However, despite all this, Zomato’s valuation grows from $ 3 BN to 8.6 BN in 18 mths. Now that’s an innovation at Zomato that I’m not willing to pay for. I’m sure they’ll find many who would like to own “fools gold”. I’ll pass.

Zomato listing – Follow up:

So what does an analyst do when listing surprises everyone. Well, he digs more.

At PE of 350, #ZomatoIPO beats DoorDash of US hands down. And we thought DoorDash is overpriced at PE of 143. Is it pricey?

So what does an analyst do when listing surprises everyone. Well, he digs more.

At PE of 350, #ZomatoIPO beats DoorDash of US hands down. And we thought DoorDash is overpriced at PE of 143. Is it pricey?

Hell yes, it is VERY pricey. And if possibilities are immense, why did sales stay flat for last 3 yrs? What did we miss here? Takes us to the listing dynamics & why most stocks decline post listing pop phenomenon. Let's see some details.

The prospectus says –

Not less than 75% of the Net Offer shall be Allotted to QIBs. One-third of the Anchor Investor Portion shall be reserved for domestic Mutual Funds, subject to valid Bids at or above the Anchor Investor Price.

So, MFs have to bid above the Anchor investors

Not less than 75% of the Net Offer shall be Allotted to QIBs. One-third of the Anchor Investor Portion shall be reserved for domestic Mutual Funds, subject to valid Bids at or above the Anchor Investor Price.

So, MFs have to bid above the Anchor investors

“Further, not more than 15% of the Net Offer shall be available for Non-Institutional Bidders (read HNIs). Not more than 10% of the Net Offer shall be available for allocation to Retail Individual Bidders.”

So retail may have got even less than 10% shares.

So retail may have got even less than 10% shares.

We don’t know. But here’s the critical point:

Any Equity Shares allotted to Anchor Investors shall be locked-in for a period of 30 days from the date of Allotment.

Any Equity Shares allotted to Anchor Investors shall be locked-in for a period of 30 days from the date of Allotment.

So not much was available on Friday, July 23rd listing day to trade for a fair price discovery. See the below disclosure. Trading shall commence on Tuesday, July 27th. But we won’t discover the real price as 90% of shares are locked in for at-least one month.

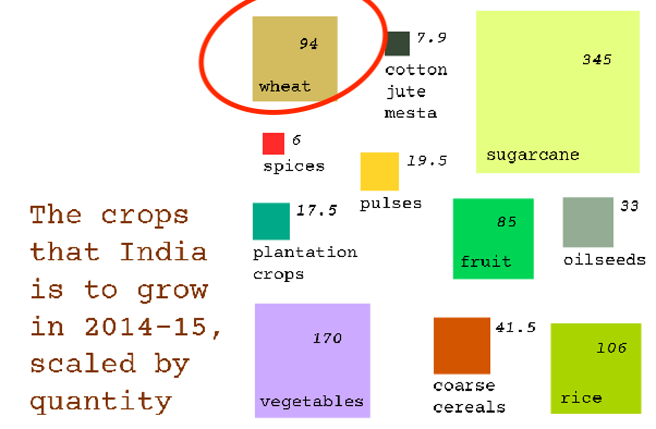

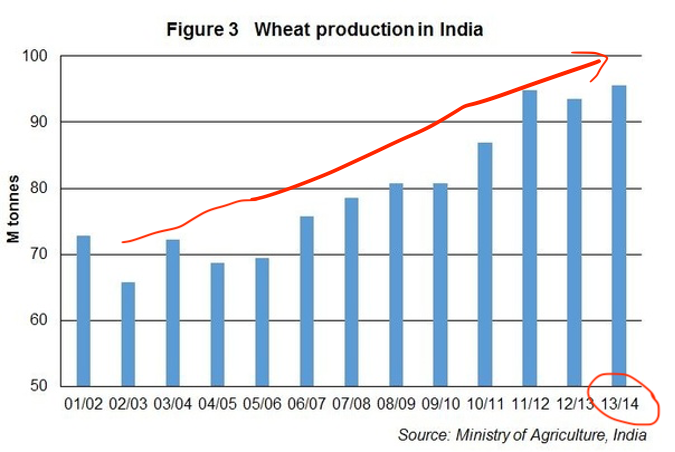

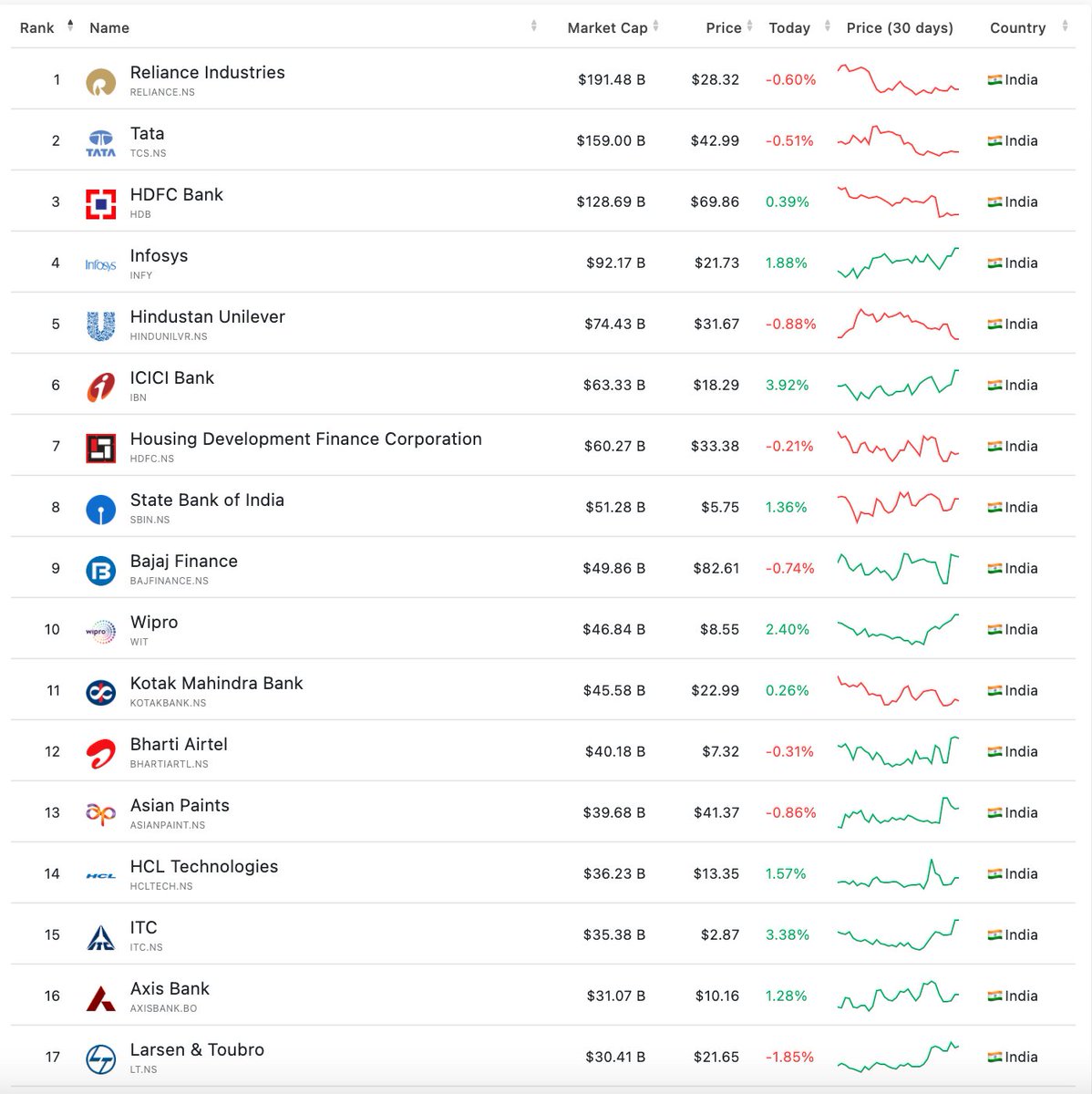

Now, what does a retail investor do till then? Well, he takes his profits & runs out of the door being lucky. Zomato with just Rs 2100 cr of stagnated sales can't be in the league of the below at $ 14.7 BN. If you don’t know why a stock shot up, you’ll have no idea when it falls

With a very well-intentioned good luck to #ZomatoListing on business, an IPO can't be a priced with nothing left on the table for retail investors. For now, round 1 goes to Zomato.

But we’re watching this one closely…… it's not over yet !

But we’re watching this one closely…… it's not over yet !

• • •

Missing some Tweet in this thread? You can try to

force a refresh