Blackburn Rovers’ financial results for 2019/20 cover a season when they finished 11th in the Championship under Tony Mowbray, the “longest serving manager in the division”. Figures adversely impacted by the COVID-19 pandemic. Some thoughts in the following thread #Rovers

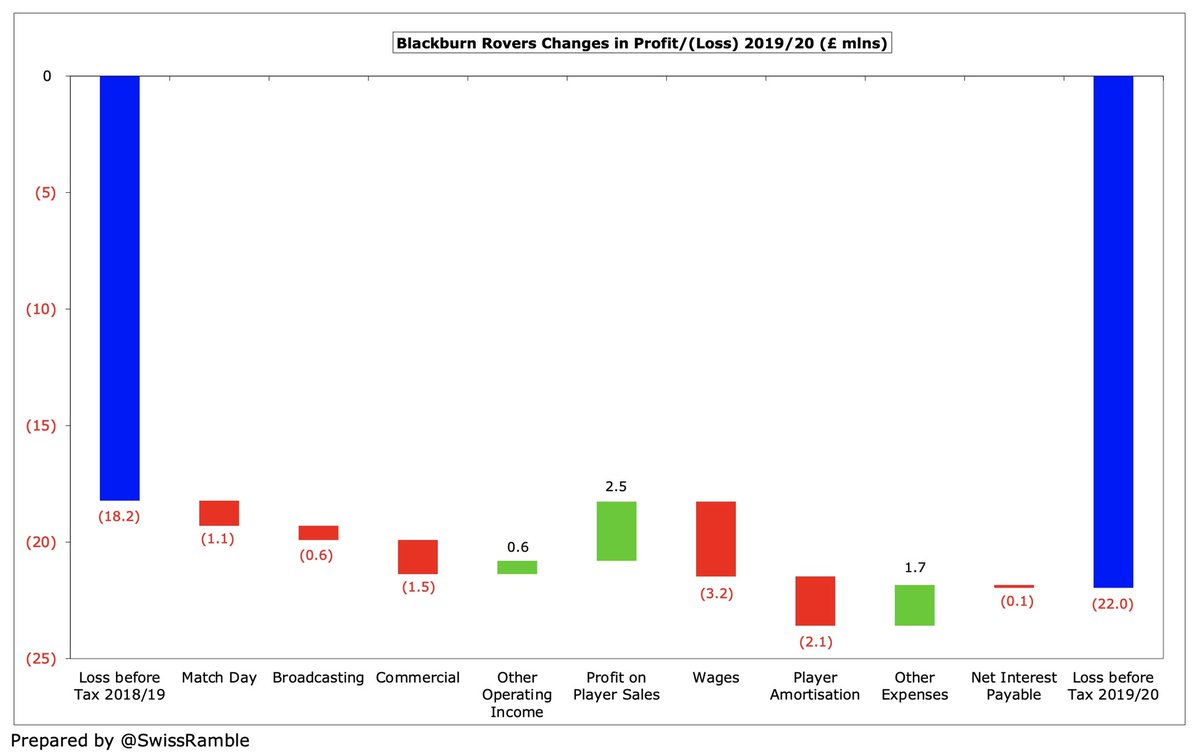

#Rovers loss widened by £4m from £18m to £22m, as revenue fell £3.2m (19%) from £16.7m to £13.2m, while operating expenses grew £3.6m (10%), partly offset by profit on player sales rising £2.5m to £3.1m and £0.6m government furlough income.

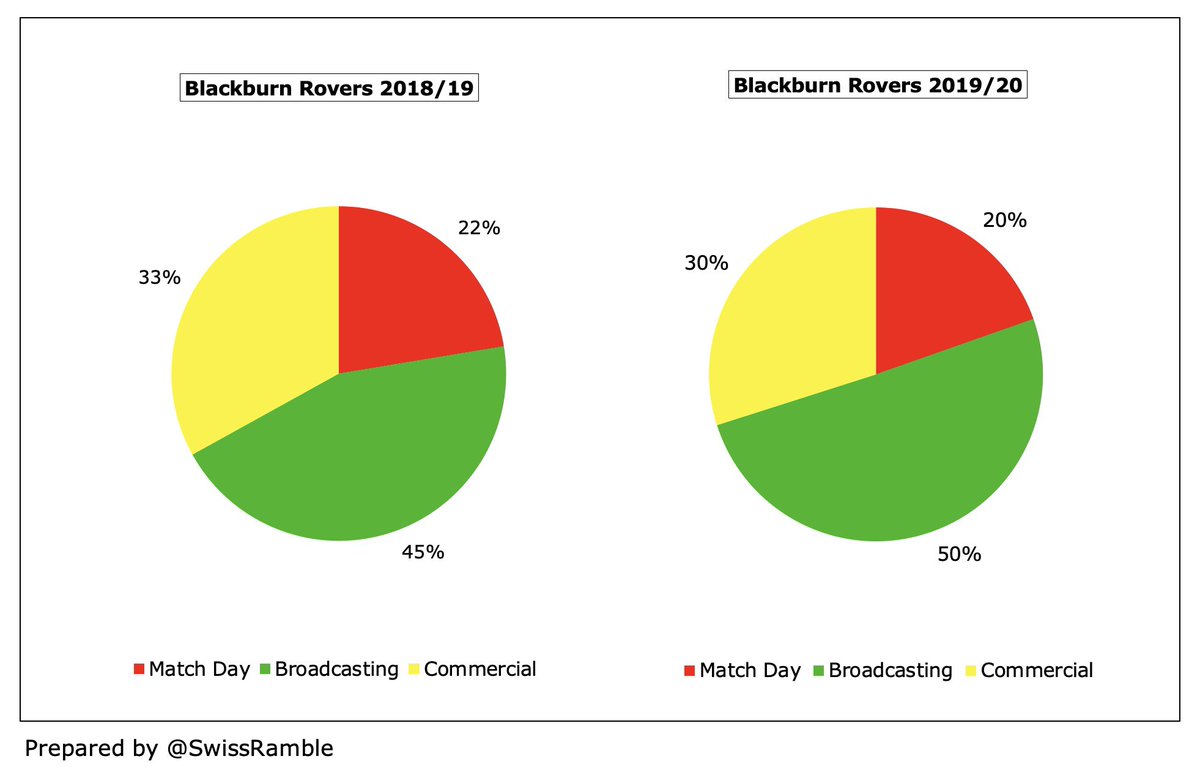

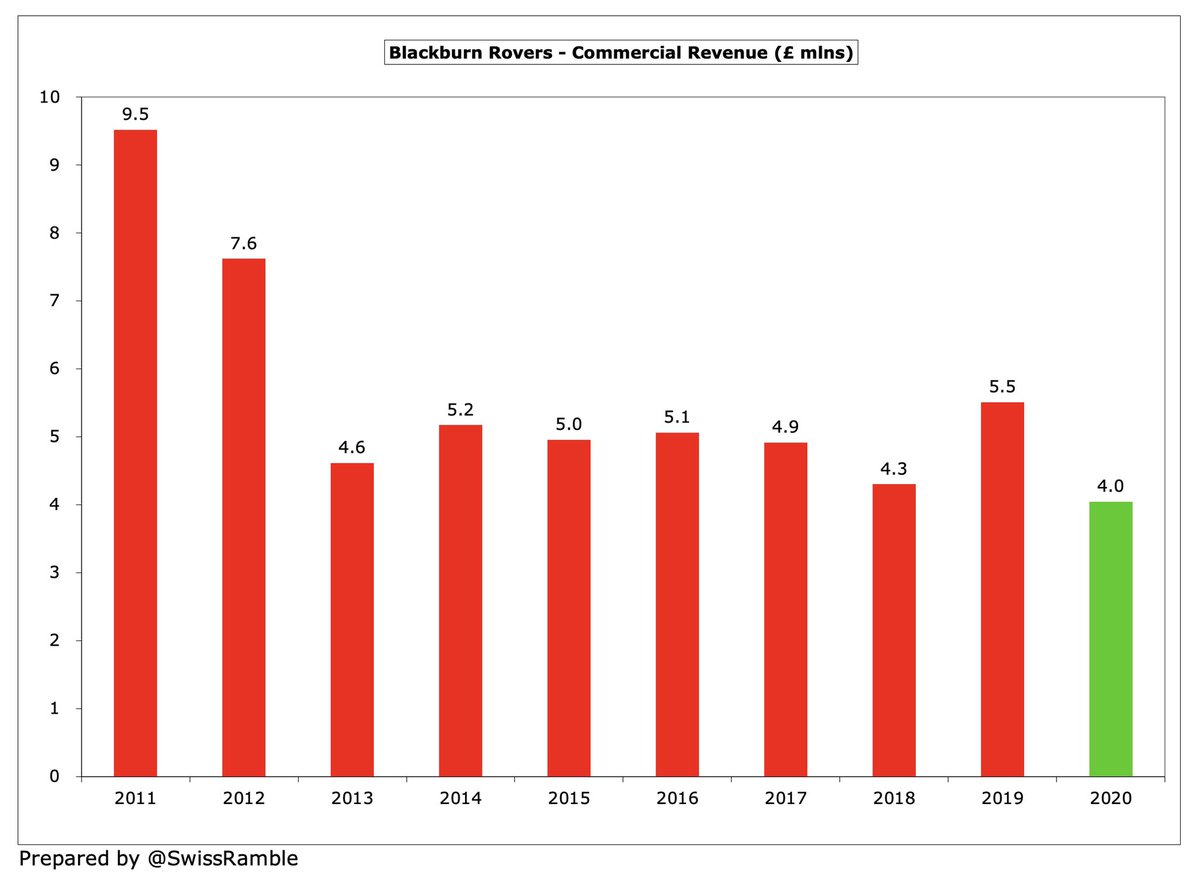

All three #Rovers revenue streams were lower, mainly due to COVID: commercial dropped £1.5m (27%) from £5.5m to £4.0m; match day fell £1.0m (29%) from £3.7m to £2.7m; and broadcasting was down £0.6m (8%) from £7.4m to £6.8m.

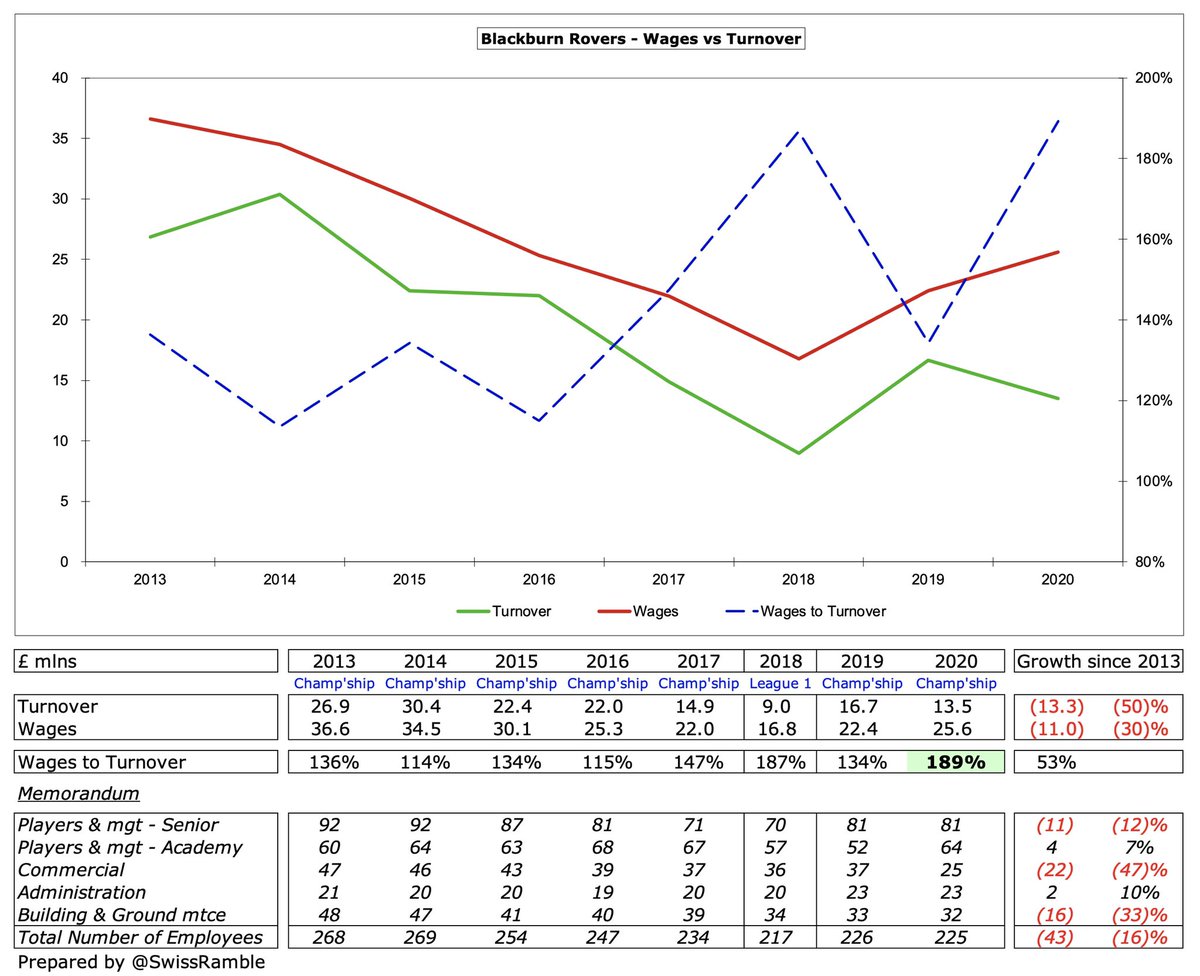

Despite the revenue decrease, #Rovers costs still grew, due to investment in the squad “to be competitive”, as wages rose £3.2m (14%) from £22.4m to £25.6m and player amortisation nearly doubled from £2.2m to £4.3m. Mitigated by other expenses being cut £1.7m (19%) to £7.4m.

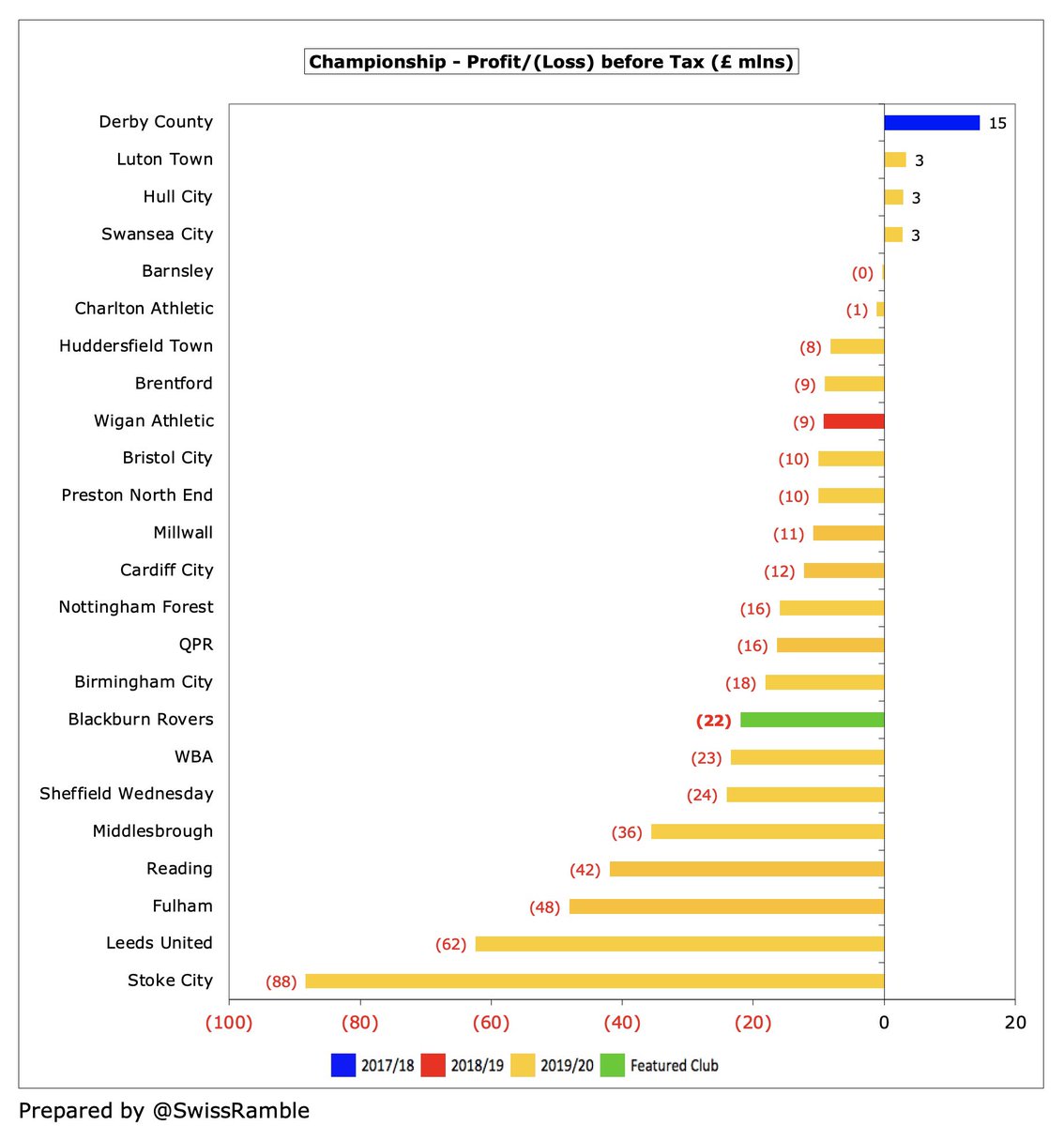

Although #Rovers £22m loss is obviously not great, it is by no means the worst in the Championship. Only 3 clubs posted a (small) profit in 2019/20, while the largest losses were made Stoke City £88m, #LUFC £62m and #FFC £48m (the latter two included hefty promotion bonuses).

#Rovers financials have obviously been hit by the pandemic, resulting in money lost from broadcasters’ rebate and games played behind closed doors, while revenue for games played after the 30th June accounting close has been deferred to 2020/21 accounts. Insurance claim pending.

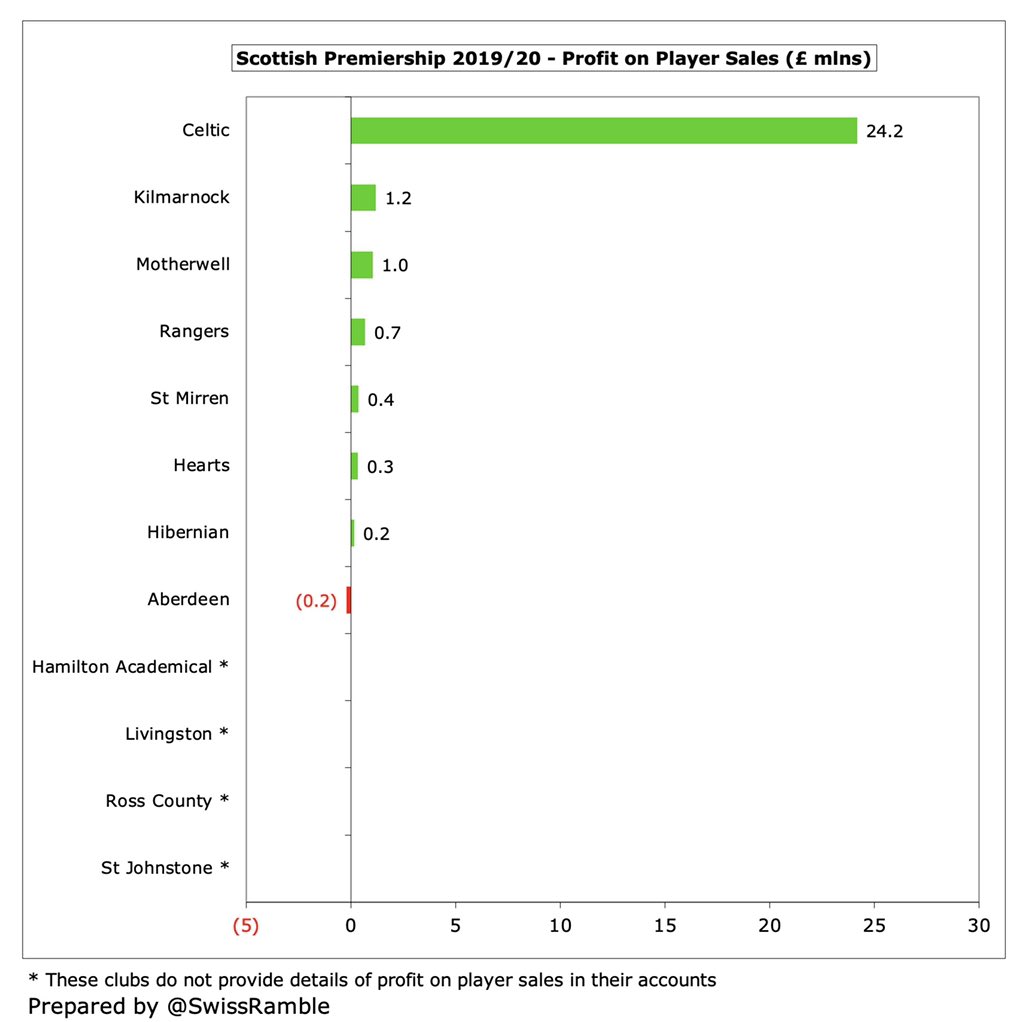

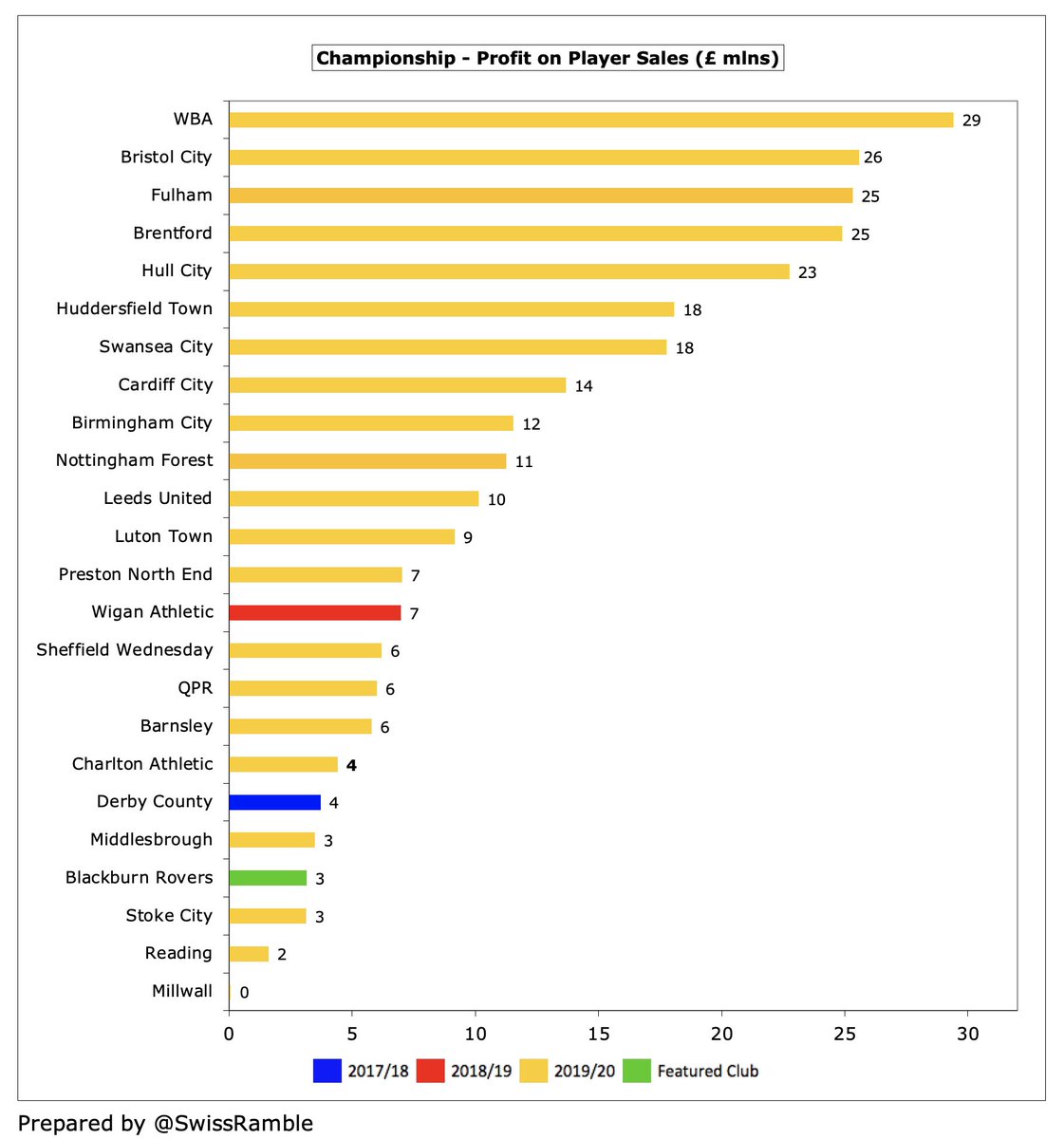

#Rovers profit on player sales increased from £0.6m to £3.1m, largely from David Raya’s move to Brentford, though this was one of the lowest profits for this activity in the Championship, far below the likes of WBA £29m, Bristol City £26m, Fulham £25m and Brentford £25m.

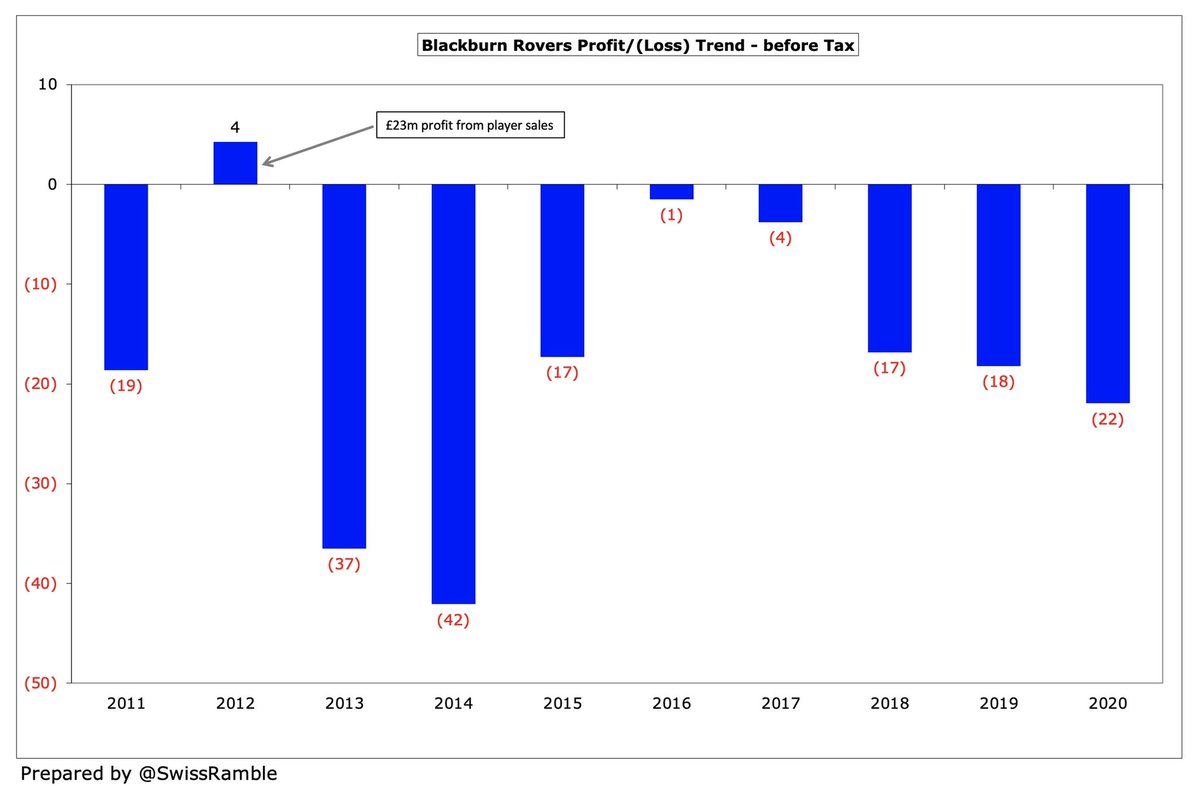

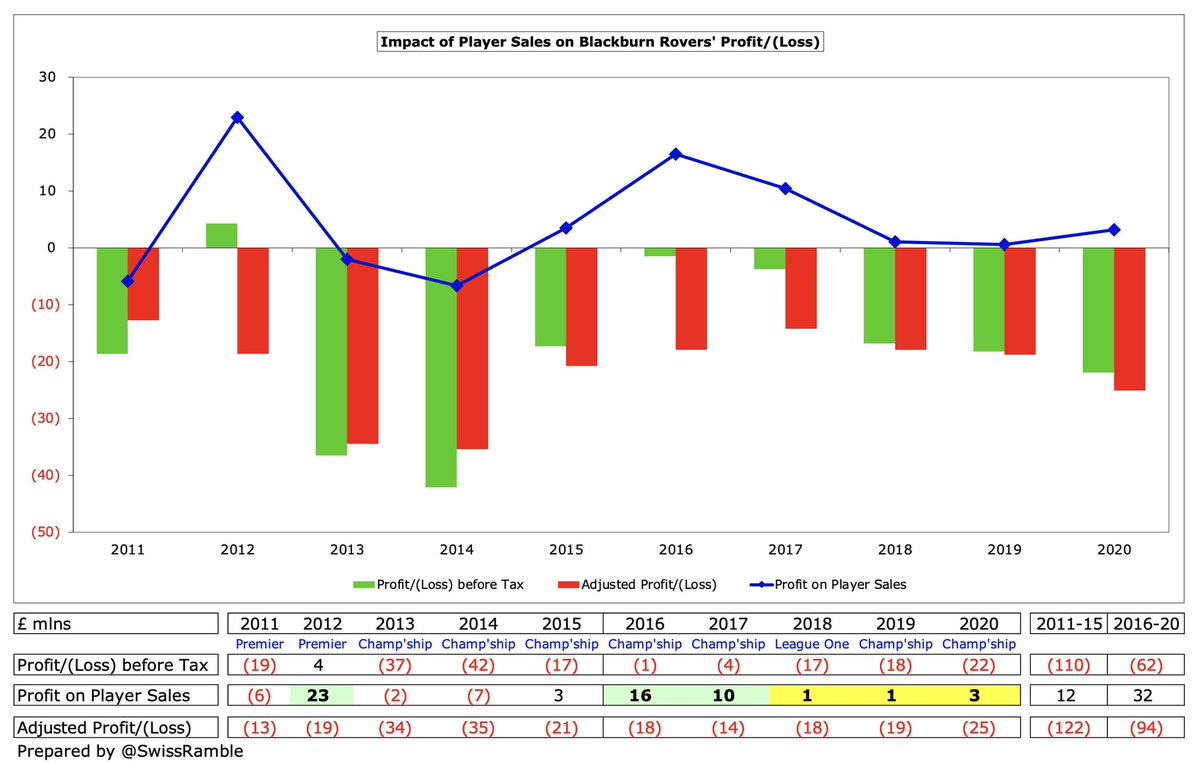

Since Venky’s arrival in 2010, #Rovers have only once made a profit – in 2012 when last in the Premier League (boosted by £23m player sales). In this period they have lost £172m, some achievement considering they had 2 seasons in top flight followed by 4 with parachute payments.

#Rovers relatively small losses in 2016 and 2017 were due to decent profits from player sales, but they have only made £5m from this activity in the last three years. Performance was no better in 2020/21, as no meaningful sales were made in the season just gone.

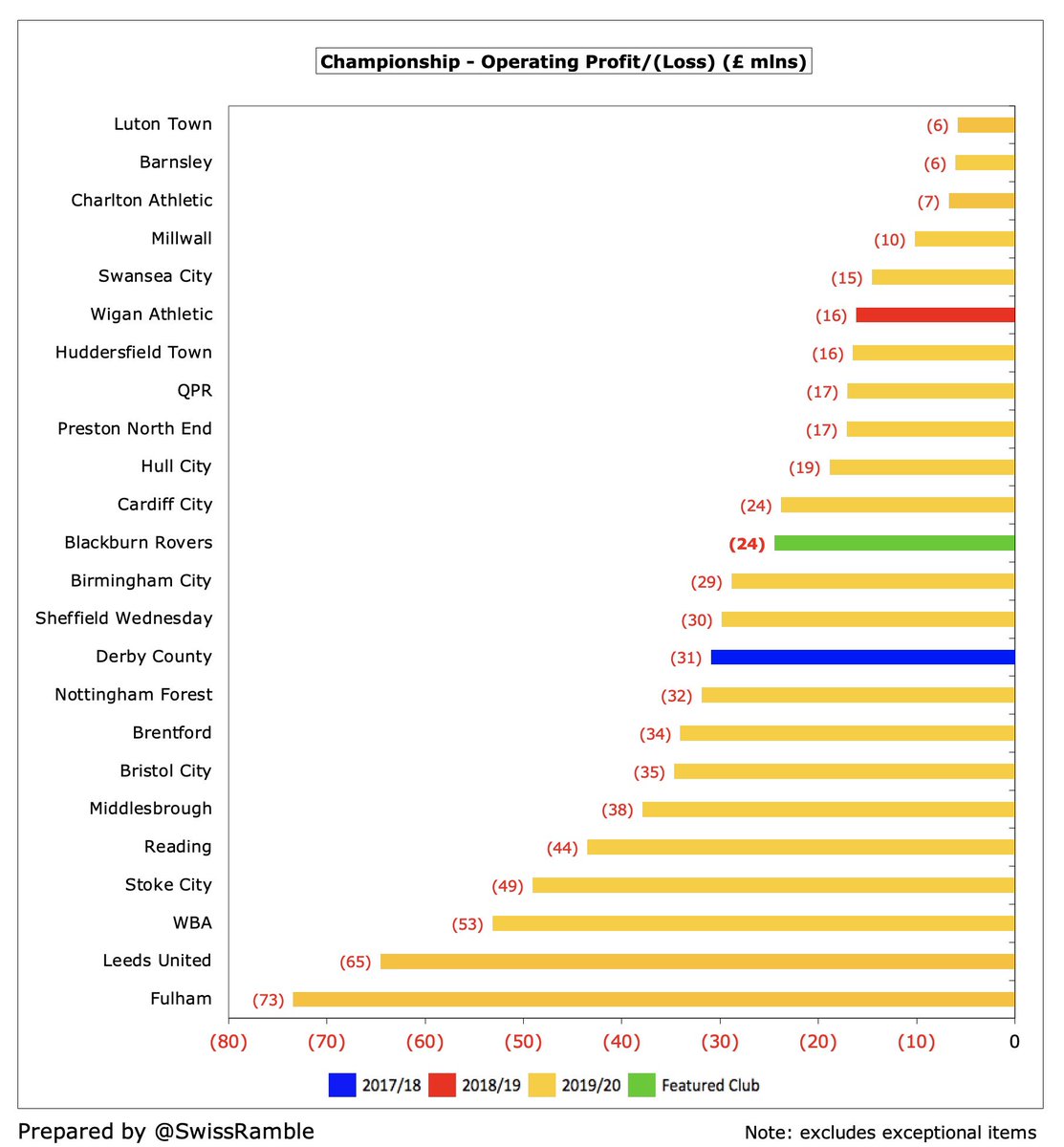

#Rovers operating loss (i.e. excluding player sales and interest) widened from £18m to £24m, though not as bad as the £34m in 2013. Almost every club in the competitive Championship posts large operating losses, including #FFC £73m, #LUFC £65m, WBA £53m and Stoke City £49m.

#Rovers £13.5m revenue has more than halved since their £30.4m peak in the Championship in 2014. It has dropped £41m (75%) since relegation from the Premier League. In the first four years they benefited from £55m parachute payments, but they lost this advantage in 2017.

Broadcasting remains #Rovers most important revenue stream, accounting for 50% of their total revenue, followed by commercial 30% and match day 20%.

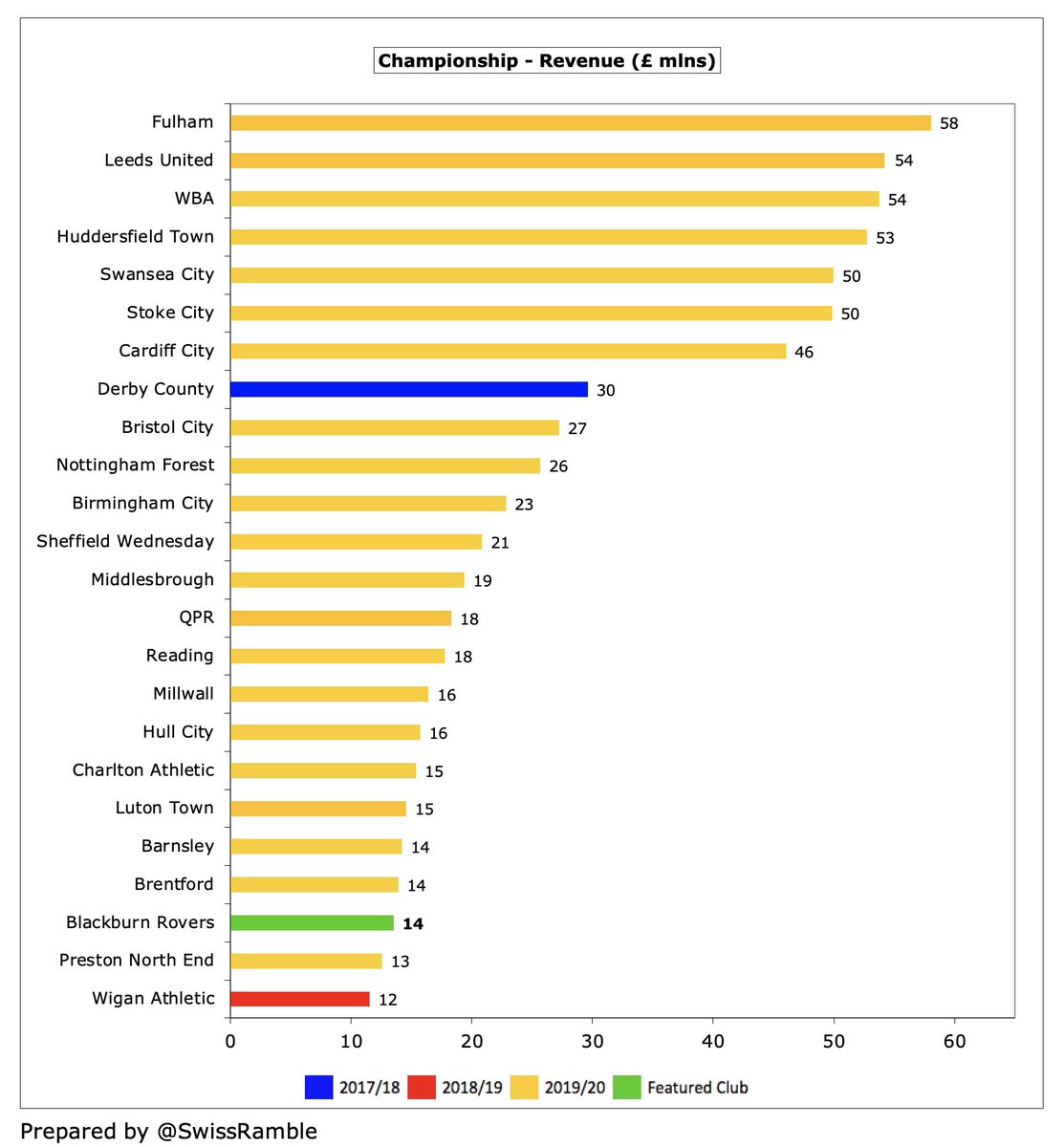

#Rovers financial challenge is highlighted by the fact that their £13.5m revenue was third lowest in the Championship, only above Preston and Wigan. For some perspective, this was only around a quarter of #FFC £58m, #LUFC £54m, WBA £54m and #HTAFC £53m.

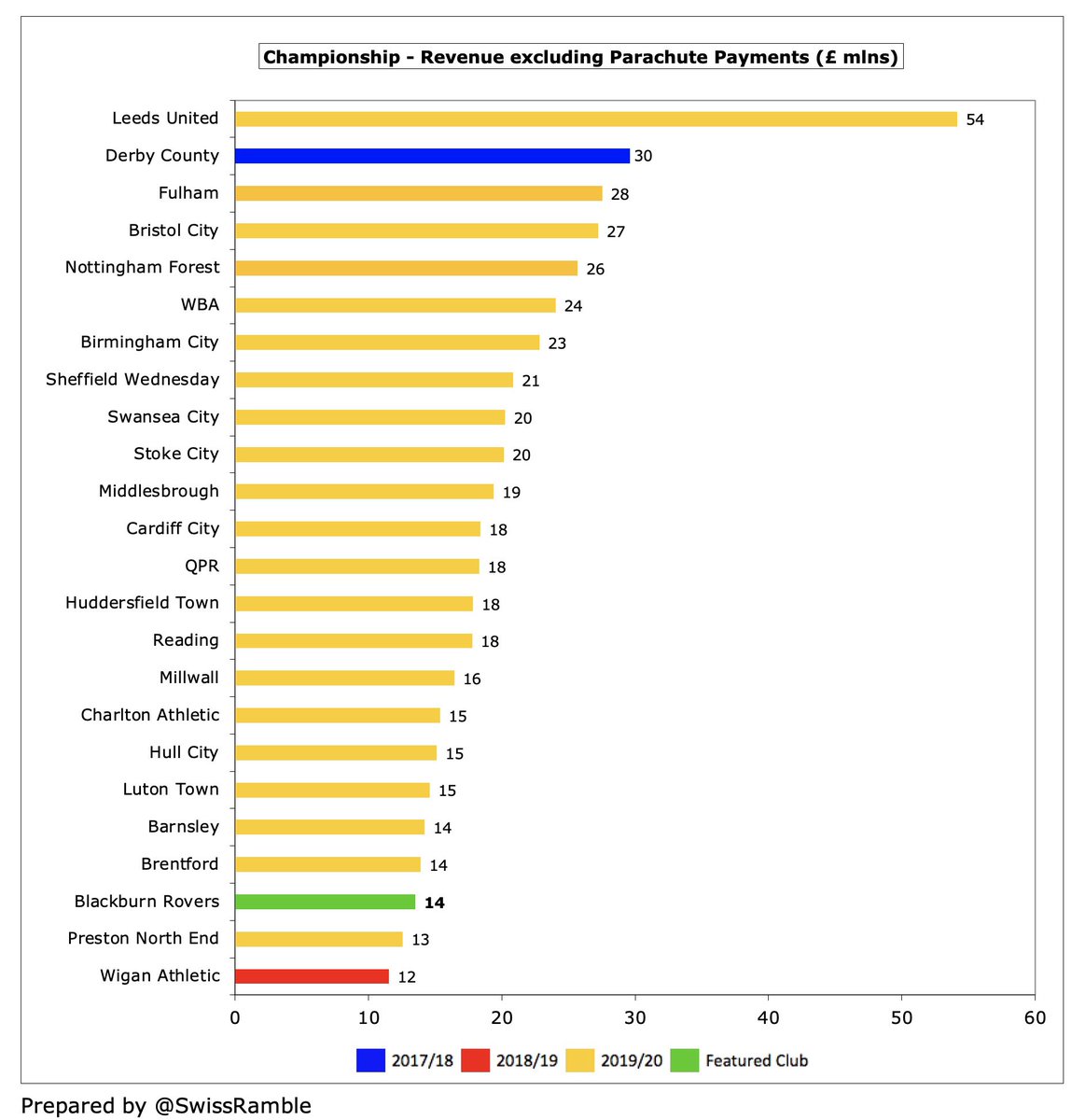

Championship revenue is hugely influenced by Premier League parachute payments with 6 clubs benefiting in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), then Stoke City, Swansea City and WBA (£34m). This makes life really difficult for clubs like #Rovers.

If parachute payments were excluded, #Rovers would still have the 22nd highest revenue in the Championship with the gap to Leeds United £54m (massive commercial income) being £40m.

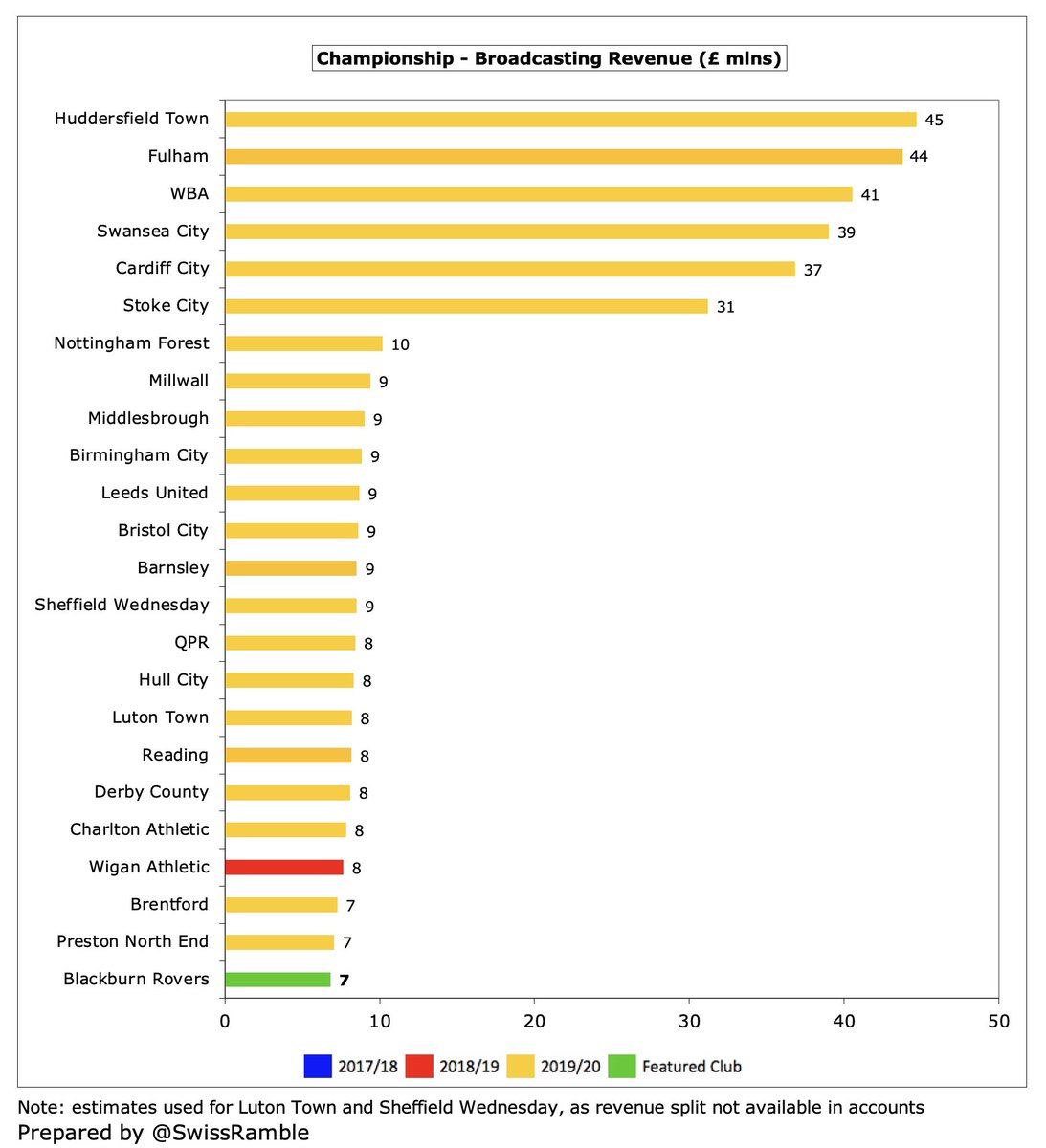

#Rovers broadcasting income fell £0.6m (8%) from £7.4m to £6.8m, obviously significantly lower than £41m in PL in 2012. Most clubs earn £7-10m, but big gap to those with parachute payments. Some benefited from a later accounting close, so less revenue was deferred to 2020/21.

#Rovers match day income fell £1.0m (29%) from £3.7m to £2.7m, largely due to playing 4 home games behind closed doors because of the pandemic. This was one of the lowest in the Championship, only above Wigan Athletic, and miles behind Leeds United £11m.

#Rovers average attendance (for games played with fans) dropped 5% from 14,508 to 13,836, less than half of the recent 25,427 peak in the 2010 Premier League. Bottom half of the Championship. Ticket prices frozen in 2019/20 (increased in 2018/19 after promotion from League One).

#Rovers commercial income fell £1.5m (27%) from £5.5m to £4.0m, less than half the £9.5m they earned in the Premier League in 2011. Firmly in the bottom half of the Championship, far below the likes of #LUFC £34m, Bristol City £14m and Stoke City £14m.

Recoverite Compression replaced 10Bet as #Rovers shirt sponsor in a 2-year deal in 2020, while the club has recently announced that Macron will replace Umbro in a 5-year kit supplier deal starting in 2021/22 with “significant financial benefit”.

#Rovers wages rose £3.2m (14%) from £22.4m to £25.6m, as the club “invested in the squad in order to be competitive.” For some perspective, this was £11m lower than their first season following relegation from the Premier League in 2013 (when they had parachute payments).

Despite the increase, #Rovers £26m wage bill was again in the bottom half of the Championship. In fact, four clubs in the division had wages more than twice as much as Blackburn, including #LUFC £78m and #FFC £73m, though they both included large promotion bonuses.

#Rovers wages to turnover ratio increased from 134% to 189%, which was even worse than the 187% in League One two years ago. Most clubs in the Championship have unsustainable wage bills, well over 100% of revenue, but Blackburn’s was the second highest in the division.

#Rovers total directors remuneration decreased from £570k to £496k, which was 8th highest in the Championship, though a fair way below Birmingham City £1.6m, #FFC £948k and Stoke City £834k. The payment for the highest paid director also fell from £320k to £272k.

#Rovers player amortisation, the annual charge to write-off transfer fees over a player’s contract, almost doubled from £2.2m to £4.3m, though still much lower than £9.7m in 2013. Far below clubs recently relegated from the PL like #FFC £40m, Stoke City £30m & #HTAFC £28m.

#Rovers spent £5m on player purchases in 2019/20, mainly on Sam Gallagher from Southampton. This was less than the previous season’s £9m and miles below #FFC £53m, #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

#Rovers transfer spend has significantly reduced following relegation from the top flight, exacerbated by an FFP transfer embargo. In fact, their gross outlay was only £17m in the last 5 years, compared to £45m in the preceding 5-year period. Low expenditure again in 2020/21.

#Rovers debt increased by £14m from £142m to £156m, thanks to another loan from Venky’s, who the club now owe £141m. There is also a £14m bank overdraft (guaranteed by Venky’s) and a £0.6m loan from the EFL.

#Rovers £156m debt was the second highest in the Championship, only below Stoke City £187m. In fact, they actually had the 9th highest debt in England at the end of the 2019/20 season, partly because the last time the club’s owners converted debt into equity was back in 2011.

Most Championship debt is provided interest-free by owners, which is the case with Venky’s loans. However, #Rovers interest still increased from £495k to £614k, due to paying 2.65% over LIBOR on the overdraft. Only 5 clubs in this division paid more than £1m interest.

#Rovers transfer debt increased from £5.7m to £6.3m, around mid-table in the Championship. Blackburn were in turn owed £0.6m by other clubs, leaving £5.7m net payables. Contingent liabilities, potential payments based on success of the team or players, were up to £5.0m.

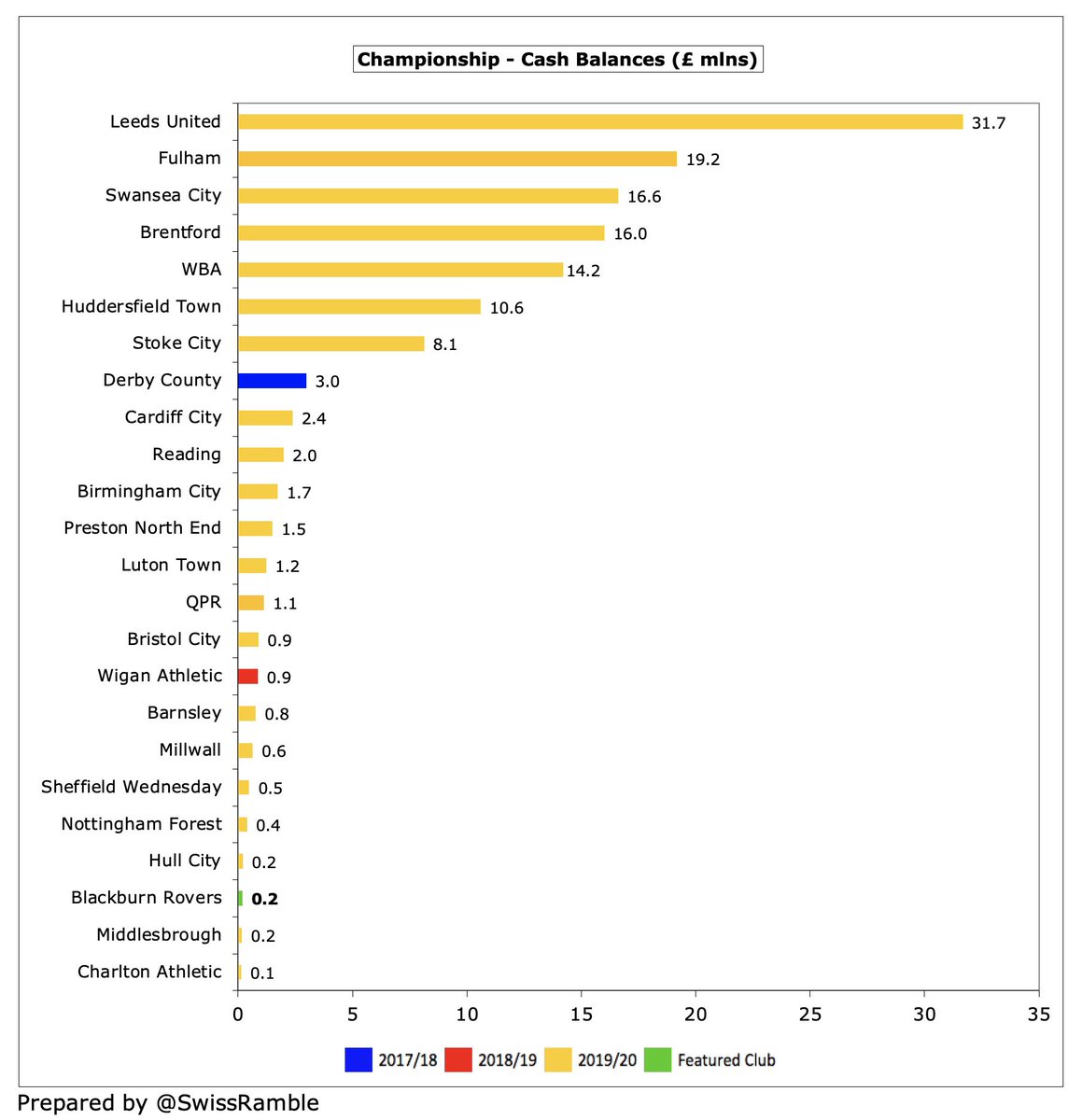

Even after adding back non-cash items such as player amortisation & depreciation, #Rovers made a £12m cash loss from operating activities, then spent £1m on players (purchases £4.6m, sales £3.7m), £0.6m interest and £0.5m capex. Funded by £14m additional loans from Venky’s.

As a consequence, #Rovers overdraft decreased, leaving cash balance of just £185k, one of the lowest in the Championship. That said, the majority of clubs in this division had less than £2m cash in the bank, so this was not exceptional (though not a great buffer).

Since Venky’s bought the club, they have effectively been #Rovers only source of funds. The club has been heavily reliant on the owners to cover £138m operating losses in the last 10 years. Also spent £7m on interest payments, but only £5m invested in infrastructure.

Last month the Venky’s increased share capital in the football club by £29.6m, though it is unclear whether this is new money or a conversion of equity. This is a break from their normal practice of adding capital in the club’s parent company, Venky’s London Limited.

#Rovers FFP calculation is complicated by the season they spent in League One in 2017/18, though the club stated that it remains “mindful of the need to ensure the company will comply with the Championship Profitability and Sustainability rules.”

#Rovers low revenue means that they face a very tough challenge in the Championship, competing against clubs with much higher spending power, especially those benefiting from parachute payments. They remain dependent on financial support from Venky’s.

• • •

Missing some Tweet in this thread? You can try to

force a refresh