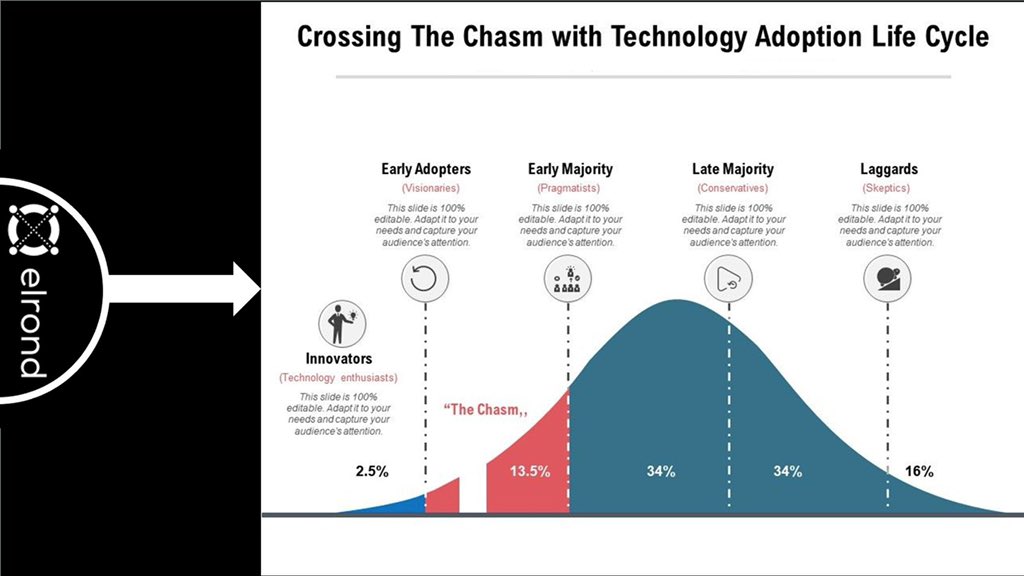

(1\20) Blockchain & Crypto was to give equitable opportunity to the people. Democratizing Money & Finance. Not to cater to Venture Capitalists or Wealthy. Many talk about this but they are narratives or stories not execution. Time to talk about funding $EGLD $SOL $DOT $ADA $ALGO

(2\20) Elrond Network led by @beniaminmincu @LucianMincu @luciantodea had been in the crypto space since 2013. They invested & worked on many crypto projects which included $DOT $ZIL $XTZ $BAT among many others. They realized none of these crypto projects were the future as

(3\20) they were not solving the bigger problems that would allow for mass adoption. Elrond saw the vision for humanity & how no one was really solving the larger problems. There was much theorizing & lots of money raising but very little substance. What did Elrond do?

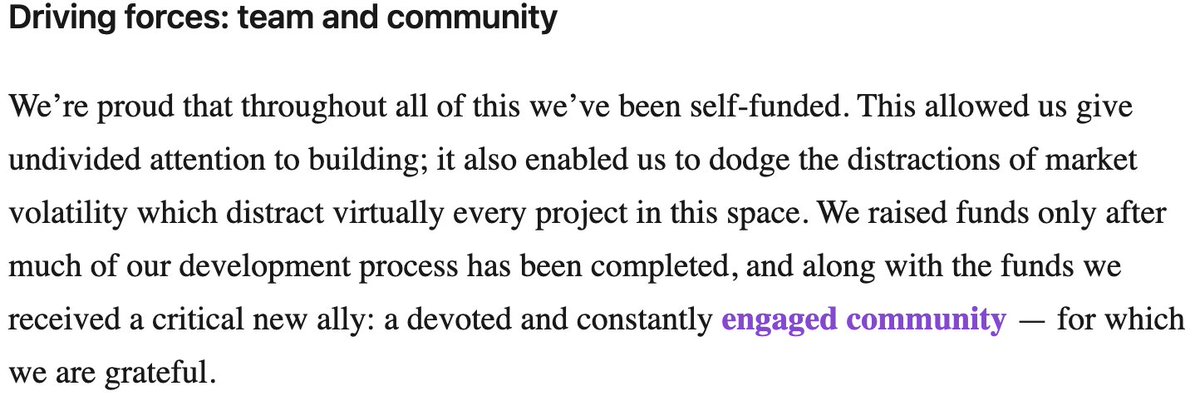

(4\20) Elrond SELF Funded, they put their own Skin in the Game. Have you ever read “Skin In the Game”? You Should. Elrond & the team took on all the risk, which aligned their incentives directly. Many in the space are comfortable or Billionaires already like Charles $ADA so their

(5\20) willingness to push 24 hour shifts like the Elrond Team & deliver real world results well, lets say is not the same. Elrond assembled a team of experienced entrepreneurs, engineers and researchers with significant blockchain and technical experience backgrounds from

(6\20) Google, Microsoft, Intel, NTT DATA, MITT, IBM and others. Backgrounds in Computer Science, Blockchain, Design, Space Exploration, Artificial Intelligence, and World Math Competition Awards. The team includes two PhDs in Computer Science & Artificial Intelligence,

(7\20) multiple math, CS, and AI Olympiad champions, and a former member of the NEM core team. Essentially, a team with the ability & capacity to build rockets. There is a deep hunger & passion that is undeniable. See the biggest issue in our world of investing & especially in

(8\20) the world of banking & finance is they don’t really have skin in the game. During the Financial Crisis the banks were all bailed out by the people. Yes, they are using the “people’s money” to bail out their buddies who get to take all the reward with essentially no

(9\20) risk. From the perspective of big business all of this is best described as capitalism on the way up and socialism of losses on the way down, or ‘Cronysim’ as stated by Scott Galloway

https://twitter.com/profgalloway/status/1250068648921882626?s=20. See, the deeper I looked into Elrond Network the more I realized

(10\20) they were about the people. I discussed in depth how they have maximized decentralization for the people in everything they have done. Elrond Self Funded all the way til working Proof of Concept. Can you imagine? This is incredible. As an entrepreneur (I understand the

(11\20) importance of skin in the game when it comes to driving towards success) & with 17+ years of investing experience I realize how much of the space has artificially inflated valuations all based on HOPIUM from white papers of what is “possible” but no proof of concept.

(12\20) Many investor presentations are this way & this is where risk is magnified as downside is increased & risk is through the roof as 95% of start up companies fail. Elrond Network solved the most difficult problem that NO one wanted too, Not 1 but ALL 3 types of Sharding)

(13\20)& have had ZERO down time for over 1 year. This screams quality, execution & extradorinary talent. Solana has had downtime among others who scarified security & stability for speed instead of solving sharding & rigorously testing it. Solana’s Founder & CEO...

(14\20) here laughs & is continually condescending about how difficult Sharding is to solve & no one would be able to do it soon, he also discusses that Sharding is great for #Decentralization but that this is clearly not important. Remember how..

(15\20) I discussed that if we don’t maintain decentralization, especially as it relates to equitable opportunity & value sharing & inclusiveness we R just putting Wall Street & their pyramid models onto the blockchain, it’s pointless On top of that

(16\20)

https://twitter.com/WesleyBKress/status/1422060921258577924?s=20$SOL #Solana has raised over $335.8 Million from Venture Capitalists & Silicon Valley. One of the wealthiest individuals in all of crypto #FTX was Solana’s biggest investor. There is a reason Solana’s valuation is so distorted despite not having

(17\20)the 2nd strongest community in all crypto like Elrond has, U can’t buy a community. It makes me proud to see the people takin the power back into their hand. It’s because Elrond is a champion of the people. $DOT has raised $293.7 Million, Cardano has raised $62.2 Million,

(18\20) Algorand has raised $126 million.

Elrond is the furthest along in terms of infinite scalability, they have skipped no steps, produced the most results with the least resources, Y? They care about fulfilling the vision of why crypto started, decentralization, censorship

Elrond is the furthest along in terms of infinite scalability, they have skipped no steps, produced the most results with the least resources, Y? They care about fulfilling the vision of why crypto started, decentralization, censorship

(19\20) resistant, equitable opportunity & value sharing & Inclusiveness.

https://twitter.com/WesleyBKress/status/1422060921258577924?s=20Most media outlets in crypto R run by wealthy investors of projects. Make no mistake the reason Elrond Network has not received its fair coverage despite being light years ahead of

(20\20) everyone is because of this. Elrond is interested in rising ALL tides. Why they R called Elrond?

https://twitter.com/WesleyBKress/status/1418333505344311296?s=20TheFunding visual R all related to private investors. Elrond has also done an Initial Exchange Offering (IEO) via Binance Launch Pad 25% of supply (below)

**A blockchain that was created for the people, now that is worth a standing ovation, especially with how they have done it. U can read more via my 44 page research paper & investment thesis here:

https://twitter.com/WesleyBKress/status/1402453421706289156?s=20& 2 Hour Video Deep Dive Here $EGLD

https://twitter.com/WesleyBKress/status/1411750510466535427?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh