Global macro review

1/14

It’s a new month! 🐰 🐰

Let’s look back on July for positioning clues ahead

Notables:

$GLD ♉️

$TLT ♉️

$FXF ♉️

$CORN 🐻

$SILVER 🐻

$EEM 🐻

$DAX and $XLE teetering on 🐻

1/14

It’s a new month! 🐰 🐰

Let’s look back on July for positioning clues ahead

Notables:

$GLD ♉️

$TLT ♉️

$FXF ♉️

$CORN 🐻

$SILVER 🐻

$EEM 🐻

$DAX and $XLE teetering on 🐻

2/14

The UST curve flattened in July with 10/2s to 103.8 BPS. MOVE 61.19 +5.01%

2Y .188 -24.5%

5Y .694 -20.69%

10Y 1.226 -15.10%

30Y 1.895 -1.46%

Chart: $TNX peaked in March at 1.765% and since rolled over

The UST curve flattened in July with 10/2s to 103.8 BPS. MOVE 61.19 +5.01%

2Y .188 -24.5%

5Y .694 -20.69%

10Y 1.226 -15.10%

30Y 1.895 -1.46%

Chart: $TNX peaked in March at 1.765% and since rolled over

3/14

Bond ETFs ↗️ with curve flattening

$TLT +3.72%

$TIP +2.68%

$IVOL +2.52%

$IEF +1.99%

$BNDX +1.49%

$LQD +1.42%

$BND +1.17%

$HYG +-0.1%

Chart: Convertibles bucked the trend with $CWB -1.07%

Bond ETFs ↗️ with curve flattening

$TLT +3.72%

$TIP +2.68%

$IVOL +2.52%

$IEF +1.99%

$BNDX +1.49%

$LQD +1.42%

$BND +1.17%

$HYG +-0.1%

Chart: Convertibles bucked the trend with $CWB -1.07%

4/14

Equity volatility ↗️

$VXEEM 25.96 +37.94%

$RVX 25.79 +15.7%

$VIX 18.24 +15.22%

$VXN 20.81 +3.33%

Chart: $VXEEM emerging markets volatility ♉️ t + T

Equity volatility ↗️

$VXEEM 25.96 +37.94%

$RVX 25.79 +15.7%

$VIX 18.24 +15.22%

$VXN 20.81 +3.33%

Chart: $VXEEM emerging markets volatility ♉️ t + T

4b/14

⚠️⚠️⚠️

Small caps are on the verge of breaking down with $RVX 25.79

$IWM closed -3.63% for the month and -1.71% for the past three months.

⚠️⚠️⚠️

Small caps are on the verge of breaking down with $RVX 25.79

$IWM closed -3.63% for the month and -1.71% for the past three months.

5/14

$SPX +2.27% ♉️ led global equities higher in July with Asia broadly ↘️

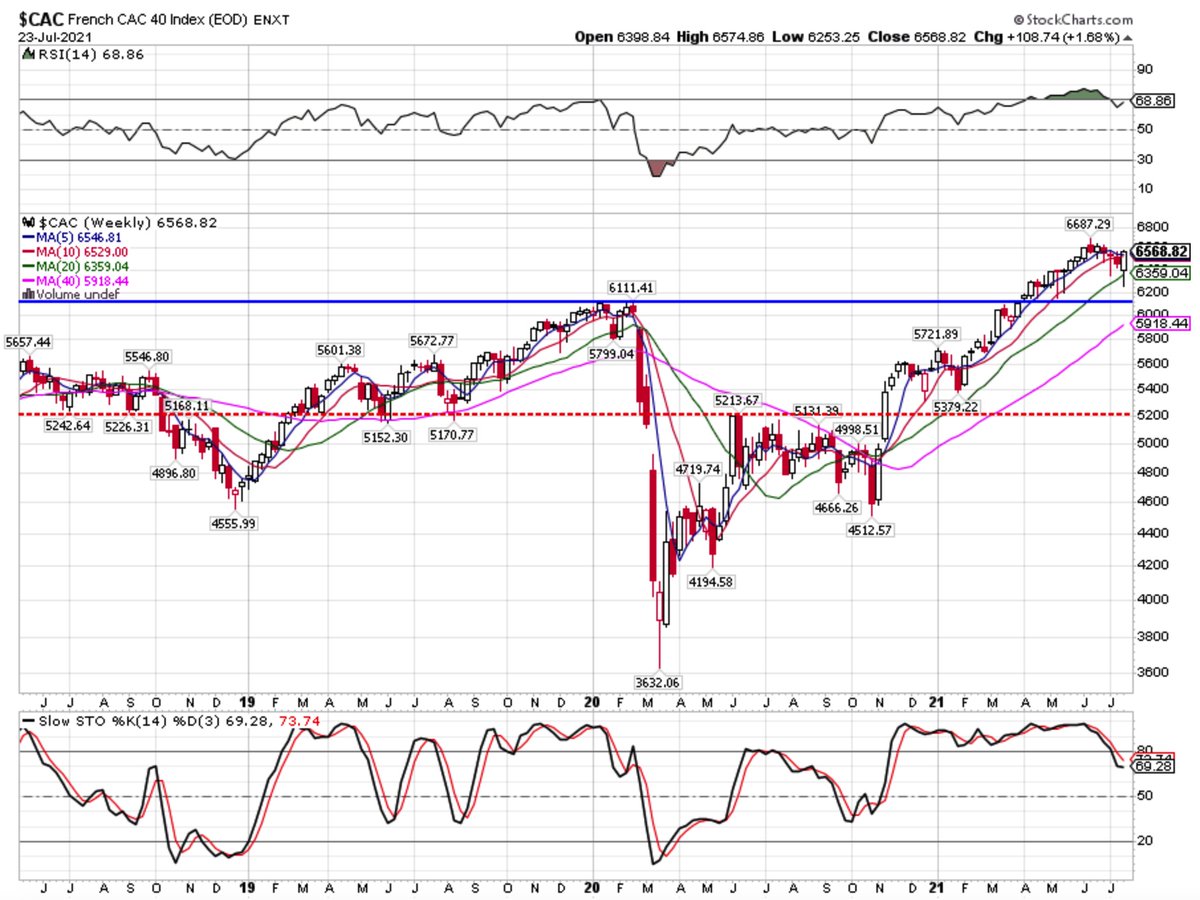

$CAC +1.61% ♉️

$COMPQ +1.16% ♉️

$DAX +0.09% < —> 👀

$KOSPI -2.86% < —> 👀

$HSI -10.13% 🐻

$NIKK -5.14% 🐻

$SSEC -5.4% 🐻

$TWII -2.86% 🐻

Chart: 👀 $KOSPI 3202 with a lower high has lost price momo

$SPX +2.27% ♉️ led global equities higher in July with Asia broadly ↘️

$CAC +1.61% ♉️

$COMPQ +1.16% ♉️

$DAX +0.09% < —> 👀

$KOSPI -2.86% < —> 👀

$HSI -10.13% 🐻

$NIKK -5.14% 🐻

$SSEC -5.4% 🐻

$TWII -2.86% 🐻

Chart: 👀 $KOSPI 3202 with a lower high has lost price momo

6/14

Top performing US equity sectors for July

$XLV +4.92%

$XLRE +4.62%

$XLU +4.33%

$XLK +3.89%

Worst sectors

$XLE -8.32% even with 💪🏻 $CVX $XOM earnings

$XLF -0.46%

$XLI +0.94%

Chart: 👀 XLE with trend at 48.89 ⚠️

Top performing US equity sectors for July

$XLV +4.92%

$XLRE +4.62%

$XLU +4.33%

$XLK +3.89%

Worst sectors

$XLE -8.32% even with 💪🏻 $CVX $XOM earnings

$XLF -0.46%

$XLI +0.94%

Chart: 👀 XLE with trend at 48.89 ⚠️

7/14

Country ETFs with strength in Northern Europe (non-oil producing)

$ENFL +5.28%

$EWD +4.33%

$EDEN +3.72%

$EWN +3.12%

Weakness is Asia

$FXI -12.5%

$EWZ -7.75%

$THD -6.22%

Chart: $EDEN +8.15% over T duration

Country ETFs with strength in Northern Europe (non-oil producing)

$ENFL +5.28%

$EWD +4.33%

$EDEN +3.72%

$EWN +3.12%

Weakness is Asia

$FXI -12.5%

$EWZ -7.75%

$THD -6.22%

Chart: $EDEN +8.15% over T duration

8/14

Metals ↔️ 👜

$COPPER 4.43% ♉️

$GOLD +2.57% ♉️ with $GVZ 15.09 -5.51%

$PLAT -2.28% 🐻

$SILVER -2.44% 👀 with $VXSLV 29.84 +1.26%

Chart: Unlike GOLD, SILVER is below T support of 25.87 ⚠️

Metals ↔️ 👜

$COPPER 4.43% ♉️

$GOLD +2.57% ♉️ with $GVZ 15.09 -5.51%

$PLAT -2.28% 🐻

$SILVER -2.44% 👀 with $VXSLV 29.84 +1.26%

Chart: Unlike GOLD, SILVER is below T support of 25.87 ⚠️

9/14

Despite OPEX+ shenanigans, hydrocarbons remain ♉️

$WTIC +0.65%

$BRENT +1.6%

$GASO +4.02%

$NATGAS +8.29%

Chart: Natty Gas +33.79% over T duration with notable decline in volume ⚠️

Despite OPEX+ shenanigans, hydrocarbons remain ♉️

$WTIC +0.65%

$BRENT +1.6%

$GASO +4.02%

$NATGAS +8.29%

Chart: Natty Gas +33.79% over T duration with notable decline in volume ⚠️

10/14

The most easily replaceable of commodities, grains ↔️

$CORN -7.35% 🐻

$SOYB -3.56% 🐻

$WHEAT +3.57% 🐻

$SUGAR +0.11% ♉️

Chart: $WHEAT 703.75 “looks” good, but < T level of 735 ⚠️

The most easily replaceable of commodities, grains ↔️

$CORN -7.35% 🐻

$SOYB -3.56% 🐻

$WHEAT +3.57% 🐻

$SUGAR +0.11% ♉️

Chart: $WHEAT 703.75 “looks” good, but < T level of 735 ⚠️

12/14

Fiat currencies spent the month chopping around with the 🇨🇭 emerging as the winner and 🇦🇺 the loser

$FXF +2.08% ♉️

$FXY +1.25%

$FXB +0.42%

$FXE -0.03%

$UUP -0.24%

$FXC -0.66%

$FXA -2.12% 🐻

Fiat currencies spent the month chopping around with the 🇨🇭 emerging as the winner and 🇦🇺 the loser

$FXF +2.08% ♉️

$FXY +1.25%

$FXB +0.42%

$FXE -0.03%

$UUP -0.24%

$FXC -0.66%

$FXA -2.12% 🐻

13/14

In summary:

New ♉️ in bonds

Equity vol ↗️

EM markets ↘️ 🐻

Small caps ↘️

Large cap US ↗️

#Quad4 US sectors ↗️

$GOLD ↗️

$FXF + $FXY ↗️ (safe havens)

$CRB ↗️

with $WTIC ↘️ and $COPPER ↘️ but $CORN ↘️

In summary:

New ♉️ in bonds

Equity vol ↗️

EM markets ↘️ 🐻

Small caps ↘️

Large cap US ↗️

#Quad4 US sectors ↗️

$GOLD ↗️

$FXF + $FXY ↗️ (safe havens)

$CRB ↗️

with $WTIC ↘️ and $COPPER ↘️ but $CORN ↘️

14/14

With $EEM and $IWM 🐻 and bonds ♉️, all 👀 on 🚧 of weakness $SPX & $COMPQ

Getting longer $GOLD and $TLT; shorting $EEM and cutting $RTY exposure.

👀 $XLE like a 🦅 with 💩 price action despite 🛢↗️

🐰 🐰 Have a 💰 August!

With $EEM and $IWM 🐻 and bonds ♉️, all 👀 on 🚧 of weakness $SPX & $COMPQ

Getting longer $GOLD and $TLT; shorting $EEM and cutting $RTY exposure.

👀 $XLE like a 🦅 with 💩 price action despite 🛢↗️

🐰 🐰 Have a 💰 August!

• • •

Missing some Tweet in this thread? You can try to

force a refresh