The bogey of maintenance capex – how the term ‘cash profit’ can be misleading for some types of companies but insightful at the same time. Read below⬇️

Some companies report ‘cash profits’ to measure financial performance. Two random examples - Time Technoplast (TTL) and Welspun India (WIL). TTL uses ‘cash profit’ in latest presentations but does not define it, whereas WIL defines it as profit before depreciation and tax. (2/22)

For TTL, I compared the 'cash profit' for FY20 from the Q4FY21 presentation, with the cash flow statement in AR FY20. The 'cash profit' for TTL seems to refer to cash from operations before working capital changes and tax. Quite hazy for the reader . (3/22)

This 'cash profit' number, usually sitting next to PAT, makes the company seem to be generating more cash than reported earnings. The difference is between 100-200% of reported PAT. In a way, it leads investors to believe the company's earnings to be higher than reported. (4/22)

A company at 10 PE generating 2x cash earning than reported earning must be a stellar bargain, one would think. However, ‘cash profit’ is not a standard term and isn't expressly outlined in the accounting standards. Experts may correct if I am wrong. (5/22)

Based on practice, we can understand it as a term for cash earnings by the company by eliminating non-cash expenses. It’s easy to dismiss non-cash expenses, though, of which the most common is depreciation. (6/22)

Depreciation is the gradual reduction in value of fixed assets due to age, and wear and tear. In asset-light companies, depreciation is inconsequential. In capital intensive industries with low asset turnover, depreciation can be a significant portion of the P&L. (7/22)

To counter depreciation, businesses need to incur recurring expenditure on fixed assets to keep operations running optimally. This is commonly called maintenance capex. This is different from growth capex, which is acquisition of fixed assets to increase the sales. (8/22)

Maintenance capex will be different for different industries, naturally. Some businesses may be capital intensive upfront but require lesser maintenance capex over the long term. Others may incur significant maintenance capex but require lesser investment upfront. (9/22)

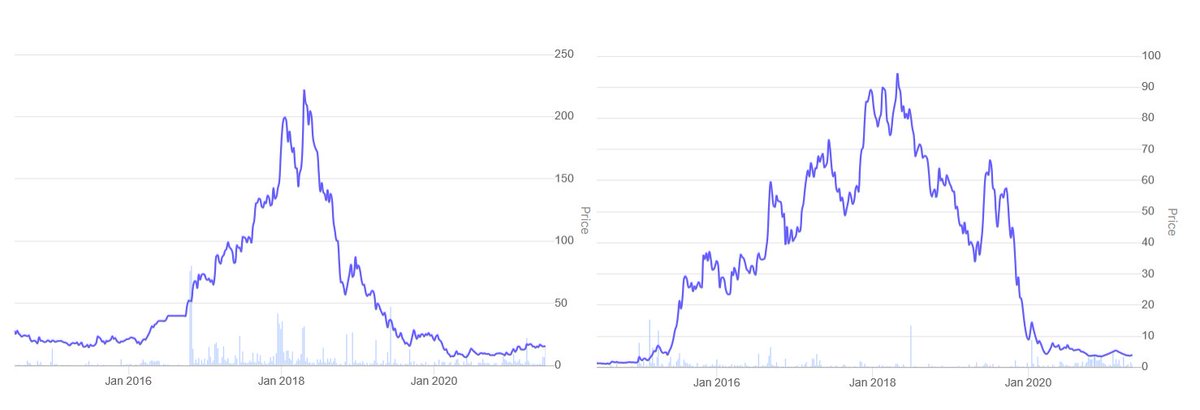

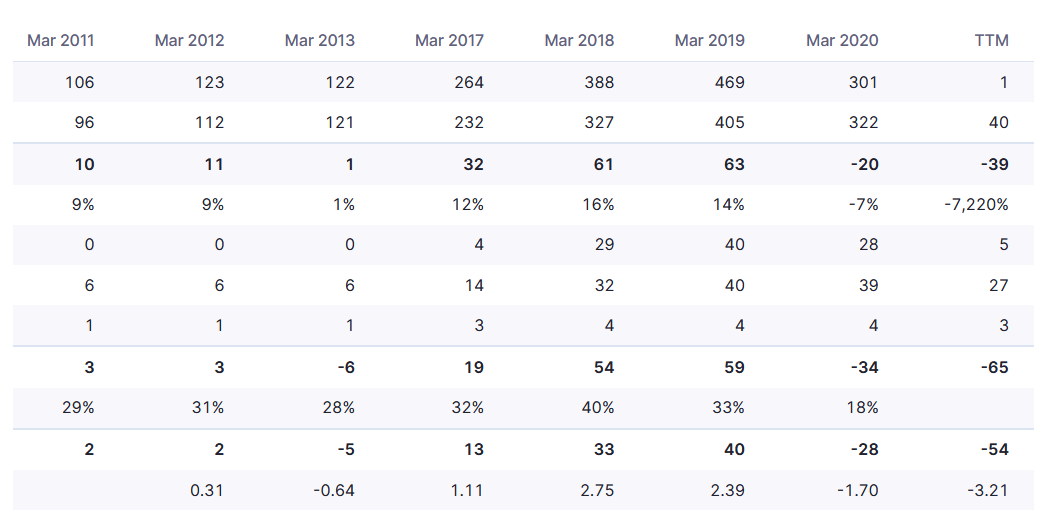

Let's analyze TTL, which is an exhibit of the latter. Take a look at the attached image carefully, and see the observations below : (10/22)

1) TTL generated 2270 crore of operating cash flows b/w 2012-20, but also invested 1670 crore into fixed assets. However, the net block increased only from 918 crore to 1349 crore, up 431 crore. Ex new assets, 1239 crore should have been available for the business. (11/22)

2) However, a large part has been used for maintenance capex, shown as an annual addition of fixed assets in the balance sheet. The depreciation of 951 crore, thus, accurately consumes a lot of the 1239 crore expected surplus b/w 2012-20 (interest is another 100 crore). (12/22)

3) Therefore, cash generated from operations is high (2200 crore), but to fund it the company invested over 1600 crores into fixed assets, mostly constant re-investment of cash for maintenance capex (105 cr p.a. b/w 2012-20). Only ~431 crore went into fresh capacity. (13/22)

4) Fixed assets consumed recurring cash due to maintenance capex, which makes 'cash profit' a misleading metric to measure financial performance. 'Cash' is real, 'profit' is accounting. Hence 'cash profit' is a creative accounting concept as far as terms are concerned. (14/22)

5) The interplay between depreciation, maintenance capex and reported earnings is stark when seen on a 5 year basis. TTL had average OCF of 272 crore p.a. b/w 2015-20, and average fixed asset addition of 188 crore p.a. (15/22)

6) 70% of cash from sales went into fixed assets annually. The depreciation is on average 130 crore p.a. b/w 2015-20, lower than the actual expenditure on assets (depreciation is a lagging indicator). For TTL, depreciation is more than real and requires annual cash costs. (16/22)

7) When a business incurs heavy maintenance capex, the term 'cash profit' is not only inaccurate, but also potentially misleading. 'Cash' is real, 'profit' is accounting. Hence 'cash profit' is a creative accounting concept as far as terms are concerned. (17/22)

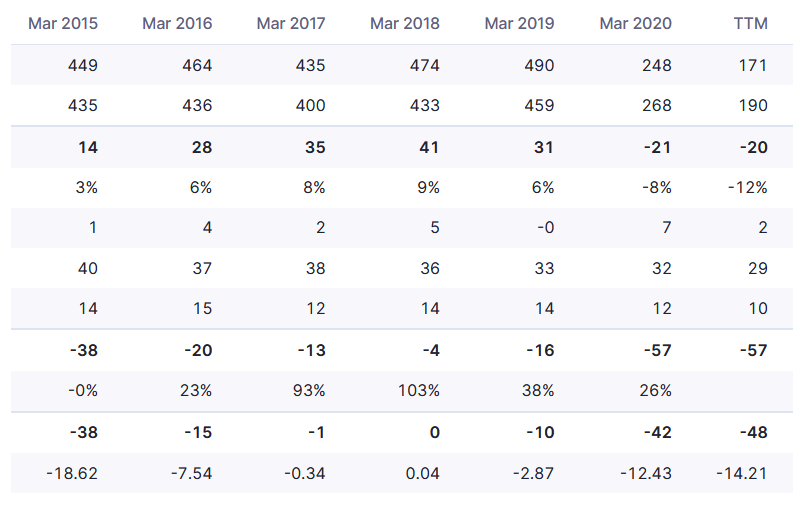

Many businesses such as textiles have the same characteristics as above. Knowing maintenance capex and how it affects certain types of companies is a useful way to understand these businesses and what improvements can change financial and operating profile in the future. (18/22)

For companies like TTL, going up the value chain offsets maintenance capex to some extent, reducing it as as a proportion of cash from sales. Value-added products = more sales on the same fixed assets = more cash for the same maintenance capex. (19/22)

However, it is important to note that not every company with increasing sales per unit of fixed assets is moving up the value chain. These industries tend to be cyclical as well, so it is necessary to understand the underlying reasons for improvement. (20/22)

TTL increased PAT 50% b/w 2015-2020, on net block addition of 18% . Value-added products has been a focus, evident from presentations and concalls. Keeping cyclicality aside, this can reduce maintenance capex as proportion of cash flow and lead to free cash flows. (21/22)

As always, this is not a recommendation, only observations. Do scroll up and RT the first post if you like it - it is pretty much the only reward for me ;) (22/22)

• • •

Missing some Tweet in this thread? You can try to

force a refresh