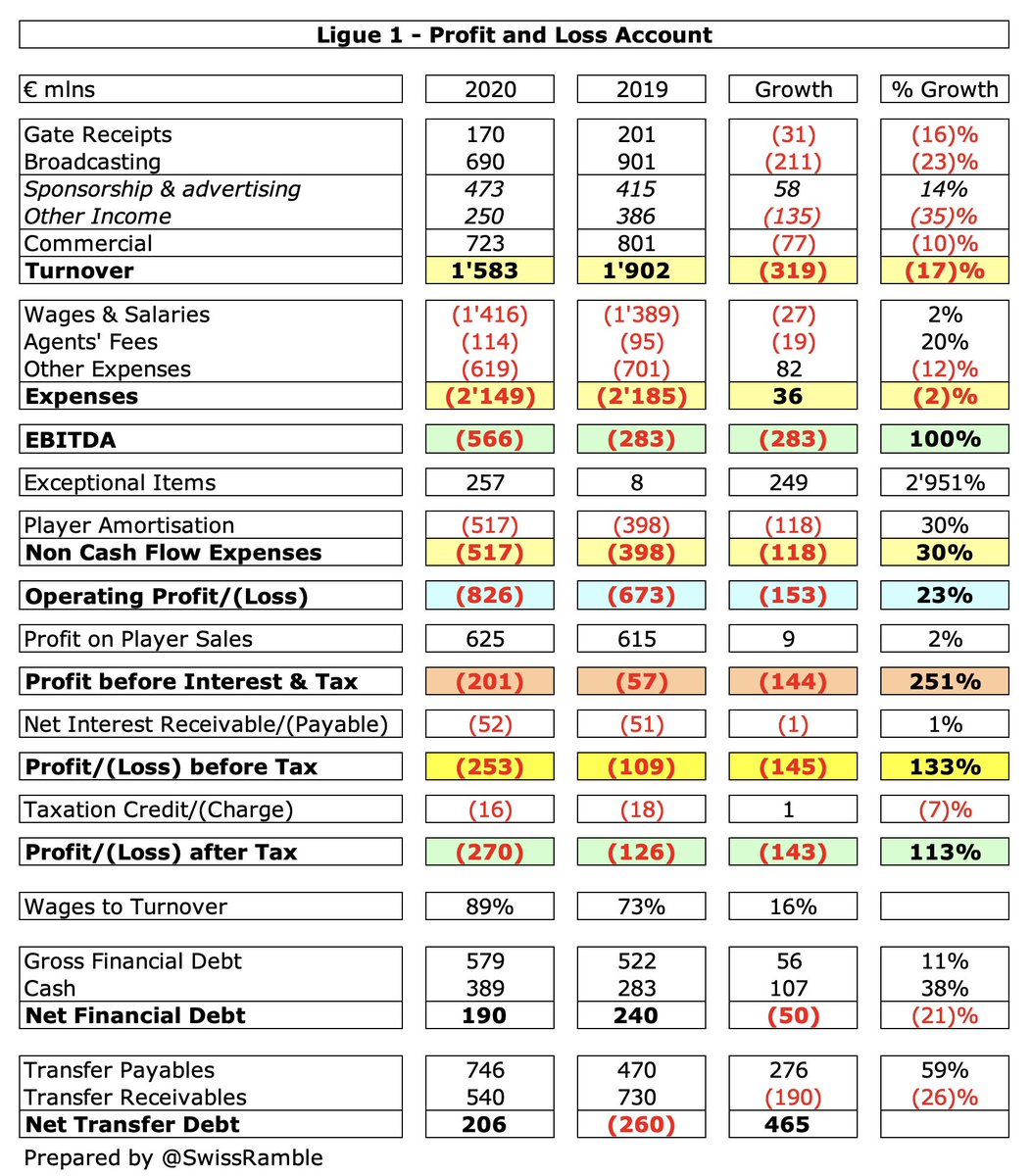

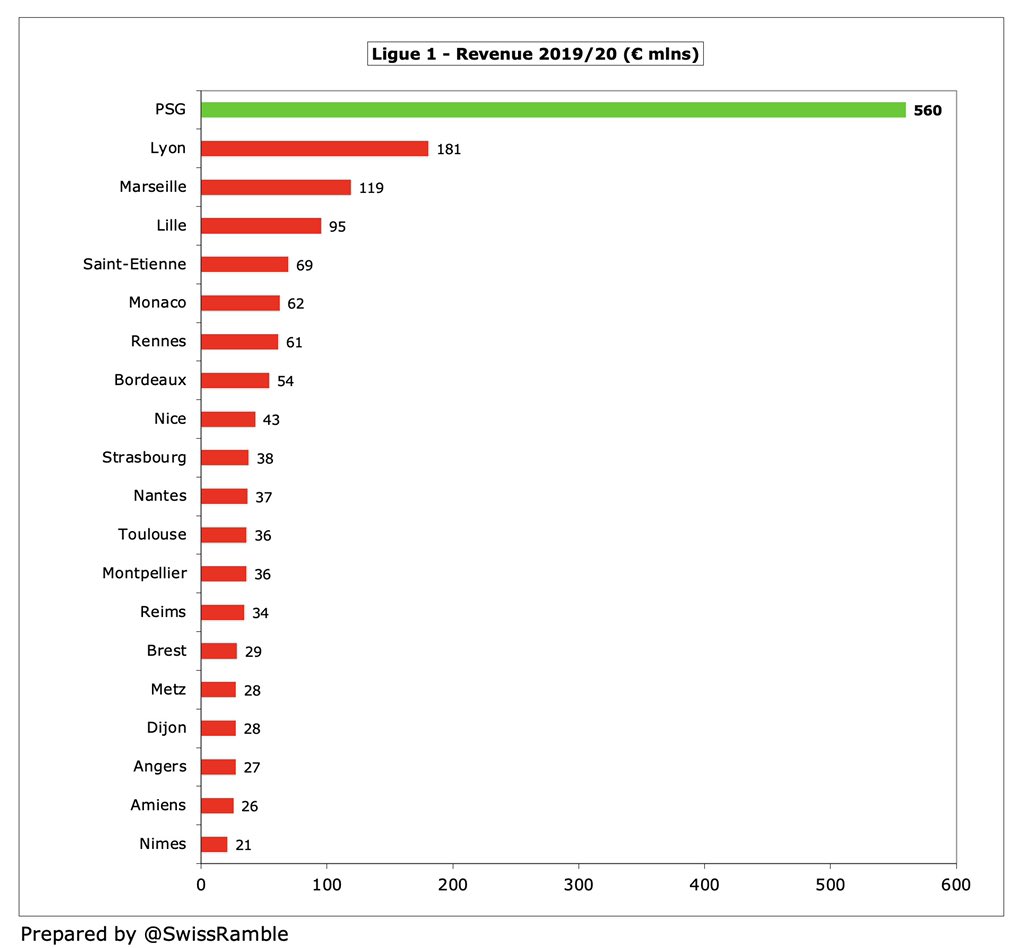

COVID-19 was particularly tough on French clubs, as Ligue 1 was the only major European league to cancel its season in response to the pandemic. Revenue of €1.6 bln was lowest of the “Big 5” in 2019/20, far below Premier League €5.1 bln, but also €469m behind Serie A €2.1 bln

#Ligue1 post-tax loss more than doubled from €126m to €270m, as revenue fell €319m (17%) from €1.9 bln to €1.6 bln, while expenses rose €83m (3%), mainly due to €118m growth in player amortisation. Partly offset by €249m rise in exceptionals, including government loans.

Overall #Ligue1 has been consistently unprofitable, only making money once in the last 9 years (a €20m surplus in 2016). The last four seasons have been especially brutal with a €648m aggregate loss in this period, averaging €162m a year.

However, half of the 20 #Ligue1 clubs were profitable with the highest profit after tax reported by Lille €22m, followed by Nimes €8m and Angers €8m. The problem was that 4 clubs reported heavy losses: #PSG €124m, Marseille €98m, Lyon €37m and Bordeaux €35m.

It was pretty much the same story for #Ligue1 profit before tax, though it is worth noting that many of the clubs effectively broke-even. Some clubs have accumulated significant losses over the last 4 years, e.g. Marseille €310m, Lille €222m, Bordeaux €96m and #PSG €72m.

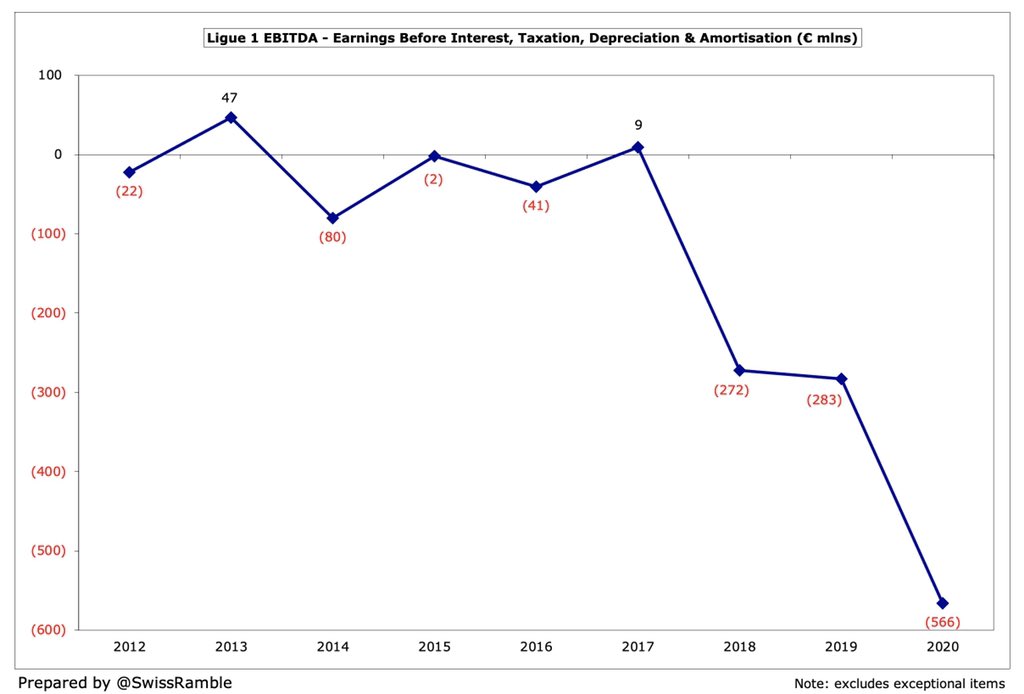

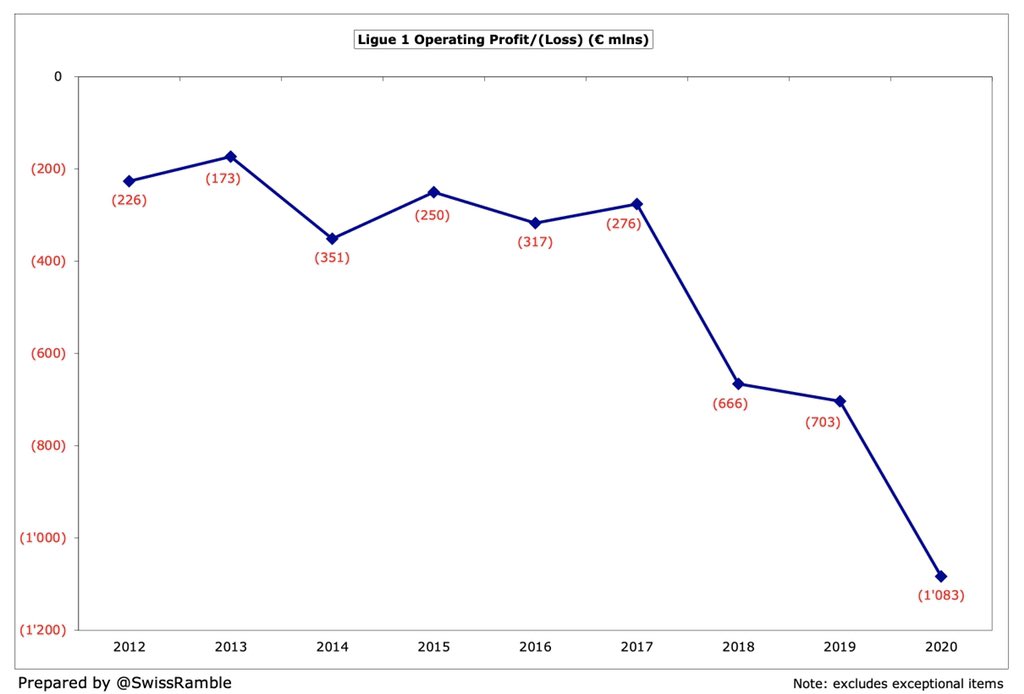

#Ligue1 EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales, dropped from €(283)m to €(566)m with only one club, Brest, achieving a positive result (€1m). Most clubs had large negatives, led by Monaco €(110)m

#Ligue1 has recorded significant operating losses (excluding player sales, exceptional items and interest payable) over the past few years. This deficit has got much worse recently, widening from €276m in 2017 to €1.1 bln in 2020, even worse than the €703m loss in 2019.

At an operating level (excluding exceptional items) all #Ligue1 clubs lose money with Monaco “leading the way” with €198m, followed by #PSG €178m, Lyon €113m and Marseille €112m. Lille and Bordeaux also reported hefty operating losses with €94m and €71m respectively.

Most #Ligue1 clubs benefited from exceptional items in 2019/20, including €225m from the French government to cover the shortfall following the league cancellation. It is unclear what the €162m credit at Monaco represents, though worth noting they had a €178m charge in 2018.

Profit on player sales has become increasingly important for #Ligue1 in the past three years with €840m in 2018, €635m in 2019 and €625m in 2020. In fact, the €2.1 bln reported in this period is significantly more than the €1.4 bln for the previous seven years combined.

Five #Ligue1 clubs posted profit on player sales above €40m. Lille led the way with €125m (mainly Nicolas Pépé, Rafael Leão and Thiago Mendes), followed by Lyon €83m, #PSG €50m, Bordeaux €49m and Monaco €48m. On the other hand, three clubs had profits less than €10m.

#Ligue1 revenue fell €319m (21%) from €1.9 bln to €1.6 bln. Largest decrease was broadcasting, down €211m (32%) to €690m, followed by other income, down €135m (40%) to €250m, and gate receipts, down €31m (19%) to €170m. However, sponsorship rose €58m (18%) to €473m.

Before QSI arrived in 2011, #PSG €101m revenue was a fair bit lower than both Marseille €151m and Lyon €133m, but following their stratospheric growth to €560m, it is now at least €379m more than their closest rivals: Lyon €181m, Marseille €119m and Lille €95m.

Despite falling by €99m in 2020 to €560m, #PSG alone generated over a third of total revenue in #Ligue 1 – more than the 15 clubs with the lowest revenue combined. More tellingly, their revenue was also more than Lyon, Marseille, Lille, Saint-Etienne and Monaco put together.

France has two clubs in the Deloitte Money League, which ranks clubs globally by revenue. #PSG fell to 7th place with €541m, partly due to the French season closing early, while Lyon were 18th. The last time there were three #Ligue1 clubs in the top 20 was back in 2012.

As a technical aside, the Deloitte Money League revenue for #PSG of €541m is different to the €560m used by the DNCG (the organisation responsible for monitoring accounts of football clubs in France), presumably due to the latter’s approach of aggregating different companies.

After steadily rising for many years, #Ligue1 gate receipts fell €31m (16%) from €201m to €170m, due to the season finishing early. Smallest revenue stream in France at just 11% of total, though it is more important at some clubs, e.g. Nantes 21%, Lyon 20% and Nimes 19%.

Only four #Ligue1 clubs had gate receipts above €10m: #PSG €38m, Lyon €36m (benefiting from moving to the Groupama stadium), Marseille €15m and Lille £14m, accounting for over 60% of the division’s income. In fact, half the clubs were €4m or lower.

Marseille registered the highest average attendance in France with an impressive 52,804, followed by #PSG 47,554, Lyon 47,299 and Lille 36,456. Sizeable revenue difference mainly due to higher prices in Paris, especially corporates. 11 clubs had attendances below 20,000.

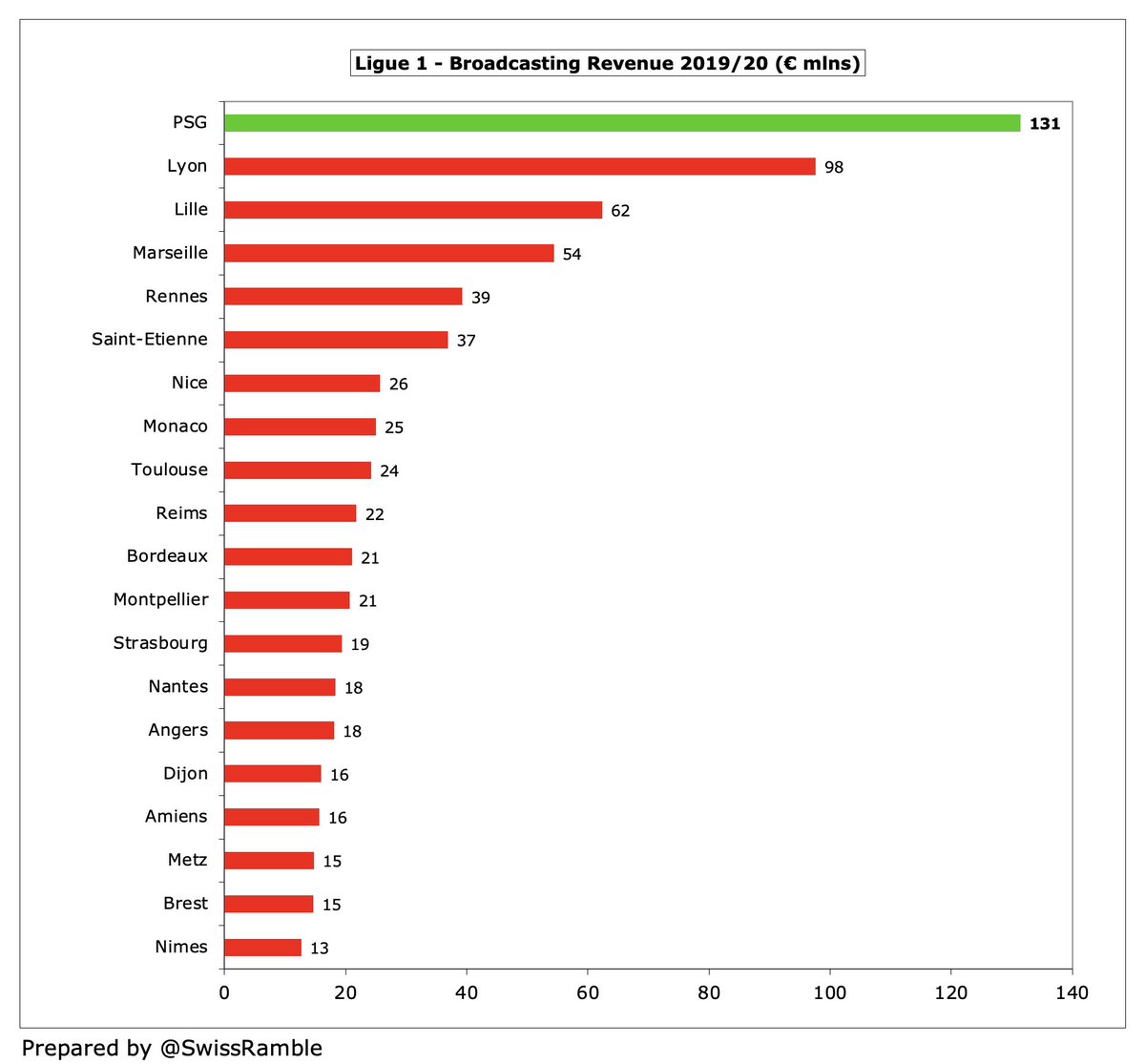

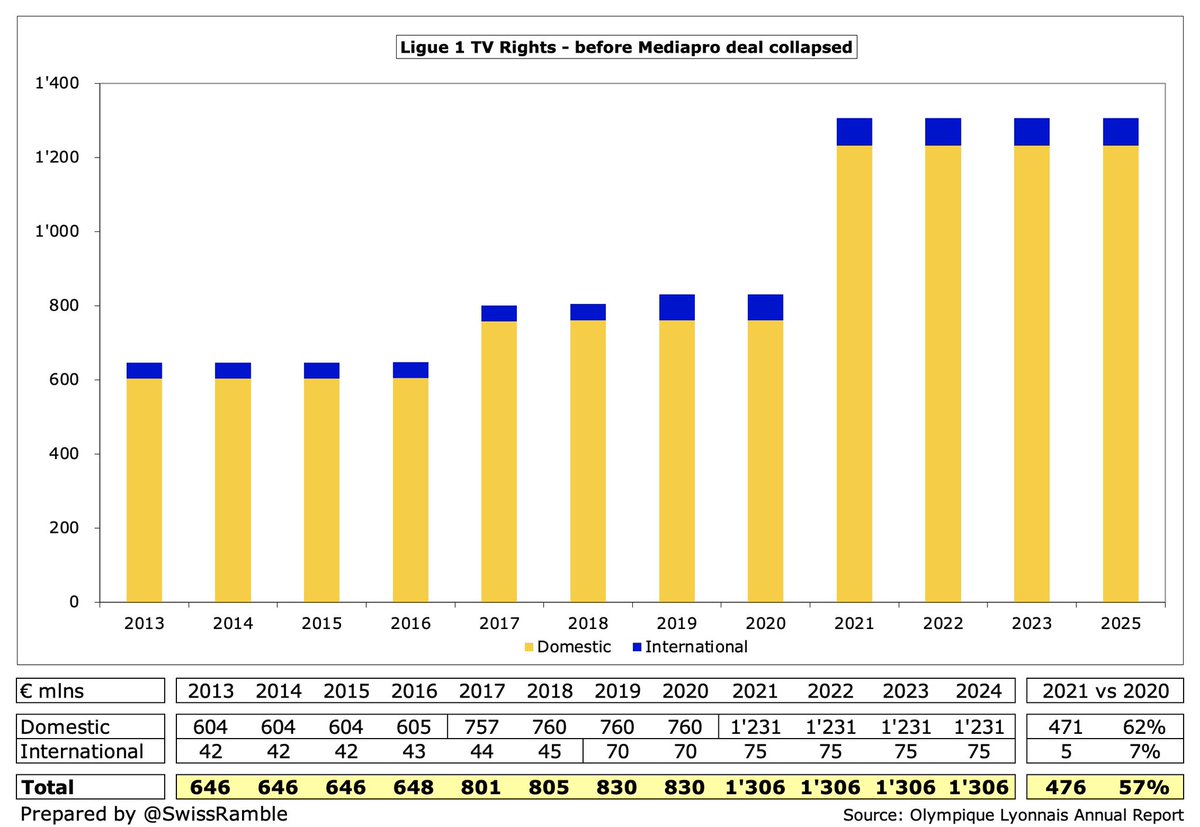

#Ligue1 TV revenue dropped €211m (23%) from €901m to €690m, partly due to rebates to broadcasters, reportedly worth €123m. Until the fall in 2020, this revenue stream had risen from €656m in 2016, due to the new domestic French TV deal in 2017 and higher UEFA money in 2019.

#PSG had the highest broadcasting revenue with €131m, followed by Lyon €98m, Lille €62m and Marseille €54m. The influence of European qualification is evident here, as 5 of the top 6 clubs competed in either the Champions League or Europa League (the exception is Marseille).

2020 TV distribution distorted by rebates, but in 2019 #PSG earned €60m, ahead of Lyon €48m & Marseille €47m. Distributed per 50-30-20 rule: 50% equal share (30% fixed, 20% per club licences); 30% league standing (25% current season, 5% 5 previous seasons); 20% media profile.

French domestic TV rights should have increased by over 60% in 2020/21 from €760m to €1.2 bln, but Mediapro could not meet the payments, so new deal was cancelled December 2020. Canal+ picked up those rights, leading to revised total of €670m, i.e. less than the previous deal.

The new deal for 2021-24 adds up to around €650m with Amazon awarded the rights originally held by Mediapro for €250m, but that has caused problems with Canal+, who are paying €332m for far fewer matches (sub-licensed from BeIN Sports). This is a major issue for #Ligue1 clubs.

This is highlighted by a comparison with TV rights in other major leagues. The revised €725m for #Ligue1 (including international rights) is the only one less than €1 billion, miles below the Premier League €3.6 bln, La Liga #2.0 bln, Bundesliga €1.4 bln & Serie A €1.3 bln.

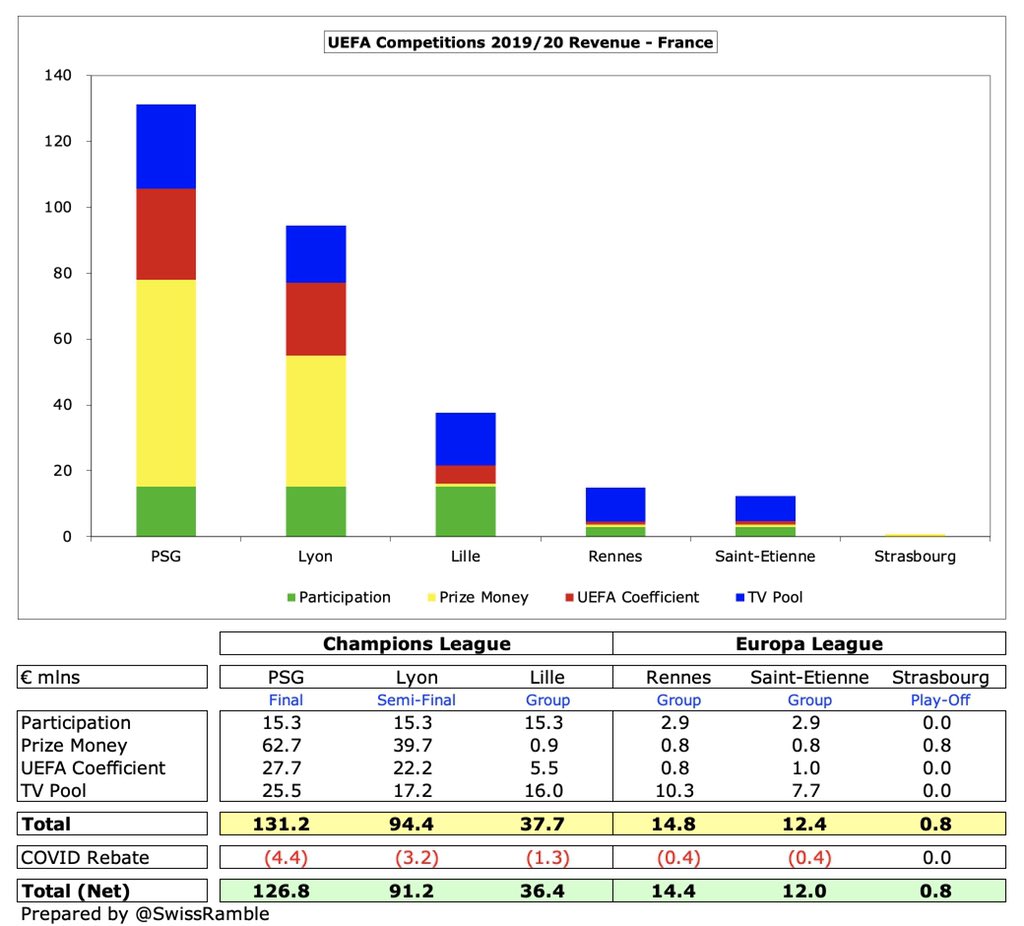

#PSG and Lyon earned good money for reaching the Champions League final and semi-final with €127m and €91m respectively, though revenue for delayed games played in August has been deferred to 2020/21 accounts. Lille received €36m, even though they finished last in their group.

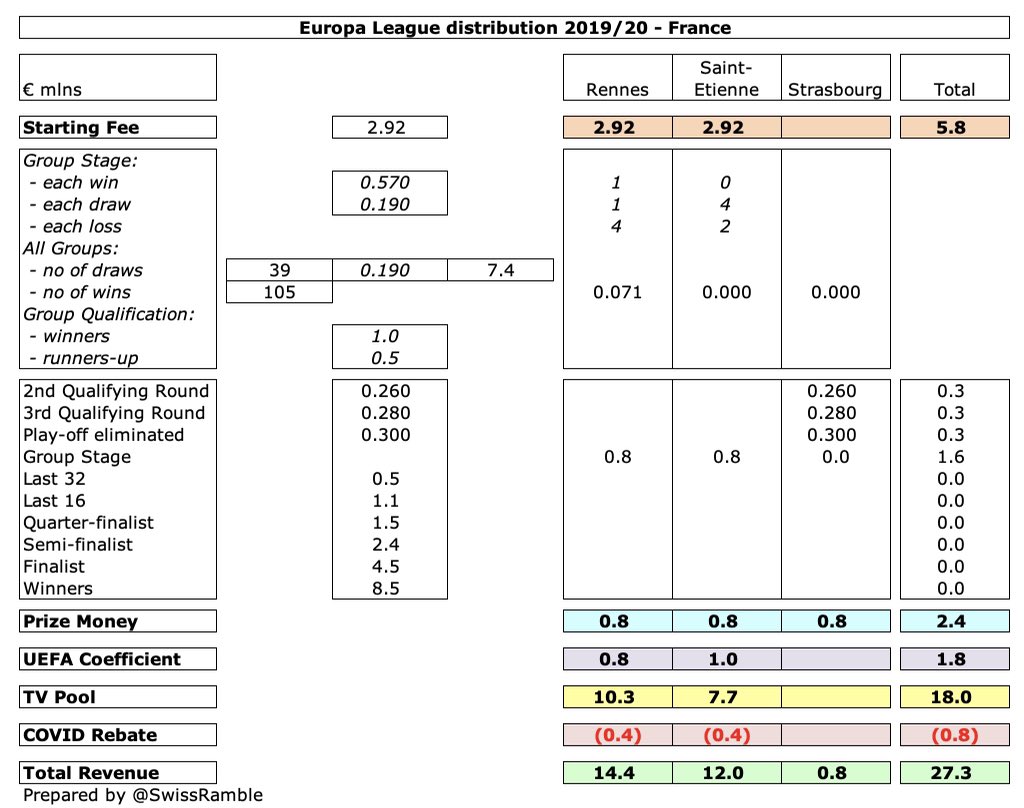

The sums earned by French clubs in the Europa League were much lower, though a useful differentiator with others. Rennes and Saint-Etienne received €14m and €12m respectively, even though they did not get past the group stage, mainly thanks to money from the TV pool.

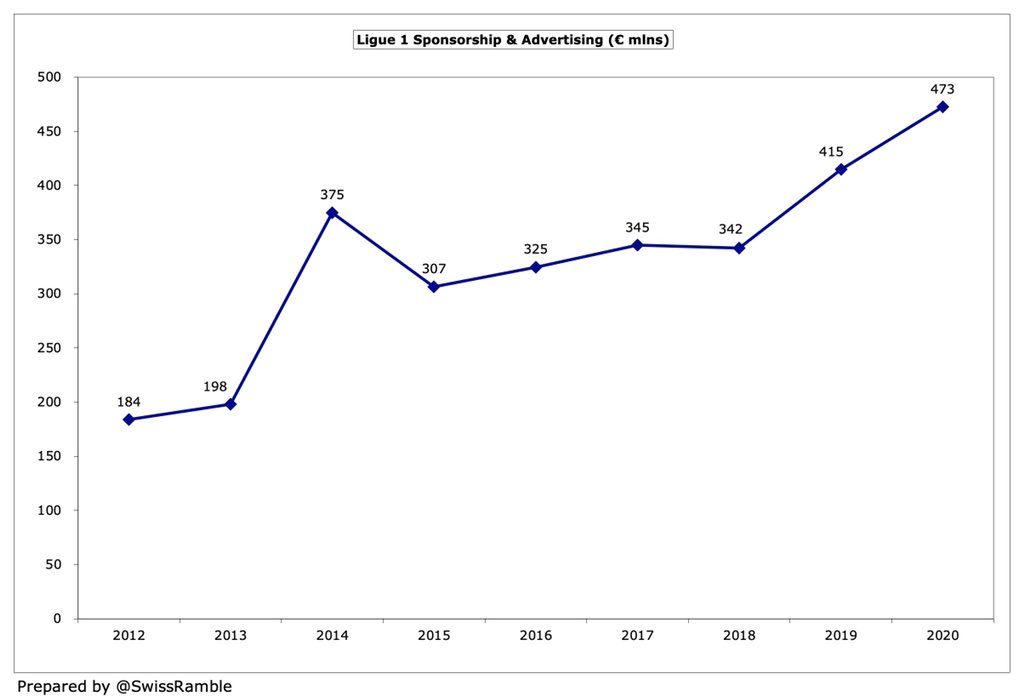

Sponsorship & advertising was the only revenue stream to increase in 2020, rising €58m (14%) from €415m to €473m. This has shot up from €184m in 2012 with biggest impact in 2014, when both #PSG and Monaco first benefited from higher sponsorships (though a one-off for Monaco).

#PSG have by far the highest sponsorship & advertising revenue in #Ligue1 of €287m (up from €195m in 2019, thanks to Accor & Nike), which is a quarter of a billion more than Marseille €36m and Lyon €27m. In fact, #PSG are over €100m more than the other 19 clubs combined.

However, other commercial income dropped €136m (35%) from €386m to €250m, mainly because the amount #PSG received from their agreement with the Qatar Tourist Authority for a "publicity campaign" was significantly reduced. Lowest #Ligue1 total since 2012.

Even after the large reduction from €257m to €104m in 2020, #PSG other commercial income remains by far the highest in #Ligue1, well ahead of Monaco €24m and Lyon €20m. Their innovative QTA deal meant that the Parisians’ revenue from this stream was as high as €270m in 2014.

Despite the steep revenue fall, #Ligue1 wages still increased by €27m from €1,389m to €1,416m, though the 2% rise was the slowest growth rate for five years. As a result, the wages to turnover ratio rose (worsened) from 73% to 89%. Wages still up around a third since 2017.

#PSG €414m wage bill represents 29% of the entire #Ligue1 payroll, an astonishing €282m more than the next highest, Lyon €132m. There are only two other clubs with wages above €100m, namely Monaco €121m and Marseille €118m. 12 clubs are below €50m.

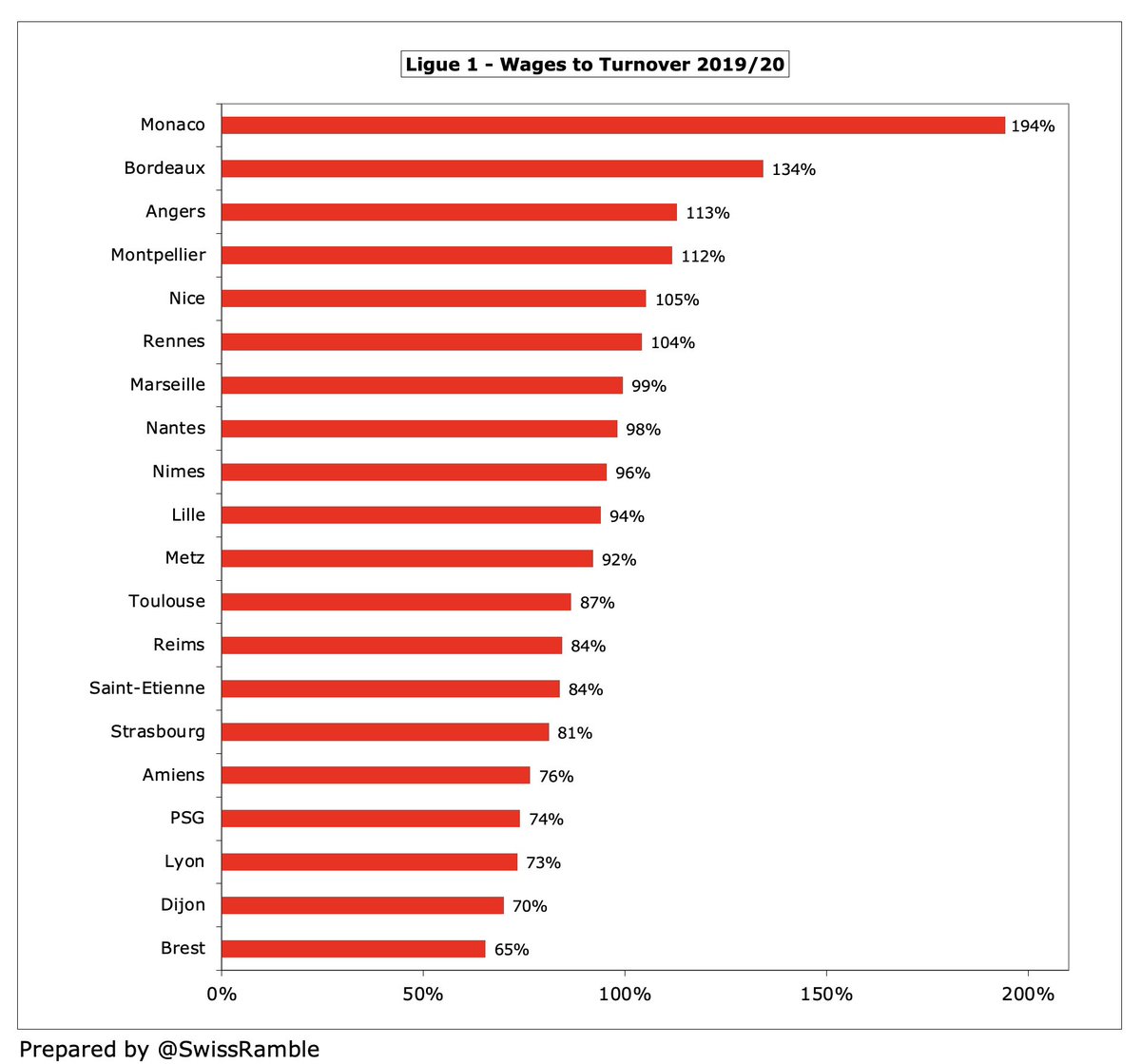

Only two clubs in #Ligue1 had wages to turnover ratios below 70%, namely Brest and Dijon. Despite their huge wage bill, #PSG have one of the lowest (best) wages to turnover ratio in #Ligue 1 at 74%. Six clubs have ratios above 100% with the worst at Monaco 194% and Bordeaux 134%.

#Ligue1 transfer costs have really shot up in the last three years from €280m to €631m. They grew by €130m (26%) from €501m in 2020 alone, comprising player amortisation €517m (up €120m) and agents’ fees €114m (up €10m).

Unsurprisingly, #PSG €142m player amortisation, the annual charge to write-down transfer fees over the length of a player’s contract, is by far the highest in France, well ahead of Monaco €88m, followed by Lyon €76m and Marseille €43m.

Similarly, #PSG had the highest agents’ fees of €27m, though Lille €23m and Monaco €20m were also quite chunky. All the other clubs paid €7m or less. Note: Lyon did not separately report agents’ fees.

#Ligue1 gross debt rose €57m (11%) from €522m to €579m, though net debt actually fell €50m (21%) from €240m to €190m, as cash increased by €106m (38%) from €283m to €389m. However, it is worth noting that net debt was zero 3 years ago, when gross debt was only €387m.

Half of the gross debt in #Ligue1 is at just two clubs, Lyon €227m & Lille €61m (down from €129m), mainly driven by investment in new stadia. The next highest debt is Saint-Etienne with €40m. 10 clubs have less than €10m debt, including #PSG with zero financial liabilities.

#PSG have no external financial liabilities, but do have €197m shareholder loans, up from €105m the prior season. Net equity has improved from €78m to €355m following various cash injections from QSI.

Stop me if you’ve heard this one before, but #PSG have the highest cash balance in #Ligue1 with €73m, well ahead of the closest challenger Marseille €50m, followed by Lyon €33m, Strasbourg €26m and Rennes €26m. Most clubs have boosted the amount of cash held in 2020.

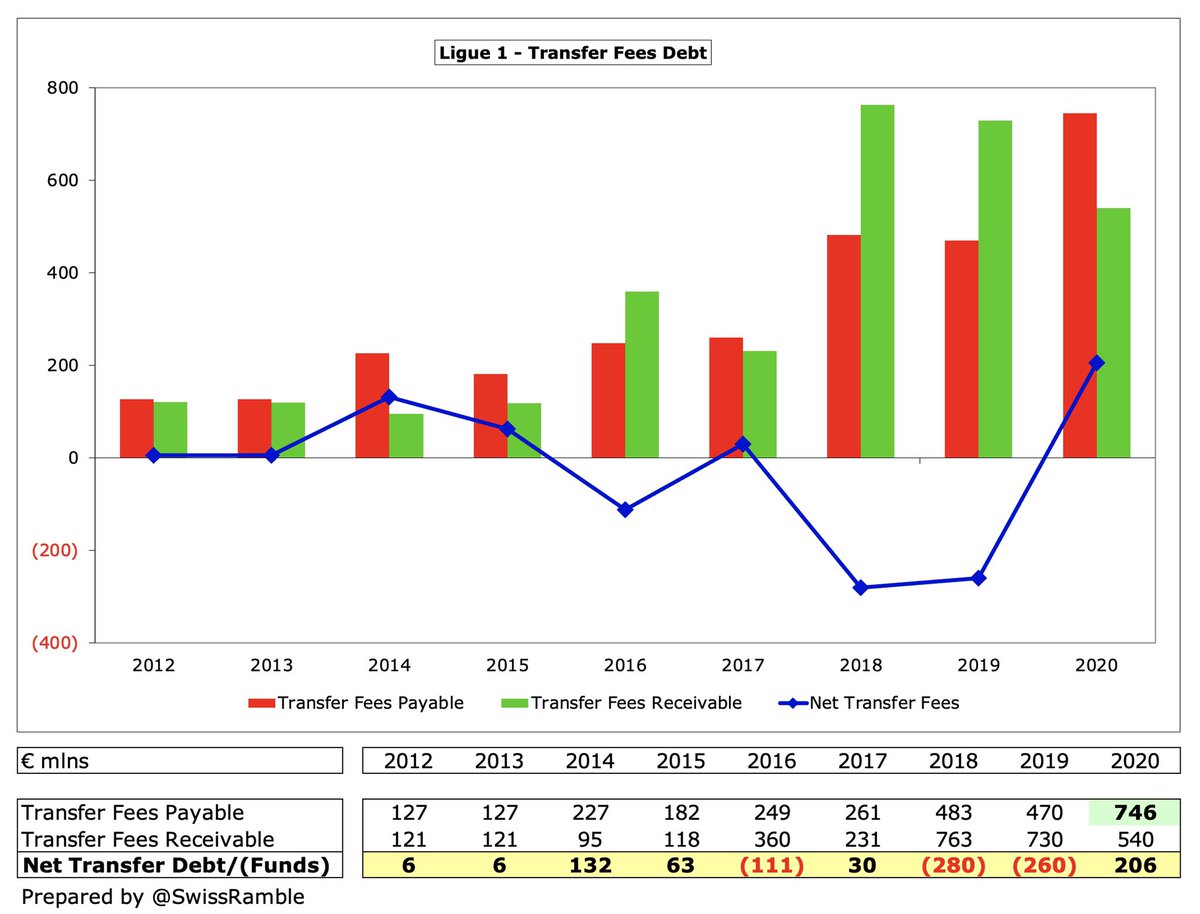

#Ligue1 transfer debt shot up €276m (59%) from €470m to €746m, while receivables fell €190m (26%) from €730m to €540m, so the league overall went from €260m net receivables in 2019 to €206m net payables in 2020, a huge swing of €466m in just 12 months.

#PSG had highest transfer debt of €144m, closely followed by Monaco €142m and Lyon €136m. However, they also had €150m transfer payments owed to them, so had £58m net receivables (though surpassed by Monaco €139m). Highest net transfer debt was Marseille, but only €19m.

In summary, most French clubs are run as self-sustaining businesses with relatively low debt, though they have been hit very hard by COVID-19 and the cancellation of the new TV deal. #PSG are a huge outlier with by far the highest revenue and wages in #Ligue1.

The financial problems in French football were highlighted in June when the DNCG provisionally imposed relegation on Bordeaux and Angers, but their appeals were successful, so they will be able to play in #Ligue1 next season after all.

The extent of the pandemic will only be revealed after accounts are published for 2020/21 with €1.3 bln combined losses forecast by DNCG (per L’Équipe), due to games played behind closed doors and a stagnating transfer market. #Ligue1 will return to 18 clubs in 2023/24.

• • •

Missing some Tweet in this thread? You can try to

force a refresh