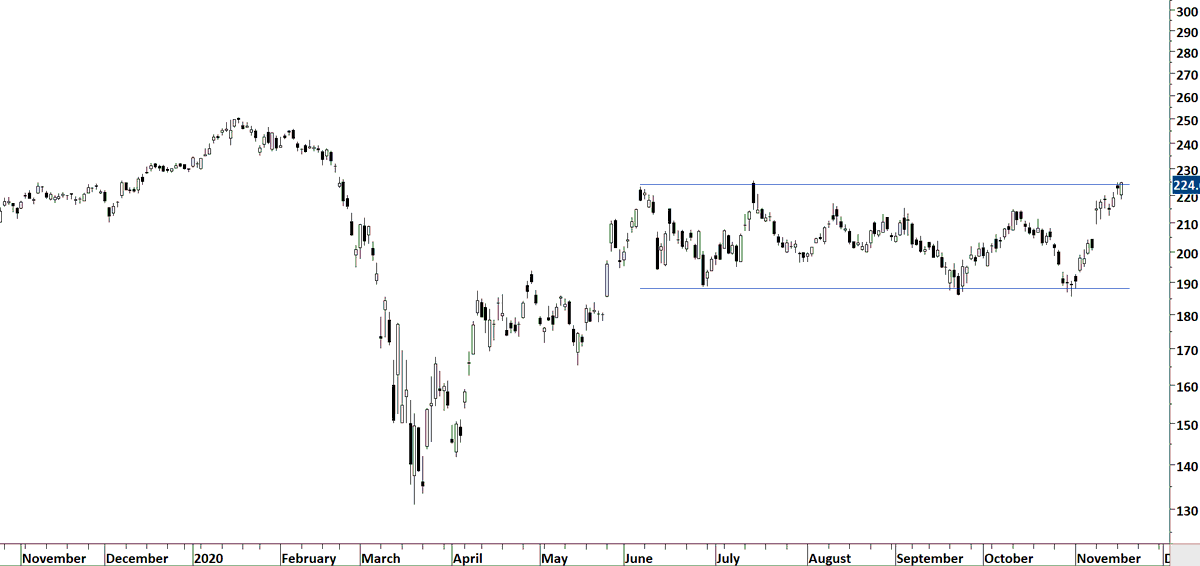

Trying to pick tops and bottoms in a trend is a low probability event.

Identifying an existing trend and trying to capture the trend periods is a high probability event.

First you are going in the direction of the existing trend. There is momentum in your favor.

Second, you have "better" levels of stop placement incase you are wrong.

First you are going in the direction of the existing trend. There is momentum in your favor.

Second, you have "better" levels of stop placement incase you are wrong.

Better meaning, levels that are actually recognized by market participants as they are formed by the battle (supply & demand) during their transactions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh