#BankNifty has been moving within the broad range for some time, but it is perhaps at weakest level since it entered this range on May 23rd.

#niftybank #nifty #nifty50

Join t.me/i2gain for detailed BankNifty analysis and charts.

#niftybank #nifty #nifty50

Join t.me/i2gain for detailed BankNifty analysis and charts.

For past nine sessions, it has been trading below a long term support line that was supporting it since Sept. 2020.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

Prolonged underperformance with broader Nifty 50, is a sign of weakness only.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

RSI below 45, not being able to cross 49-50 levels, again none days with RSI below 50.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

ADX gaining momentum with RSI and DMIs confirming weakness.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

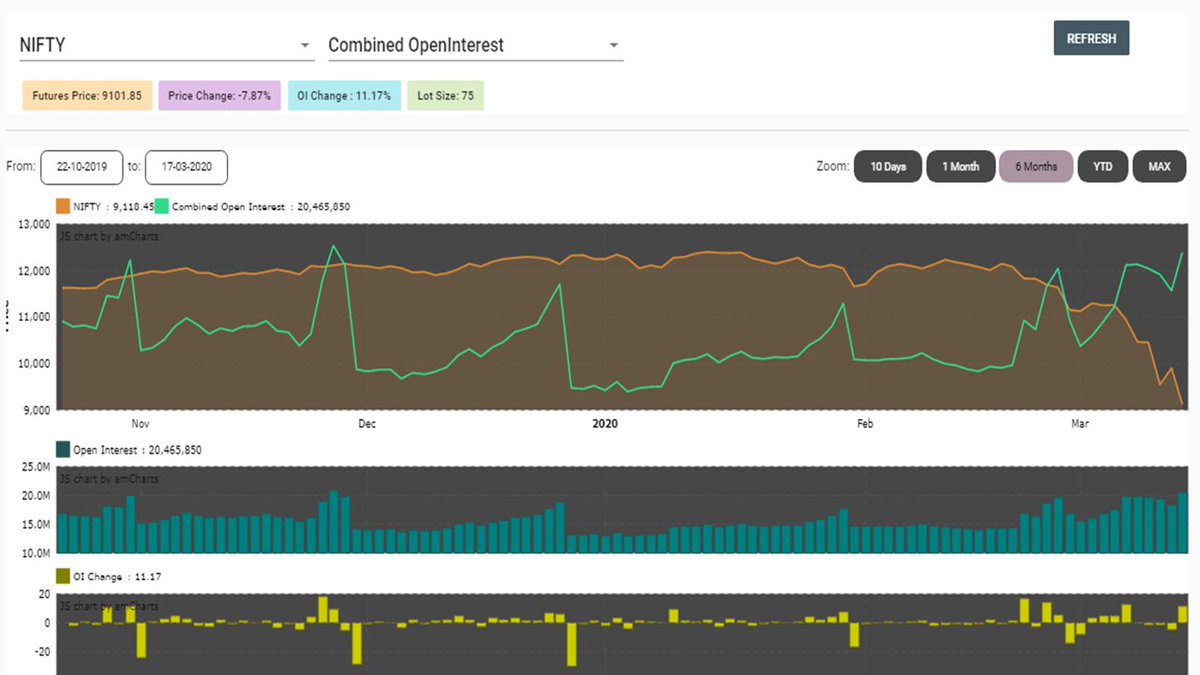

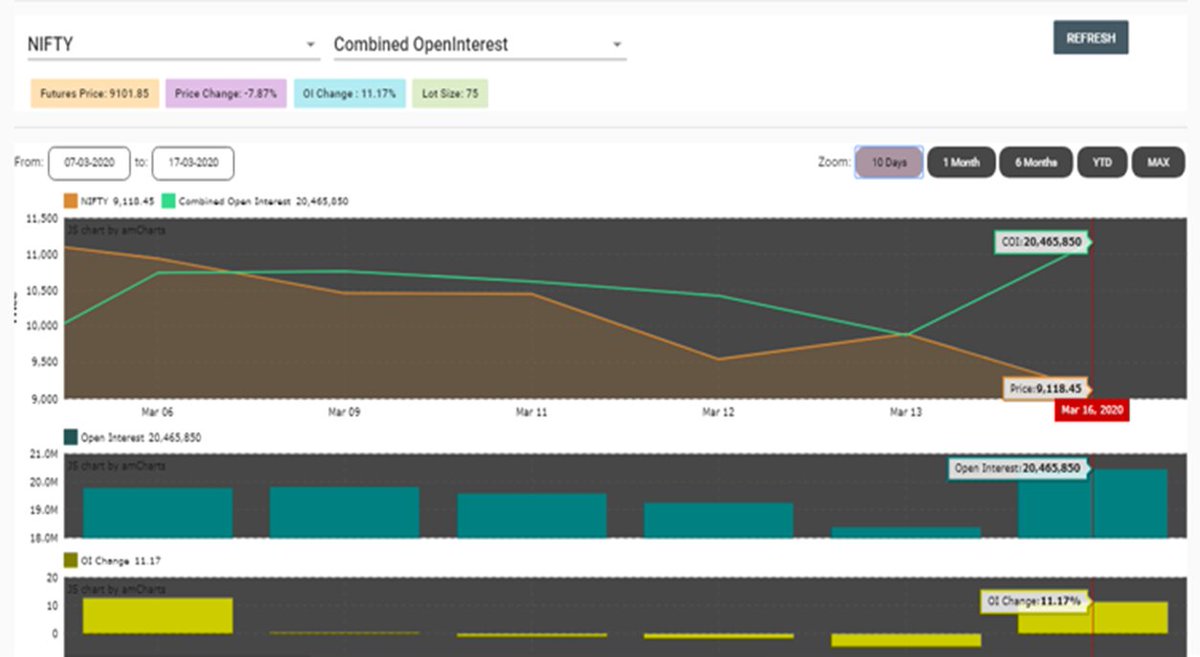

OI analysis shows, future buildup is on short side, some short covering is going on for past few days.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

PCR making lower highs, can be considered as a sigh of weakness.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

IVs n HVs have probably touched the bottom.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

#BankNifty #niftybank

Join t.me/i2gain for detailed BankNifty analysis and charts.

To conclude, I must say some caution is advised to go long at lower levels this time, borader #Nifty is not as week as it has made a sharper recovery last week in comparision with #BankNifty, it is somewhere in the middle of range while #NiftyBank is near lower range.

• • •

Missing some Tweet in this thread? You can try to

force a refresh