I am very happy that my paper with @KShakhnov “Global Risk in Long-Term Sovereign Debt” has been accepted in @RevOfAssetPric #EconTwitter

Thread 1/n

Thread 1/n

Our paper is motivated by recent work by @HannoLustig et al. (AER 2019) who found that currency carry trade strategies with T-bonds are different from those with T-bills because local currency term premia offset currency premia 2/n

Results in Lustig et al. (AER 2019) are for advanced economies with no/low default risk and imply that the volatility of the permanent component of investors’ SDF must be equalized across countries 3/n

In our paper we also consider currency carry trade strategies with T-bonds and T-bills, but for #EmergingMarkets with sizeable default risk 4/n

In contrast with results for advanced economies, we find negative and significant carry trade returns which further decrease with the maturity of the bonds 5/n

This means that, as bond maturity increases, low-interest rate currency bonds offer larger returns in US dollars than those denominated in high-interest rate currencies, just the opposite of the traditional carry trade strategy using short-term instruments. 6/n

We estimate an affine model with global and idiosyncratic shocks that prices defaultable bonds across currencies and maturities. In order to replicate our empirical findings, the exposure to the global shock must be inversely related to the loading on the global state 7/n

This is a novel restriction on the SDFs of domestic and foreign investors that implies that the volatility of the permanent component of the SDFs must be different for low and high interest rate EM currencies 8/n

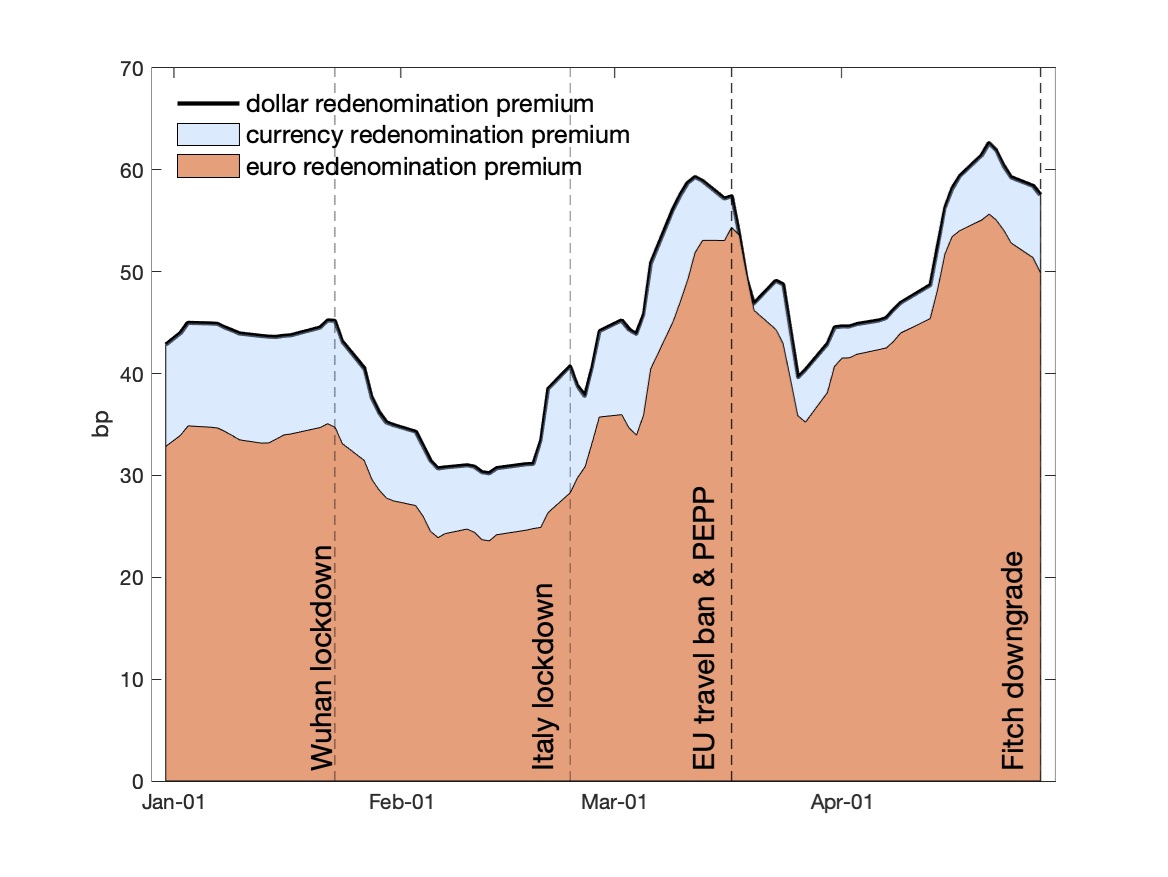

The focus of our paper is on EM government bonds and one might think that a default premium drives their returns. We decompose returns in components associated with currency, default, and term premia, and show that the local currency term premium drives bond excess returns 9/n

In order to obtain this decomposition, we use the methodology in @WenxinDu and @JSchreger (JF 2016) to construct default-free returns from zero-coupon yield curves in local currency by swapping dollar cash flows from default-free US T-bonds 10/n

We build portfolios sorted by one of the strongest predictors of currency returns: the short-term interest rate. We find a declining cross-section of term premia that more than offsets the increasing cross-section of currency excess returns. 11/n

The default premium is positive for all countries, does not change with bond maturities, and contributes to the level, but not to the slope, of carry trade returns because it is similar for low and high-interest rate currencies 12/n

Our results contribute to literature on bond risk premia, default risk and term structure. The novel restriction on the SDF of EM investors is related to work by Aguiar and Gopinath (JIE 2007) who find that shocks to trend growth are a primary source of fluctuations in EM 13/n

@threadreaderapp unroll

The full paper with additional results is available at tinyurl.com/fhusu8yx and on our web pages

• • •

Missing some Tweet in this thread? You can try to

force a refresh