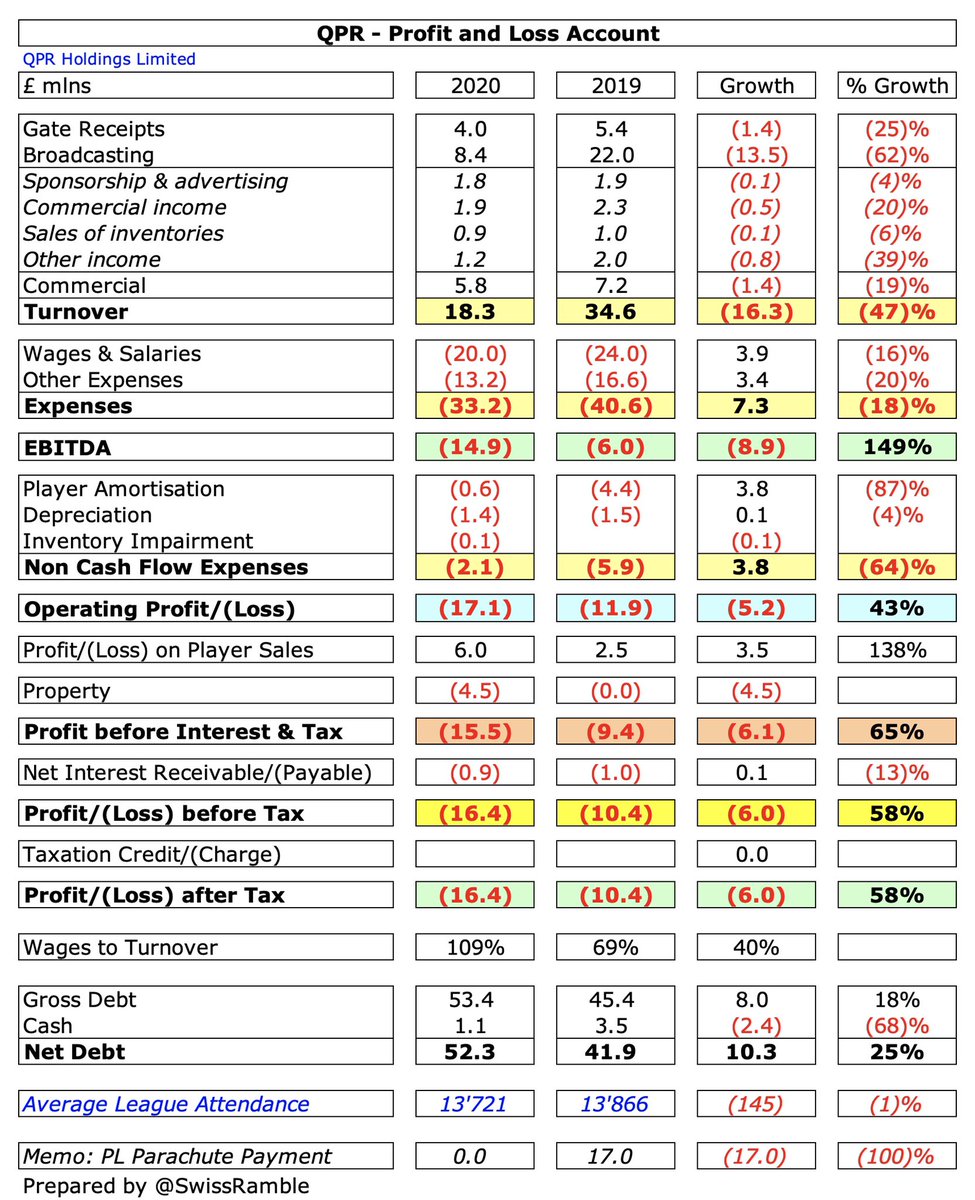

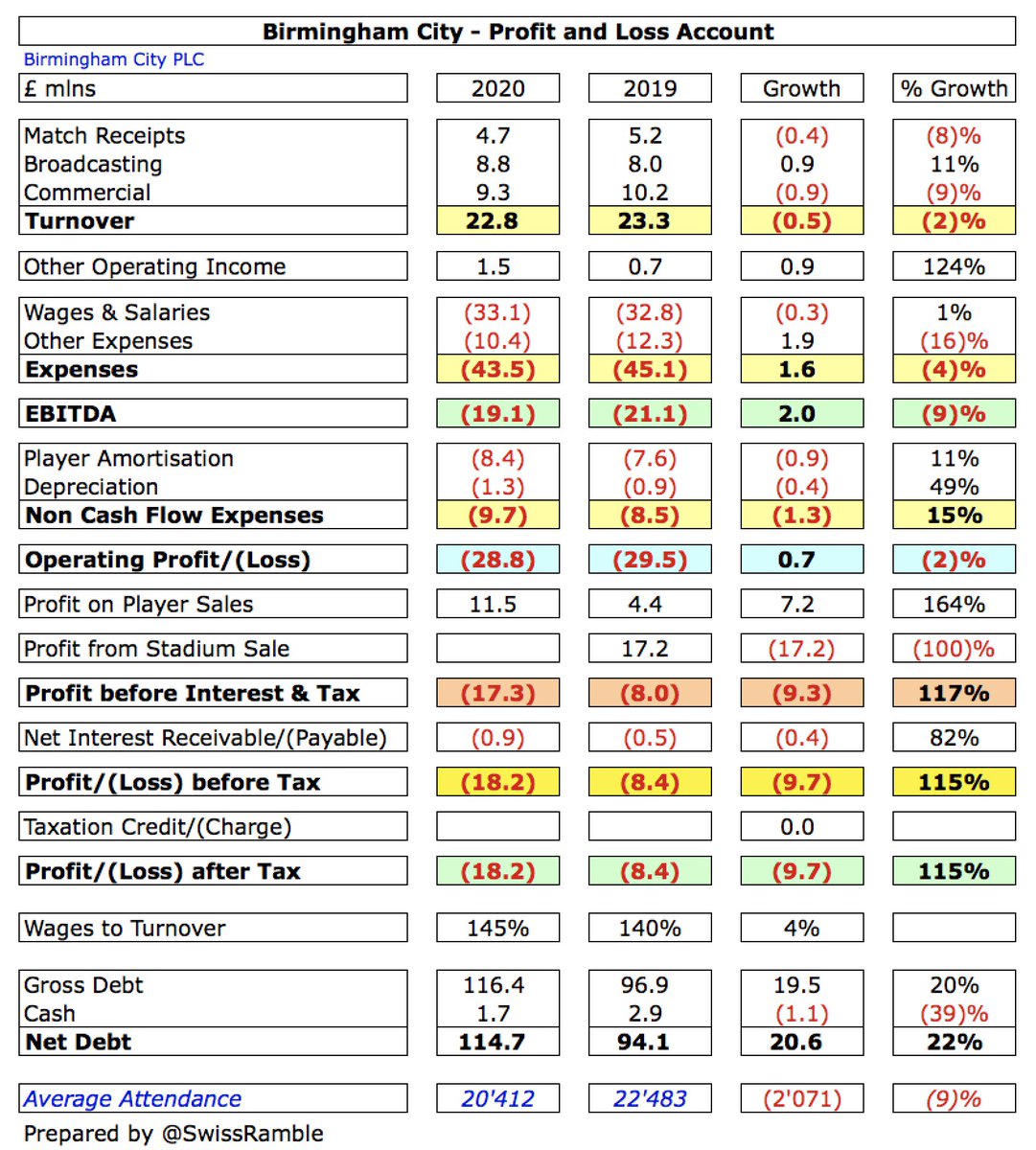

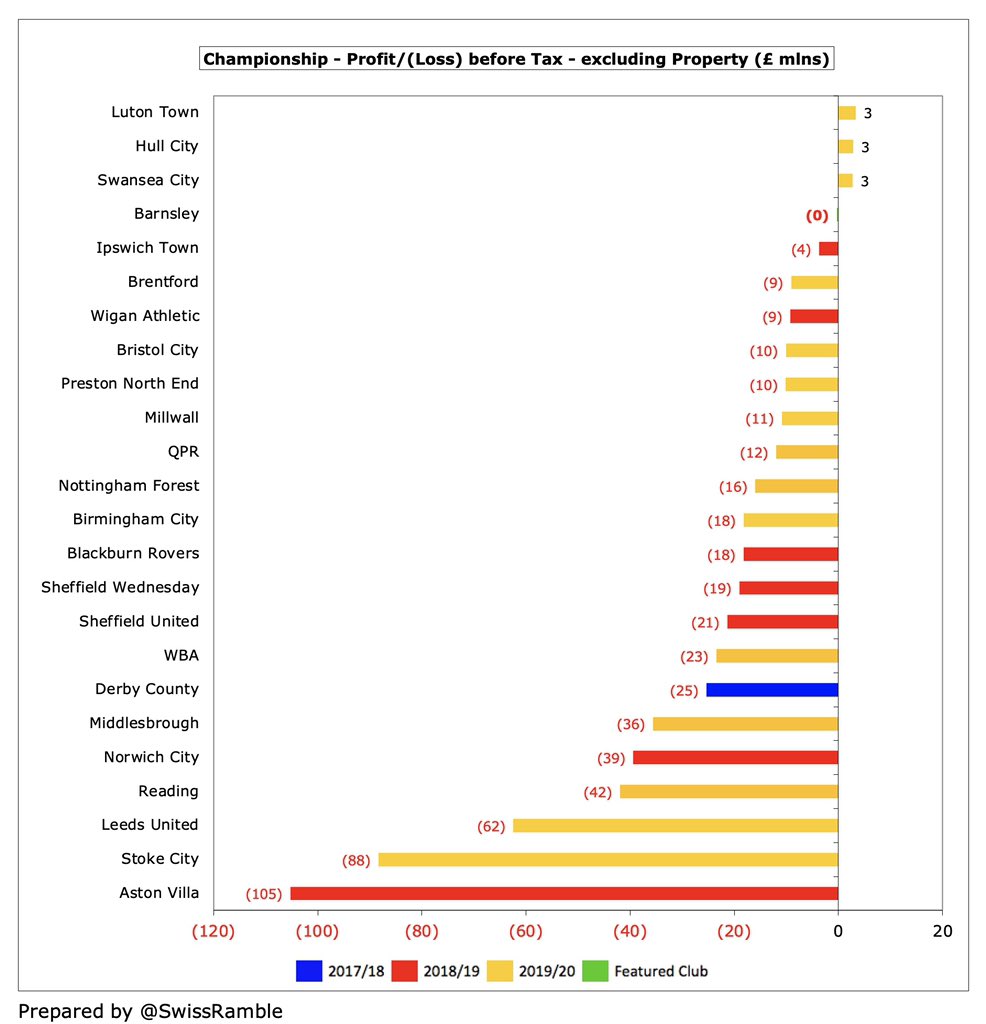

Although a loss is rarely good news, #BarnsleyFC £0.3m deficit was actually one of the best financial results in the Championship. Many clubs have reported much larger losses in 2019/20, including Stoke City £88m, #LUFC £62m (large promotion bonus), Reading £42m and #Boro £36m.

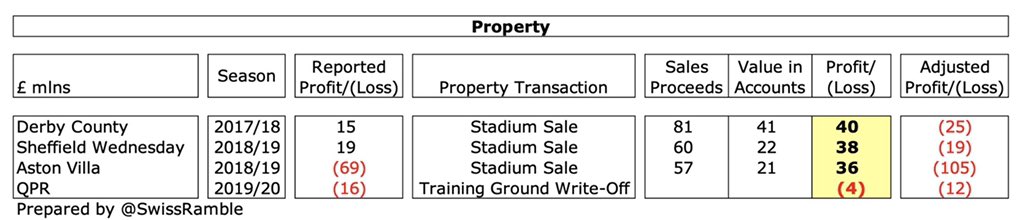

It is also worth noting that some clubs’ figures have been boosted by the sale of stadiums, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying profitability was even worse than reported.

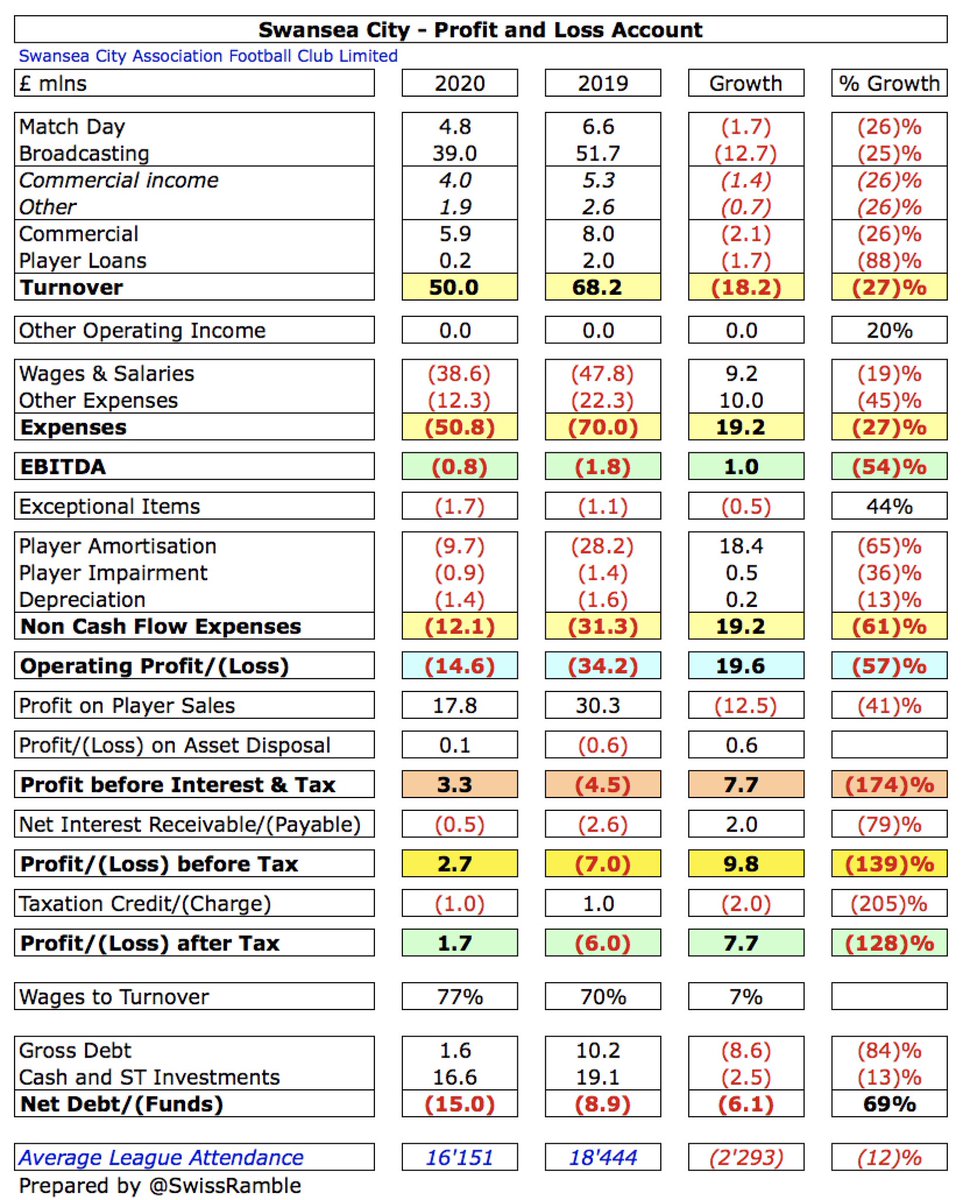

Excluding property sales, only 3 Championship clubs are profitable in 2019/20 to date (#LTFC, #HCAFC and #Swans, all £3m). Very few clubs manage to make money in this ultra-competitive division, though largest losses often from promoted clubs – including hefty promotion bonuses.

#BarnsleyFC have not quantified the effect of COVID-19, though they said they would have achieved break-even and satisfied the objective of operating a self-sustainable budget without the impact of lost match day revenue. Utilised furlough scheme and deferred payments to HMRC.

#BarnsleyFC profit on player sales rose £2.0m to £5.8m, mainly Ethan Pinnock to Brentford, Kieffer Moore to Wigan Athletic and Liam Lindsay to Stoke City. That’s a solid improvement, but still a fair bit lower than WBA £29m, Bristol City £26m, Brentford £25m and Hull City £23m.

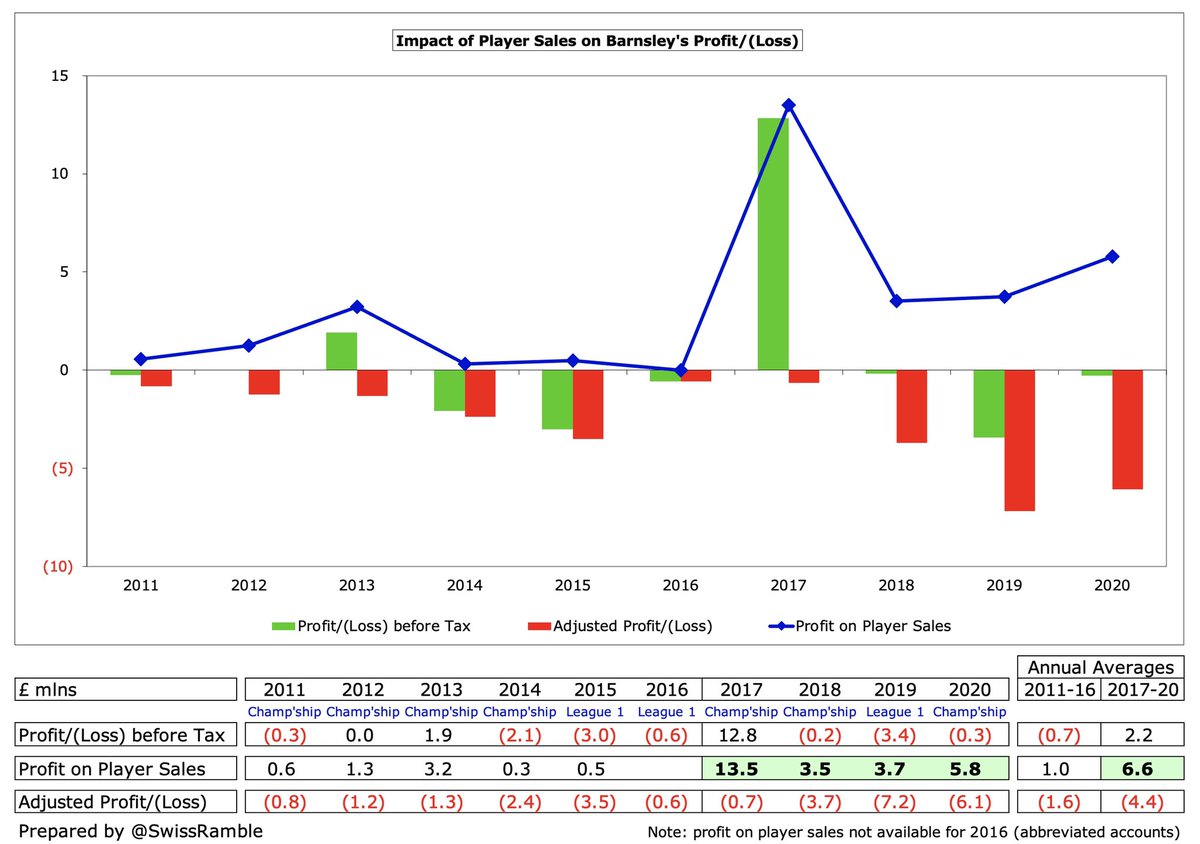

#BarnsleyFC clearly run a tight ship, as they usually report small losses every year (the highest in the past decade being just £3.4m). The £12.8m profit in 2016/17 is the outlier, which is the main reason that the club has made an overall £5m profit over this period.

Like many other clubs, #BarnsleyFC have become increasingly reliant on player sales, averaging £6.6m profit in the last four years with the highlight being £13.5m in 2017, including a large sell-on fee for John Stones moving from #EFC to #MCFC.

As a technical aside, #BarnsleyFC only published abbreviated accounts for the 2015/16 season, so unfortunately not all of the usual financial details are available for that year.

#BarnsleyFC operating loss (i.e. excluding player sales and interest) improved from £7m to £6m, which is actually one of the best performances in 2019/20 Championship to date. Almost every club in this division posts substantial operating losses, i.e. half of them are above £30m.

#BarnsleyFC £14.2m revenue was slightly higher than the last time they were in the Championship two years ago. Promotion from League One was worth £6.4m. Broadcasting is the most important revenue stream at 60%, followed by match day 24% and commercial 16%.

