Want to do this kind of an analysis yourself? Lot of messages asking how to learn to do this. It's quite simple, let me show you step-by-step. (1/18)

https://twitter.com/leading_nowhere/status/1416342213529796608

The first step, obviously, is spotting a candidate gives insights when the data is arranged in a particular manner. In the thread, I spoke of 'cash profits', so let's take the other example I cited - Welspun India Limited (WIL). WIL also likes to talk about cash profits. (2/18)

Next step, you need to get data. You can use any popular screener website that allows you to download data in Excel format. My default is @screener_in by @ayushmitt and @faltoo. I don't get any incentives for this mention, it is just easy to use. (3/18)

So, search on Screener and open the WIL page. You click 'Export to Excel' on top and download the document and open it. You will find many tabs for different aspects, only three are relevant here - cash flow, balance sheet and profit & loss. Start with the cash flow sheet. (4/18)

Delete the row 'cash flow from financing activities' (it has no relevance for analyzing maintenance capex). I also delete the FY21 column because I want to normalize data and FY21 had a large COVID impact variance. (5/18)

Go to the P&L sheet and copy the 'depreciation' row and the 'net profit' row and paste them in the cash flow sheet. Also take 'net block' from the balance sheet and copy it into the cash flow sheet. Your data set is ready. (6/18)

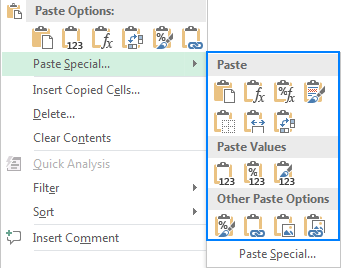

Do remember, when copying rows from across sheets, always use 'paste special' feature and select 'paste values'. You don't want to be copying formulae, that will lead to grossly incorrect data. This learning took an hour of head scratching, so....avoid it. (7/18)

Now, in the column after FY20 (say column K), you use 'Auto Sum' function in Excel to add up the values for every year. I do not do Auto Sum on net block because it is an incremental value. In the next column (say L), you use Auto Sum and select 'Average'. (8/18)

Last, in the next column (say M), compare FY16 w/ FY20 to see how things moved over the last 5 years. Formula is (FY20-FY16)/FY16. Don't worry, this is just simple math. You're done now. FYI - this is not a perfect measure, there can be one-offs or extraordinary items. (9/18)

Minor beautification later, you're ready to see the results:

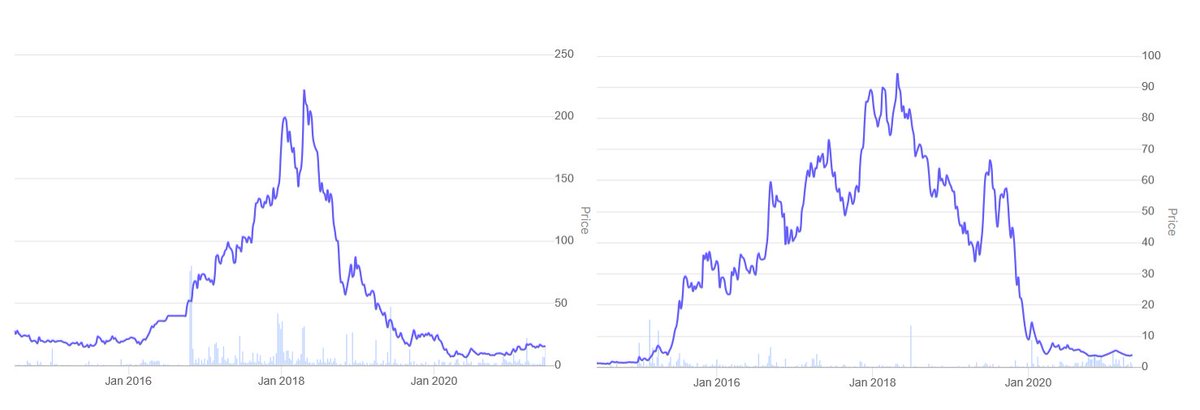

1. WIL generated 6567 crore in operating cash flows b/w 2012-20, but also invested 4641 crore into fixed assets. 70% of operating cash went into fixed assets. (10/18)

1. WIL generated 6567 crore in operating cash flows b/w 2012-20, but also invested 4641 crore into fixed assets. 70% of operating cash went into fixed assets. (10/18)

2. Depreciation was a mammoth 3600 crore, still lesser than the total addition of fixed assets at 4641 crore. Net block addition was much slower, growing 900 crore in 9 years. Effect of assets depreciating quickly and requiring replacement. (11/18)

3. On 5 year average, WIL generated 860 crore operating cash flow per annum, of which 560 crore required reinvestment, leaving ~200 crore cash for other business activities. Accounting profit, on average, was 439 crore per annum. Tax isn't even part of this calculation. (12/18)

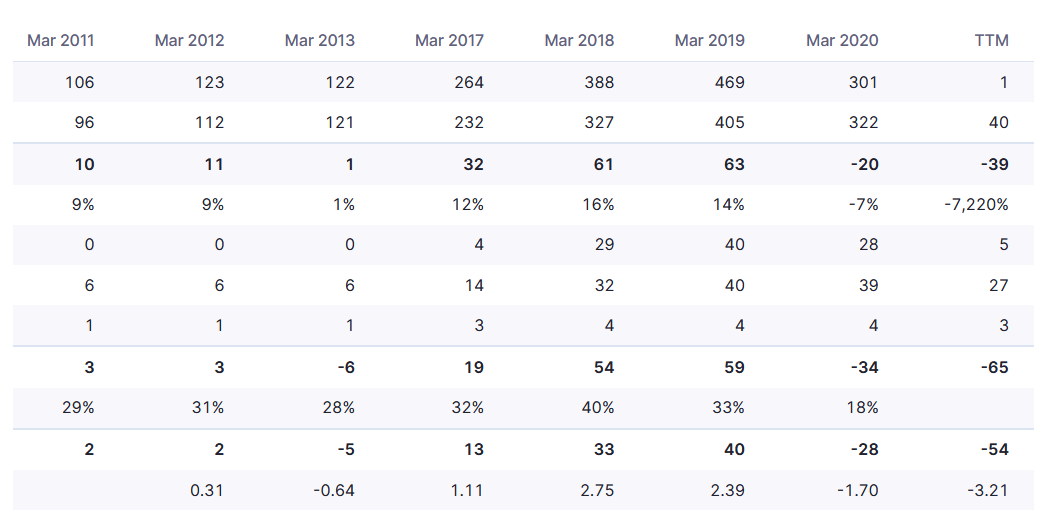

This analysis is very dandy, but a reader might legitimately ask, can you show me a business that has seemingly grown beyond being constrained by maintenance capex? Yes, let's see KPR Mills. (13/18)

KPR Mill is an old favourite and analyzing its financials in a similar manner makes it apparent why it has outperformed other textile companies (a part of it also has to do with diversification into ethanol, just to be fair). (14/18)

So, the Excel for KPR Mill. To keep this brief, first thing that jumps out is the flat/declining trend in depreciation with growing operating cash flows. Secondly, on 5Y basis, KPR's investment in fixed assets is ~45% of operating cash flows compared to 70% for WIL. (15/18)

KPR's trends that indicate it is able to generate more revenue on every rupee in fixed assets. The reasons can vary - better realizations, efficiency, supply chain, value addition, etc. These can be ascertained and validated through information from other channels. (16/18)

There are many different ways to analyze companies, and a lot more can be written on all these examples for a holistic analysis. However, the objective here is only to show how you can use simple tools and concepts to understand businesses and their trends. (17/18)

As always, none of this is a recommendation, only observations and perspectives. Do RT if you found it useful. (18/18)

• • •

Missing some Tweet in this thread? You can try to

force a refresh