Newcastle United’s 2019/20 financial results cover a season when they finished 13th in the Premier League for the second year in a row. Disrupted by the COVID-19 pandemic. Some thoughts in the following thread #NUFC

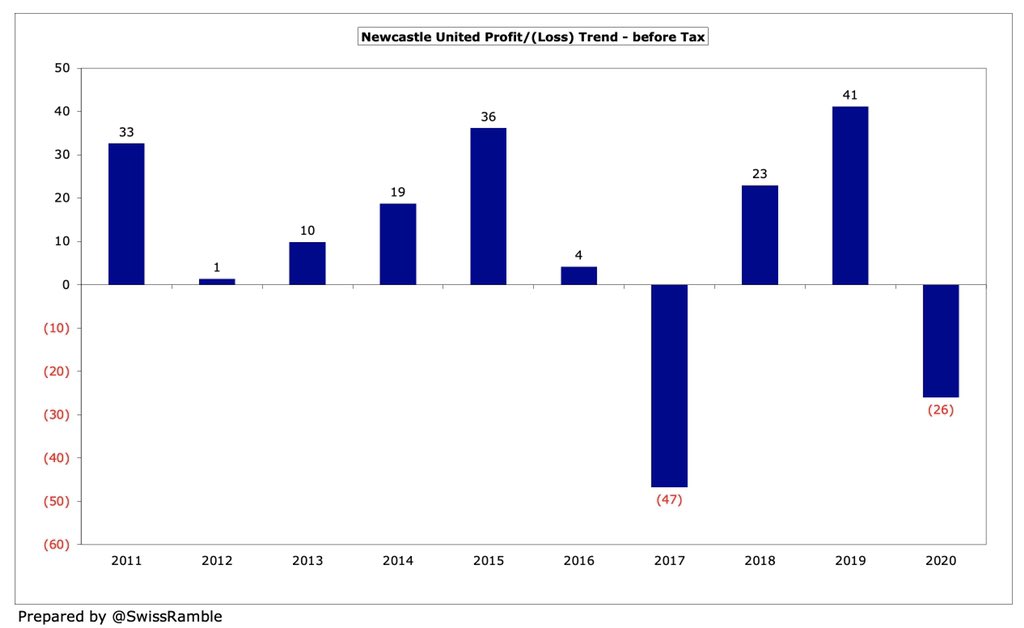

#NUFC swung from £41m pre-tax profit to £26m loss, as revenue fell £23.8m (14%) from £176.4m to £152.6m, partly due to COVID, while expenses increased £45m (28%), including an additional month of accounts. Profit on player sales was up £2m to £26m. Loss after tax was £23m.

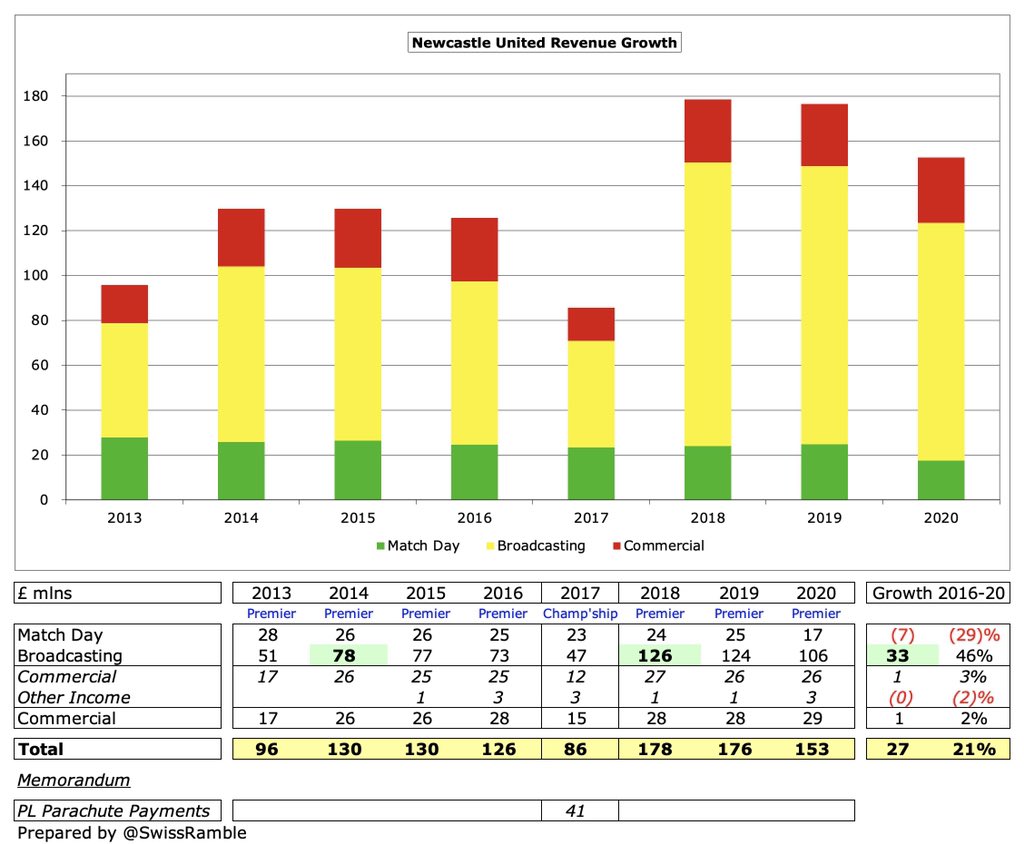

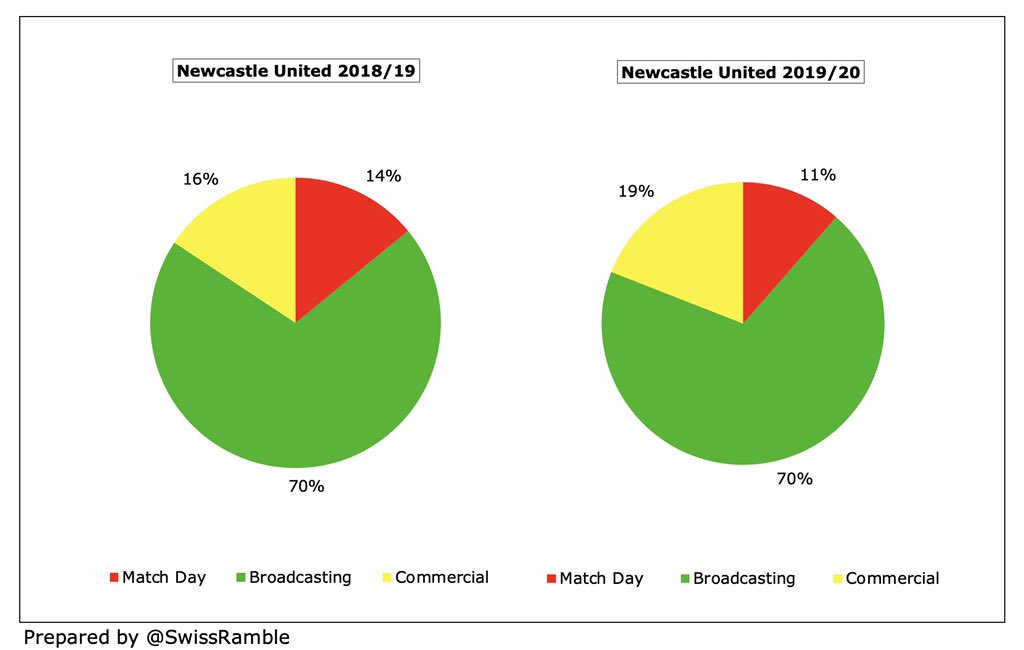

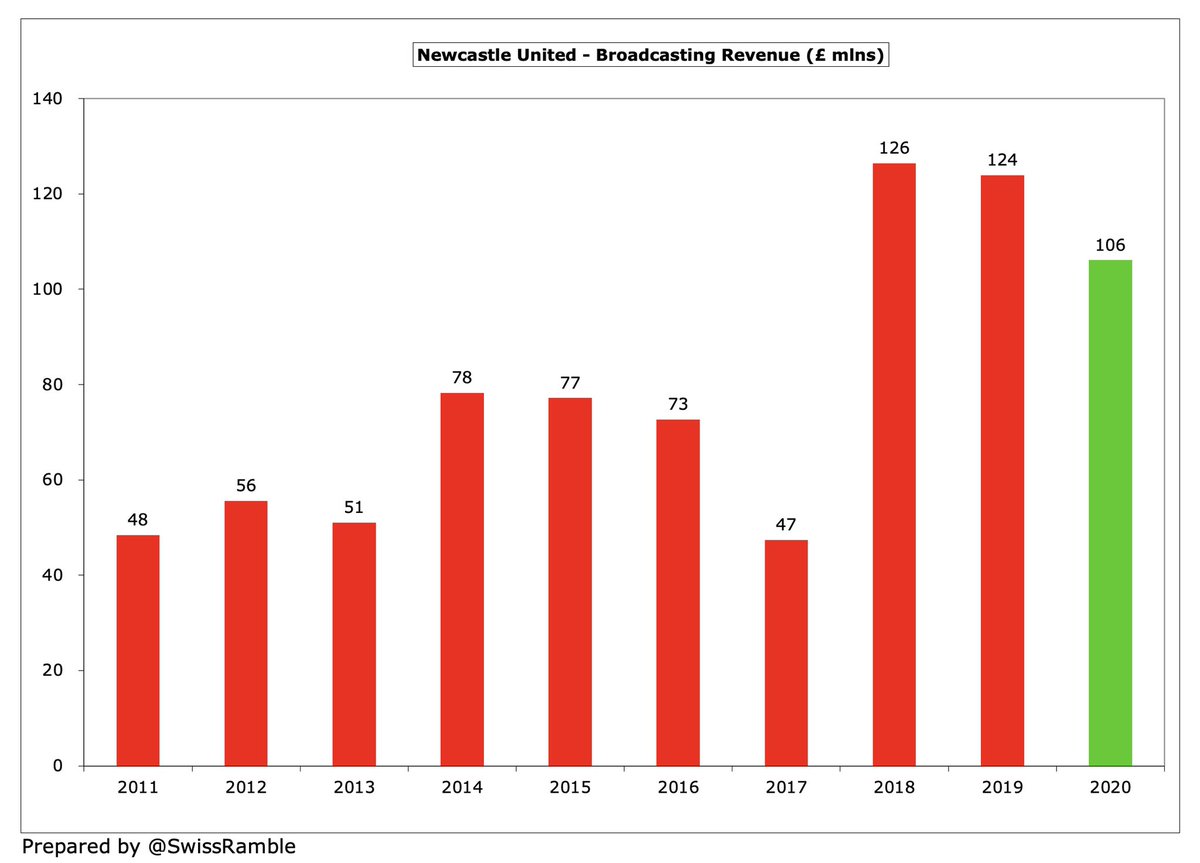

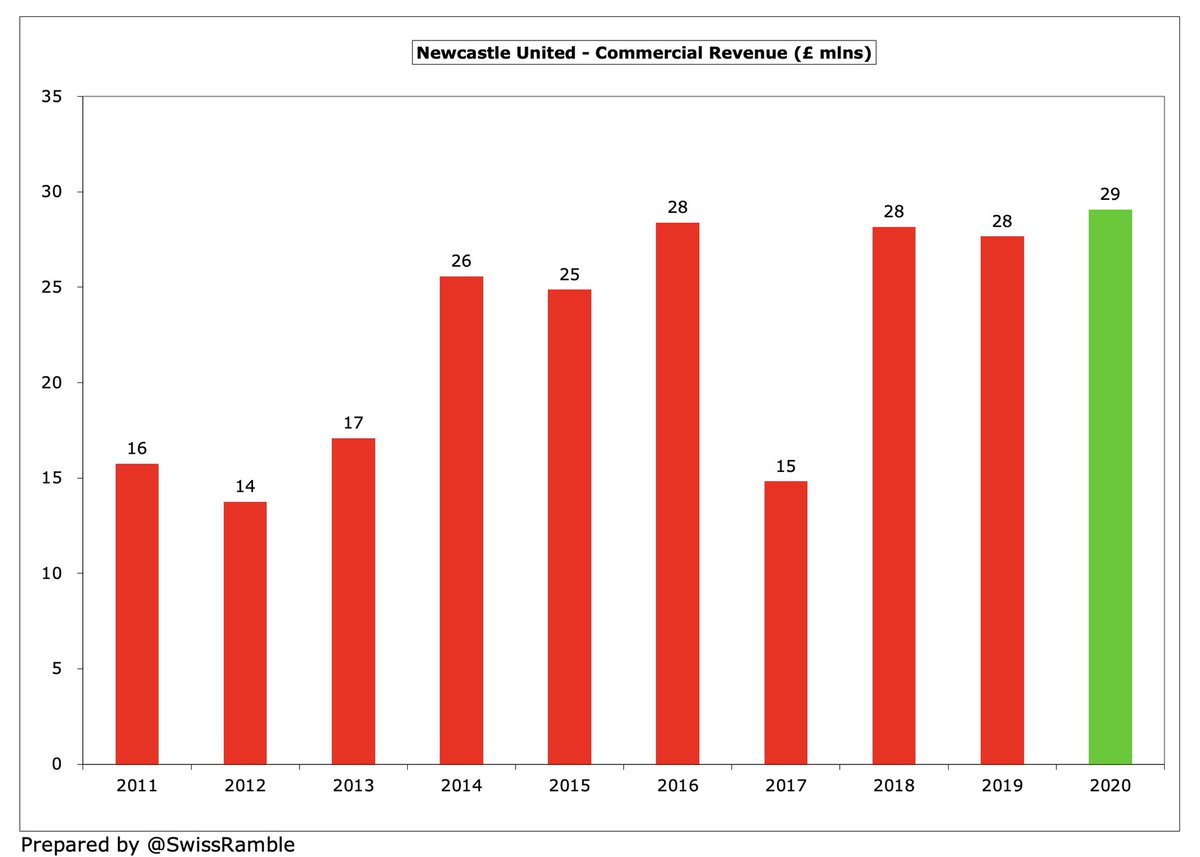

Main driver of #NUFC revenue reduction was broadcasting, which fell £18m (14%) from £124m to £106m, while match day dropped £7.4m (30%) from £24.8m to £17.4m. However, commercial rose £1.4m (5%) from £27.7m to £29.1m, including £1.2m from government job retention scheme.

Despite the revenue decrease, #NUFC wage bill increased £24m (25%) to £121m, while player amortisation rose £9m (23%) to £48m and they also booked a £11m impairment charge. Other expenses rose £0.5m (2%) to £23.8m. Costs impacted by 13-month accounts in 2019/20.

Although #NUFC £26m loss is obviously not great, it is actually one of the better financial results in the Premier League, as all clubs have been adversely impacted by COVID with many posting much higher losses, especially #EFC £140m, #MCFC £125m and #AVFC £99m.

Without COVID, #NUFC revenue would have been £14.4m higher at £167m, due to broadcasting rebate and lost match day income. Along with £12.7m additional costs incurred for 13th month in accounts, the net impact was £27.1m, so club’s underlying profit was a healthy £1m.

It is worth noting that #NUFC extended their accounting close to 31st July 2020, a period of 13 months, in order to “present the best comparable financial information”. This meant the revenue impact of the COVID-19 pandemic on their accounts was smaller than most other clubs.

#NUFC bottom line was boosted by £26.3m profit on player sales, up from £24.6m prior year, mainly due to Ayoze Perez’s move to #LCFC. This was the 7th highest profit in the Premier League from this activity, though far below #CFC £143m, #LCFC £63m and #AFC £60m.

#NUFC have made money in 8 of the last 10 years, the only exceptions being 2017 (Championship) & 2020 (COVID). They posted £94m profits in this period, which is impressive from a financial perspective, though the Toon Army would have liked to see more of that money on the pitch.

The #NUFC focus on the bottom line is very well illustrated by them reporting the 4th highest aggregate profit in England in the last decade of £94m. The only clubs with higher profits than Newcastle were #THFC £338m, #MUFC £191m and #AFC £112m.

Player sales have had a decent impact on #NUFC profits, contributing £185m in the last decade. The interesting thing is there has been no sizeable increase recently, so last 5 years £100m, preceding 5 years £85m. Very little money in the 2020/21 season, as largely free transfers.

#NUFC EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out player sales and non-cash items to give underlying profitability, dropped from £56m to £8m. This was mid-table in the top flight, though far below #MUFC £132m and #THFC £106m.

At an operating level (i.e. excluding player sales and interest), #NUFC deteriorated from £15m profit to £54m loss. This is the club’s worst ever performance, but is still in the top half of the Premier League with no fewer than 5 clubs having operating losses above £100m.

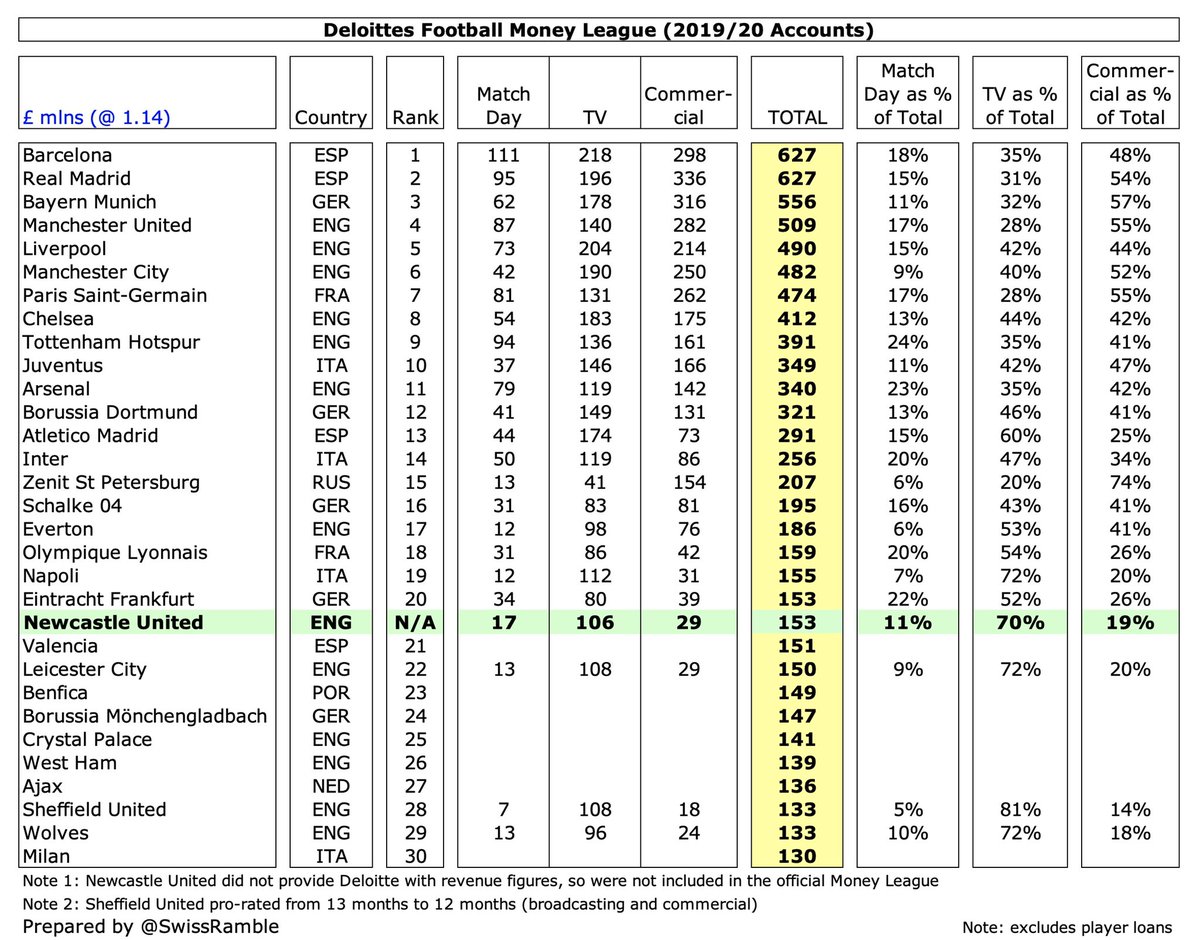

Despite the fall in 2020, #NUFC £153m revenue has grown £27m (21%) in last four years, entirely due to the new TV deal that started in 2017/18. It’s a similar story since Ashley’s arrival in 2007, as revenue has grown £66m, but £80m is from centrally negotiated TV contracts.

Even after the steep decrease in broadcasting income in 2020, this was still by far the most important revenue stream for #NUFC, accounting for 70% of total revenue, followed by commercial 19% and match day 11%.

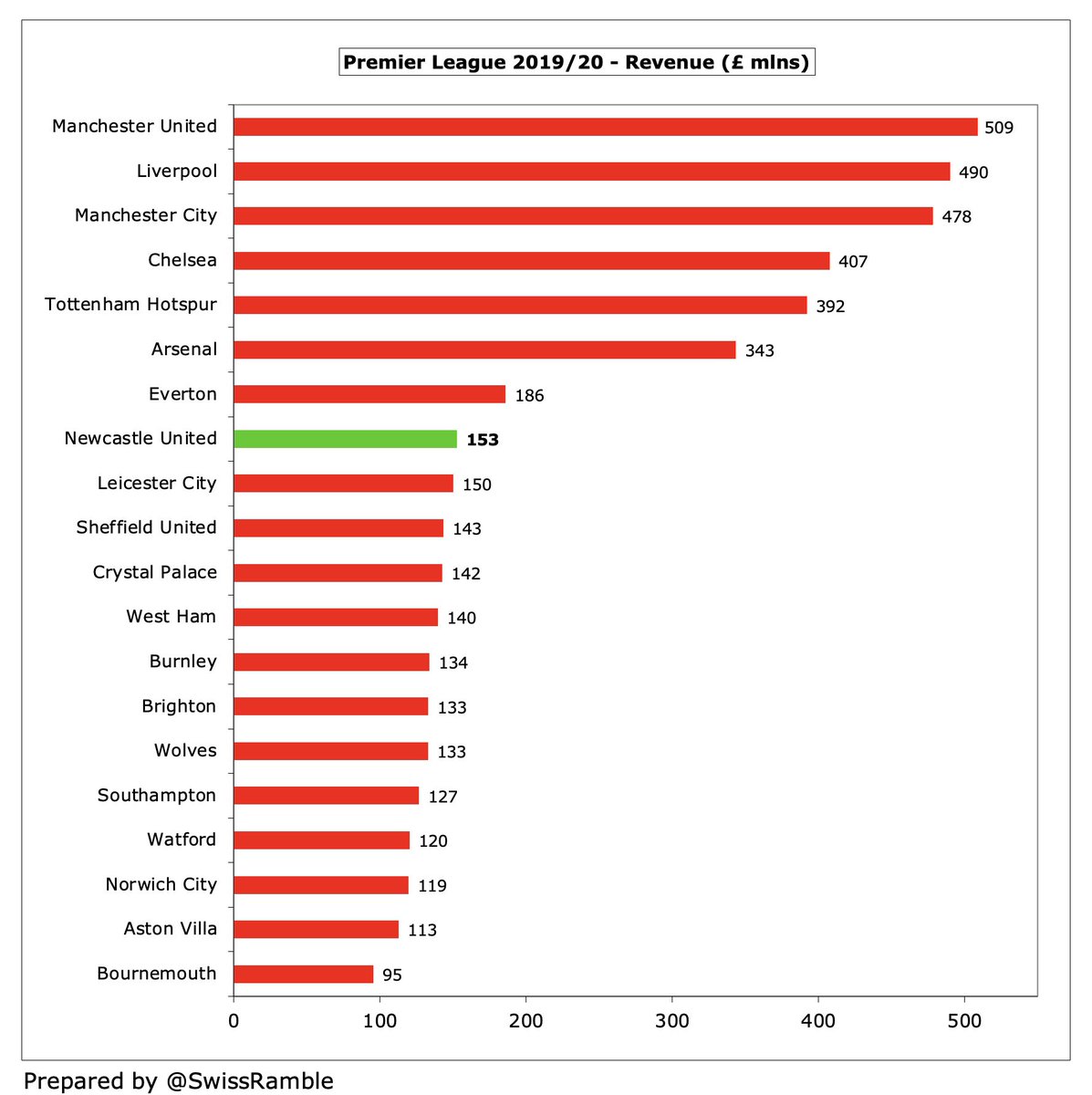

#NUFC £153m revenue was 8th highest in the Premier League, only behind the Big Six and #WHUFC. However, there is a substantial gap to sixth place with Newcastle being less than half of #AFC £343m and less than a third of top of the (financial) table #MUFC £509m.

Most clubs’ revenue was significantly down in 2019/20, averaging decreases of £38m and 13% due to COVID, so #NUFC £24m (14%) reduction was one of the best performances. Helped by extending accounts to 31st July, whereas others with May/June closes had to defer revenue to 2020/21.

For some reason, #NUFC did not submit revenue details to Deloitte for their annual Money League, which ranks clubs globally. However, their £153m would have placed them 21st, up from prior year’s notional 23rd. Ahead of Valencia, Benfica, Borussia Mönchengladbach, Ajax and Milan.

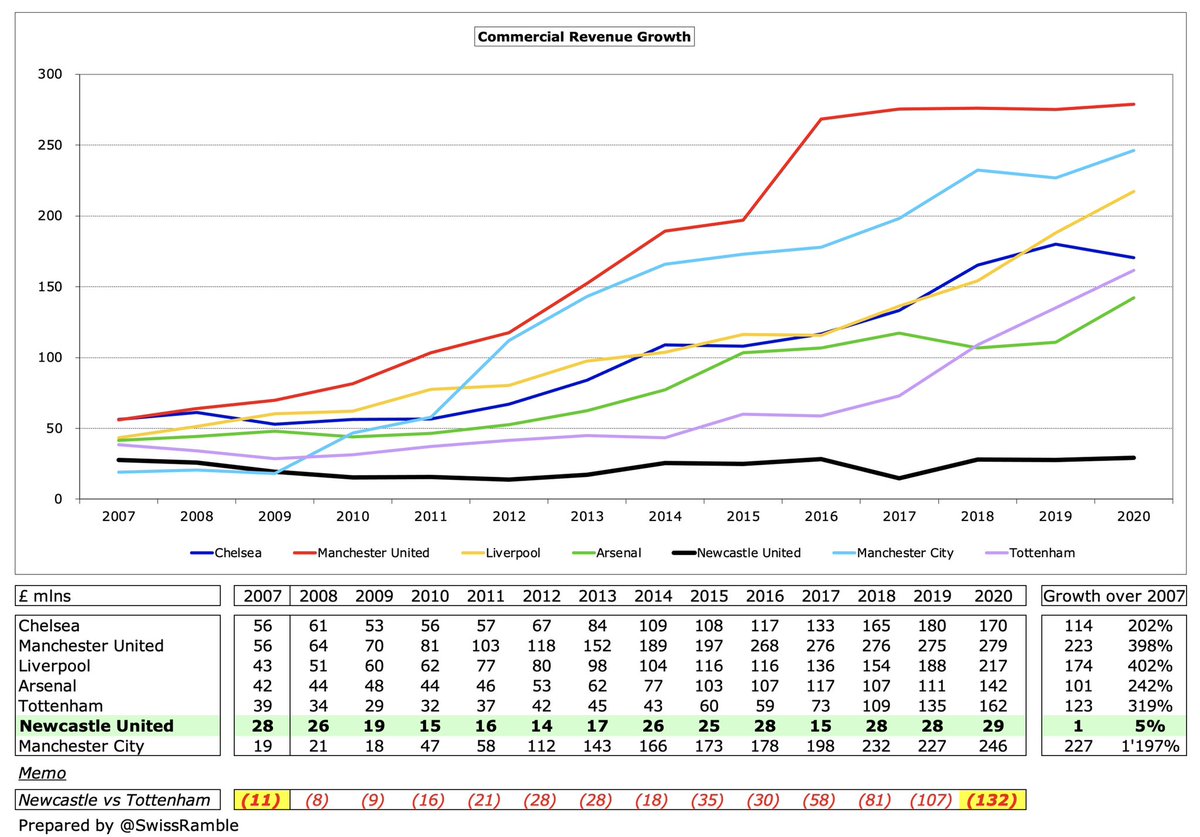

Before Ashley’s takeover in 2007, #NUFC had the 14th highest revenue in the world, just £19m lower than the 10th placed club. In 2020 this gap has soared to £196m, as Newcastle have stagnated and so been left behind by the growth at other clubs.

#NUFC broadcasting income fell £18m (14%) from £124m to £106m, due to a rebate to broadcasters and lower facility fees (4 fewer live games). Other clubs also had to defer some revenue into 2020/21, as season extended beyond their 31st May & 30th June accounting close.

Much of Premier League TV deal is distributed equally, but part based on league position (merit payments, growth in overseas rights) & number of times shown live (facility fees). From 2019/20 each live game worth just over £1m, so 4 fewer games cost #NUFC around £4-5m.

#NUFC have only qualified for Europe once under Ashley, earning just €5m in 13 years. In contrast, they qualified in 10 of the 13 years before he became owner, including 3 times for the Champions League. As an example of what they could have won, #THFC got €272m in last 4 years

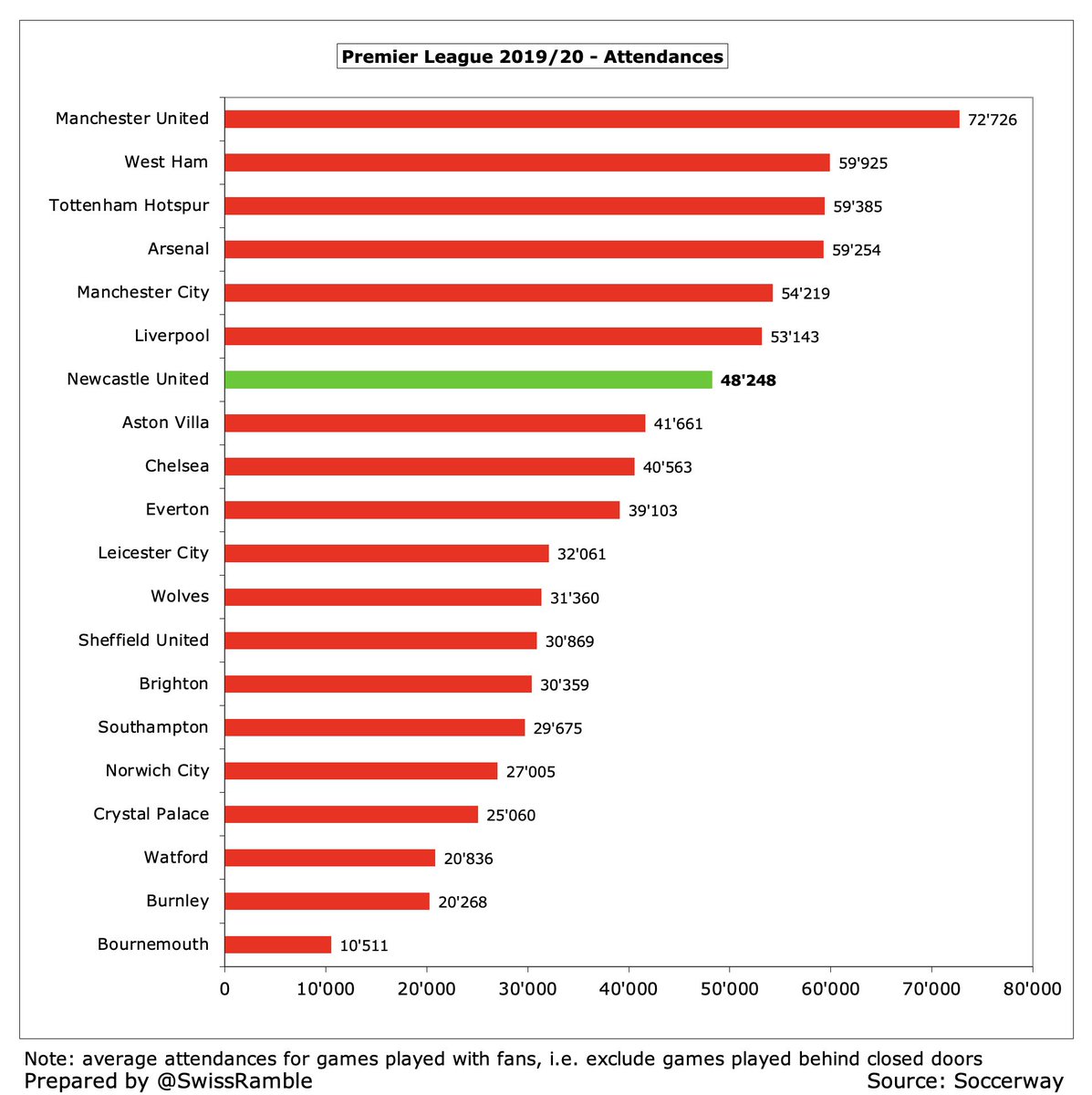

#NUFC match day income fell £7.4m (30%) from £24.8m to £17.4m, as they played 5 home games behind closed doors due to COVID and average attendance (for games with fans) dropped from 51,116 to 48,248. Still 8th highest income in Premier League, only behind Big Six and #WHUFC.

However, #NUFC £17m match day revenue is £17m (48%) less than £34m in last season before Ashley’s arrival. Obviously impacted by COVID, but other clubs have surged ahead in this period either via stadium developments or success on the pitch, notably #THFC up £59m and #LFC £32m.

As testament to #NUFC fans’ loyalty, average attendance has been around 50,000 for last 10 years, including a very impressive 51,108 in the Championship. Ticket prices rose 5% in 2019/20, though not for 20,000 long-term season ticket holders (no price increases for 10 years).

Despite the decrease in 2019/20, #NUFC attendance of 48,248 remained the 7th highest in the Premier League, but it is worth noting that the club reportedly had to give away around 10,000 half season tickets to present a full stadium to broadcasters (and potential purchasers).

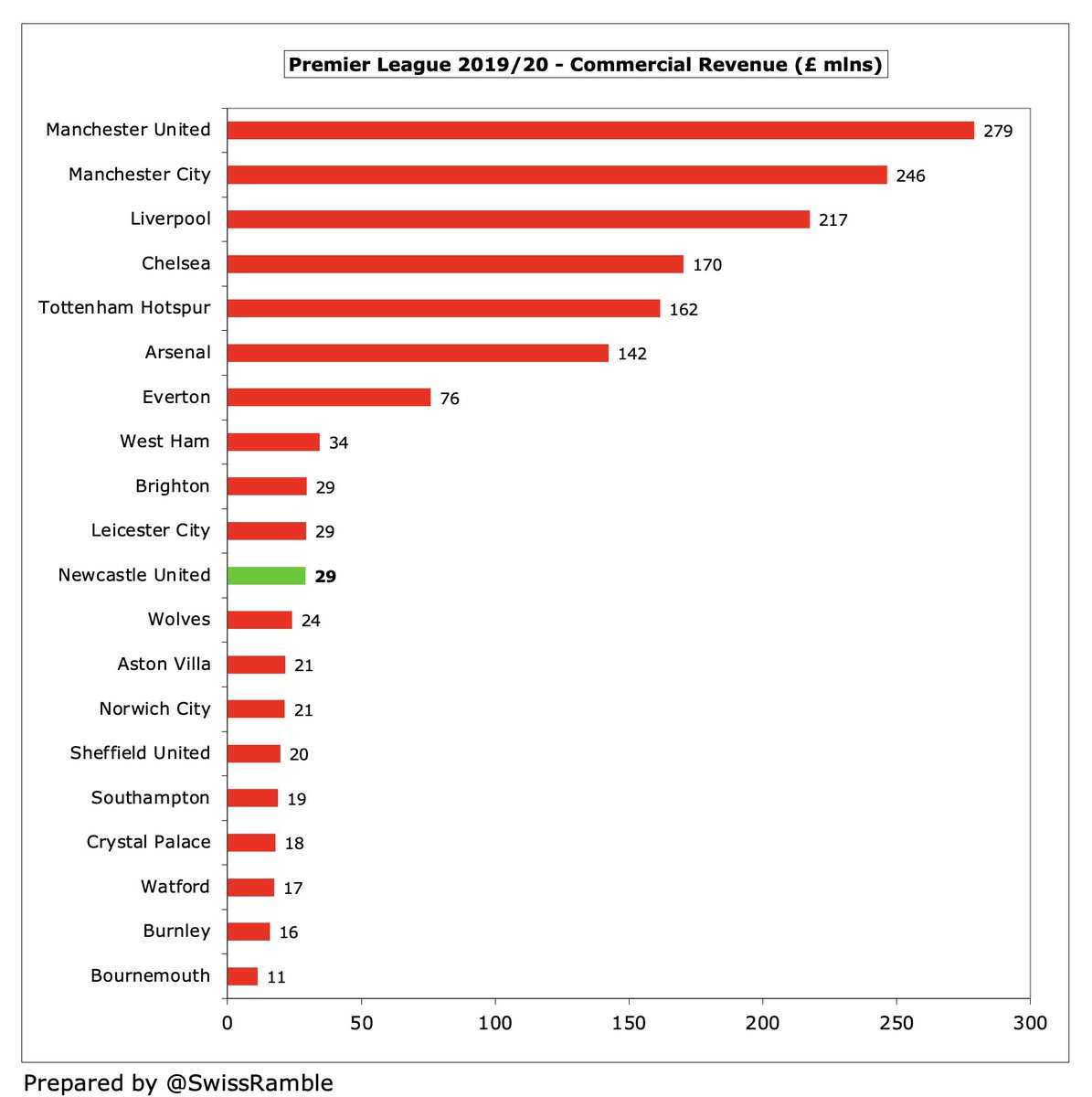

#NUFC commercial income rose £1.4m (5%) from £27.7m to £29.1m, including £1.2m from government job retention scheme. This is mid-table in the Premier League, only around 10% of #MUFC £279m. That might be an unreasonable comparison, but they are also behind #BHAFC and #LCFC.

Ashley has barely managed to grow #NUFC commercial income at all in 13 years, so the club has fallen way behind rivals in this important revenue stream, e.g. the Big Six have grown by £100-230m in this period. Newcastle outsourced catering in 2009, but that was only worth £6m.

Ashley did pay #NUFC £141k, though this was down from prior season’s £1.1m and less than the £594k the club spent on purchasing goods from the owner’s companies. Previous accounts said the club would receive payment from Sports Direct for stadium advertising, but not quantified.

#NUFC £6.5m shirt sponsorship with Fun88 has been extended, while Puma’s long-term kit supplier deal ended in 2021, replaced in a multi-year deal by Castore, who will also take over the club’s retail operations. Sleeve sponsor for 2021/22 will be Kayak, succeeding ICM.

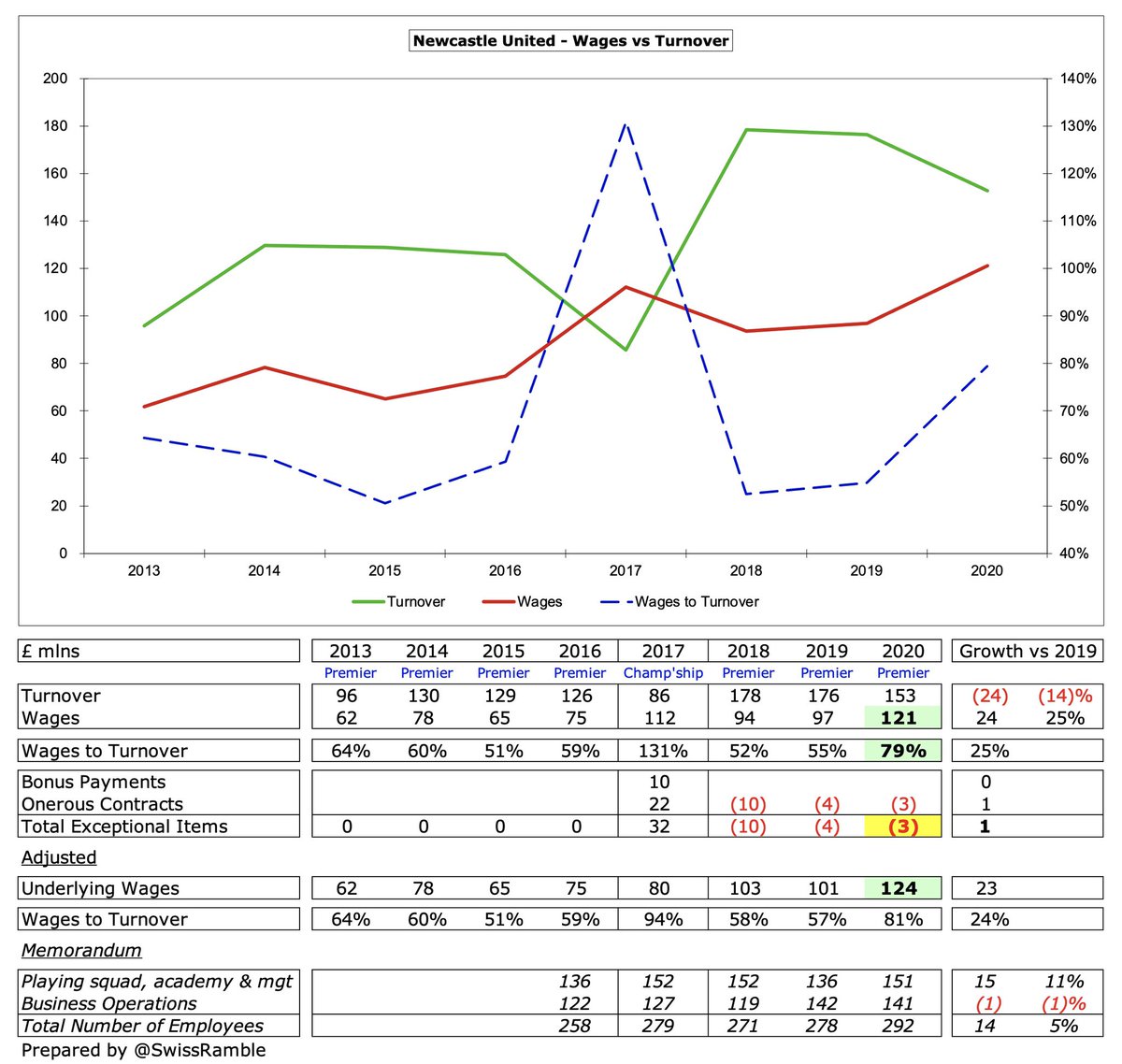

#NUFC reported wage bill rose £24m (25%) from £97m to £121m, mainly because accounting period was extended to 31st July, thus covering 13 months. Increase would have only been £15m to £112m if adjusted for 12 months. Increase also driven by 14 growth in headcount.

#NUFC enjoyed the 5th highest wage bill in England before Ashley bought the club in 2007. Although wages have doubled from £61m to £121m since then, other clubs have increased wages by significantly more, e.g. #LFC up £248m (320%) from £44m to £326m.

As a result, #NUFC £121m was 11th highest wage bill in England in 2019/20. If it were adjusted to £112m, based on a 12-month period, it would fall to 12th place. Either way, this is at least £200m below #MCFC £351m and #LFC £326m.

