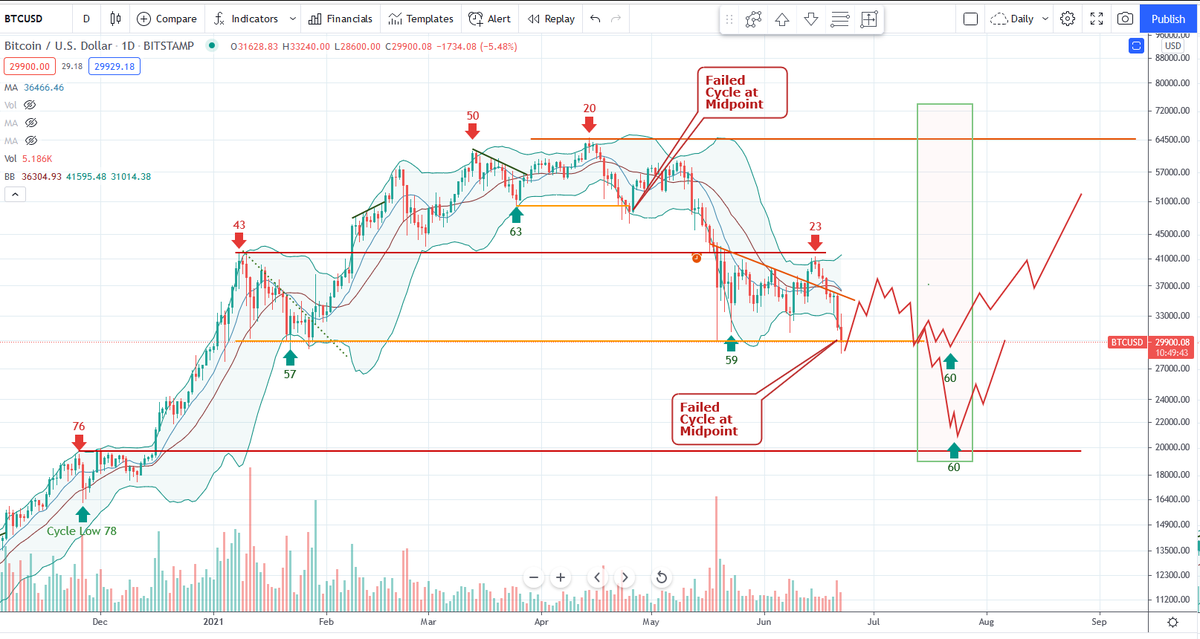

Intermediate downtrend continues #bitcoin

Just like April 24th Failed Cycle started this process, we have 2nd straight Cycle showing Failed Cycle, coming at midpoint. Day 30.

Normally expect bounce from mid-cycle low. But lower targets no longer just an outside possibility.

Just like April 24th Failed Cycle started this process, we have 2nd straight Cycle showing Failed Cycle, coming at midpoint. Day 30.

Normally expect bounce from mid-cycle low. But lower targets no longer just an outside possibility.

Sorry I don't make the cycle rules, this is just the reality. Sometimes the cycle picture isn't clean and it's more of a guess. In this case, the Cycles are very clean.

Doesn't mean it Must play out in these paths, but based on experience, you would be crazy to ignore them.

Doesn't mean it Must play out in these paths, but based on experience, you would be crazy to ignore them.

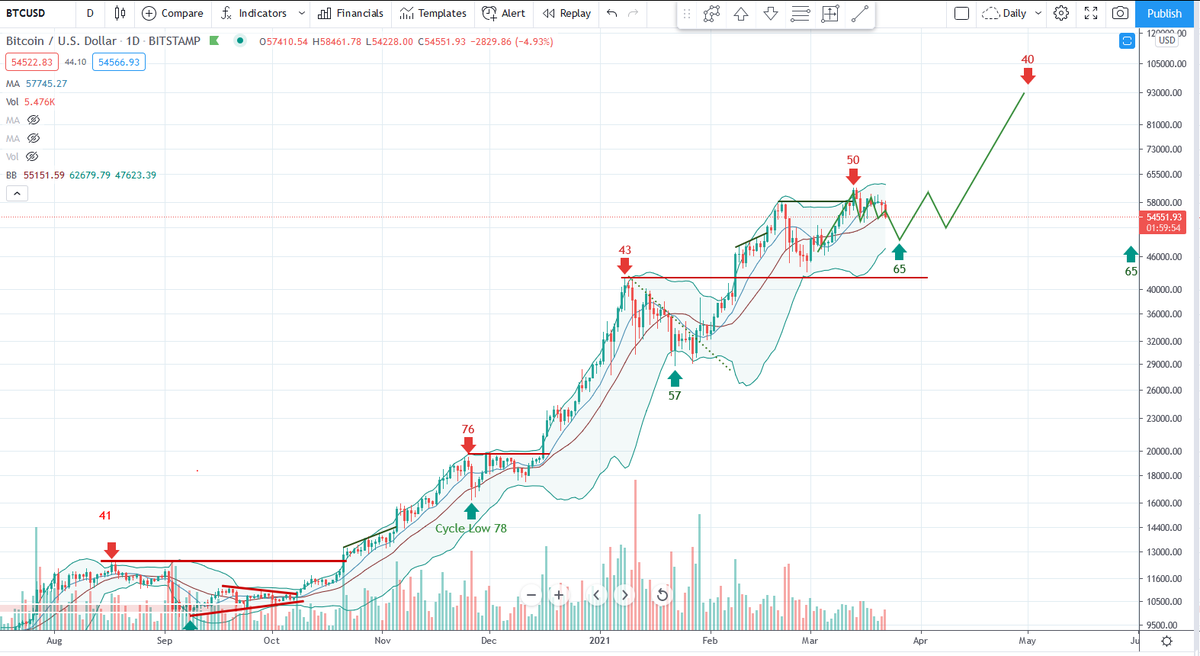

Here is the exact same Cycle event on April 24th

https://twitter.com/BobLoukas/status/1385614549282344960?s=20

Many should be asking, how the hell is this a bull market.

Good question. Firstly, it's a bear market. Yeah OK obviously. The "hope" is based on the speed of the decline, that it's more of a (corrective like) bear market, within a cyclical bull market cycle.

Good question. Firstly, it's a bear market. Yeah OK obviously. The "hope" is based on the speed of the decline, that it's more of a (corrective like) bear market, within a cyclical bull market cycle.

We get that hope from the belief the recent $60k top occurred too early in the cycle, only 3x from the prior bubble top, and without the massive mania top we've seen in the past.

Sure, it got really frothy...but it wasn't a blow-off.

Sure, it got really frothy...but it wasn't a blow-off.

Although always a possibility, I never expected a correction could exceed $40k level many weeks back, that was my floor target.

Mostly because you just don't see corrections of more than 35% in a bull market.

But the reality we find ourselves in is that we're in a bear market.

Mostly because you just don't see corrections of more than 35% in a bull market.

But the reality we find ourselves in is that we're in a bear market.

But although I didn't expect it, I planned for it.

Many have been asking me (DM's / email) on what they should do, describing stories of 100% allocations to crypto to net worth, margin etc.

Well the problem is, seeking advice when your ship is sinking is never a good time.

Many have been asking me (DM's / email) on what they should do, describing stories of 100% allocations to crypto to net worth, margin etc.

Well the problem is, seeking advice when your ship is sinking is never a good time.

There is no right answer by that point. When #bitcoin was at $55k and dropping, I said can you handle a drop to $40k and not puke? Or what if worse. And if you could not, sell some now at $55k.

So the same goes here, can you handle a drop to $20k? Is $30k so a horrible price looking over the past 18 months? Can you handle your alt's going down another 50%?

This isn't FUD, this is reality.

This isn't FUD, this is reality.

This fundamentally comes down to narrative in crypto "it's programmed"

A way of forming bias to say guaranteed.

And with a 100% vol asset class, you don't even need to touch leverage to have a portfolio that acts like it's margined to the hill.

A way of forming bias to say guaranteed.

And with a 100% vol asset class, you don't even need to touch leverage to have a portfolio that acts like it's margined to the hill.

So all I can say in cases like this.

Remove the pain. Sell down to the sleeping point. Cut losses. Get back to the right size.

With Bitcoin still only back to Dec prices, this should not be all that painful in reality, in fact should still be very profitable.

Remove the pain. Sell down to the sleeping point. Cut losses. Get back to the right size.

With Bitcoin still only back to Dec prices, this should not be all that painful in reality, in fact should still be very profitable.

• • •

Missing some Tweet in this thread? You can try to

force a refresh