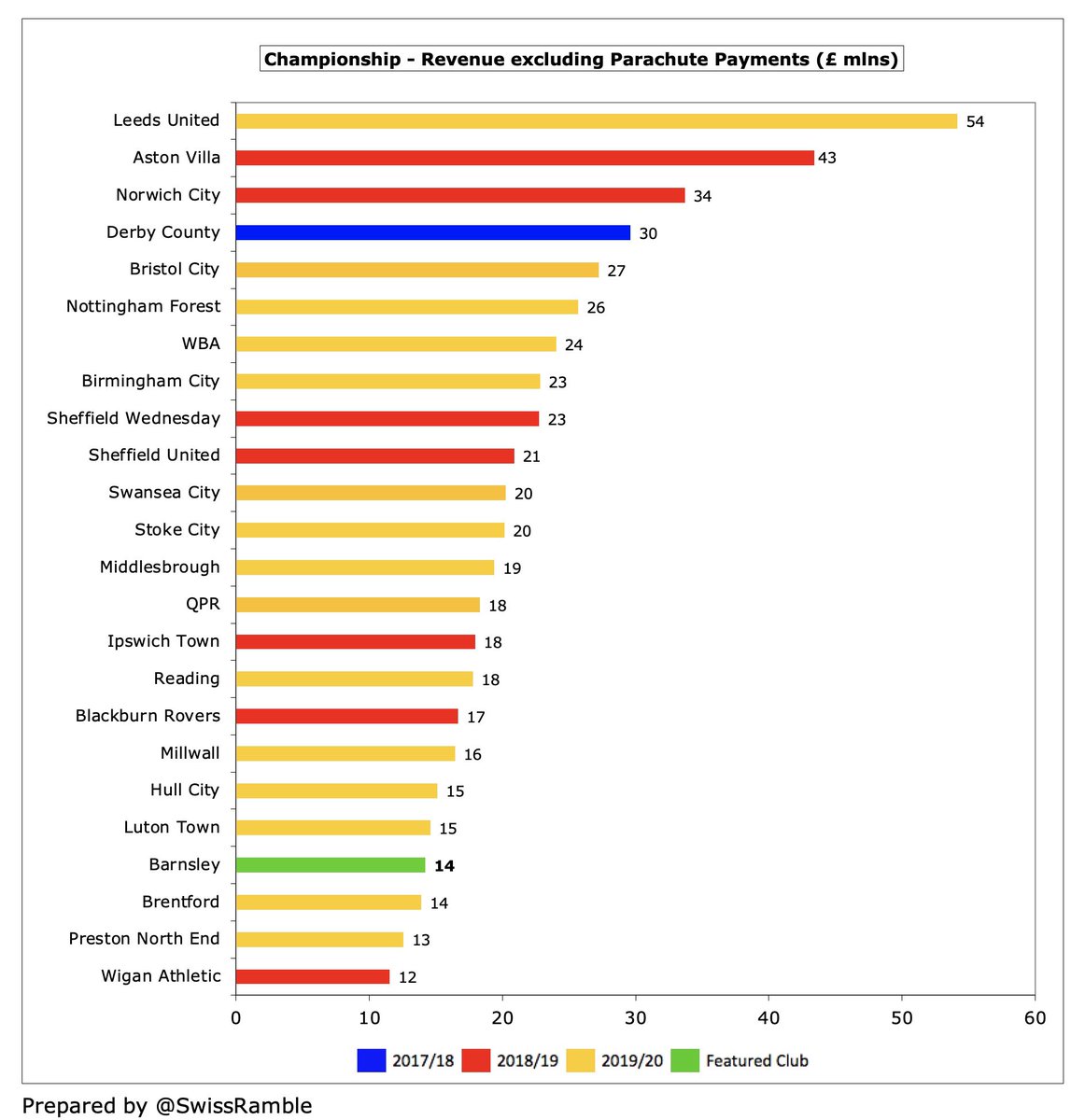

Despite the growth in 2019/20, #BarnsleyFC £14m revenue was still one of the lowest in the Championship. To place this into context, this is around a quarter of #LUFC and WBA (both £54m), while the recently relegated clubs will be around £70m when they publish 2019/20 accounts.

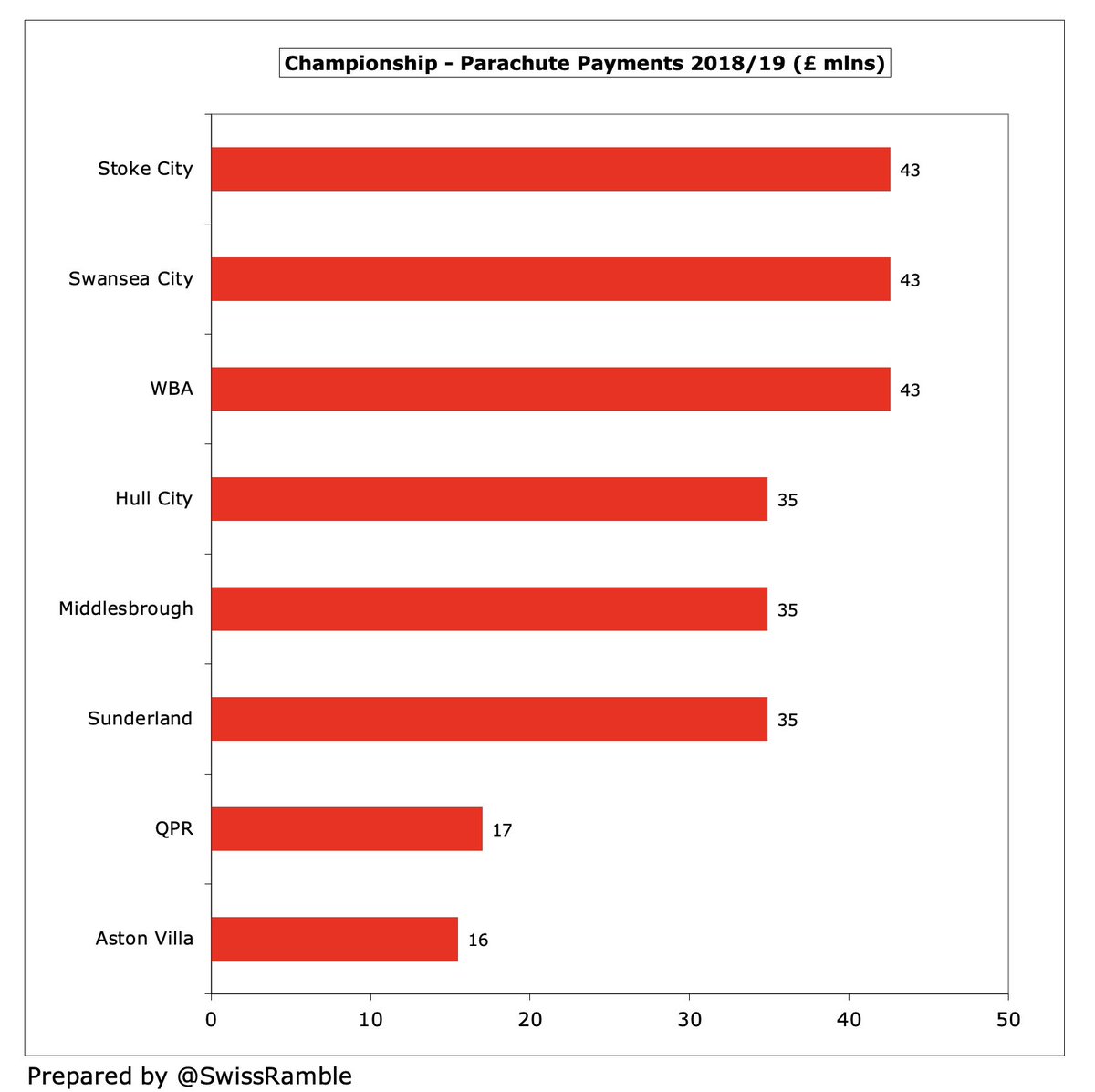

Championship revenue is hugely influenced by PL parachute payments, making #BarnsleyFC performance this season all the more impressive. Seven clubs benefited from these in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

If parachute payments were excluded, #BarnsleyFC £14m position in the Championship revenue league would be unchanged. They would still be miles below the leading clubs with the gap to the highest placed Leeds United an incredible £40m.

#BarnsleyFC broadcasting income more than tripled from £2.6m to £8.5m, due to higher EFL distributions and PL solidarity payment in the Championship. Most clubs earn £7-10m, but a significant gap to those with parachute payments, e.g. around £50m for those recently relegated.

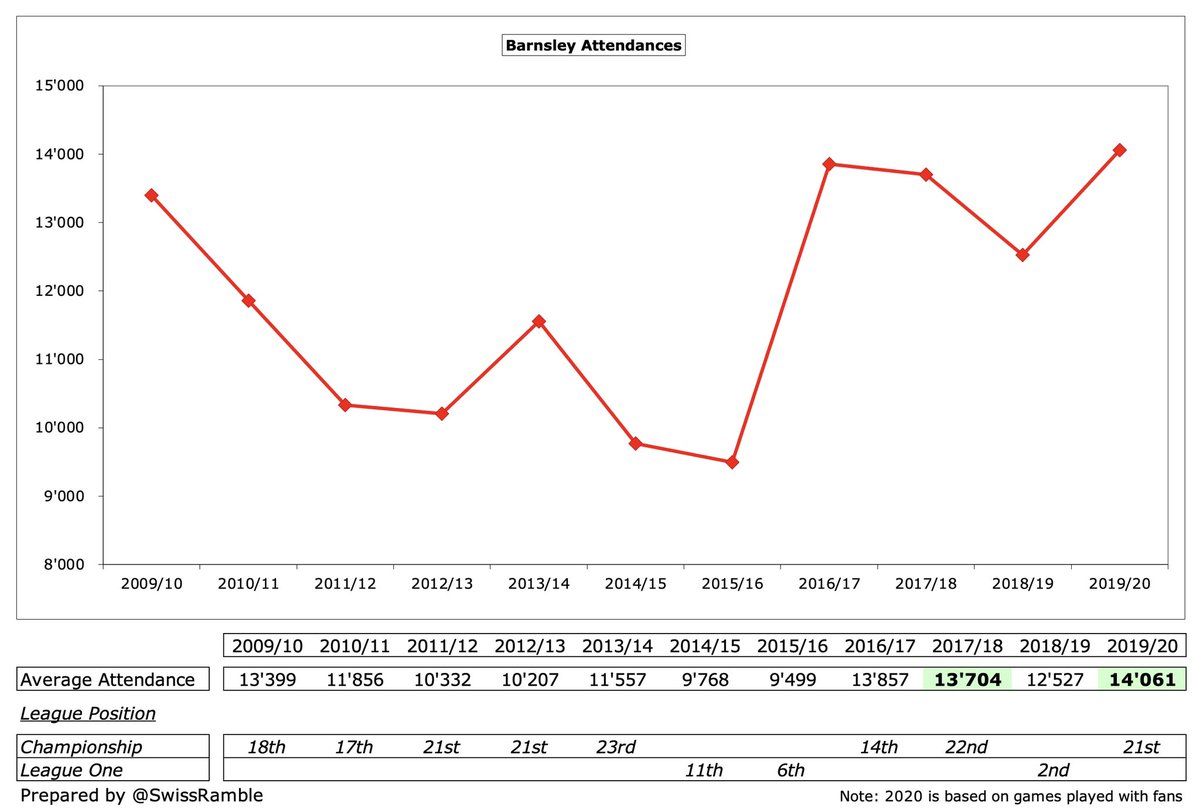

#BarnsleyFC match day income rose £0.3m (9%) from £3.1m to £3.4m, despite playing 4 home games behind closed doors because of the pandemic, as attendances rose following promotion. Revenue still one of the lowest in the Championship, less than a third of #LUFC £11m.

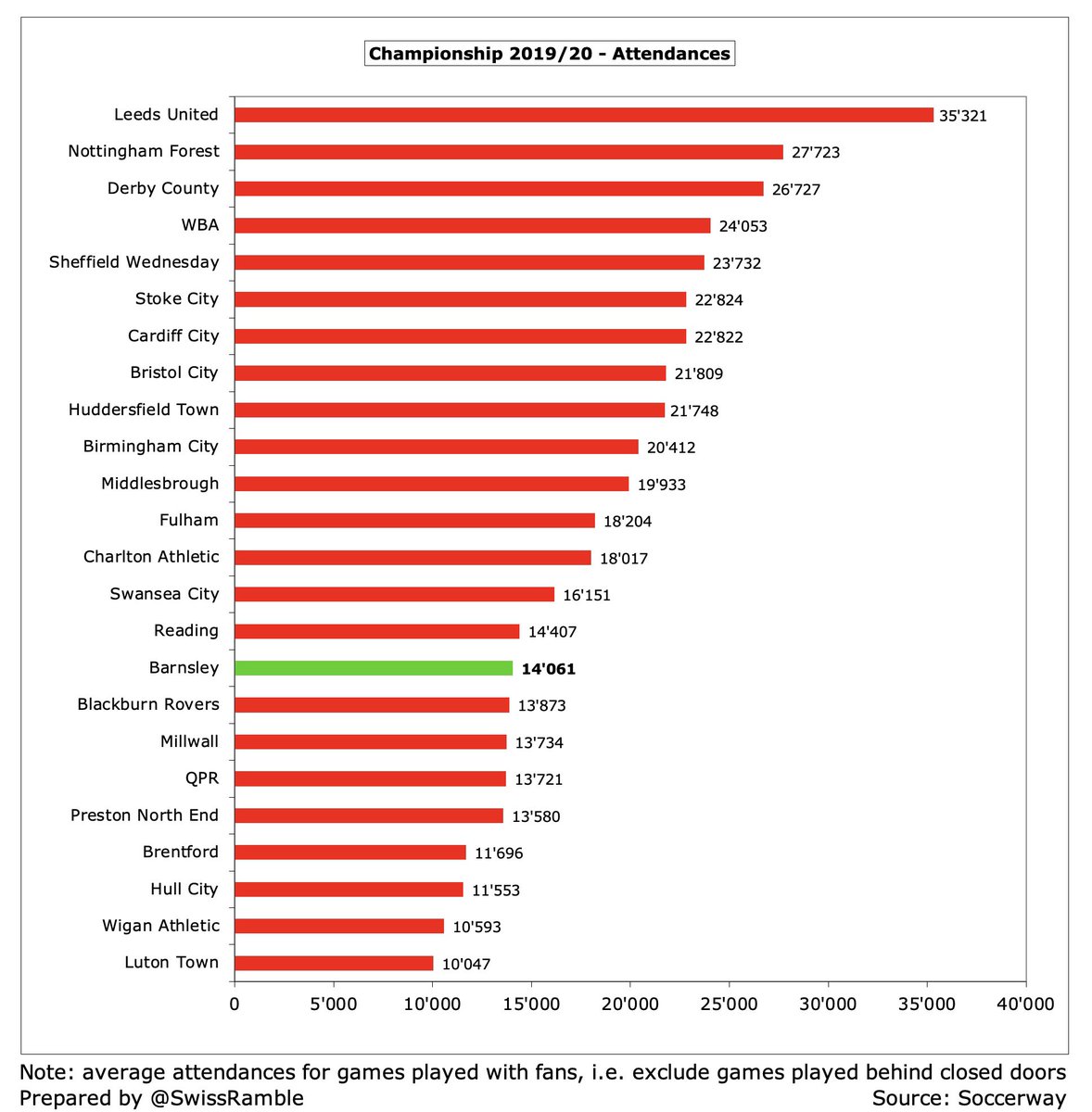

#BarnsleyFC average attendance (for games played with fans) increased 12% from 12,527 to 14,061, which is also higher than last time in the Championship. However, still firmly in the bottom half of the division. Worth noting that 7,500 fans bought season tickets for 2020/21.

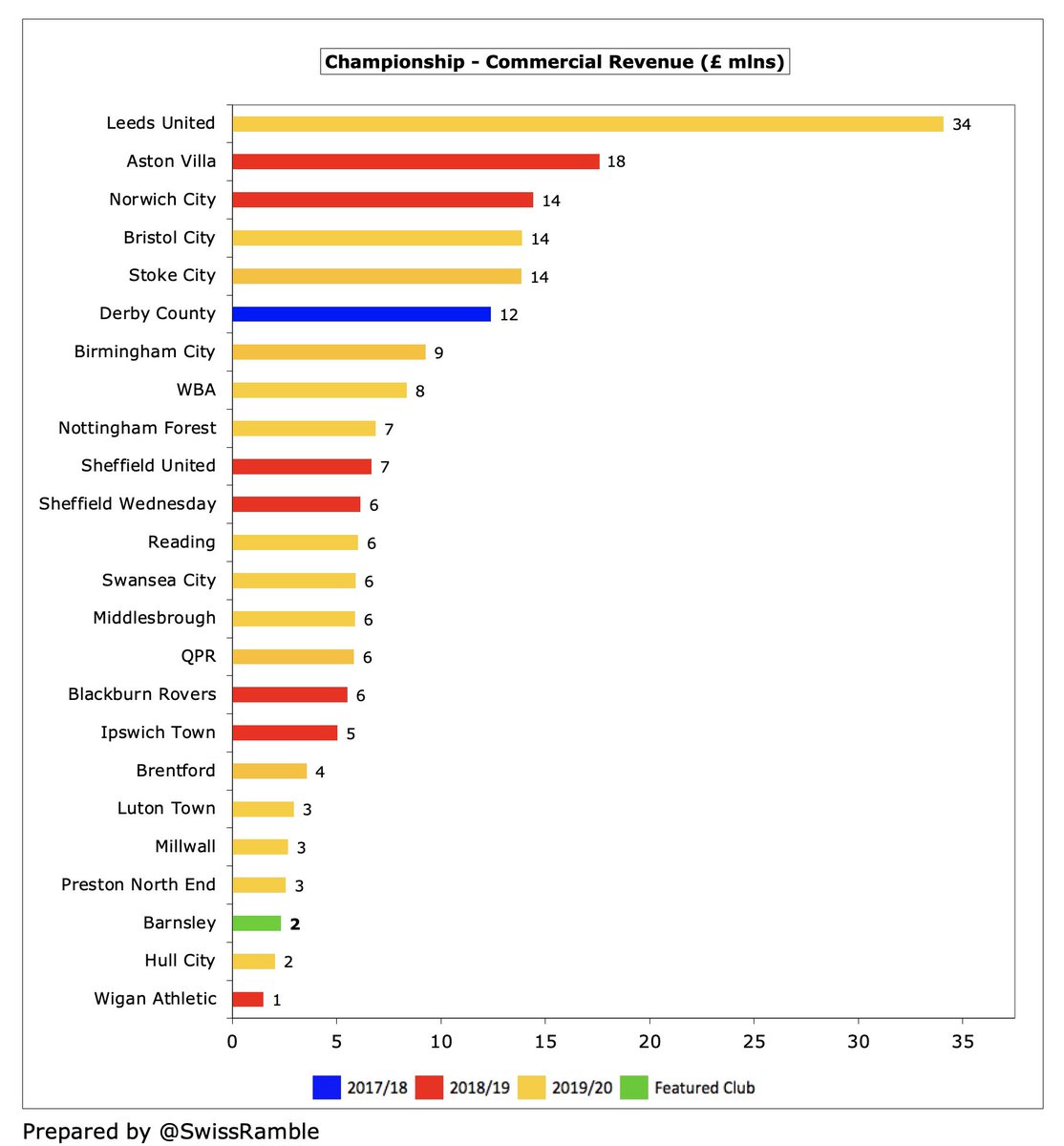

#BarnsleyFC commercial income rose £0.2m (11%) to £2.3m: merchandising £0.7m, sponsorship & advertising £0.7m and other receipts £0.9m. Still one of the lowest in the Championship, far below the likes of #LUFC £34m and Bristol City £14m.

#BarnsleyFC had a new shirt sponsor in 2019/20, The Investment Room, replacing local industrial recycling company, CK Beckett, who had been sponsoring the club since 2011. Puma have been the kit supplier for the last six years.

#BarnsleyFC wage bill increased £3.0m (37%) from £8.1m to £11.1m, which is £0.5m (5%) higher than the last time they were in the Championship two years ago. In that period headcount is unchanged, though footballing activities are down 30, offset by an increase in match day staff.

Despite the increase, #BarnsleyFC £11m wage bill is lowest in the Championship (#LTFC have not divulged wages), £7m less than the next lowest #HCAFC £18m. Miles behind #LUFC £78m and WBA £67m (both included hefty promotion bonuses), so the club punches well above its weight.

