For good reason, folks are looking for inflation-proof yield-generating real assets. Agricultural land and primary industries are definitely in the spot light, and Rural Funds $RFF.AX $RFF has been on a tear.

But did you know your dividends will be unfranked and grossed down?👇

But did you know your dividends will be unfranked and grossed down?👇

Before we get into divvies, a quick plug to a previous post on agricultural land, inflation and real asset plays on the #ASX 👇

https://twitter.com/DownunderValue/status/1389061982095958017

And here is a primer on Rural Funds and why I am bullish on their underlying assets and their income-generating funds from operations. 👇

https://twitter.com/DownunderValue/status/1357171268630450178

It's been a bit unusual to see such a boring stock have such a long run in a short period. The underlying fundamentals have not changed that much, but the flight to safety and yield is definitely pushing things up.

Today RFF goes ex dividend with it's quarterly payment of 2.8c, yielding ~4.36% on today's share price. Just yesterday the stock rose another 3% in advance of the dividend payment.

The dividends are unfranked, so they have not paid their 30% corporate tax on it.

4.36% unfranked is the equivalent of 3.052% franked dividends after you've done your taxes. Which is exactly the same as $ASX.AX fully franked dividends.

4.36% unfranked is the equivalent of 3.052% franked dividends after you've done your taxes. Which is exactly the same as $ASX.AX fully franked dividends.

Generally that's where people stop. BUT.. we need to compare apples with apples.

And RFF is not an ASX listed company, it's an attributable managed investment trust (AMIT) 🤷

And RFF is not an ASX listed company, it's an attributable managed investment trust (AMIT) 🤷

An AMIT is a quirk of the Australian Tax System, thanks to the #ATO. It requires trusts to pass through all earnings and capital gains to the holders.

ato.gov.au/Forms/Personal…

ato.gov.au/Forms/Personal…

"In relation to capital gains, these rules mean you will treat the capital gains component of your trust income as being a capital gain that you made." - in real speak, you pay the capital gains in your personal income statement, not RFF.

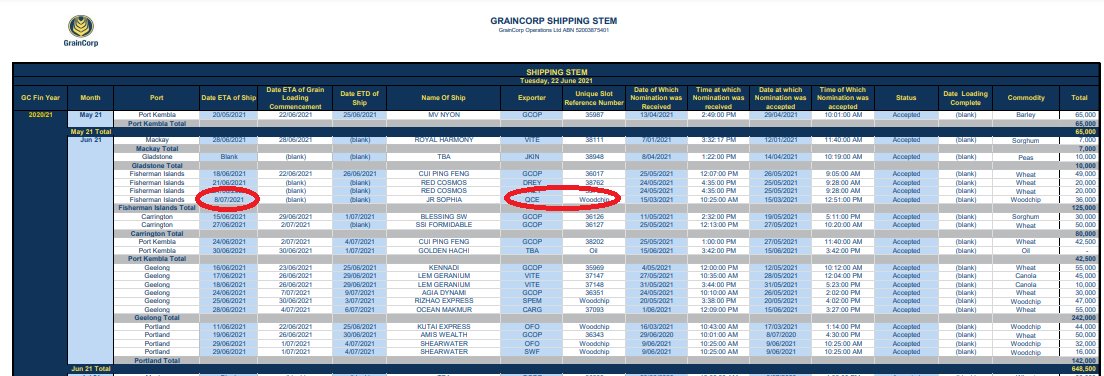

So a couple of months after you get your distribution statement from RFF and feel like your yield winning.. you get a notice that looks like this: 👇

And when it comes to tax, this is the important part - you are taxed on the cash component that hit your bank account, and all other gains in the trust they pass through.. erm, that's 8.5c per share.

🚨I AM NOT AN ACCOUNTANT🚨

My understanding is if you have a marginal tax rate of say 30%, and you receive 8.5c of disbursements for tax purposes.. that's 2.556c of taxes owing come 30 June 2021, almost the full 2.8203c that was disbursed!

My understanding is if you have a marginal tax rate of say 30%, and you receive 8.5c of disbursements for tax purposes.. that's 2.556c of taxes owing come 30 June 2021, almost the full 2.8203c that was disbursed!

So back of the envelope for a middle income households.. the grossed down yield may be 0.44%.. oh and with the Medicare levy, potentially 0%.

I may be wrong, I did write to RFF investor relations and this is how I interpreted their communication.

I may be wrong, I did write to RFF investor relations and this is how I interpreted their communication.

The reason this occurs is that the cash payment is made from adjust funds from operations (AFFO) - think rent less costs. This is around 11.7c, of which 11.3c is paid per annum - high payout ratio due to asset turnover, growing at +4% CAGR generally.

The capital gains tax component is due to recycling of assets - selling farms at a profit. The capital gain is realised at the time of sale, and this year they sold Mooral for $98m for a tidy profit. Thus, someone (shreholders) needs to pay the tax bill.

farmweekly.com.au/story/6907528/…

farmweekly.com.au/story/6907528/…

This is not always the case, it seems FY21 is an outlier. In FY22 there will be new macadamia farms coming online (trees currently under development) - this should increase AFFO / reduce payouts; and in FY20 they didn't recycle and so the dividends went as cash payments.

RFF is currently trading at a significant premium to it's NAV ($2.01 as of 31/12/2020, maybe $2.10 now). Traditionally it trades around 1.1x NAV, giving it a fair value of ~$2.30.

So right now it's around 15% overpriced and yielding ~0% gross of taxes in FY21.

So right now it's around 15% overpriced and yielding ~0% gross of taxes in FY21.

Without a crystal ball, I think FY22 will be good for RFF's underlying assets as they expand macadamias - but perhaps not so good for the share price.

I'm not long RFF anymore, and will wait for a better entry price when the tax / asset recycling scares off yield hunters.

I'm not long RFF anymore, and will wait for a better entry price when the tax / asset recycling scares off yield hunters.

• • •

Missing some Tweet in this thread? You can try to

force a refresh