#CardiffCity 2019/20 accounts cover a season when they finished 5th in the Championship following relegation from the PL, losing in the play-off semi-final. Manager Neil Warnock was replaced by Neil Harris in November 2019, since succeeded by Mick McCarthy. Some thoughts follow.

#CardiffCity swung from £3m profit to £12m loss, as revenue fell £79m (63%) from £125m to £46m due to relegation and COVID, partly offset by profit on player sales rising £12m to £14m, while expenses were down £33m and no repeat of prior year £20m provision for the Sala transfer.

#CardiffCity £79m revenue fall was largely driven by broadcasting’s £70m (66%) decrease from £107m to £37m, due to lower TV money in Championship, though commercial also dropped £5m (48%) from £10m to £5m and match day fell £4m (53%) from £8m to £4m.

To compensate for the steep revenue decline, #CardiffCity cut the wage bill by £18m (34%) from £54m to £36m and other expenses by £6m (31%) to £14m. Player amortisation rose £3m (17%) to £18m, but no repeat of prior year’s £12m player impairment charge.

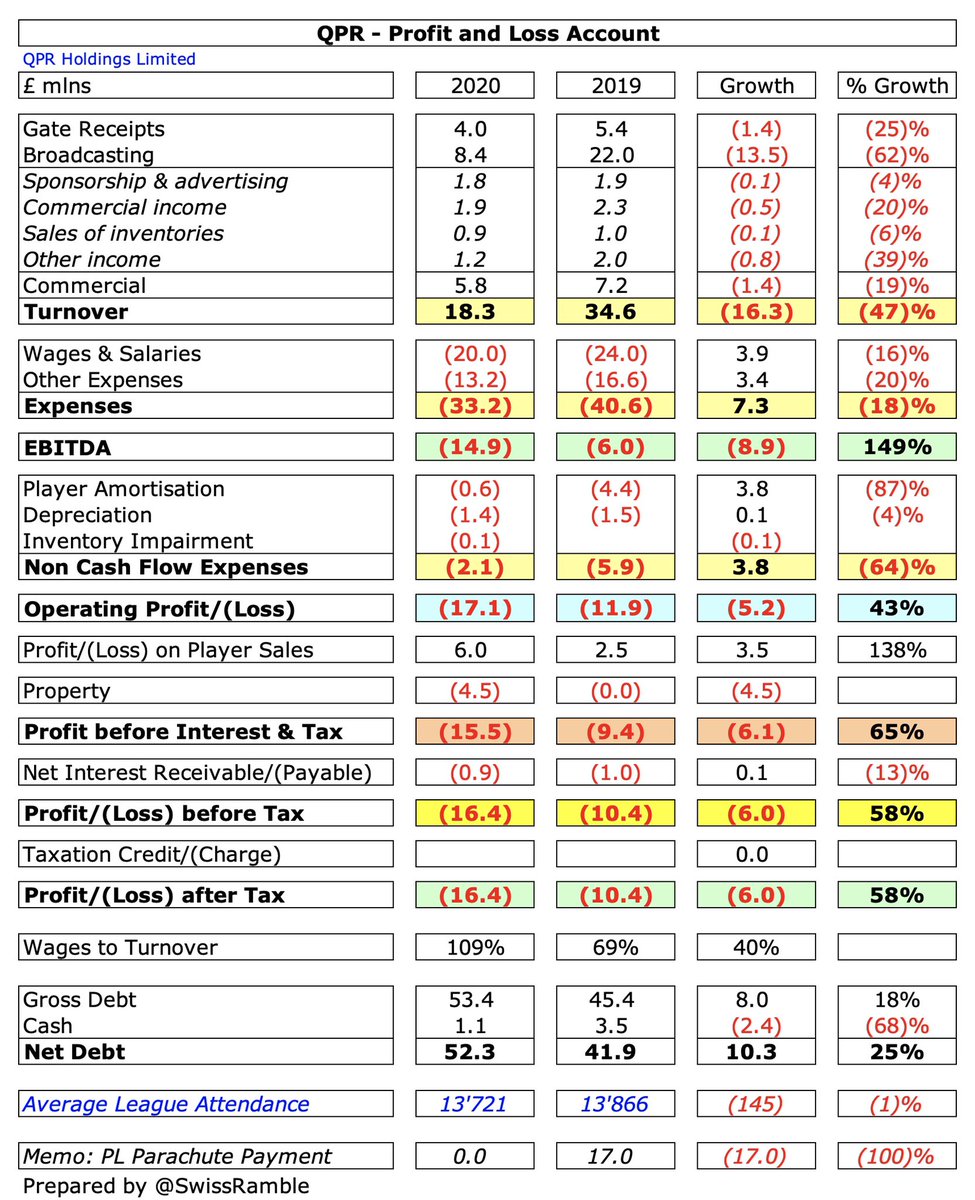

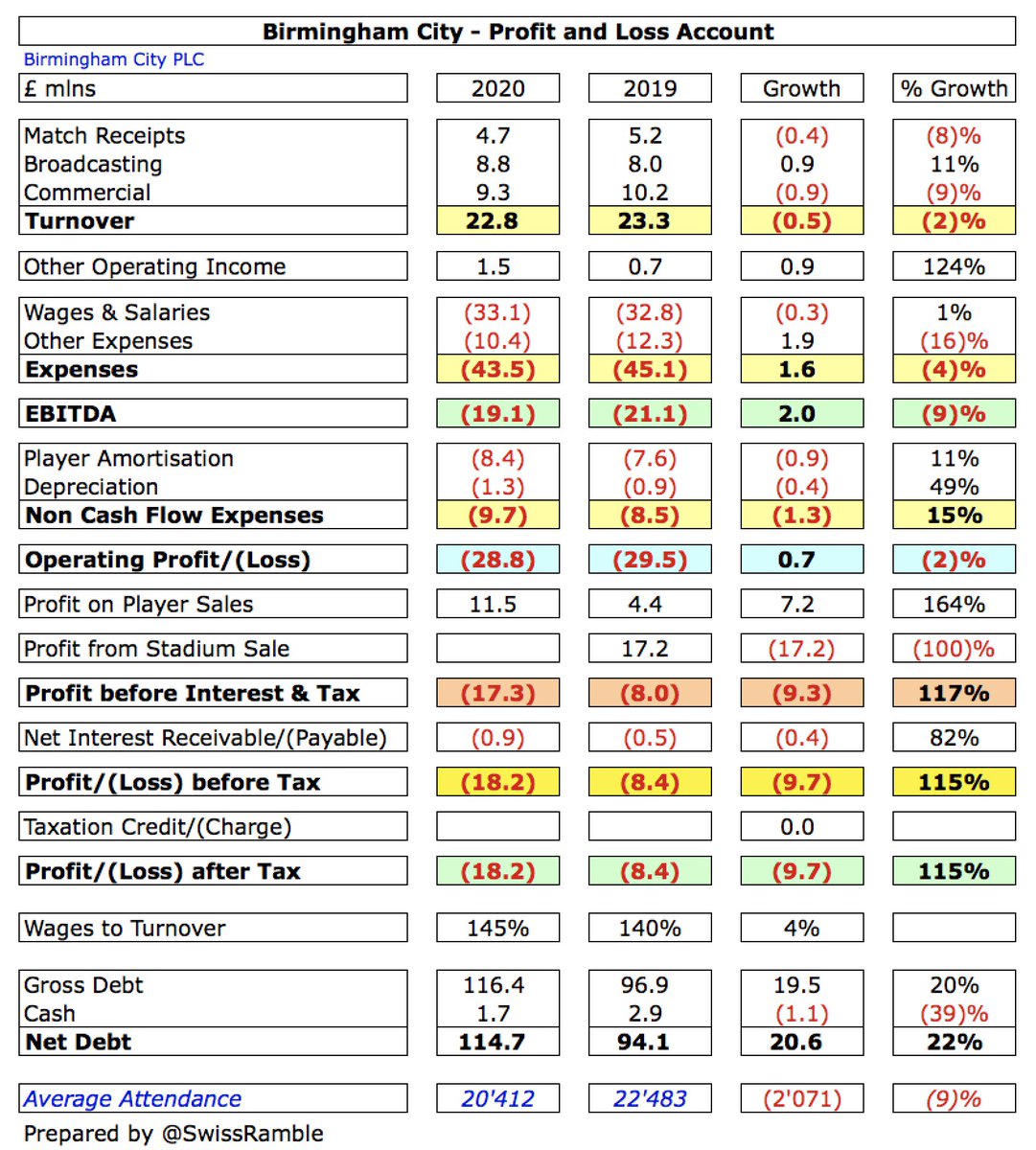

Although #CardiffCity £12m loss is clearly not great, it was around mid-table in the Championship with many clubs reporting much larger losses in 2019/20, including Stoke City £88m, #LUFC £62m (large promotion bonus), Reading £42m, #Boro £36m and WBA £23m.

It is also worth noting that some clubs’ figures have been boosted by the sale of stadiums, especially #DCFC £40m and #SWFC £38m, so their underlying profitability was even worse than reported.

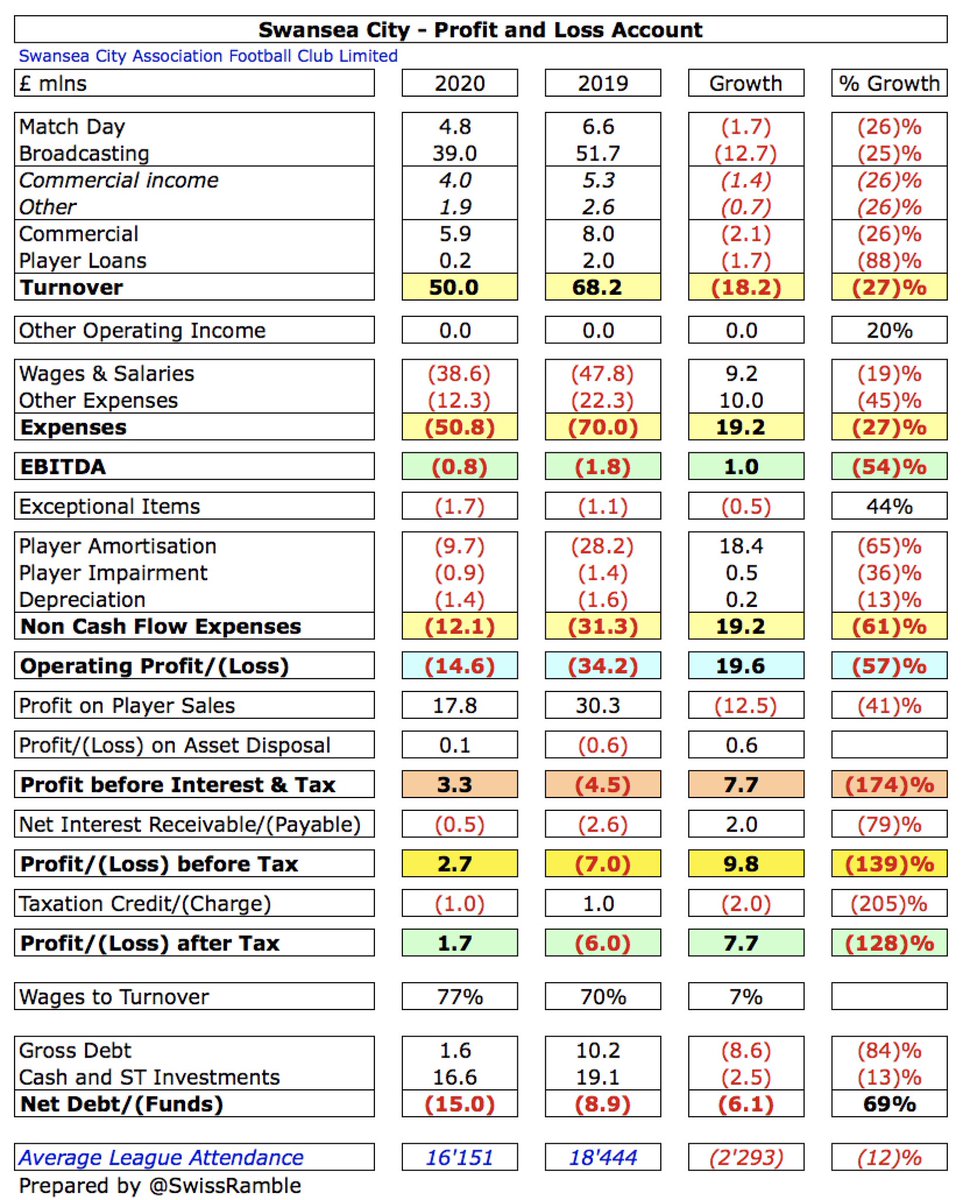

Excluding property sales, only 3 Championship clubs are profitable in 2019/20 to date (#LTFC, #HCAFC and #Swans, all £3m). Very few clubs manage to make money in this ultra-competitive division, though largest losses often from promoted clubs – including hefty promotion bonuses.

#CardiffCity figures have been significantly hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after 31st May accounting close has been deferred to 2020/21 accounts.

COVID resulted in £12.3m reduction to #CardiffCity revenue, split between £3.5m lost (match day £1.1m, TV rebates £2.4m) and £8.8m broadcasting deferred to 2020/21. Without this, revenue would have been £58m and they would have broken-even. Full extent only clear this season.

#CardiffCity profit on player sales rose £12m from £2m to £14m, mainly Bobby Reid to Fulham, Kenneth Zohore to WBA and Bruno Manga to Dijon. That’s pretty good, but still a fair bit lower than WBA £29m, Bristol City £26m, Brentford £25m and Hull City £23m.

In the decade since Vincent Tan bought #CardiffCity in May 2010, they have accumulated £142m of losses, half in last 4 years. In that period the club has only had two (small) profits, £4m in 2015 and £3m in 2019. They even contrived to lose £12m in the Premier League in 2014.

Furthermore, #CardiffCity 2015 £4m profit was entirely due to once-off factors (£13m debt-write-off and £13m interest adjustment). If the club is correct that they will not need to pay a transfer fee for Sala, then future financials will be boosted by reversal of £20m provision.

#CardiffCity have made very little money from player sales, only £31m in total in the last decade, most of which came in just two years (£10m in 2015 and £14m in 2020). This season will only include the sales of Neil Etheridge to Birmingham City and Callum Paterson to #SWFC.

At an operating level (excluding player sales, impairment and interest), #CardiffCity went from £33m profit to £24m loss, though this is par for the course in the Championship, where almost every club produces substantial operating losses, i.e. half of them are above £30m.

Despite the COVID impact, #CardiffCity £46m revenue is still £6m higher than 2015, when they were also relegated to the Championship, thanks to £8m broadcasting growth (though match day and commercial are both lower, by £2m and £1m respectively).

#CardiffCity revenue decrease was softened by £42m Premier League parachute payment, though this was reduced by £2.1m COVID rebate and £7.8m deferral. Despite broadcasting falling from £107m to £37m, it still accounts for 80% of total revenue (commercial 12% and match day 8%).

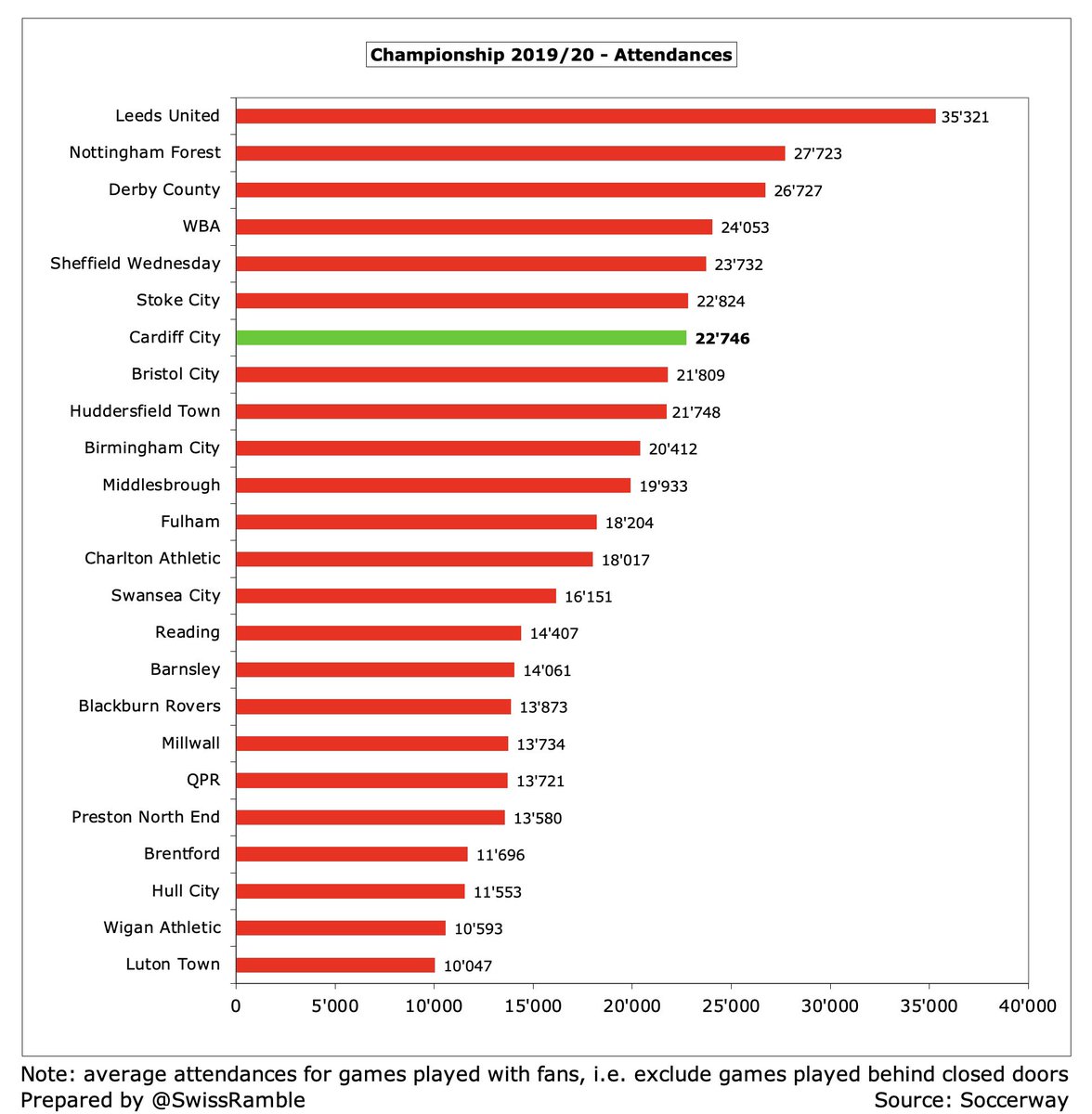

Even after the fall, #CardiffCity £46m revenue was still 6th highest in the Championship, not far behind #LUFC (massive commercial income) and WBA, both £54m, though another club recently relegated from the Premier League, Fulham, has yet to publish 2019/20 accounts.

Obviously #CardiffCity benefited from £42m parachute payment (before rebate and revenue deferral). Six other clubs received parachutes in 2019/20: #FFC and #HTAFC(£42m), followed by Stoke City, Swansea City and WBA (£34m for second year payment), Sunderland (£15m for third year).

If parachute payments were excluded, #CardiffCity revenue would fall to £18m (£42m parachute less £2.1m rebate and £7.8m revenue deferral, replaced by £4.5m solidarity payment). This would have placed them mid-table in the Championship, around a third of #LUFC £54m.

#CardiffCity broadcasting income fell £70m (66%) from £107m to £37m, 4th highest to date in Championship. Most clubs earn £7-10m, but a significant gap to those with parachute payments. Clubs above them benefited from later accounting close, so less revenue deferred to 2020/21.

#Cardiff City will receive around £76m in parachute payments: £42m in 2019/20 and £34m in 2020/21 (before any COVID rebates). They only get two years of payments instead of the usual three years, as they were relegated after just one season in the Premier League.

#CardiffCity match day income fell £4.2m (53%) from £7.9m to £3.7m, largely due to playing 6 home games behind closed doors because of the pandemic (including play-off semi-final). This revenue was in the bottom half of the Championship, only around a third of #LUFC £11m.

#CardiffCity average attendance (for games played with fans) dropped 28% from 31,409 to 22,746 “as a direct result of relegation”. Still 7th highest in the Championship and also 2,582 more than 2018 promotion season. Ticket prices cut in 2019/20 and frozen for 2020/21 campaign.

#CardiffCity commercial income halved from £10.4m to £5.5m, partly due to the pandemic causing loss of revenue and sponsorship opportunities. Now in the bottom half of the Championship, far below the likes of #LUFC £34m, Bristol City £14m and Stoke City £14m.

Since 2011 the #CardiffCity shirt sponsor has been Visit Malaysia, reportedly worth £3m a year, though this has been rebranded as Malaysia Berjaya from this season. The long-term kit supplier deal with Adidas is due to expire in 2022.

#CardiffCity wages fell £18m (34%) from £54m to £36m, due to the departure of some high earners and relegation clauses. Most of this was due to player salaries, down from £42.5m to £27.9m. Likely to further fall in 2021, as parachute payment reduces.

Even after the decrease, #CardiffCity £36m wage bill was in the top ten in the Championship, though much lower than #LUFC £78m, WBA £67m and Stoke City £53m (though the first two included hefty promotion bonuses).

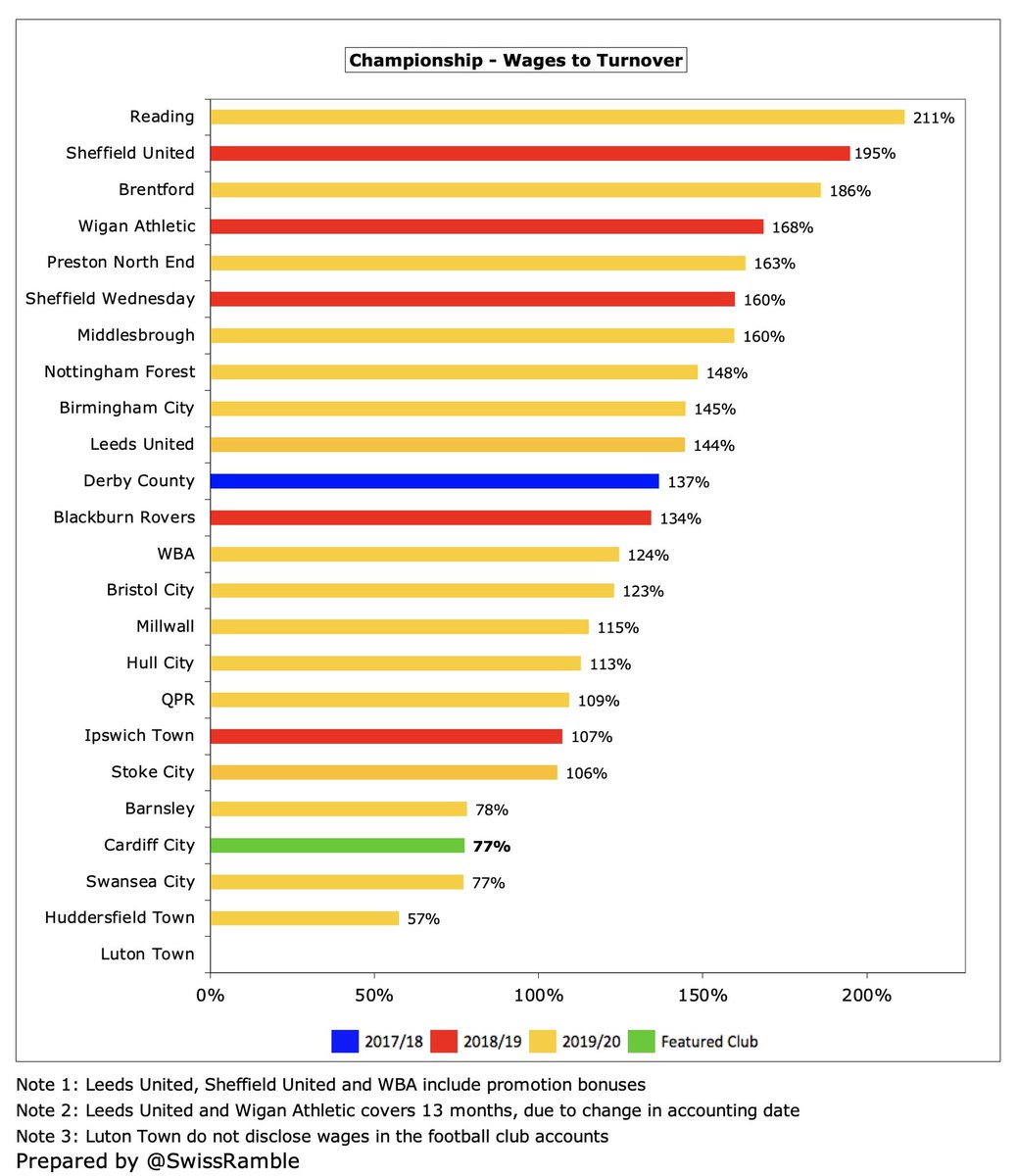

Following relegation, #CardiffCity wages to turnover ratio increased from an incredibly low 43% in the Premier League to 77%, which is the third lowest (best) in the Championship. The vast majority of clubs in this division have unsustainable ratios well over 100%.

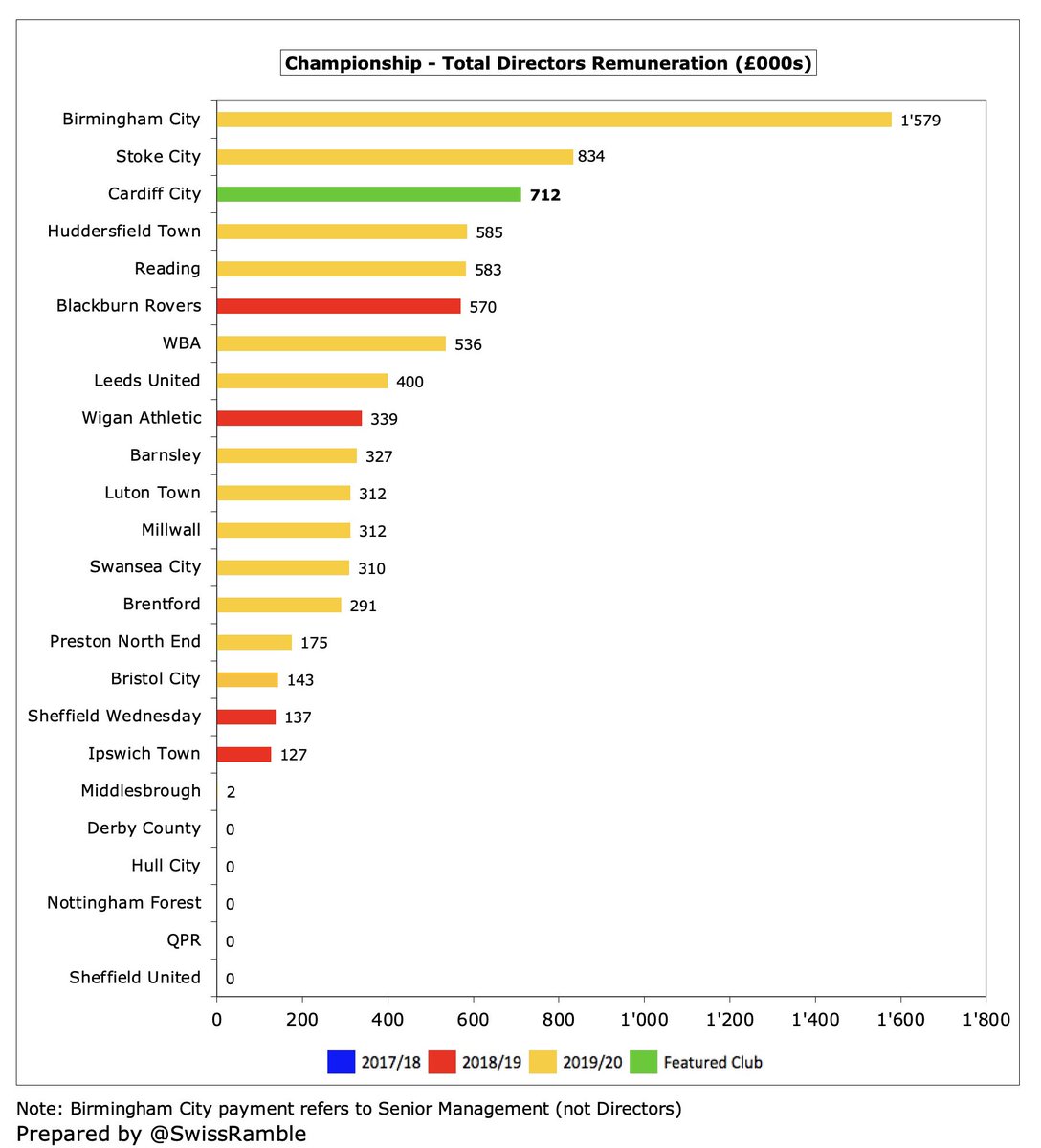

Despite relegation, #CardiffCity total directors’ remuneration rose 34% from £533k to £712k, the 3rd highest in the Championship. Highest paid director up from £380k to £507k. Also paid £586k to two companies in which chairman Mehmet Dalman has interests (WMG and Tormen).

#CardiffCity player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £3m (17%) from £15m to £18m. This is the fifth highest in the Championship to date, but a fair way below Stoke City £30m and #HTAFC £28m. Prior year £12m impairment.

#CardiffCity spent £19m on players in 2019/20, mainly on Glatzel, Flint, Vaulks, Vassell, Whyte and Pack. This was the fourth highest annual outlay in the club’s history, but still outspent by #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

Interestingly, #CardiffCity £79m gross transfer spend in the last five years is less than the £86m outlay in the preceding 5-year period. Unsurprisingly, the highest expenditure came in the two seasons in the Premier League. Around £5m spent this season, including Kieffer Moore.

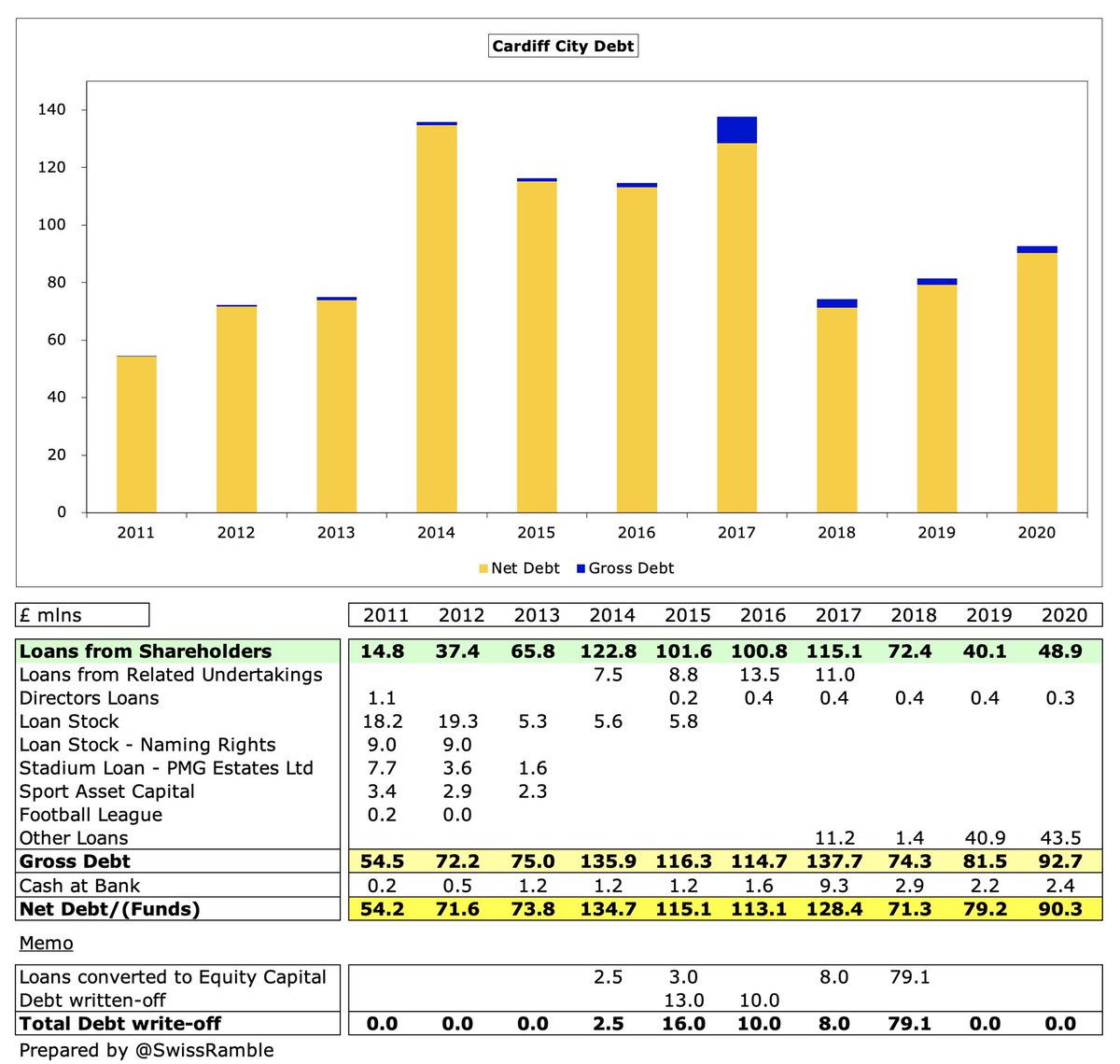

#CardiffCity gross debt rose £11m from £82m to £93m, split between £49m owed to owner Vincent Tan (up £9m), including £3m from his son, and £43m other loans (up £2m), of which £32m is secured on TV money and £11m secured on player proceeds.

#CardiffCity £93m debt is 6th highest in the Championship, though far below the likes of Stoke City £187m, #BRFC £142m, #BCFC £116m and #Boro £116m. However, Cardiff’s debt would be much higher without Tan converting £93m into capital and writing-off £23m in the last decade.

In addition, a director provided £4m loan during 2019/20, which was repaid during the year including £123k interest. Since these accounts were closed, #CardiffCity have taken on an additional £35m of debt from unnamed parties at chunky interest rates of up to 9%.

#CardiffCity paid £123k interest in 2019/20, down from £1.9m, all on other loans. Around £18m of Tan’s loan is at 7%, but the interest to date has been waived. The remaining £31m of the owner’s debt is interest-free (like most debt provided by owners in this division).

#CardiffCity transfer debt (for outstanding stage payments) was cut from £10m to just £4m. They are in turn owed £13m by other clubs, but this has largely been earmarked to repay one of the bank loans.

#CardiffCity £24m operating loss became £4m cash flow after adding back player amortisation/depreciation and working capital movements, but club then spent £22m on players (purchases £24m, sales £2m) and £1m on infrastructure. Funded by £9m owner loans and £11m external loans.

As a result, #CardiffCity cash balance rose slightly to £2.4m. This is on the low side, but in fairness most Championship clubs have less than £2m cash in the bank.

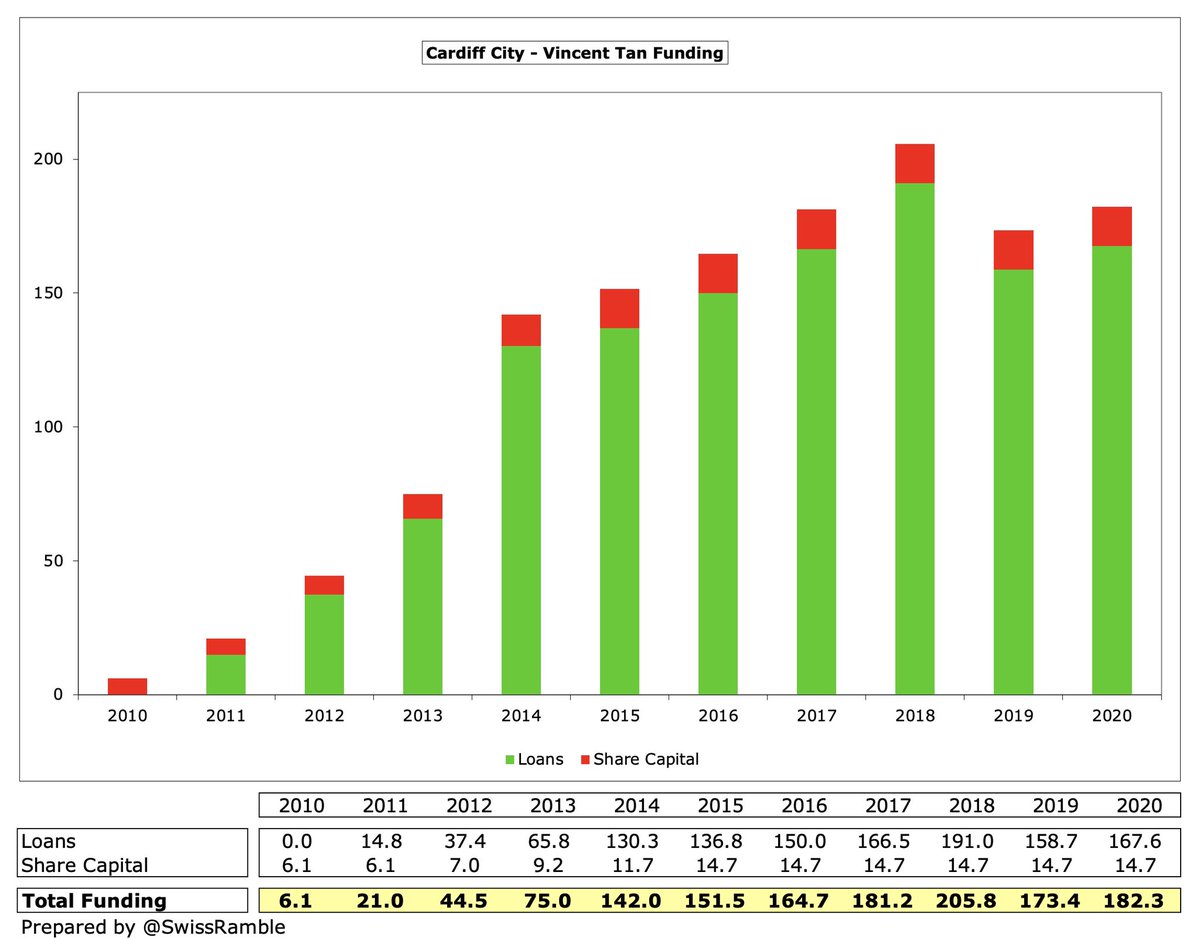

In the last decade #CardiffCity have been very reliant on owner financing £176m plus external loans £22m. This has been used to fund £120m of player purchases (net), £21m infrastructure investment and £4m interest payments, while covering £51m of operating losses.

Tan has provided £182m of funding to #CardiffCity, split between £167m loans and £15m share capital. The club continues to rely on the owner’s financial support, though the accounts note that additional shareholder funding is “not guaranteed”, leading to a “material uncertainty”.

#CardiffCity have no issues with FFP regulations, as they can adjust reported losses for allowable deductions (academy, community & infrastructure), promotion bonus and COVID impact. Limit over 3-year monitoring period is £61m (Championship 2 years at £13m, Premier League £35m).

#CardiffCity chairman Mehmet Dalman said that the club’s challenge remained “to secure our return to the Premier League at the earliest opportunity”, though this task has become much more difficult now that the parachute payments have ceased.

• • •

Missing some Tweet in this thread? You can try to

force a refresh