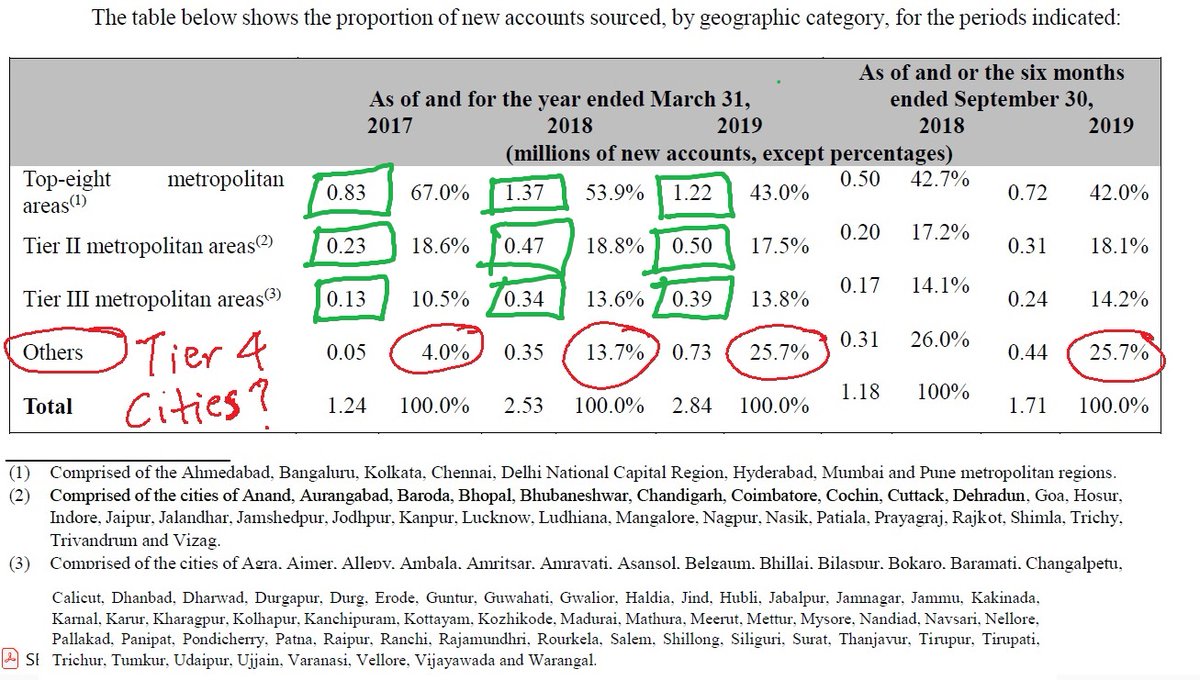

13 crore shares offered out of total of 93 crore stocks. 14% float at Rs 750 per share is valuation of Rs 70 thousand crore to SBI Cards. #sbicards

SBI Cards

So, with a FY’19 PE of 80 , if someone tries to sell me the story of growth in cards issued over last 5 yrs(which basically is in last 2 years), I’m not going to buy it.

HDFC Bank - $ 92 BN

ICICI Bank - $ 45 BN

Kotak Bank - $ 44 BN

Axis Bank - $ 28 BN

IndusInd Bank - $ 11 BN

Do you think that credit card arm of SBI is equal to entire IndusInd bank & 1/3 of Axis bank?