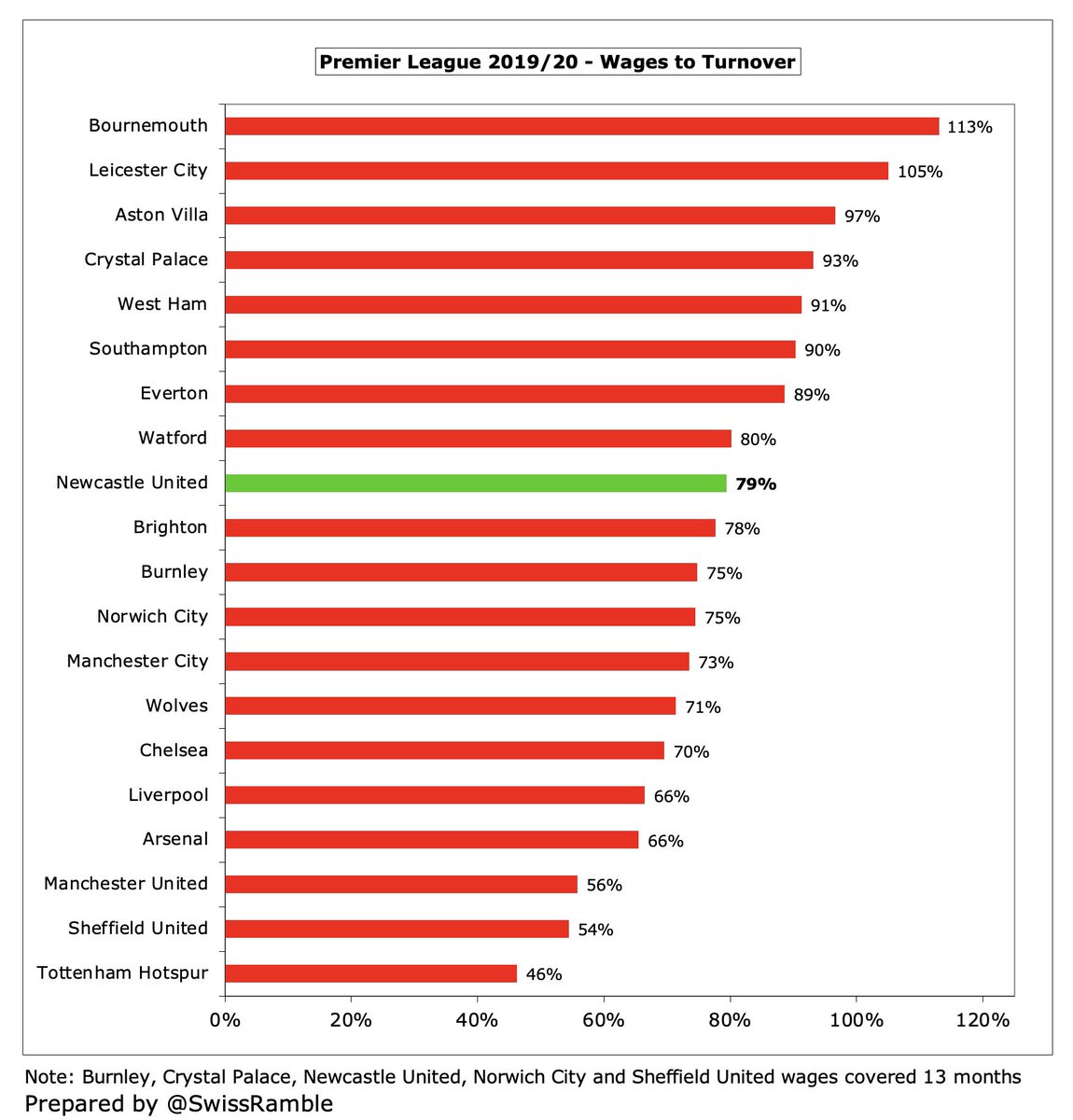

#NUFC wages to turnover ratio increased from 55% to 79%, 9th highest in the Premier League, though this would fall to 73% based on 12-month wages. If we further adjust for the COVID £14.4m revenue loss, the ratio would fall to 67%, though still above Newcastle’s own 60% target.

Remuneration for #NUFC highest paid director (presumably managing director Lee Charnley) surged from £267k to £675k, which might raise eyebrows with staff furloughed, though still mid-table in the Premier League, miles below Ed Woodward #MUFC and Daniel Levy #THFC (around £3m).

#NUFC player amortisation, the annual charge to expense transfer fees over a contract, rose £9m (23%) from £39m to £48m, partly due to booking 13 months in 2020, though still firmly in bottom half of the Premier League. Also £11m impairment charge to reduce player values.

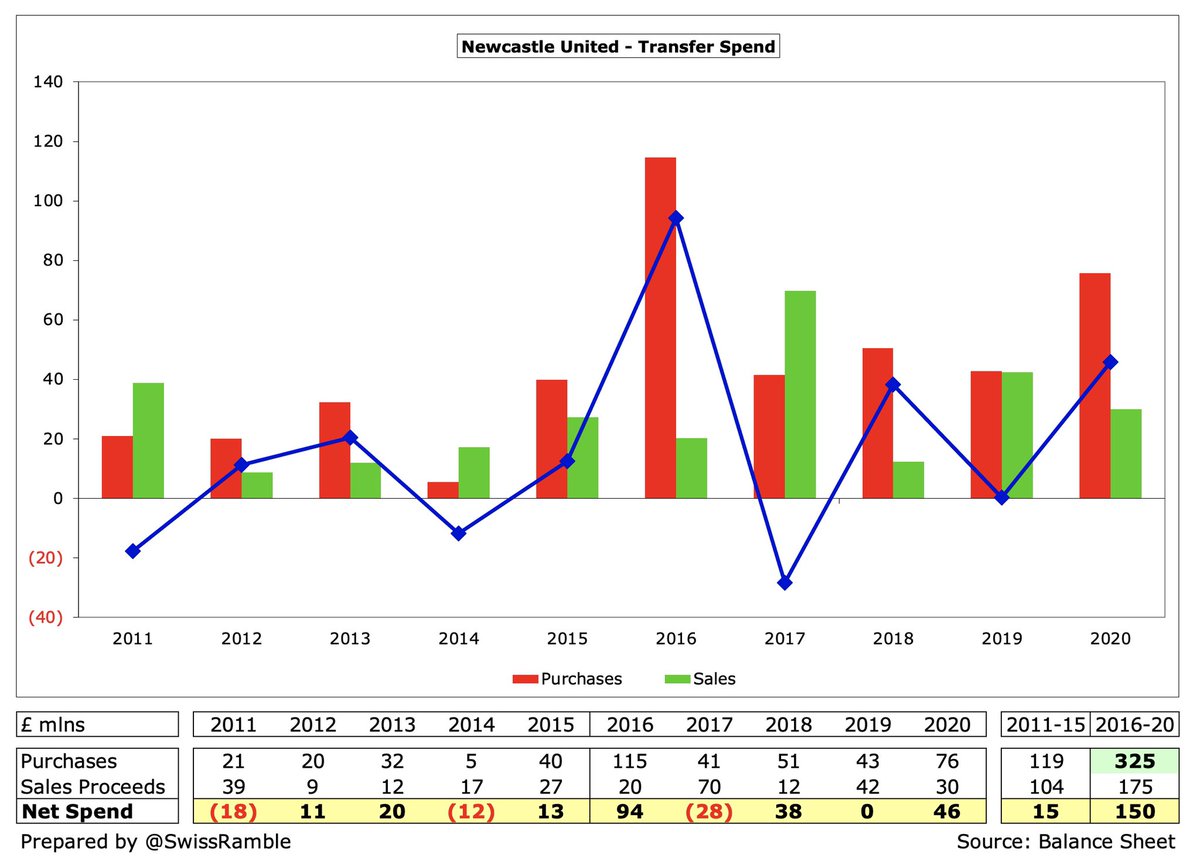

#NUFC spent £76m on player purchases, mainly on Joelinton, Allan Saint-Maximin and Emil Krafth. This was nearly twice the previous season’s £43m outlay, but only mid-table in the Premier League, way below #MUFC £183m, #AFC £182m and #MCFC £180m in 2019/20.

#NUFC have ramped up transfer market activity, so that their £325m gross spend in the last 5 years is almost 3 times the £119m in preceding 5 year-period. The problem is that their average annual net spend of just £17m over the last decade is much less than the leading clubs.

In fact, #NUFC £150m net spend in the last five years is only 14th highest in the Premier League, less than half #EFC £326m and even behind #FFC. They move up to 11th based on gross spend of £325m, but still below #AVFC £333m, who spent 3 of those 5 years in the Championship.

#NUFC 2020/21 accounts will include the acquisitions of Callum Wilson from #AFCB and Jamal Lewis from #NCFC. Accounts state £48m net spend since year-end, though fans will note that Newcastle have not made a single signing yet this summer (though Willcock could be arriving).

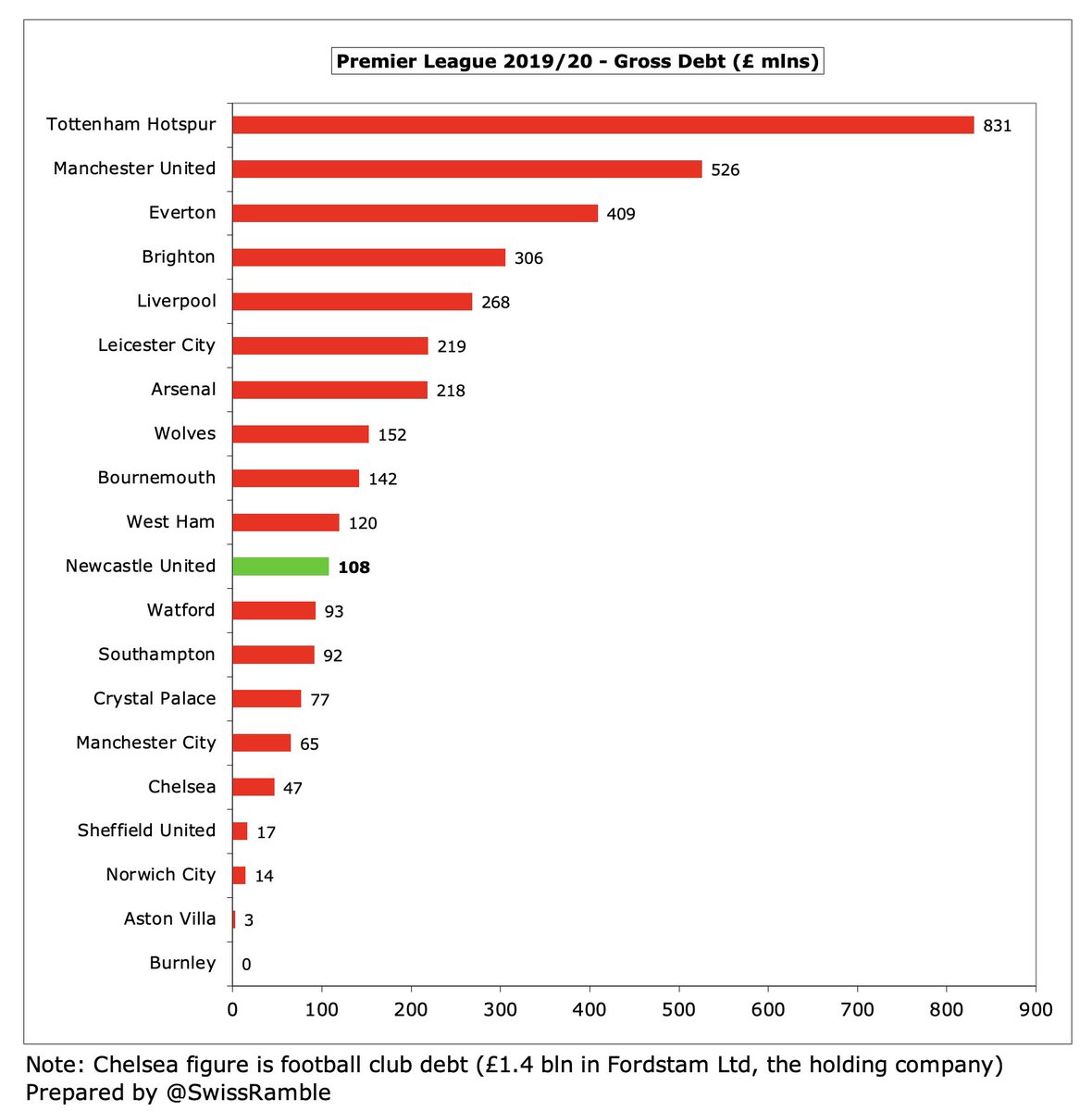

#NUFC gross debt fell from £112m to £108m, mainly £107m owed to Mike Ashley. This reduced from £111m, not because of a cash repayment, but due to club netting amount owed by the parent company “in preparation for club being sold”. No external debt apart from £1m finance leases.

#NUFC £108m debt is 11th highest in top tier, far below THFC £831m (stadium) and #MUFC £526m. However, £31m more than £77m Ashley took on in 2007, including £58m mortgage for stadium development. Unlike owners at many other clubs, Ashley has not converted any debt into equity.

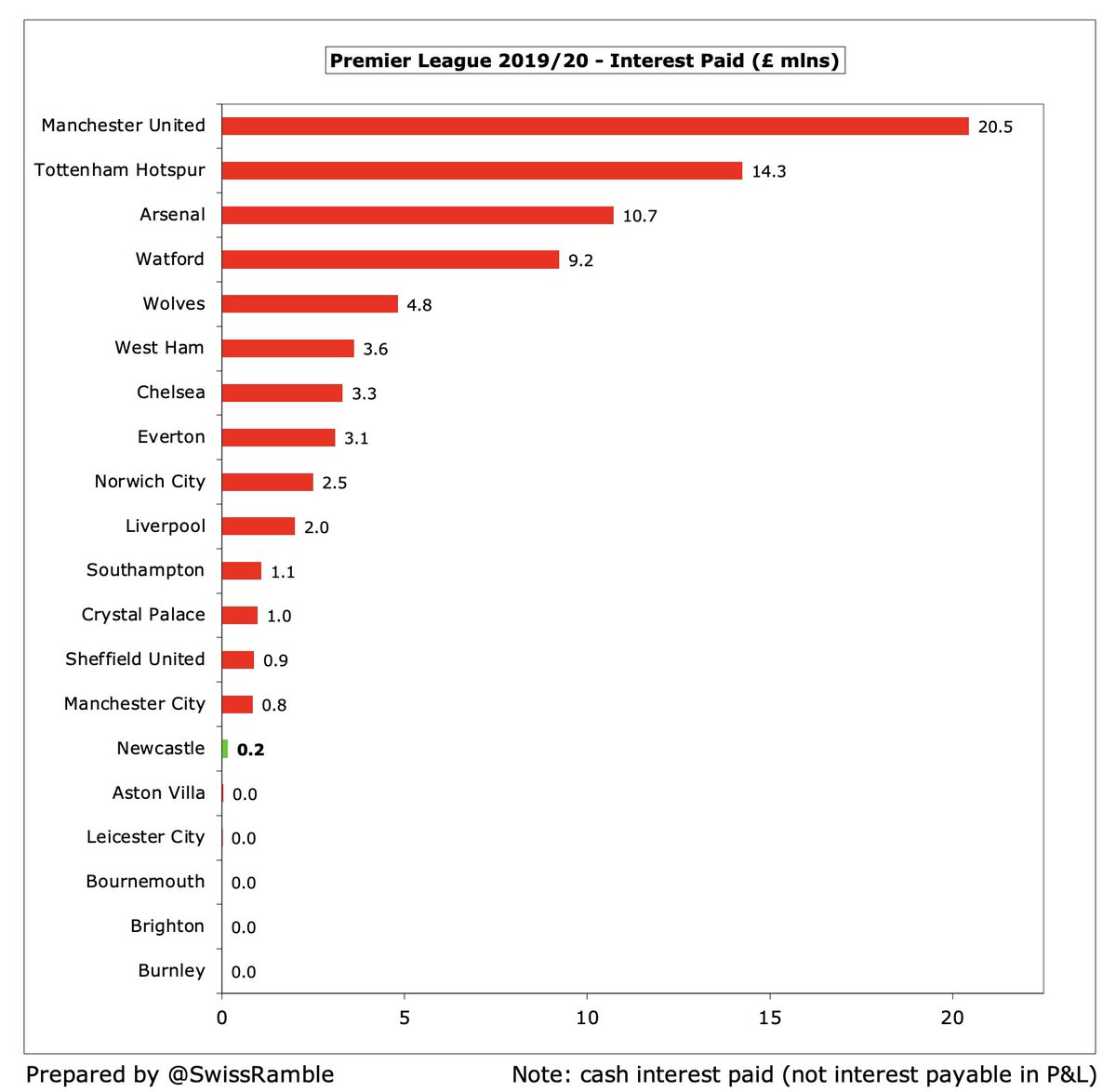

#NUFC only paid £160k interest, as Ashley’s loans are interest-free, far below #MUFC £20m, #THFC £14m and #AFC £11m. In fairness to Big Mike, the switch from external bank debt to owner financing has saved the club a lot of money in interest, which was as high as £8m in 2008.

#NUFC have managed to clear their transfer debt, reducing the amount owed from £12m to zero, which is the lowest (best) in the Premier League, e.g. #six clubs had more than £100 transfer debt, led by #AFC £154m, #MUFC £149m and #THFC £140m.

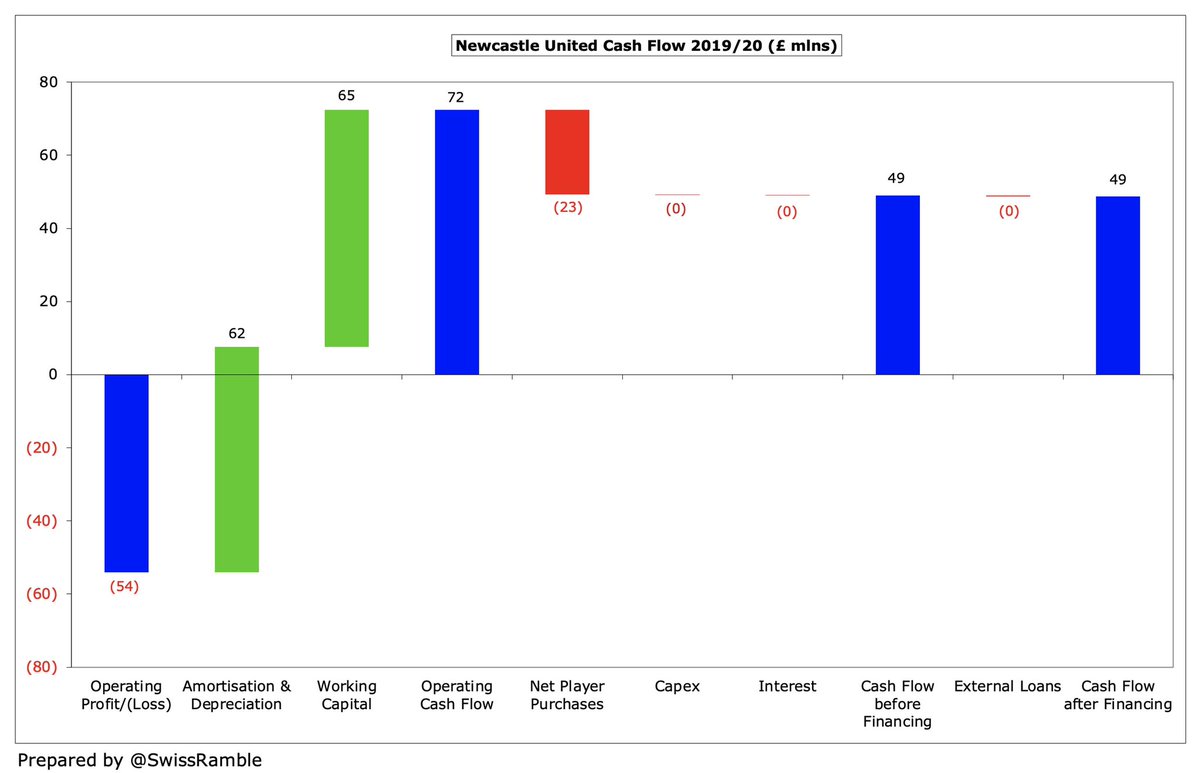

Despite £54m operating loss, #NUFC had £72m operating cash flow (adding back £62m amortisation/depreciation and £65m working capital movements), but then spent net £23m on players (purchases £83m, sales £60m) to give £49m net cash inflow.

#NUFC cash balance shot up from £22m to £63m, which is actually the 6th highest in the top flight, though the club emphasised that the accounting period extension meant that it included the 2020/21 advance payment of TV money from the Premier League, so it is a bit misleading.

During the Ashley era, #NUFC generated £236m from operations, boosted by his £111m loan. Most spent on the squad £187m, while £84m used to repay bank loan and make interest payments (mostly in the early years of his reign). Feeble £11m invested in infrastructure over 13 years.

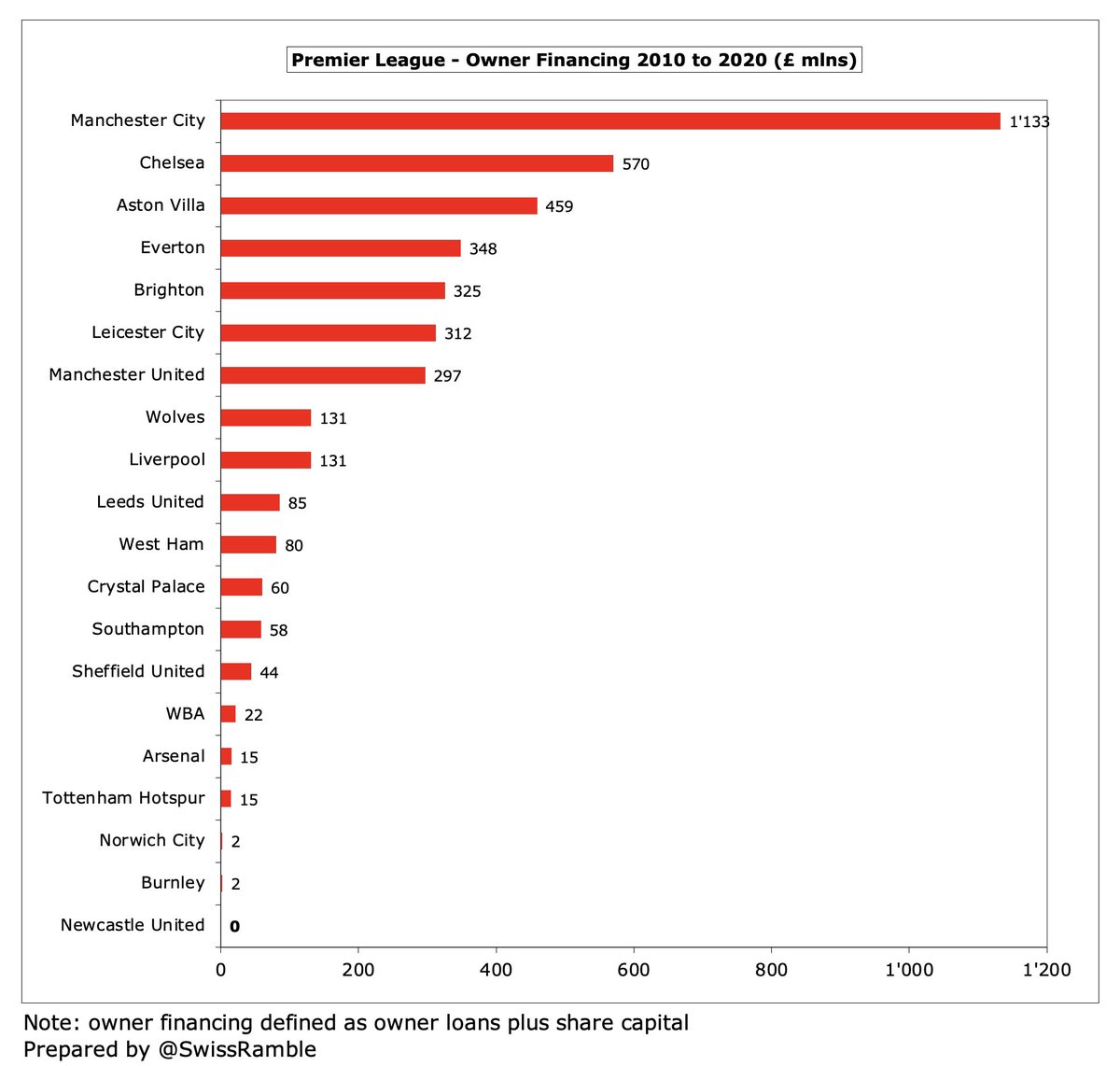

Looking at owner financing since 2010 (defined as owner loans plus share capital), #NUFC is the only club to have received a big fat zero. In stark contrast, owners have been far more generous than Ashley at #MCFC £1.1 bln, #CFC £570m, #AVFC £459m, #EFC £348m and #LCFC £325m.

#NUFC were approached a year ago by a consortium led by Saudi Arabia’s investment fund (plus the Reuben brothers and Amanda Staveley). However, the deal still awaits Premier League approval, which has been delayed due to alleged links between the Saudi government and TV piracy.

Although the possible #NUFC takeover rumbles on, a deal does not appear to be close. Ashley has demanded that the Premier League “finally accepts public scrutiny” which Newcastle fans will think is a trifle rich given their owner’s track record when it comes to transparency.

There is no doubt that Ashley has put #NUFC on a sound financial footing, though he can be criticised for under-investment and poor commercial performance. Big spending does not always deliver success, but a club of Newcastle’s resources should really be aiming higher.

The ultimate goal of a football club is not to make profits, but to challenge for trophies. At the very least, #NUFC should be capable of comfortably finishing in the top half of the table, though they appear to be in a state of limbo, exacerbated by the impact of the pandemic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh