(Thread)

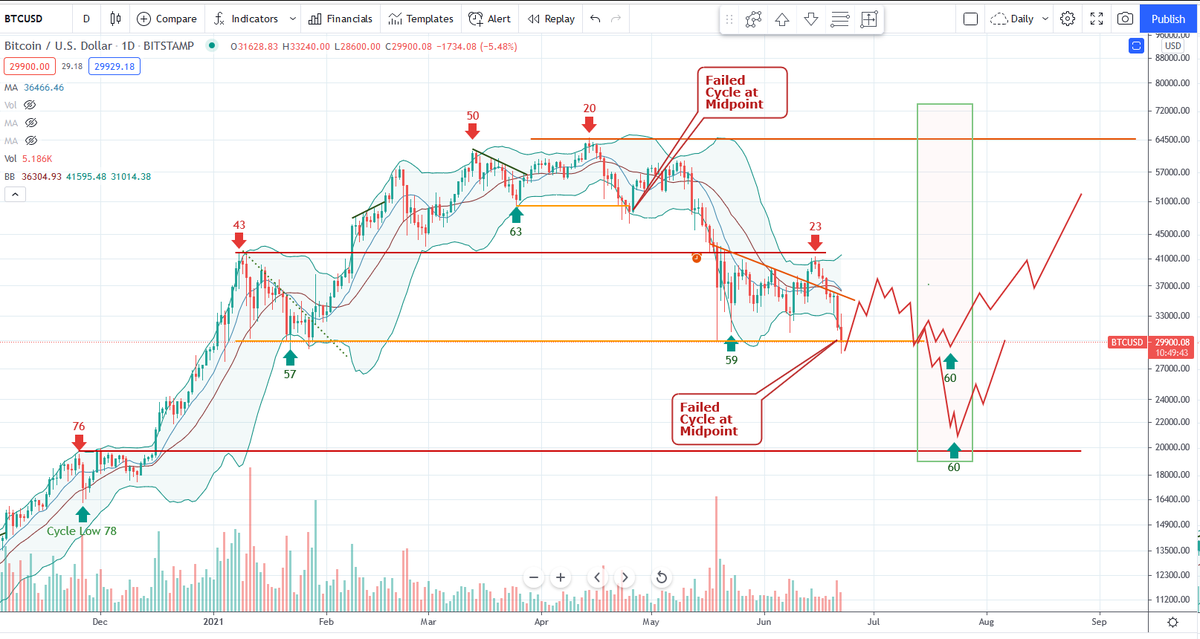

No confirmation of a new #bitcoin Cycle....yet. But looking like the path where support held in this Cycle has unfolded.

In Cycle theory, by definition, an intermediate downtrend can only end on a Cycle Low at the lower time-frame cycle.

No confirmation of a new #bitcoin Cycle....yet. But looking like the path where support held in this Cycle has unfolded.

In Cycle theory, by definition, an intermediate downtrend can only end on a Cycle Low at the lower time-frame cycle.

https://twitter.com/BobLoukas/status/1407326136552542212

"IF" we're on Day 2 of a new Cycle, then we can start to look forward another 60-days.

The Cycle lengths have been consistent lately (Days 56, 61, 58, 57). Puts the next Cycle Low timing band around the Sept 20th range.

The Cycle lengths have been consistent lately (Days 56, 61, 58, 57). Puts the next Cycle Low timing band around the Sept 20th range.

Caveat - "IF" AND, the usual disclaimer, "just guides" not gospel.

Notice in the above chart, I still show two opposing scenarios for the next Cycle. That pisses some people off, but it's a reality of the current price action.

Why opposing views?

Notice in the above chart, I still show two opposing scenarios for the next Cycle. That pisses some people off, but it's a reality of the current price action.

Why opposing views?

A Cycle theorist would lean more to the bearish outcome. B/c the most recent cycle structure shows a clean downtrend.

A trader or investor who does not respect (and plan) for that possibility, given the cycle structure, is one who does not survives long in this game.

A trader or investor who does not respect (and plan) for that possibility, given the cycle structure, is one who does not survives long in this game.

But there is a bullish case. The Long Cycle (4YR Cycle).

As the Cycle is still "technically" in an uptrend, the expectation would be that given the horrible sentiment and size of retracement, a change in trend is imminent.

Again "IF".

As the Cycle is still "technically" in an uptrend, the expectation would be that given the horrible sentiment and size of retracement, a change in trend is imminent.

Again "IF".

If a 60-day Cycle low has formed, coming at a support level the prior 60-day Cycle also found, then we at least have the early making of an end to the downtrend.

But again "IF" and for bulls, requires a leap of faith.

But again "IF" and for bulls, requires a leap of faith.

The good news is that 60-day Cycle Lows provide a break point in a sequence. They become actionable markers for traders and investor alike.

As we're in a downtrend, traders would be only be scalping longs and early in the cycle, more focused on the opportunity to short the trend for position around the Day 15-25 mark.

Investors however can use the mark to add to positions (at discounts) but mindful of the downside using the mark to quickly reverse course if lost. And also choose to hedge below that mark.

What's most important is to understand who you are and what your objectives are. What playing field are you really on, and to ignore the noise coming from the other fields.

There is never one right answer to fit all. It's always based on individual plans.

When in doubt, don't play. When the stars align to your system, play and play hard to win. Out.

When in doubt, don't play. When the stars align to your system, play and play hard to win. Out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh