I have a new working paper out on “#Crypto Premium and Jump Risk” with Paolo Santucci de Magistris #EconTwitter Link: ssrn.com/abstract=38891… [1/n]

The paper shows that sudden and large price moves in bitcoin prices (jumps) explain a large portion in the variation in bitcoin returns [2/n]

Study tail-risk in crypto markets is important for at least two reasons 1/ is tail-risk priced similarly to that in equity markets? 2/ to characterize the SDF of the marginal investor and price alternative cryptocurrencies and tokens and do risk-management [3/n]

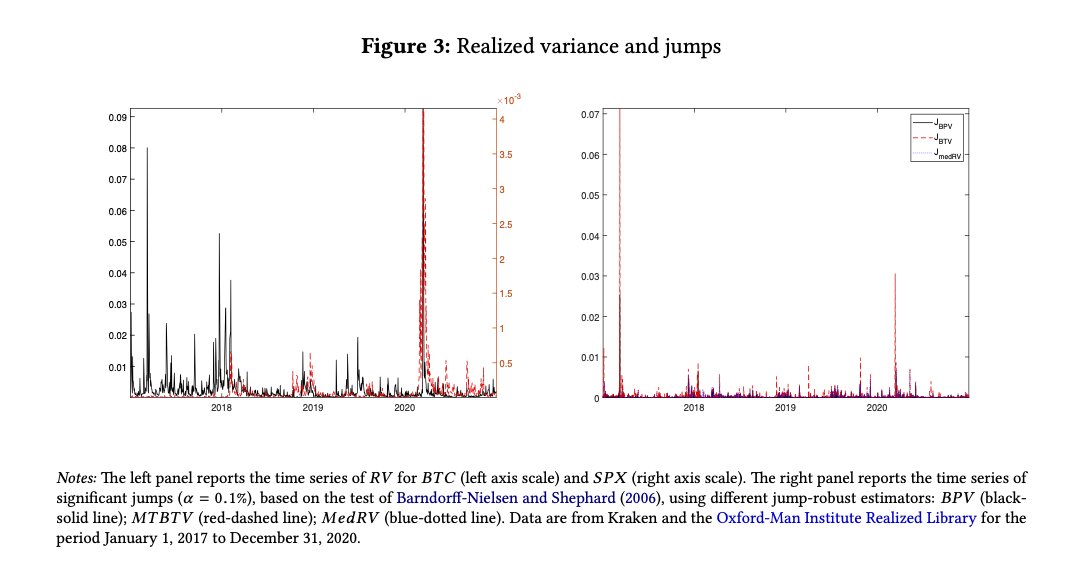

We start from the model in Maheu, McCurdy and Zhao (JFE 2013) to characterize the conditional mean of daily bitcoin excess returns (the crypto premium) and use high-frequency measurements of daily volatility to separate jumps from the diffusive component of volatility [3/n]

We find that the conditional skewness and kurtosis are both significantly priced, and that a relevant portion of the variability of bitcoin returns can be attributed to compensation for the jump term [4/n]

The crypto premium is related to crypto factors (in line w/Liu and Tsyvinski (RFS 2020)), and higher investor attention and lower crypto liquidity are associated with higher expected excess returns, conditional variance and jump intensity, and lower conditional skewness [5/n]

Finally, we show that the price of crypto risk is time-varying, and higher in bad times for investors, when the conditional variance and kurtosis are high [6/n]

In order to do so, we consider a large number of portfolios constructed using 100 cryptocurrencies and predictors of returns explored in Liu, Tsyvinski and Wu (2020) and let the risk prices be function of the conditional components of the SDF [7/n]

The cross-sectional asset pricing estimates confirm that the price of crypto risk is time-varying, and higher in bad times for investors when the conditional variance and kurtosis are high.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh