1/22 This 2nd edition of @BitcoinMagazine Cycling On-Chain, "#Bitcoin Enters Geopolitics", focuses on:

1) The impact of China's crackdown 🇨🇳

2) Metrics for El Salvador's adoption 🇸🇻

This 🧵 summarizes it; but read the article for in-depth explanations:

bitcoinmagazine.com/markets/bitcoi…

1) The impact of China's crackdown 🇨🇳

2) Metrics for El Salvador's adoption 🇸🇻

This 🧵 summarizes it; but read the article for in-depth explanations:

bitcoinmagazine.com/markets/bitcoi…

2/22 Since mid-April, China came down hard on #Bitcoin, banning its institutions to offer #bitcoin services, censoring related search results and shutting down mining operations in recent weeks

Hash rate dropped ~50%, to levels not seen since briefly after last year's halving 🤕

Hash rate dropped ~50%, to levels not seen since briefly after last year's halving 🤕

3/22 A result of the hash rate drop is that #Bitcoin blocks are coming in much slower than the usual 10 minute block intervals

In fact; block creation slowed down to more than twice the intended interval & levels not seen in >11 years, illustrating the magnitude of this drop 🤯

In fact; block creation slowed down to more than twice the intended interval & levels not seen in >11 years, illustrating the magnitude of this drop 🤯

4/22 The beauty of #Bitcoin is that its difficulty will simply adjust downward, incentivizing miners to come (back) to the network by increasing their profit margins

The next difficulty adjustment is estimated to be on July 3rd and be -27.2%, which would be an all-time record 👀

The next difficulty adjustment is estimated to be on July 3rd and be -27.2%, which would be an all-time record 👀

5/22 Chinese #Bitcoin miners are hurting, but due to the global chip shortages and Bitmain halting its sales, they will have no problems finding a new home in more mining-friendly jurisdictions like Texas & Kazakhstan, where a lot are rumored to be moving

6/22 Since the China crackdowns, aggregated miner wallets (🟩) have dropped by 6,701 BTC (-0.37%), which is relatively modest compared to the 28,266 BTC (-1.54%) drop during the bull run

Miner to exchange flows (🟥) confirm that current miner sell pressure is relatively modest

Miner to exchange flows (🟥) confirm that current miner sell pressure is relatively modest

7/22 Lost hash rate will likely be deployed elsewhere within months, #Bitcoin will continue to function normally after difficulty adjustment, and current hash rate levels are likely more than enough to keep the network secure

Honey badger don't care 🤷♂️

Honey badger don't care 🤷♂️

8/22 If that indeed happens, China's crackdowns may go down as an example of #Bitcoin's anti-fragility

You cannot ban #Bitcoin - you can only ban yourself from it

China's hash rate exodus would lower credence of future 'China bans #Bitcoin' or 'China controls #Bitcoin' FUD

You cannot ban #Bitcoin - you can only ban yourself from it

China's hash rate exodus would lower credence of future 'China bans #Bitcoin' or 'China controls #Bitcoin' FUD

9/22 The Puell Multiple (daily #bitcoin creation / its 1-year moving average) also shows how extreme the current situation is

The recent drop was the steepest ever, whereas current levels are in the green zone that is historically only touched during larger market bottoms 👀

The recent drop was the steepest ever, whereas current levels are in the green zone that is historically only touched during larger market bottoms 👀

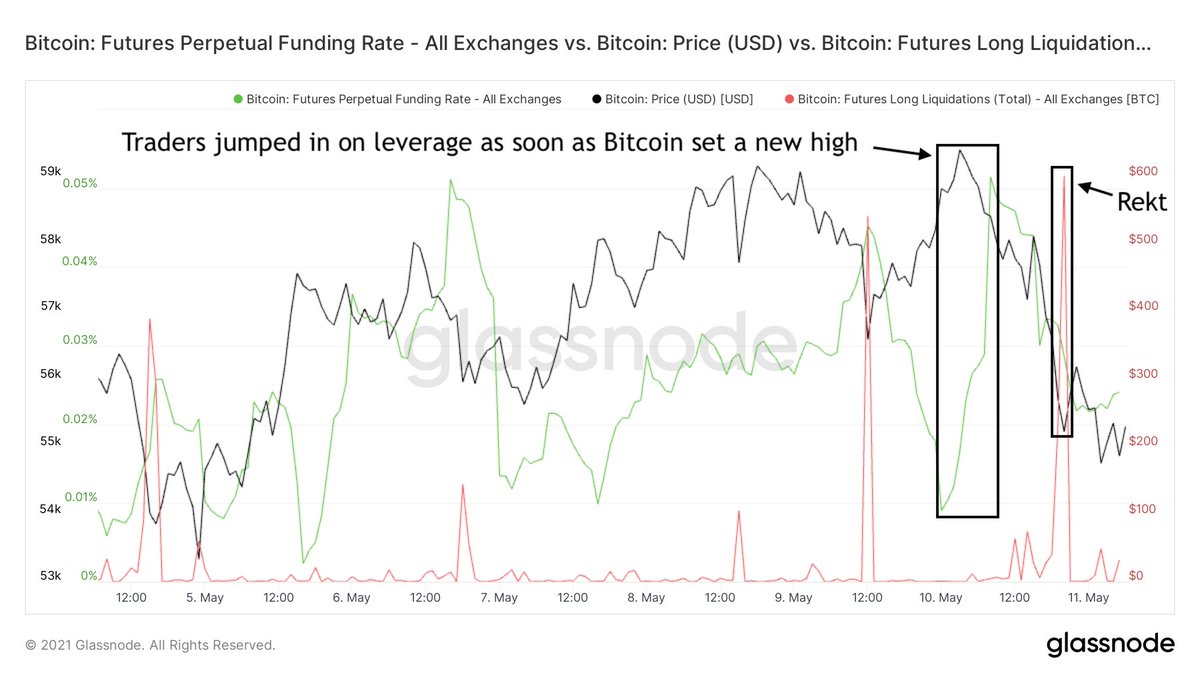

10/22 However, China's crackdowns impact the current #bitcoin market either way

Banning institutions from offering services & censoring search results are examples of a (very) large market being shielded from adopting it, also raising the ❓ if other countries will follow suit

Banning institutions from offering services & censoring search results are examples of a (very) large market being shielded from adopting it, also raising the ❓ if other countries will follow suit

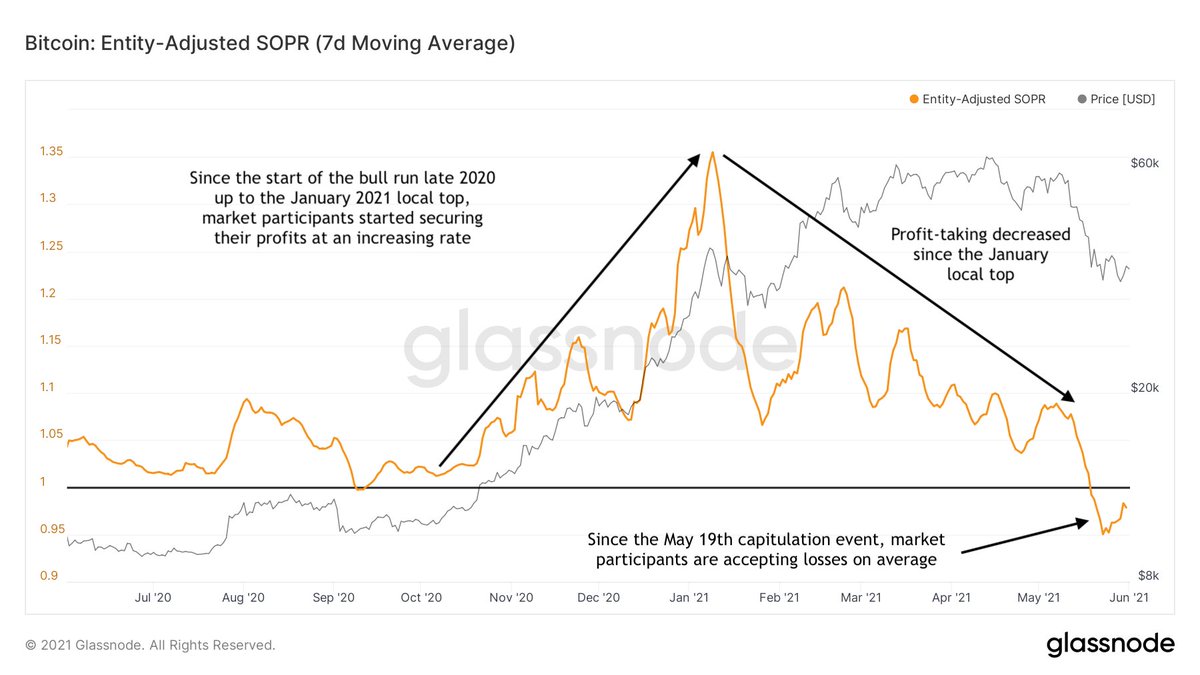

11/22 During the recent downturn, the number of entities that are (on-chain) active on #Bitcoin have declined a lot & is now at March 2020 (macro) market crash levels

Some entities were likely scared away, whereas others might be just waiting to see how this plays out 🥱

Some entities were likely scared away, whereas others might be just waiting to see how this plays out 🥱

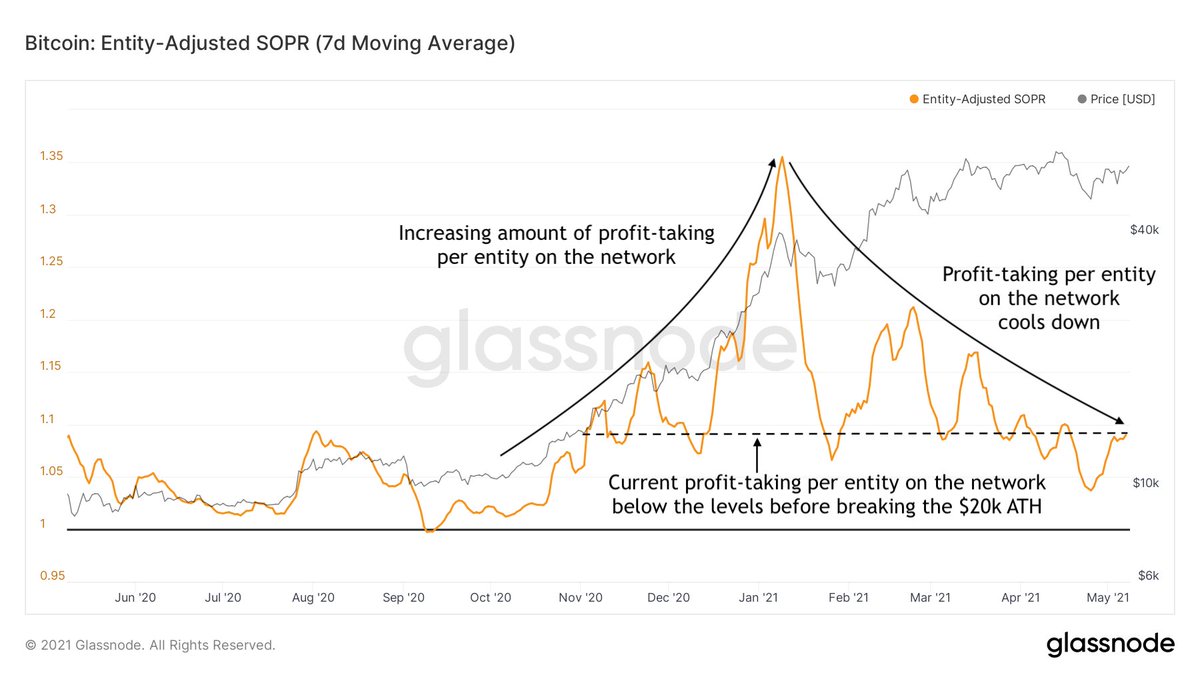

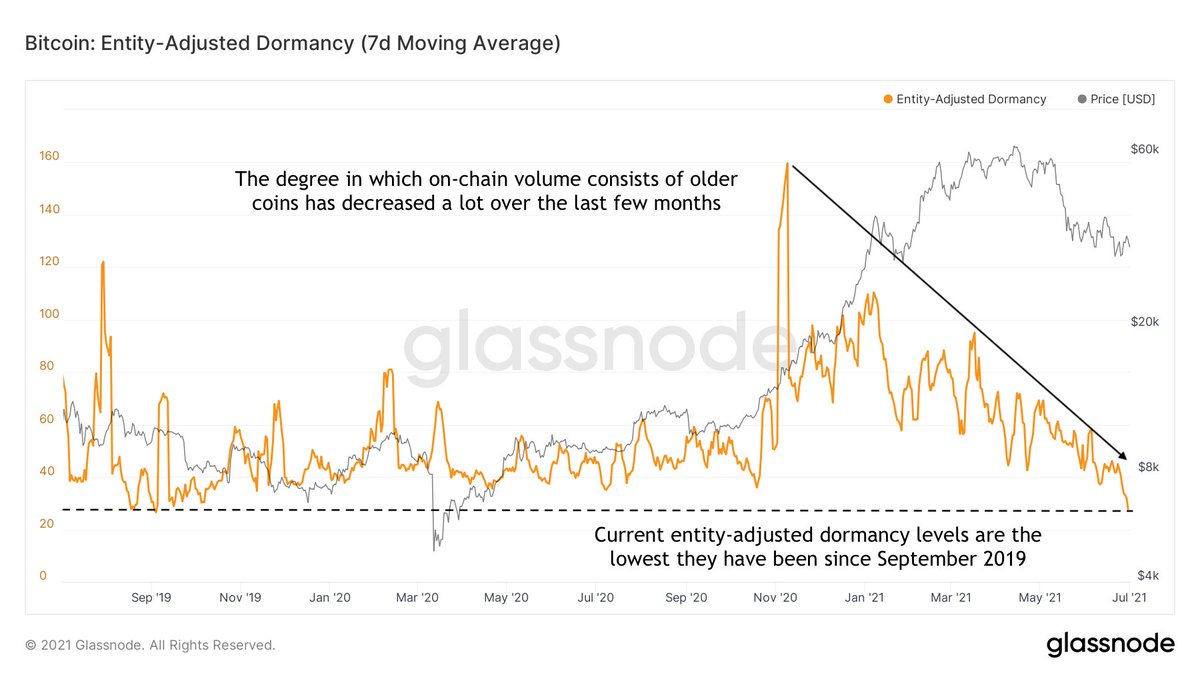

12/22 Another trend is that degree in which #Bitcoin's on-chain volume consists of older coins moving has fallen to levels not seen since September 2019

This suggests that experienced market participants are just waiting, whereas its the short term holders that are panicking 😨

This suggests that experienced market participants are just waiting, whereas its the short term holders that are panicking 😨

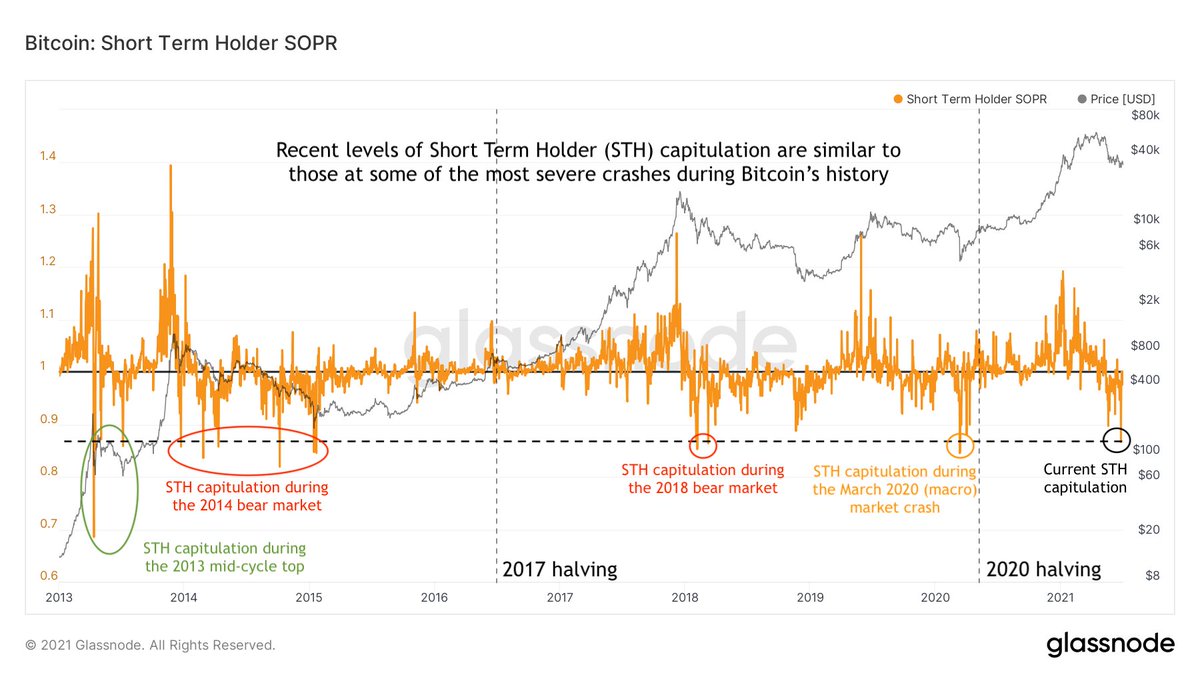

13/22 The Short Term Holder (STH) Spent Output Profit Ratio (SOPR) shows that current STH capitulation is on par with some of the most painful moments in #Bitcoin's history

The big ❓: Is this an early bear market capitulation (🟥) or a mid-cycle flush of weak hands (🟩/🟧)? 👀

The big ❓: Is this an early bear market capitulation (🟥) or a mid-cycle flush of weak hands (🟩/🟧)? 👀

14/22 Due to the recent capitulation, the #Bitcoin supply held bij STH is declining again, whereas the Long Term Holders (LTH) cohort's supply is increasing

This is typical for larger market turnarounds; but the 2013 double top showed that this pattern can repeat >1x per cycle

This is typical for larger market turnarounds; but the 2013 double top showed that this pattern can repeat >1x per cycle

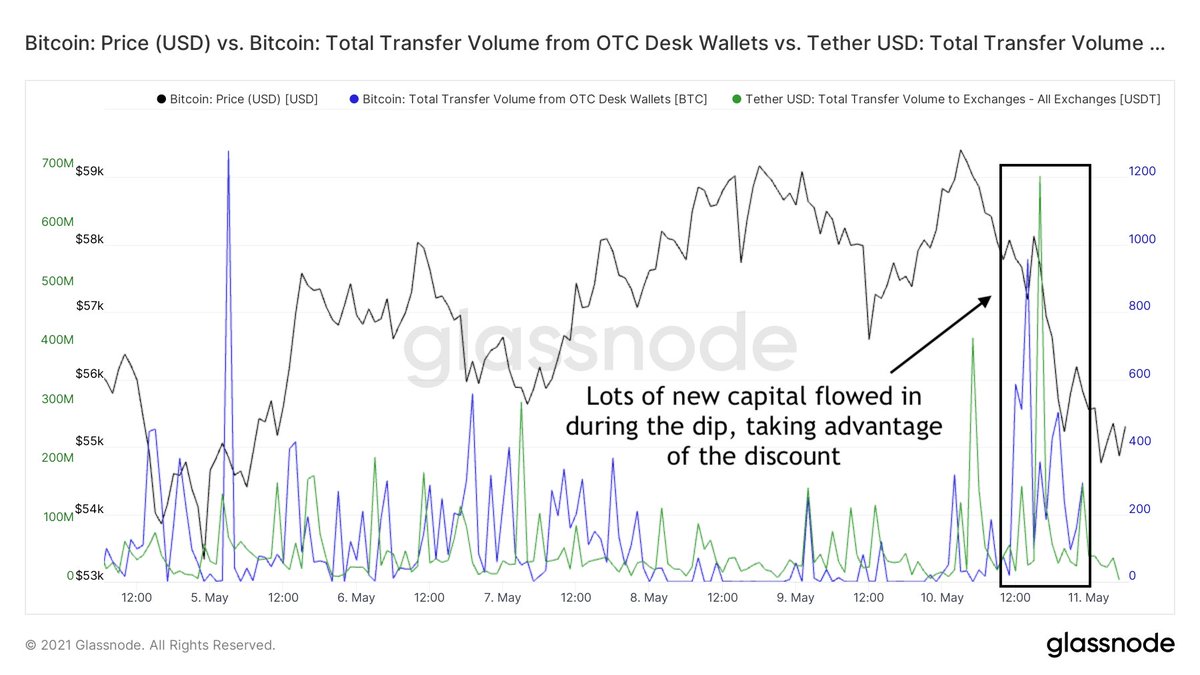

15/22 #Bitcoin's liquid supply rapidly increased during the recent price drop up to the May 19th capitulation and liquidation event, trending down again afterwards, flipping negative again on June 16th

Could this be a sign of exhaustion of (short term holder) sell pressure...?

Could this be a sign of exhaustion of (short term holder) sell pressure...?

16/22 While China 🇨🇳 was pushing #Bitcoin away, El Salvador 🇸🇻 opened its arms for it as wide as it could

@nayibbukele hopes it gives the 70% unbanked in his country a payment option, lowers costs for remittances and attracts entrepreneurs & miners 🌋

@nayibbukele hopes it gives the 70% unbanked in his country a payment option, lowers costs for remittances and attracts entrepreneurs & miners 🌋

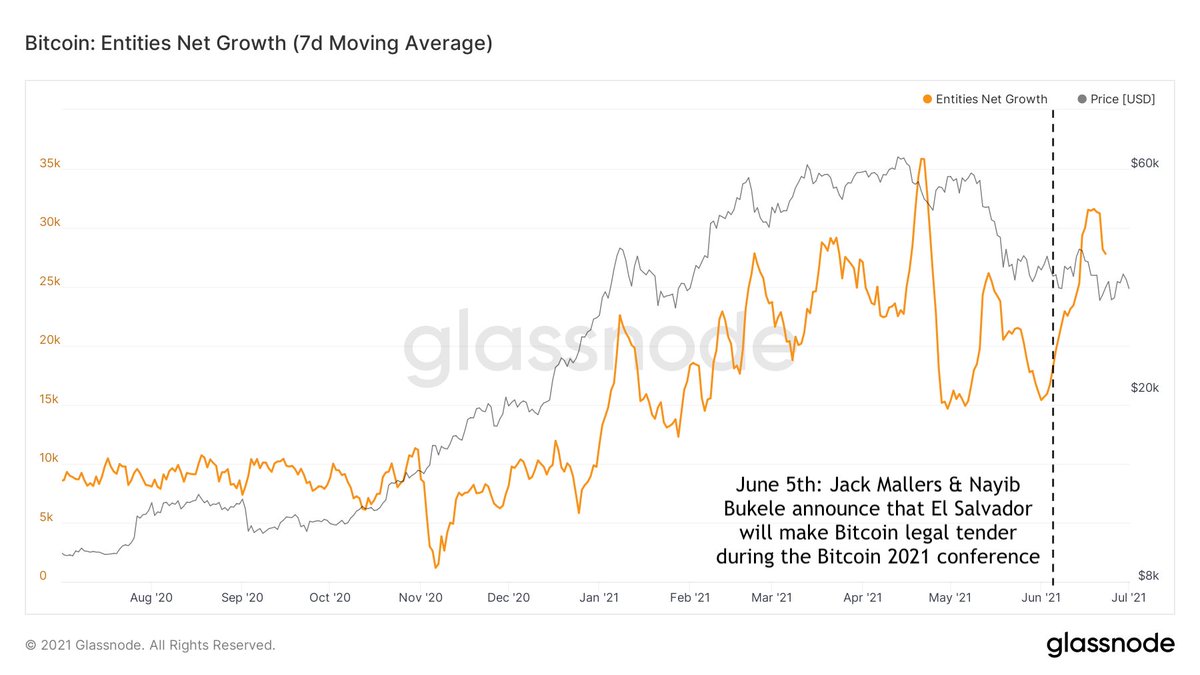

17/22 The law will go into full effect in September and it is too early to see a relevant on-chain footprint of 🇸🇻, but a few metrics are interesting to 👀

E.g., entities net growth on the #Bitcoin network is rising since @jackmallers & @nayibbukele's #Bitcoin2021 presentation

E.g., entities net growth on the #Bitcoin network is rising since @jackmallers & @nayibbukele's #Bitcoin2021 presentation

18/22 The # of #Bitcoin accumulation addresses was already 📈 before the 🇸🇻 announcement so its growth may be unrelated - but hasn't exactly slowed down either since then, despite the downwards price pressure

19/22 Similarly, the #bitcoin supply held by entities holding up to 0.1 BTC has been trending up throughout the bull run but currently seem to be accelerating

Will we see a further 📈 here over the upcoming months, as 🇸🇻 gradually starts to adopt it?

Will we see a further 📈 here over the upcoming months, as 🇸🇻 gradually starts to adopt it?

20/22 The 'Chivo' wallet that the 🇸🇻 government will roll out runs on Lightning ⚡️, which is bound to see a large uptick in adoption if #Bitcoin adoption in 🇸🇻 takes off for daily payments

⚡️ adoption has been on 🔥 throughout this bull run anyway, as nodes, channels & value 📈

⚡️ adoption has been on 🔥 throughout this bull run anyway, as nodes, channels & value 📈

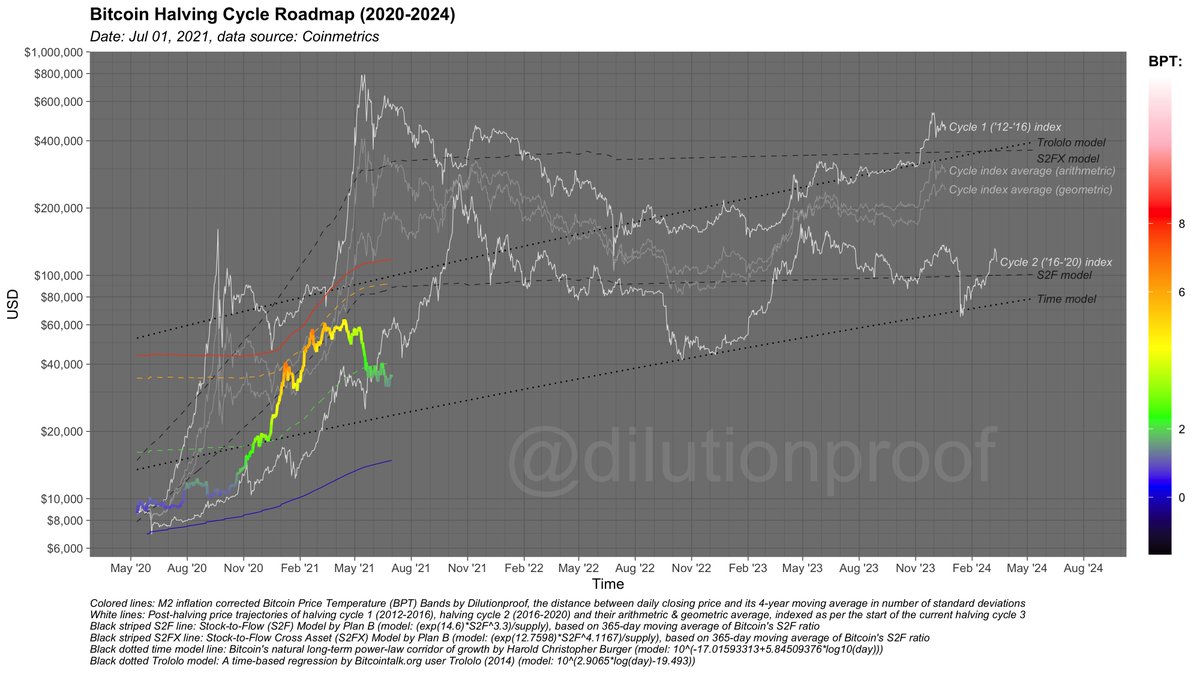

21/22 The big❓: is the current #bitcoin bull market over, or will hash rate recovery + the 🇸🇻 law going in full effect after the summer fuel a double top scenario like in 2013? 🤷♂️

My last found market sentiment to be bullish on all timeframes - especially the longer ones 🐂

My last found market sentiment to be bullish on all timeframes - especially the longer ones 🐂

22/22 I like to close off the monthly analysis with the #Bitcoin Halving Cycle Roadmap that combines several popular time & S2F models, as well as indexes & price 🌡️

Will this be the most underwhelming halving cycle in #Bitcoin's existence, or are we still in for a treat later?

Will this be the most underwhelming halving cycle in #Bitcoin's existence, or are we still in for a treat later?

• • •

Missing some Tweet in this thread? You can try to

force a refresh