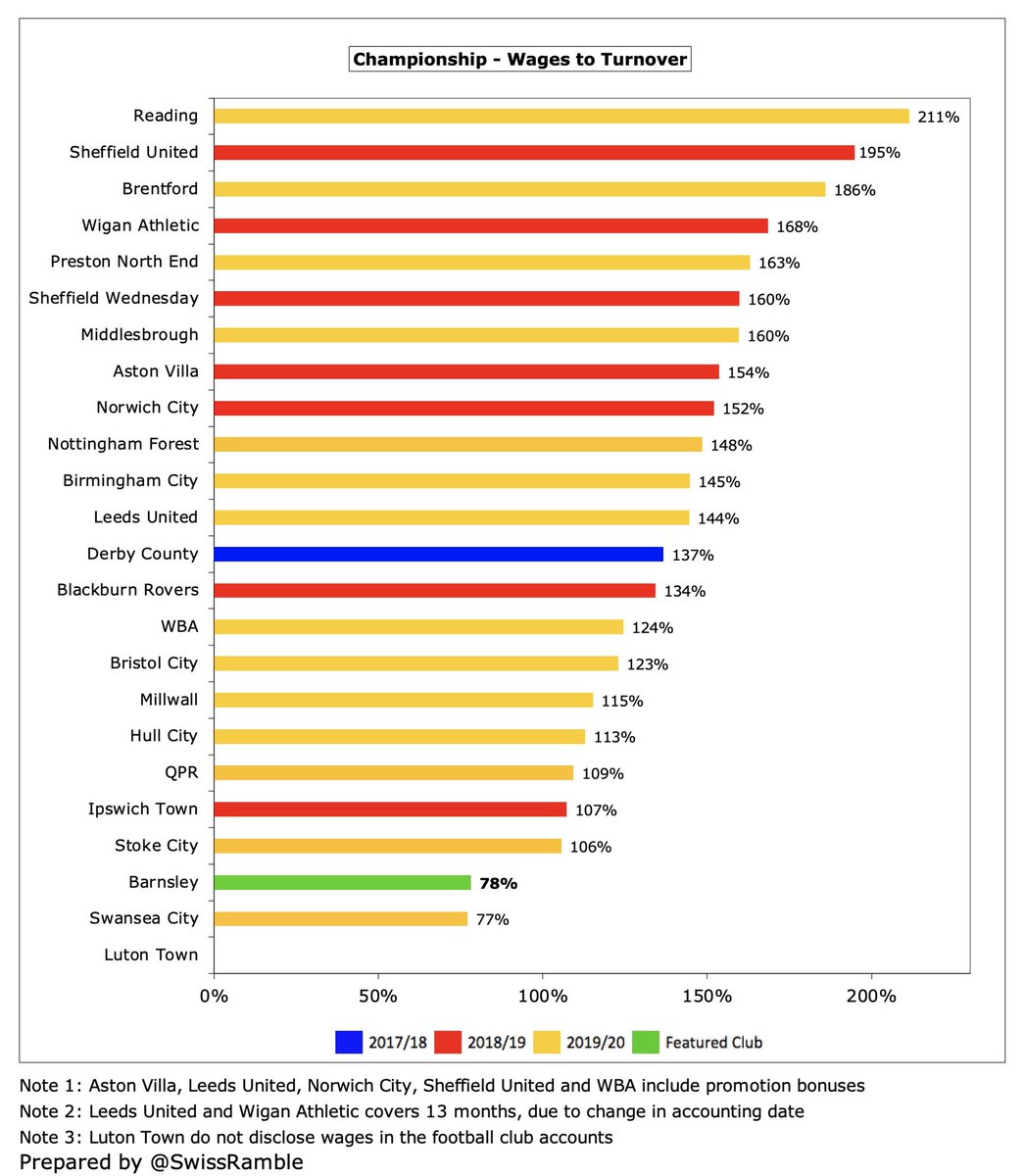

#BarnsleyFC wages to turnover ratio improved from 105% to 78%, similar to the 76% the last time they were in the Championship. The Board believes this is “a sustainable level and well below the divisional average.” In fact, the vast majority of clubs have ratios well over 100%.

#BarnsleyFC total directors’ remuneration decreased by 6% from £348k to £327k. This is still in the top half of the Championship (unlike most metrics), though in fairness a fair way below the likes of Birmingham City £1.6m, Stoke City £834k, Reading £583k and #BRFC £570k.

#BarnsleyFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £0.1m (6%) to £2.5m. Although high for the club, a long way below the division’s spenders, e.g. Stoke £30m. Also wrote-off £0.5m of player value via impairment (Diaby?)

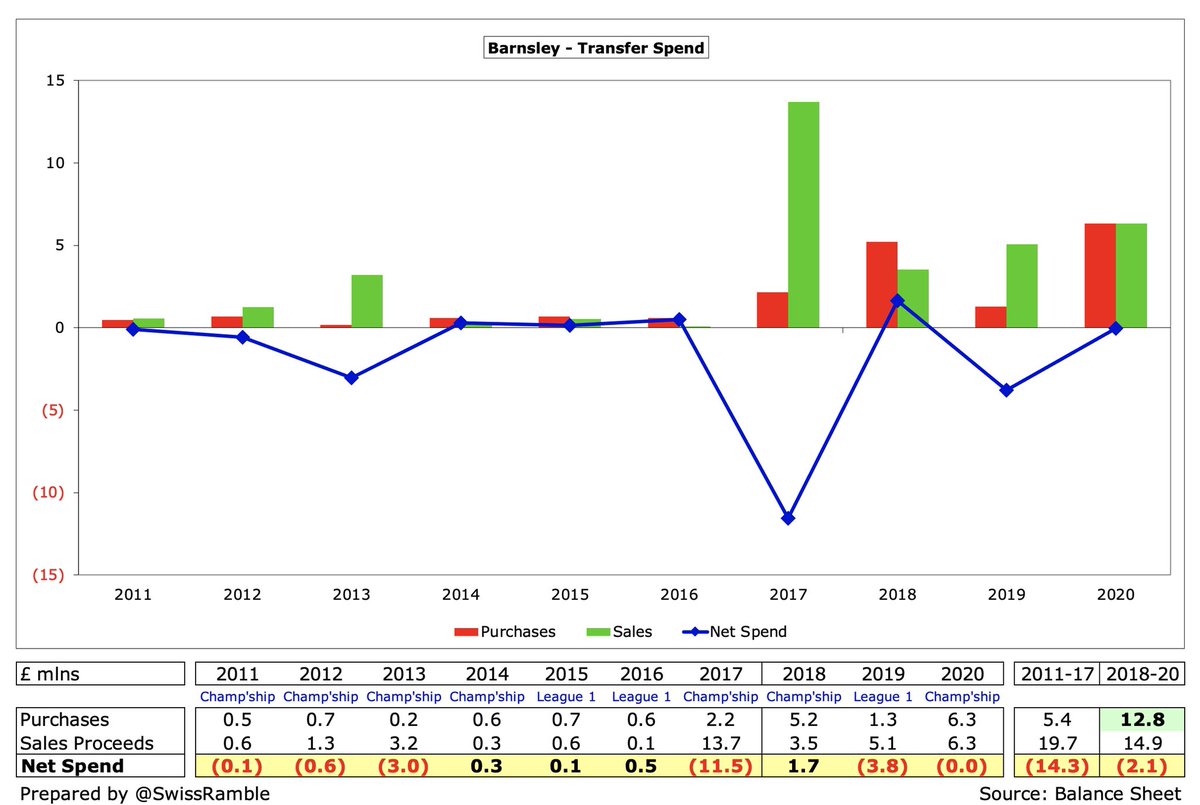

#BarnsleyFC spent £6.3m on player purchases, including Thomas, Schmidt, Wilks and Andersen. This was huge by the club’s standards, but they were still massively outspent by the likes of #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

#BarnsleyFC have ramped up transfer spend since the new owners arrived with a £12.8m outlay in the last 3 years, compared to only £5.4m in the preceding 7-year period. Nevertheless, they have reported net sales of £2m since 2017, as the club strives to break-even.

The good news is that #BarnsleyFC have been debt-free since £6.3m of loans from former owner Cryne was converted into share capital in 2017/18. This is in stark contrast to many others in the Championship, e.g. Stoke City £187m, Birmingham City £116m and #Boro £116m.

That said, most debt in this division is provided interest-free by club owners with the highest annual payments being just £1.7m at Hull City and Birmingham City. Like a few other clubs, #BarnsleyFC paid no interest in 2019/20.

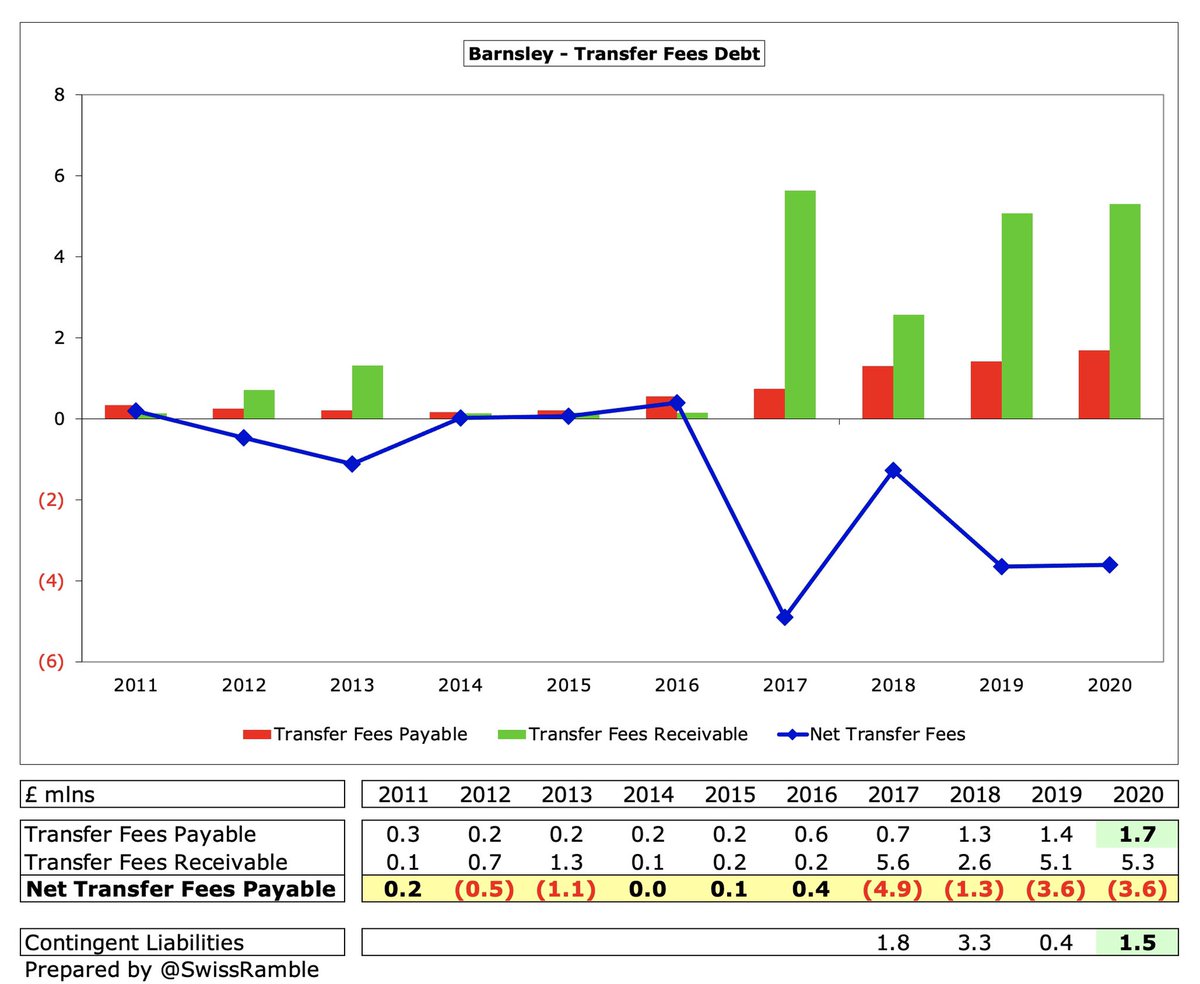

#BarnsleyFC transfer debt (for outstanding stage payments) increased from £1.4m to £1.7m, but this is still very low. Furthermore, they are in turn owed £5.3m by other clubs, so they have £3.6m net receivables.

#BarnsleyFC small £6m operating loss became £3m from a cash perspective after adding back non-cash player amortisation and depreciation and was further improved by £1m net player sales (sales £6m, purchases £5m), giving a £2m net cash outflow.

As a result, #BarnsleyFC cash balance dropped from £2.6m to £0.8m (down from £5.6m two years ago). This is on the low side, but in fairness most Championship clubs have less than £2m cash in the bank.

#BarnsleyFC have had less than £10m available cash in the last decade, mainly coming from net player sales £7m plus £2m owner funding. This has almost entirely used to cover (small) £8m operating losses with less than £1m invested in infrastructure.

#BarnsleyFC have no issues with Financial Fair Play (FFP) regulations, as their losses over the 3-year monitoring period are much lower than the £39m limit, even before excluding allowable deductions for academy, community and infrastructure.

#BarnsleyFC had to pay £750k to Oakwell Holdings Limited on behalf of the club’s parent company per the incentive consideration clauses within the original purchase agreement. This has been reported within other expenses in the profit and loss account.

#BarnsleyFC have adopted a smart strategy of data-led recruitment, focusing on youth, and profitable player sales that has compensated for their limited financial resources. Reaching this season’s play-offs was a seriously impressive performance, vindicating their approach.

• • •

Missing some Tweet in this thread? You can try to

force a refresh