The next 2 to 3 weeks for #BTC are going to be the most critical in determining bull market continuation. Here I explain the exact technical and Onchain confirmations I would like to see for bull market continuation.

Thread

👇👇👇

Thread

👇👇👇

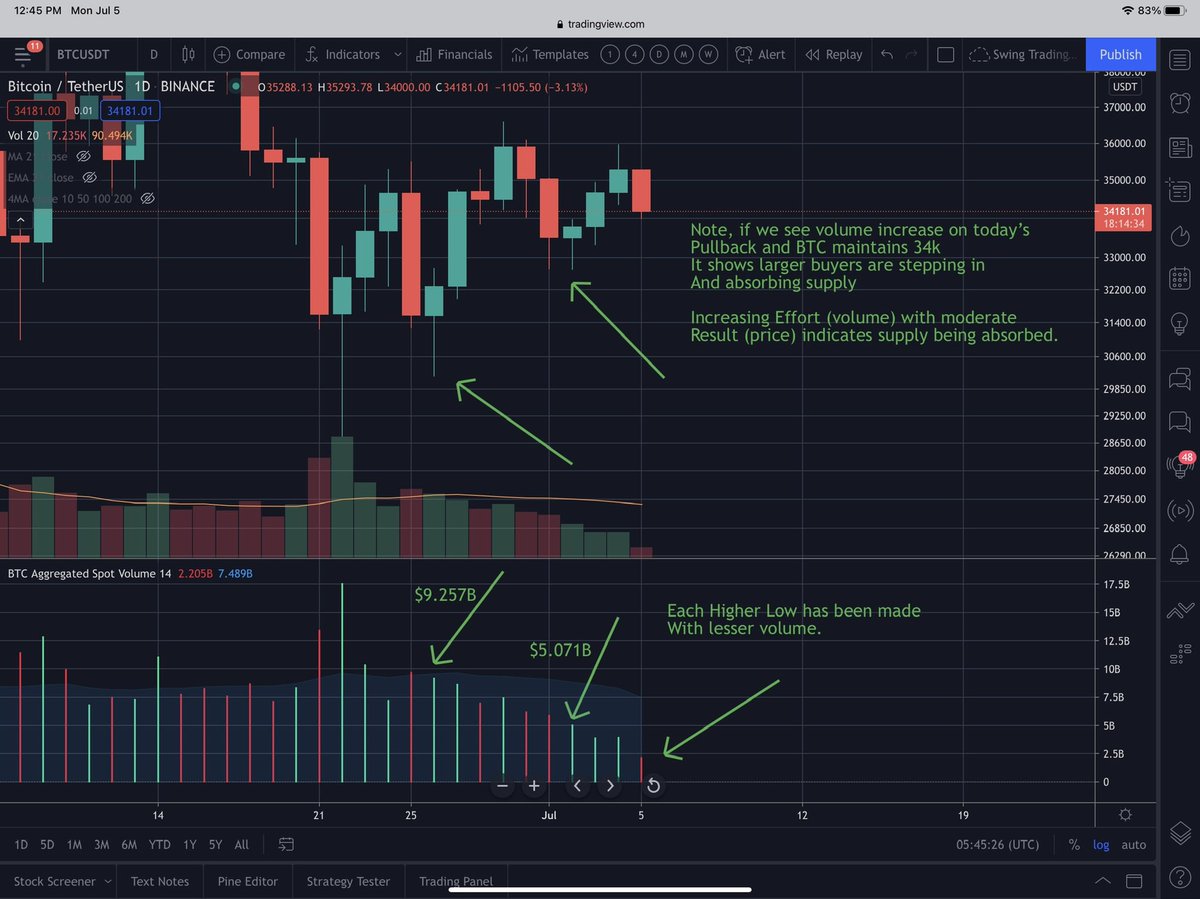

The first big step for #BTC is making a strong weekly close above the 21 week and 200 day MA. This will flash a very bullish technical buy signal, potentially causing a wave of capital to enter the market.

More importantly, after the first weekly close above major resistance at the 21 week and 200 day, we need to see follow through higher for the next 2 weeks, ideally breaking above 47k to 50k and entering the golden fib zone between 51.1k to 57.1k.

Previous bear markets that saw rallies up to the 200 day either saw resistance or a push above the 200 day and failure to follow through higher, leading to a break below the 200 day and lower lows. This is why I emphasize on the importance of follow through higher.

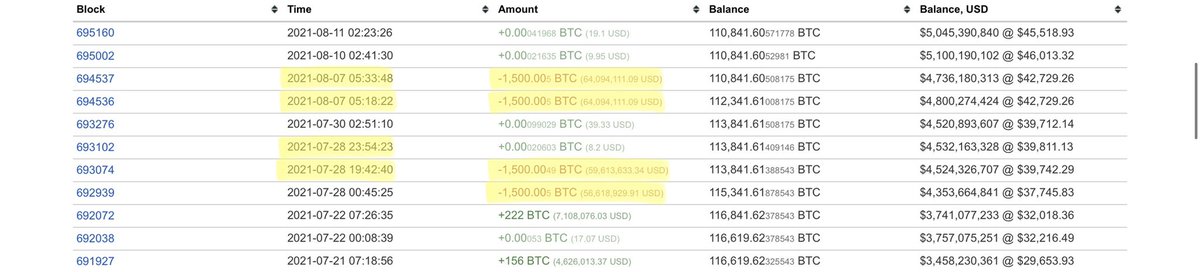

Whenever #BTC tests major resistance between 47k to 64k, I want to make sure Onchain is showing no signs of long term holders, large miners, and entities holding illiquid supply selling. If these cohorts start selling, the risk of a false breakout or downside increases.

Particularly in the next few weeks, if LTHs show little to no signs of selling this rally and technical breakout attempt, then I can see BTC pushing significantly higher, preparing to push towards 51.1k, 57.1k, and retesting ATHs at 64k. Supply exhaustion is a huge catalyst.

Near term I would like to see #BTC push above the local high at 46.7k, resistance at 46.8k, and start entering the realized price distribution zone between 47k to 50k.

We need to see spot buying continue and absorb any supply coming into the market from previous buyers looking to break even or realize small profits.

The quicker #BTC takes out this 47k to 50k zone, the more bullish the technicals will look. The next zone to enter will be 51.1k to 57.1k which has another area of realized price distribution. So expect some more supply to enter the market.

At this point if there’s any major bullish catalysts such as a public company announcing a major purchase of #BTC, or a sovereign fund buying, this can easily push price higher if sentiment is bullish.

As long as Onchain shows no signs of LTHs selling, price should continue pushing higher as #BTC has been deep in supply exhaustion.

If we get bullish buy signals from the weekly close above the 21 week and 200 day, follow through higher, momentum continues to strengthen with the longer term buy signals flashing, and Onchain remains strong, this should prepare #BTC to retest ATHs.

#BTC never had a parabolic blow off top, many Onchain indicators never reached previous bull market peaks, the accumulation has been very strong, record amounts of new users are entering the network, and the strong hands are not selling this rally.

I believe #BTC has completed a Wave 4 correction from 64k to 28.8k and is now entering Wave 5, likely sending BTC significantly higher into the Q4 2021 or early 2022.

This data suggests #BTC is still in a bull market, and now we just need price confirmation for bull market continuation.

The biggest risk is LTHs starting selling in largest amounts, pushing price below the 200 day, causing a false breakout and price falls back into the trading range. Or BTC pushed side ways for months, 21/40 has a bearish crossover.

The Onchain data suggests this is less likely, but always possible. This is why we have to monitor Onchain data and watch the technicals for confirmation and validation.

Make sure you have a plan and do not rely on emotions when making investment decisions.

I am bullish as long as the data supports my view. If we see major sell signals flashing on technicals and Onchain, then I will turn bearish.

Long term, given the strong fundamentals, I can see #BTC reaching significantly over $500k this decade. Maybe even $1 million if fiat continues to plummet and the world transitions to #BTC as the global reserve asset. I can’t find a better asset. Long #BTC

If you enjoy my analysis, make sure to follow me for more updates!

• • •

Missing some Tweet in this thread? You can try to

force a refresh