#LIC agent is a known social person in locality. It becomes almost obligatory to buy policy from agents, even if you didn’t understand the policy. If each agent knows 100 “relatives”, we almost have the half of Indian households covered.

This is the best trick up their sleeve. Majority of (tempted to say all) LIC agents have a similar selling pitch.They almost never talk to you about “annualized returns”. The pitch is “your money grows 4 times in 20 yrs or 6 times in 30 yrs”

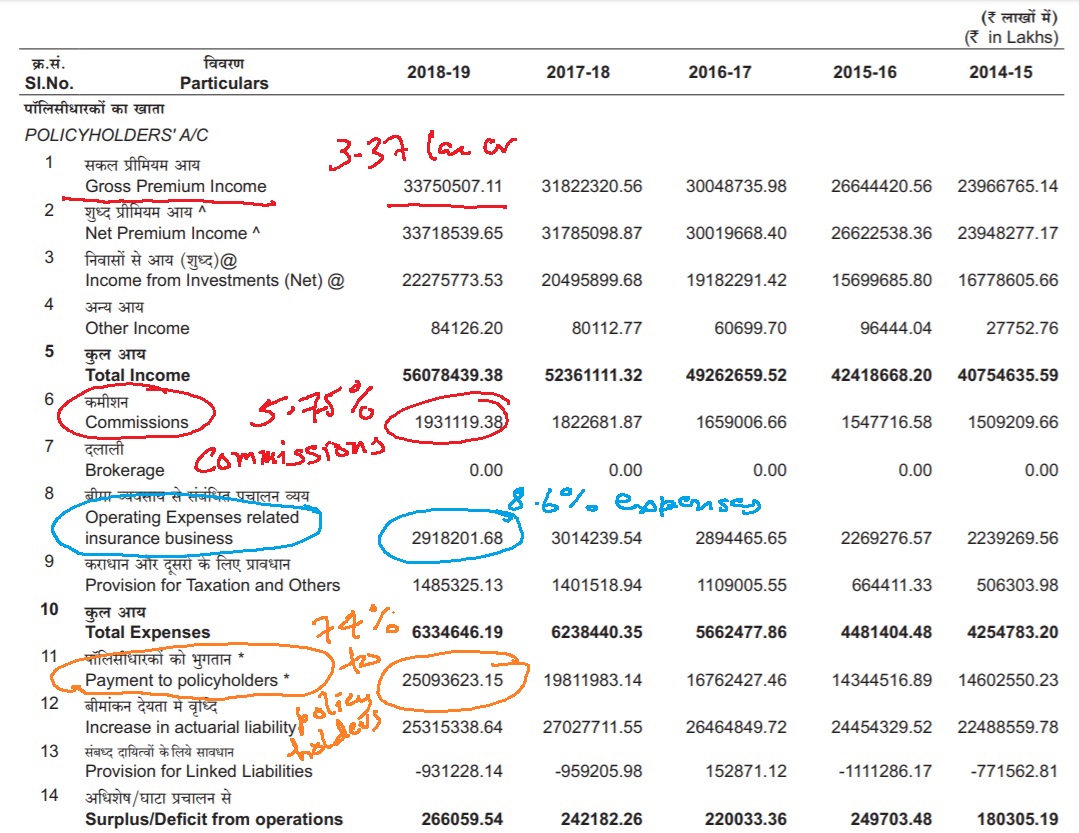

The buyer thinks he's being smart by taking a small % of the commission from agent. What he certainly doesn’t know is that the “cut” he takes in first year is just a small fraction of the money agent will make in trail commissions

Now this one has some cultural history. Indians have been duped so much by notorious private investing firms that anything from the govt gives us comfort. I understand that there is a notion of implied govt guarantee in LIC.