1/9 About 9 hours ago, Elon Musk tweeted that Tesla would stop accepting #Bitcoin for payments out of environmental concerns, crashing price by -$8.7k (-16%) to just below $46k

Something smells fishy here though.. 🐟

A 🧵 with some on-chain data ⛓️

Something smells fishy here though.. 🐟

A 🧵 with some on-chain data ⛓️

https://twitter.com/elonmusk/status/1392602041025843203

2/9 First, there's the inconsistency:

- On April 22nd, Elon agreed with Jack that #Bitcoin incentivizes renewable energy

- On May 11th, his latest tweet before this was a poll where he asked if Tesla should accept $DOGE as a payment option; which is also a Proof-of-Work coin

- On April 22nd, Elon agreed with Jack that #Bitcoin incentivizes renewable energy

- On May 11th, his latest tweet before this was a poll where he asked if Tesla should accept $DOGE as a payment option; which is also a Proof-of-Work coin

3/9 Then there's also the inconsistency that Tesla is apparently still comfortable holding #Bitcoin

As pointed out by @yassineARK, its energy consumption is there to secure past transactions

Are they THAT unaware, or is something else going on? 🤔

As pointed out by @yassineARK, its energy consumption is there to secure past transactions

Are they THAT unaware, or is something else going on? 🤔

https://twitter.com/yassineARK/status/1392616801410891783

4/9 If you ask me, I suspect that Tesla's stock price dropping since they announced that they bought #Bitcoin is likely related

Since then, $TSLA is in a downtrend, while the $SPX is in a clear uptrend

Why though, since @MicroStrategy's stock mooned after its announcement?

Since then, $TSLA is in a downtrend, while the $SPX is in a clear uptrend

Why though, since @MicroStrategy's stock mooned after its announcement?

5/9 The answer probably lies in Tesla being subsidized by parties targeting environmental sustainability, as pointed out by @PrestonPysh

#Bitcoin's environmental impact is massively understood, particularly by people in the legacy financial system

#Bitcoin's environmental impact is massively understood, particularly by people in the legacy financial system

