1/10 Recently, I became convinced that the #bitcoin price simply went up too fast and this consolidation is functioning as a re-accumulation phase

IMO the January local top was the turnaround point in the market structure 🏔️

I'll elaborate in this 🧵 with some on-chain data ⛓️

IMO the January local top was the turnaround point in the market structure 🏔️

I'll elaborate in this 🧵 with some on-chain data ⛓️

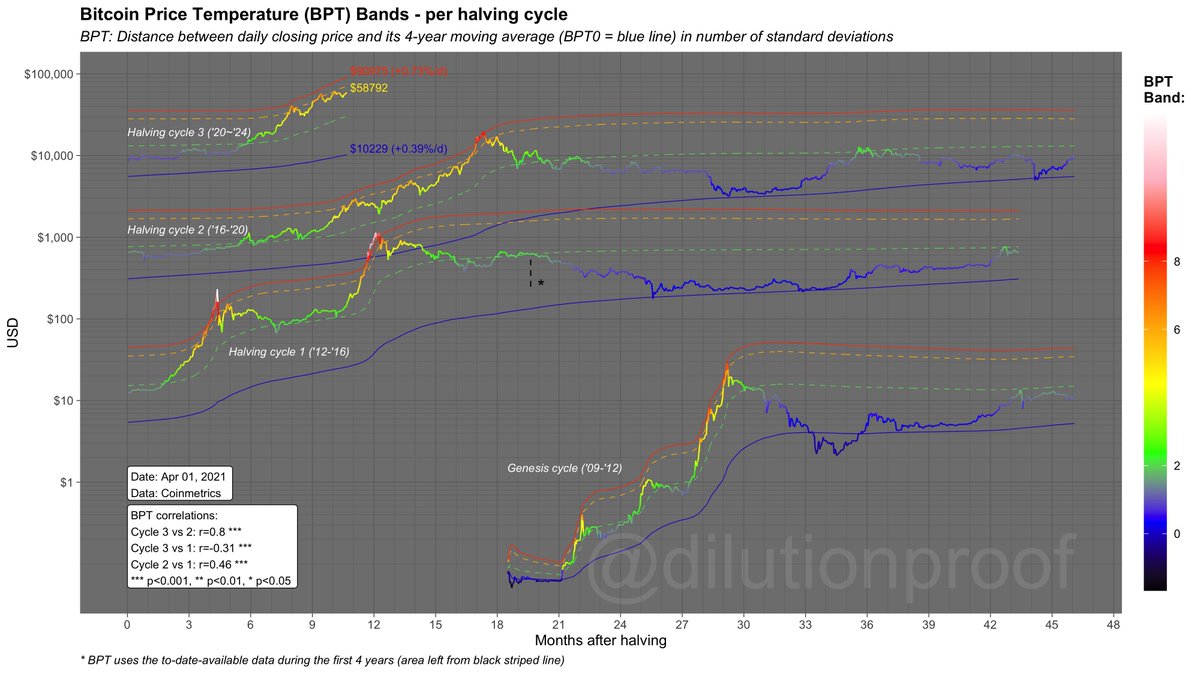

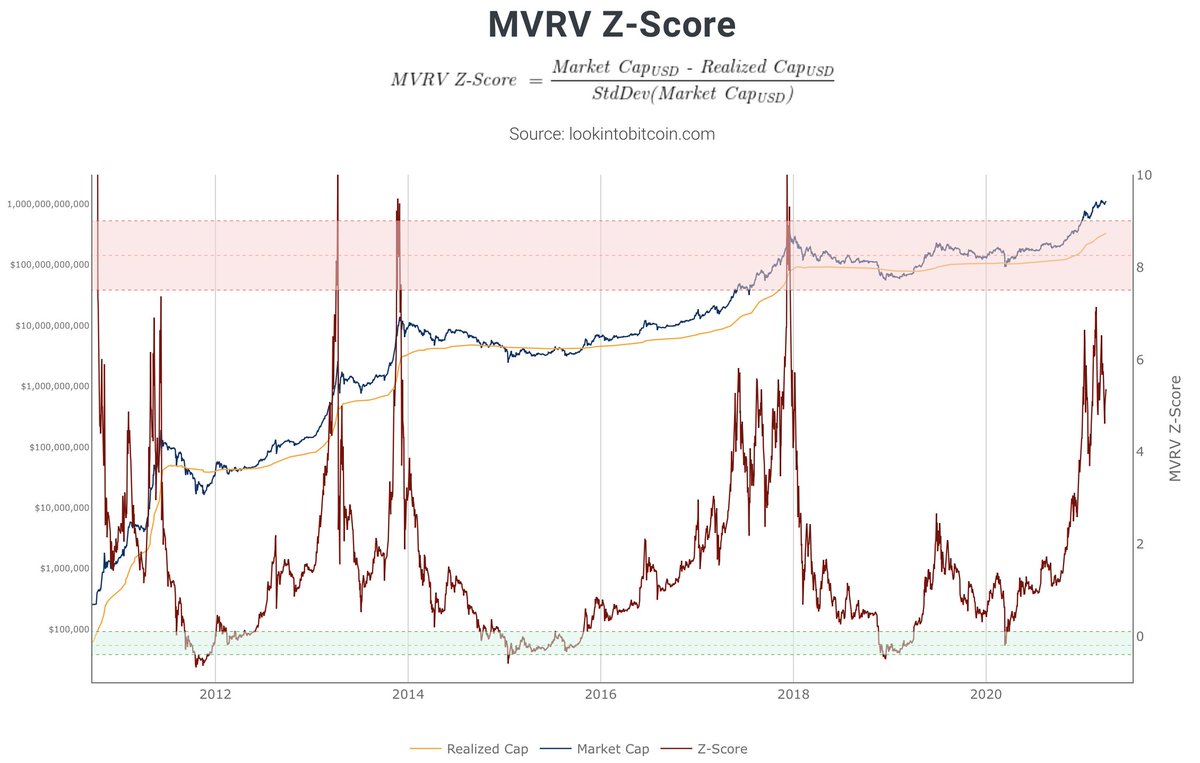

2/10 During the January local top, the #bitcoin price went up FAST 🥵

Compared to 2017, this run-up happened:

1) at an earlier post-halving date

2) at a faster acceleration, and

3) to a higher degree (reached a 🌡️ of 7 - which in 2017 it only reached during the blow-off top)

Compared to 2017, this run-up happened:

1) at an earlier post-halving date

2) at a faster acceleration, and

3) to a higher degree (reached a 🌡️ of 7 - which in 2017 it only reached during the blow-off top)

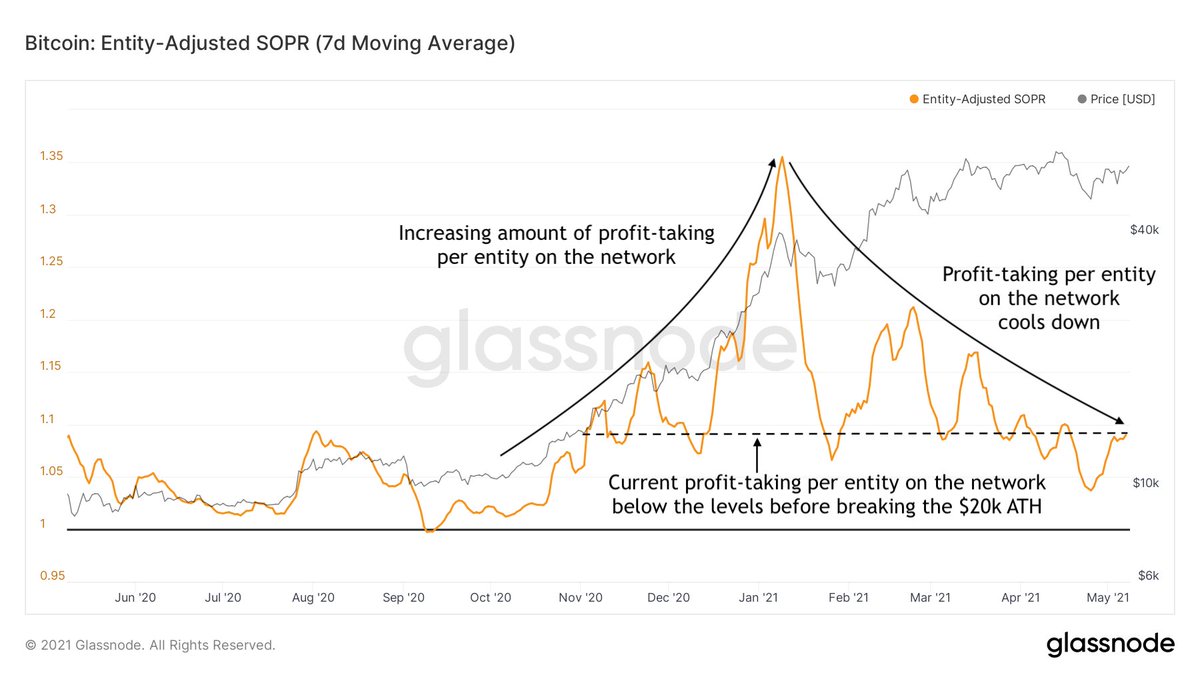

3/10 Due to the rapid price increase, unrealized profits were sky high, triggering an increasing number of entities to take profits

Since the January local top, profit-taking cooled down to pre-ATH levels - despite the #bitcoin price itself still grinding up 👀

Since the January local top, profit-taking cooled down to pre-ATH levels - despite the #bitcoin price itself still grinding up 👀

4/10 So who were selling? 🧐

The most obvious group is the long-term HODL'ers. They became net sellers late Oct at ~$13k, but sell pressure tapered off fast and they now net buyers again

Simply put: HODL'ers with weak hands were shaken out, as strong hands kept accumulating 👊

The most obvious group is the long-term HODL'ers. They became net sellers late Oct at ~$13k, but sell pressure tapered off fast and they now net buyers again

Simply put: HODL'ers with weak hands were shaken out, as strong hands kept accumulating 👊

5/10 A similar pattern can be seen with the miners ⛏️

Compared to the long-term HODL'ers, the miners waited longer to take profits - but did so more drastically 👀

Their profit-taking didn't take long though, as they have been net accumulators again since March 30th 😋

Compared to the long-term HODL'ers, the miners waited longer to take profits - but did so more drastically 👀

Their profit-taking didn't take long though, as they have been net accumulators again since March 30th 😋

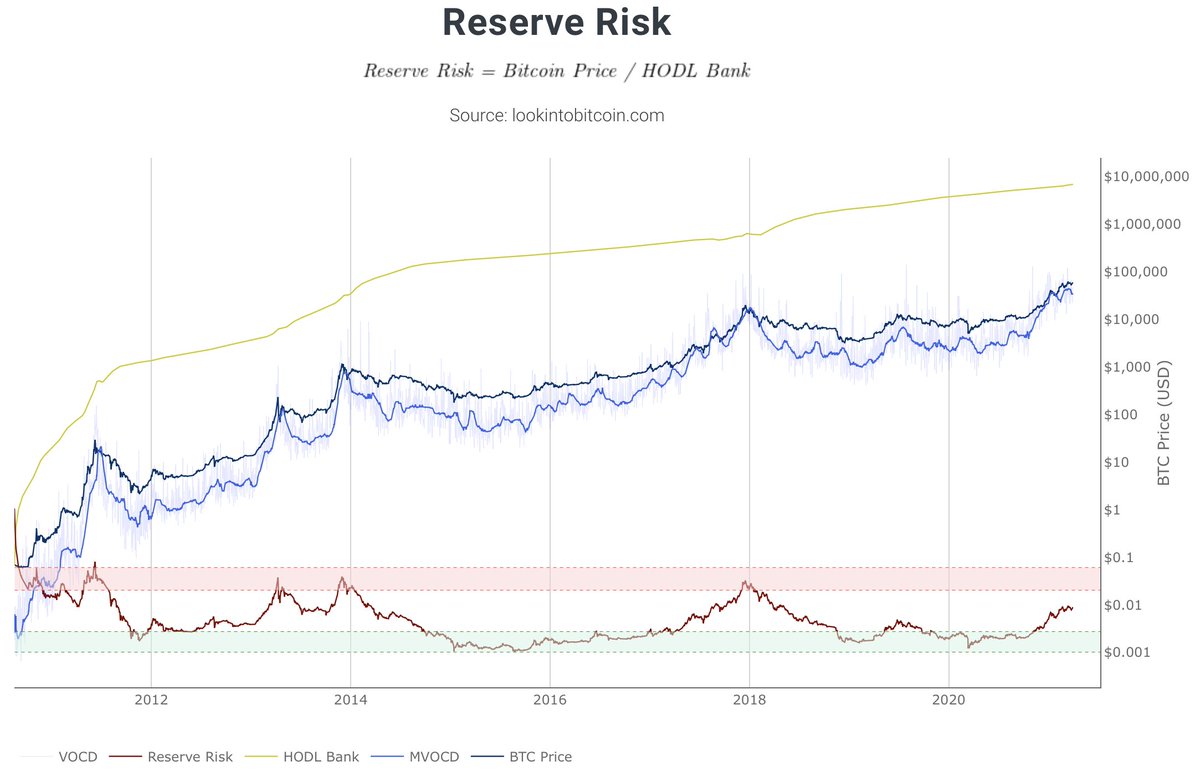

6/10 So what is taking price so long? 😴

Aside from the actual profit-taking (which just takes a while), an explanation can be sought in futures funding rates 💸

After the January local top, funding rates actually increased - literally creating an incentive to push the price 📉

Aside from the actual profit-taking (which just takes a while), an explanation can be sought in futures funding rates 💸

After the January local top, funding rates actually increased - literally creating an incentive to push the price 📉

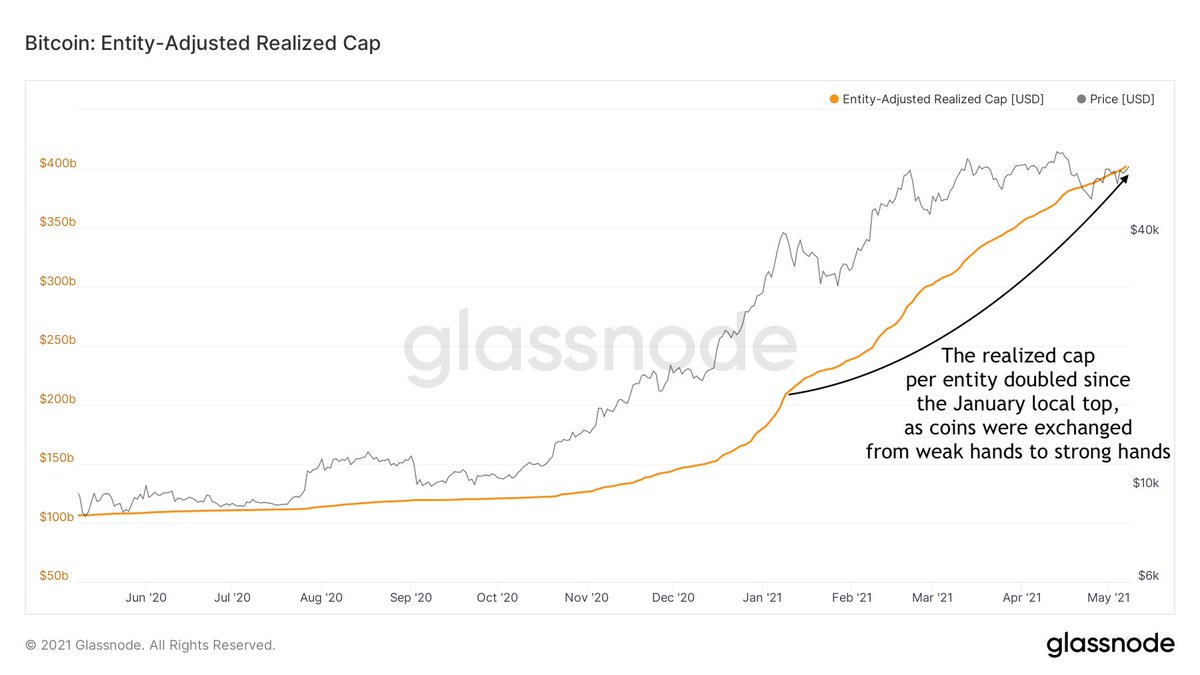

7/10 There are benefits to this re-accumulation though

As coins were exchanged from weak hands to strong hands since January, the realized cap (total value of all #bitcoin when were last moved on-chain) per entity nearly doubled

Current prices are therefore now more 'normal'

As coins were exchanged from weak hands to strong hands since January, the realized cap (total value of all #bitcoin when were last moved on-chain) per entity nearly doubled

Current prices are therefore now more 'normal'

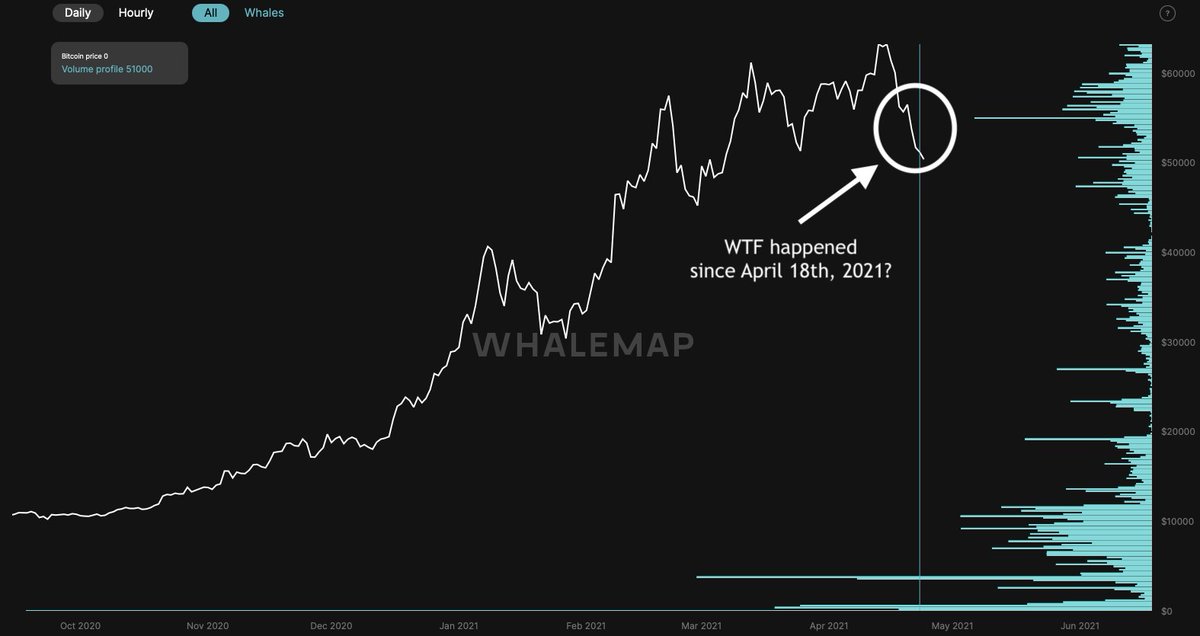

8/10 Another positive consequence of this re-accumulation is that we're building a massive price support base that may act as support if we were to revisit these prices in the future 💪

16.3% of the #Bitcoin has moved at prices above the $1T market cap - validating that as well

16.3% of the #Bitcoin has moved at prices above the $1T market cap - validating that as well

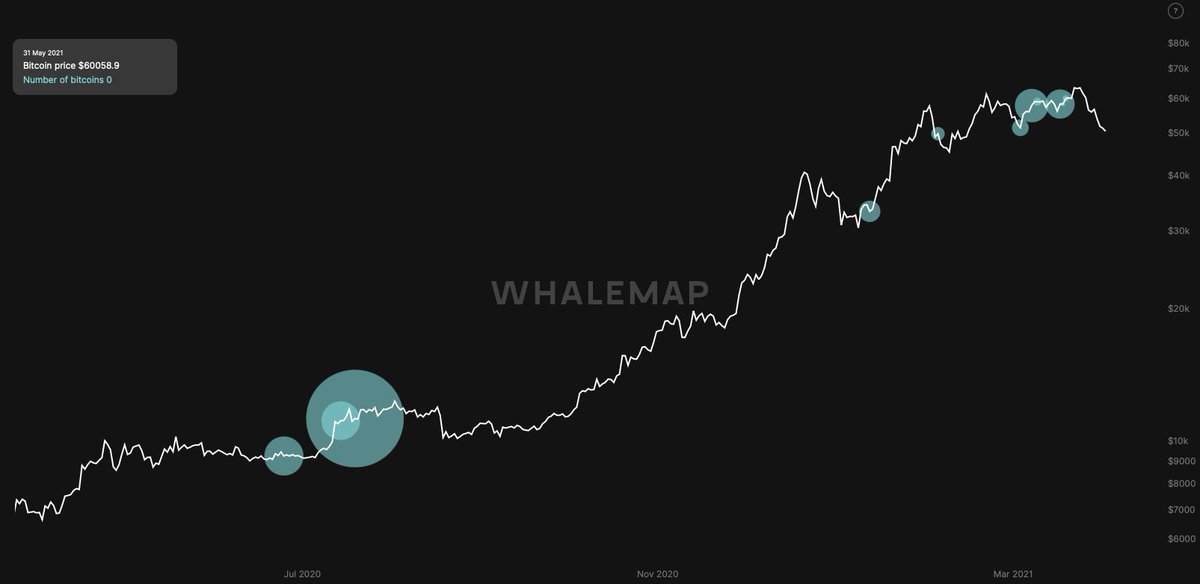

9/11 Besides the mentioned accumulation by long-term HODL'ers and miners, there are signs that large entities (e.g. institutionals) are accumulating

For instance: since February 6th, ~427k BTC have been stacked in addresses holding 100-1,000 #bitcoin

Just yesterday: ~52k BTC 👀

For instance: since February 6th, ~427k BTC have been stacked in addresses holding 100-1,000 #bitcoin

Just yesterday: ~52k BTC 👀

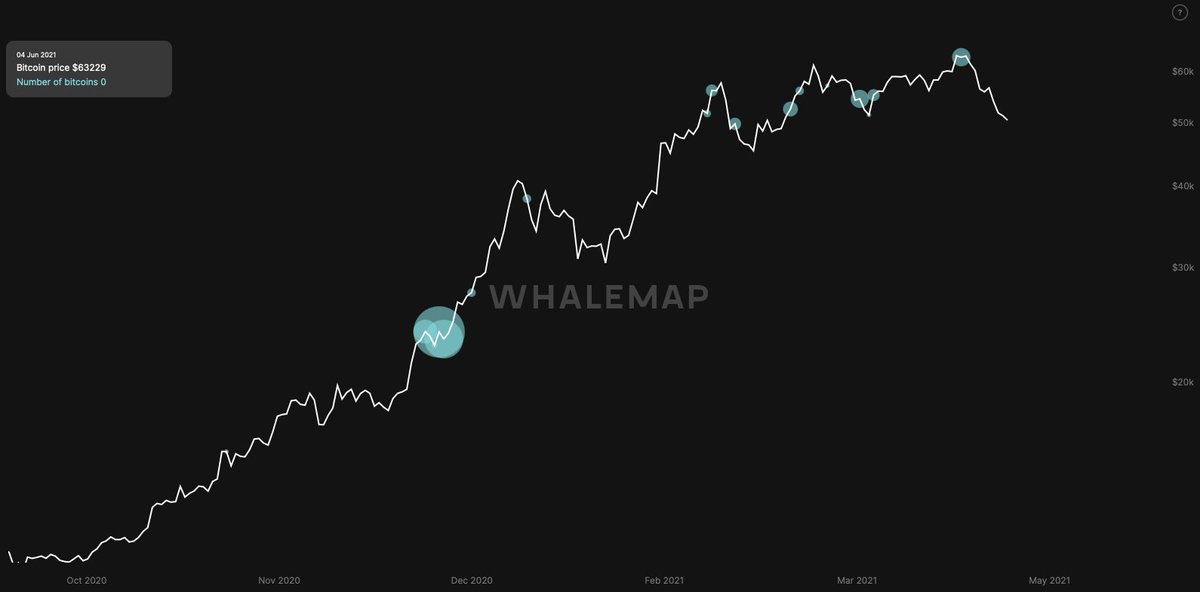

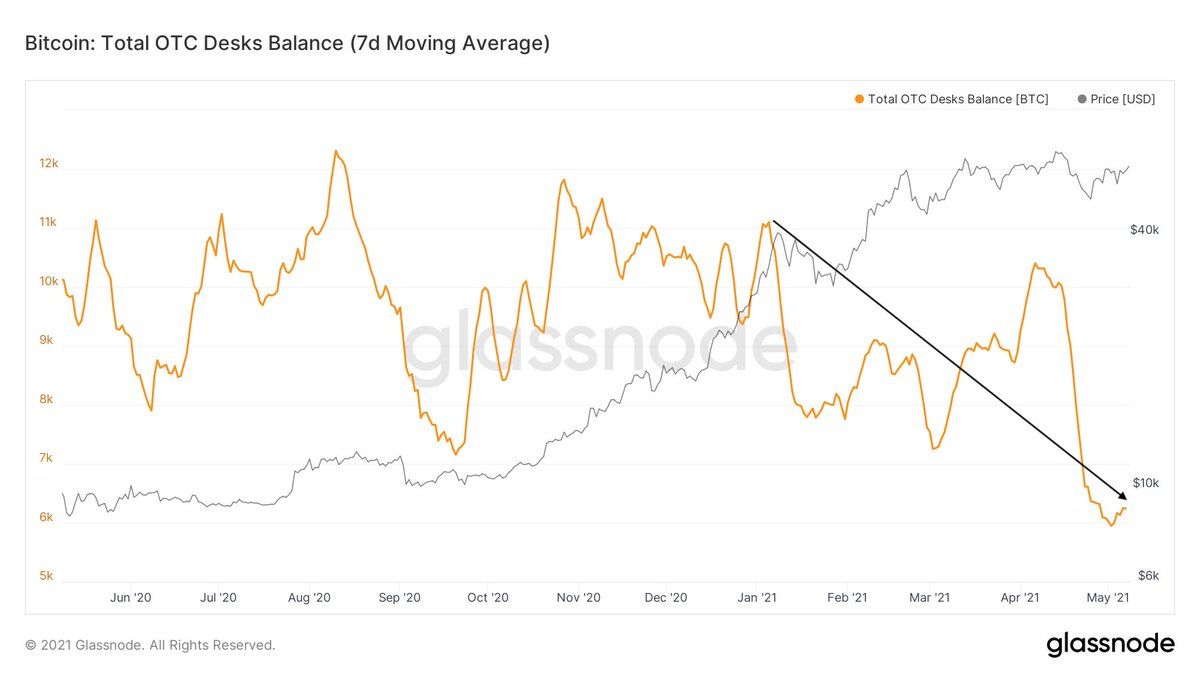

10/11 Finally, another sign of possible institutional accumulation during this relative price consolidation since the January local top is the clear declining trend in the #bitcoin balances of the Over The Counter (OTC) trading desks that are often used by these parties

11/11 So my current view is that:

- In January, price got overheated

- HODL'ers & miners with weak hands took profits

- Besides profit-taking, high funding rates provided a headwind for price growth

- Miners, HODL'ers & possibly institutionals with strong hands kept accumulating

- In January, price got overheated

- HODL'ers & miners with weak hands took profits

- Besides profit-taking, high funding rates provided a headwind for price growth

- Miners, HODL'ers & possibly institutionals with strong hands kept accumulating

• • •

Missing some Tweet in this thread? You can try to

force a refresh