https://twitter.com/PrestonPysh/status/1392614259431985153

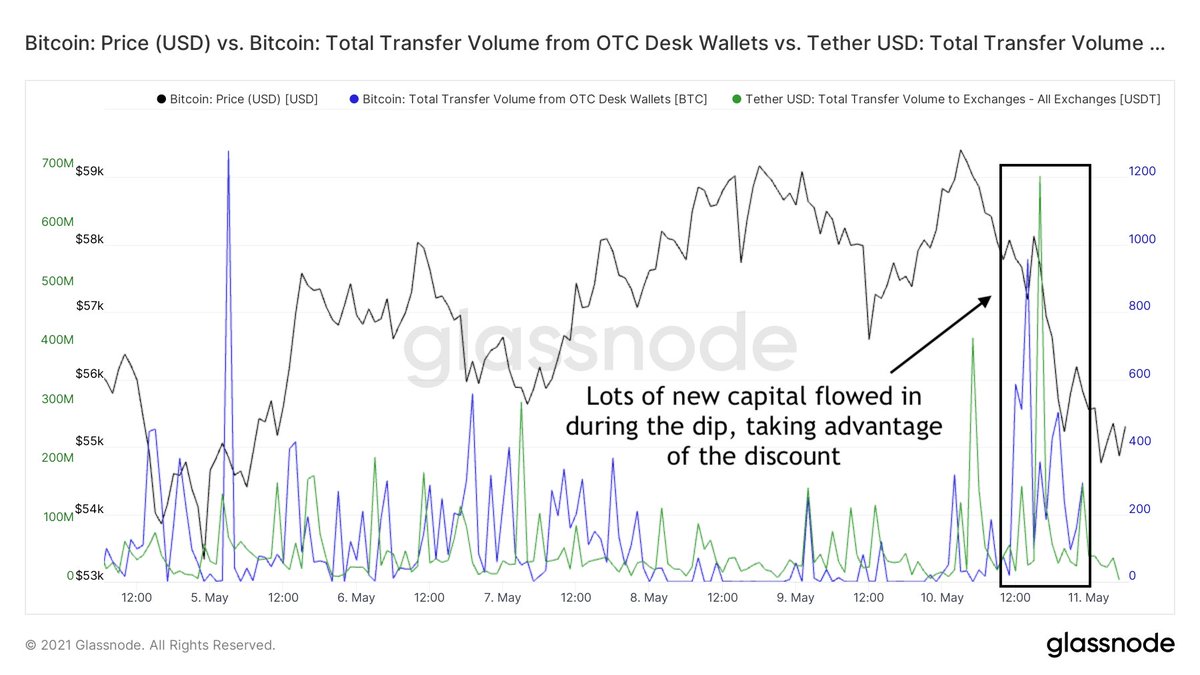

6/9 More weird things happened over the last 24 hours though

A few hours before Elon's tweet, over 19k #BTC, worth ~$1.1B at that time, were deposited on exchanges 🧐

The crash after his tweet caused a cascade of long liquidations, further exacerbating the price crash

A few hours before Elon's tweet, over 19k #BTC, worth ~$1.1B at that time, were deposited on exchanges 🧐

The crash after his tweet caused a cascade of long liquidations, further exacerbating the price crash

7/9 The on-chain coin movements before Elon's tweet appeared to be mostly relatively older coins that (still) moved at a profit

What did these holders know that we didn't (yet)..? 🤔

Or was this just a coincidence..? 👀

What did these holders know that we didn't (yet)..? 🤔

Or was this just a coincidence..? 👀

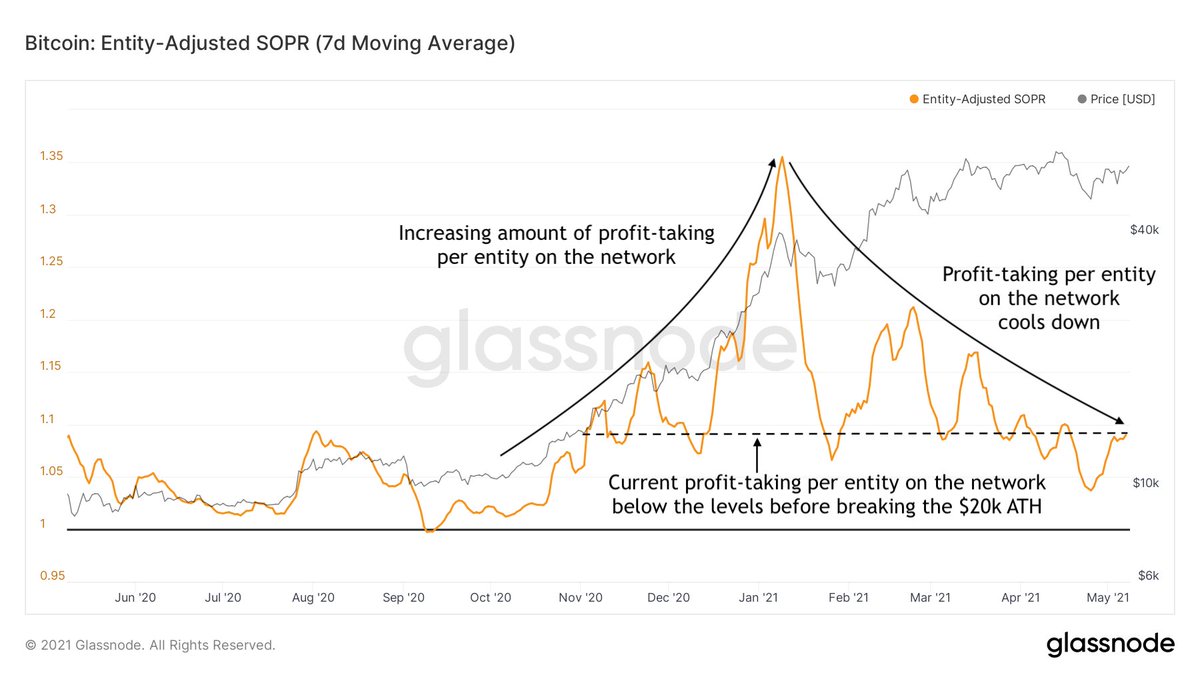

8/9 It is good to realize that those tweets were zoomed in on intra-day charts

If we zoom out & look at the bigger picture, we see that in comparison to late last year's run-up, most long-term #Bitcoin holders are not parting with their coins

So far, no concern overall IMO

If we zoom out & look at the bigger picture, we see that in comparison to late last year's run-up, most long-term #Bitcoin holders are not parting with their coins

So far, no concern overall IMO

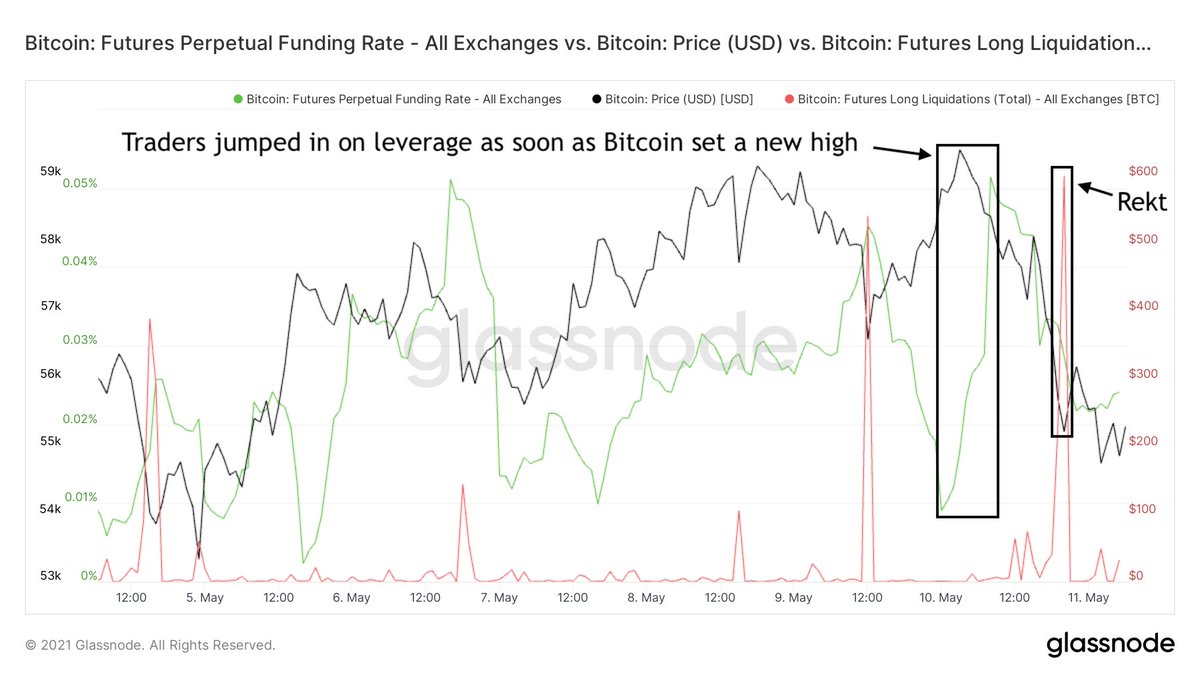

9/9 If anything, this crash flushed out even more leverage

The futures perpetual funding rate briefly even went negative, which means that there was a premium on going long #Bitcoin over the past few hours

This Elon-FUD-crash may be a good buy the dip opportunity (via spot) 👀

The futures perpetual funding rate briefly even went negative, which means that there was a premium on going long #Bitcoin over the past few hours

This Elon-FUD-crash may be a good buy the dip opportunity (via spot) 👀

• • •

Missing some Tweet in this thread? You can try to

force a refresh