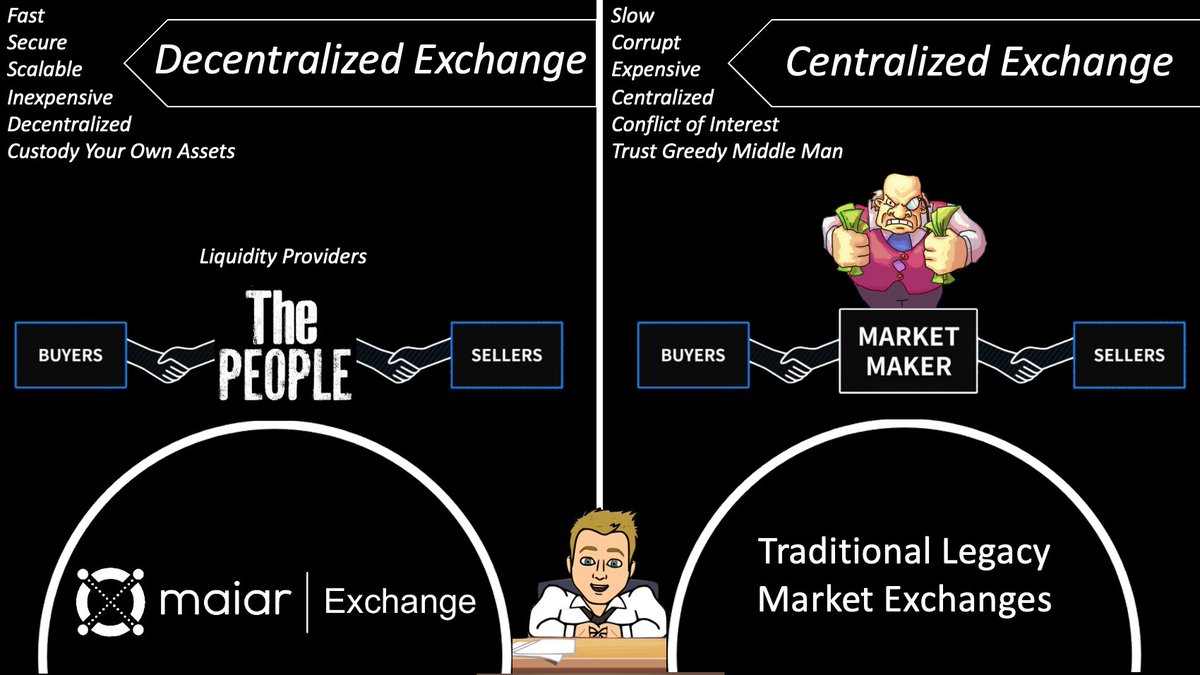

(1\27) Let’s discuss further about the #MaiarExchange as it nears its Official Launch $MEX $eGLD. The ability earn passive income is due to U the people getting to replace the greedy middleman.Powerful. Traditional Market Exchanges (CEX) have numerous problems #BTC #DeFi #Yield

(2\27)Groundbreaking elements of #DeFi has allowed new income streams to everyday individuals, leveraging #Blockchain.Tech Enthusiasts have experienced it. Thanks to #MaiarExchange & @getMaiar for the first time it will be accessible to the everyday person

https://twitter.com/WesleyBKress/status/1426987736154603525?s=20

(3\27)The ability to make money while U sleep is amplified, many have earned passive income by helping to secure @ElrondNetwork by #Staking The #MaiarExchange $MEX allows U to earn earn money normally reserved for #MarketMakers of Exchanges #PassiveIncome

https://twitter.com/WesleyBKress/status/1417907443187679236?s=20

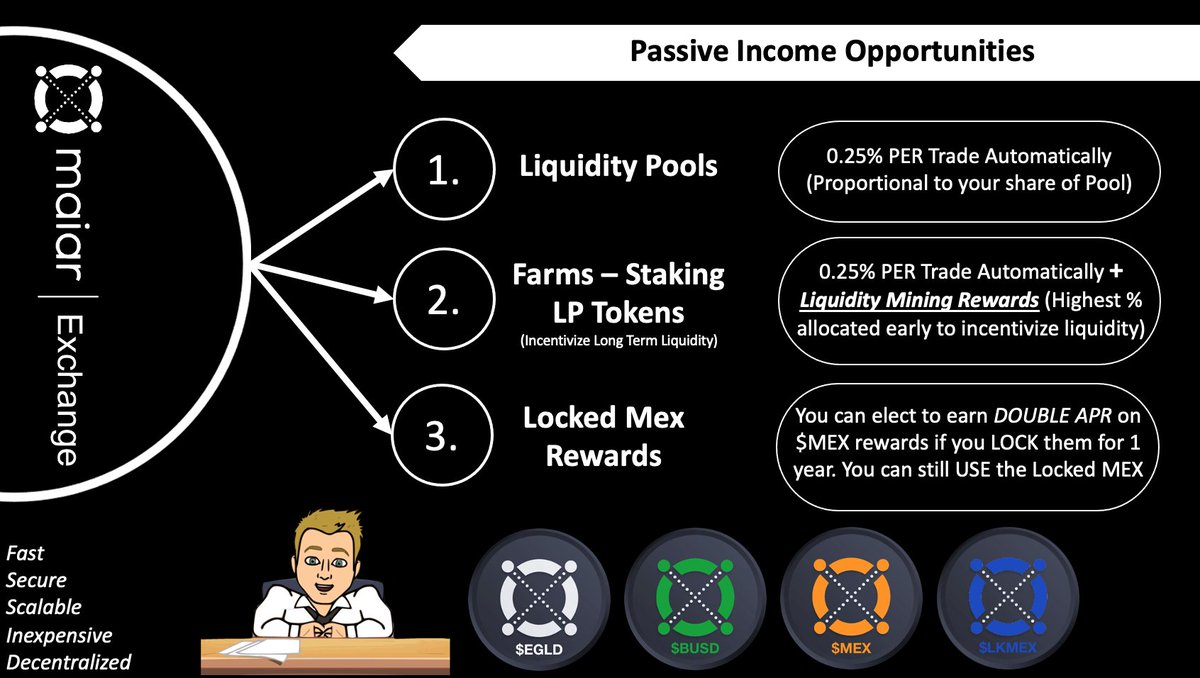

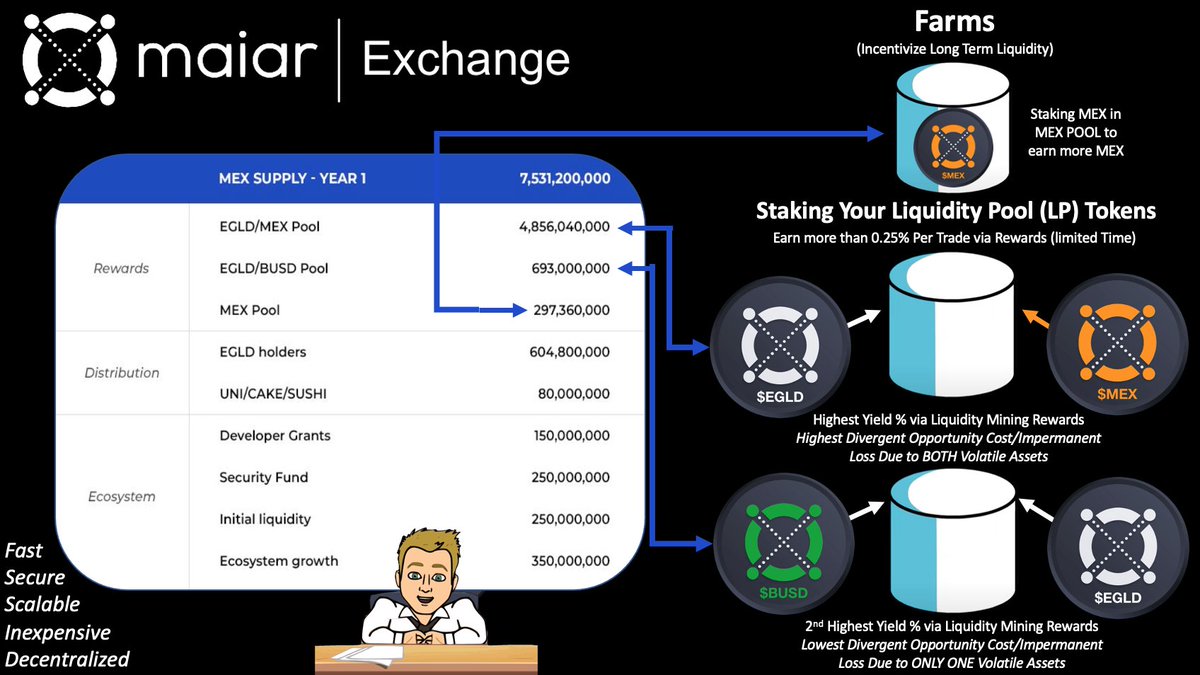

(4\27) With the #MaiarExchange there are 3 main ways of earning #PassiveIncome that would normally go to the Exchange or Market Makers. 1. Liquidity Pools 2. Farms (Staking LP Tokens) 3. Locked $MEX Rewards. Let’s discuss all three & what it looks like.

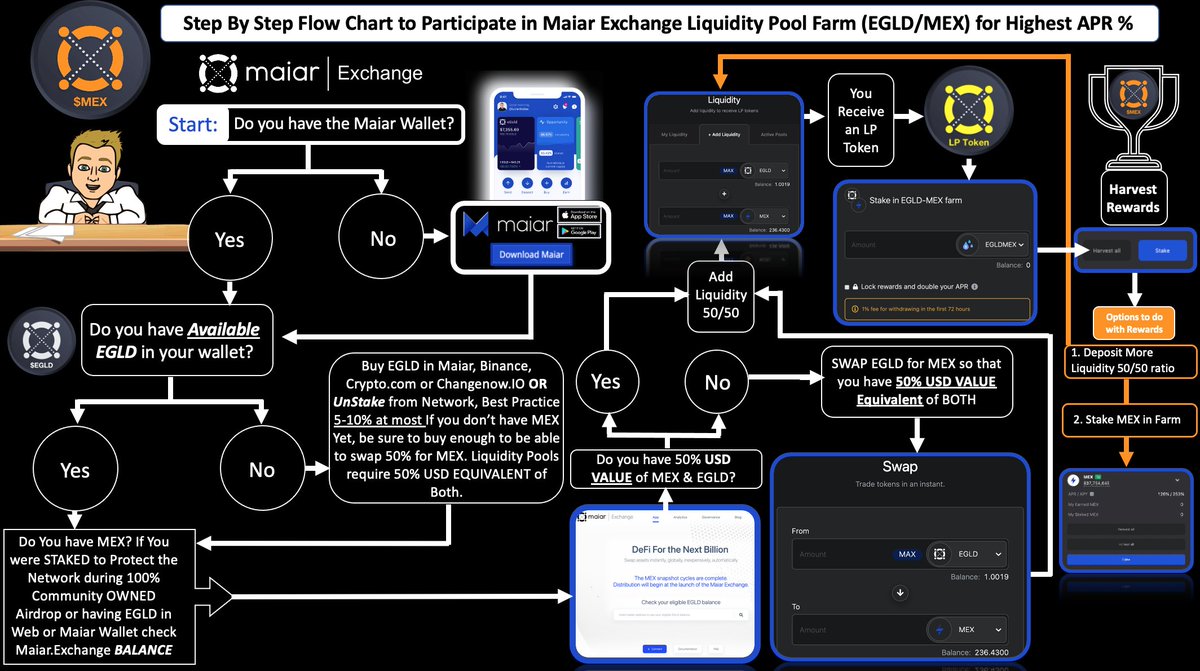

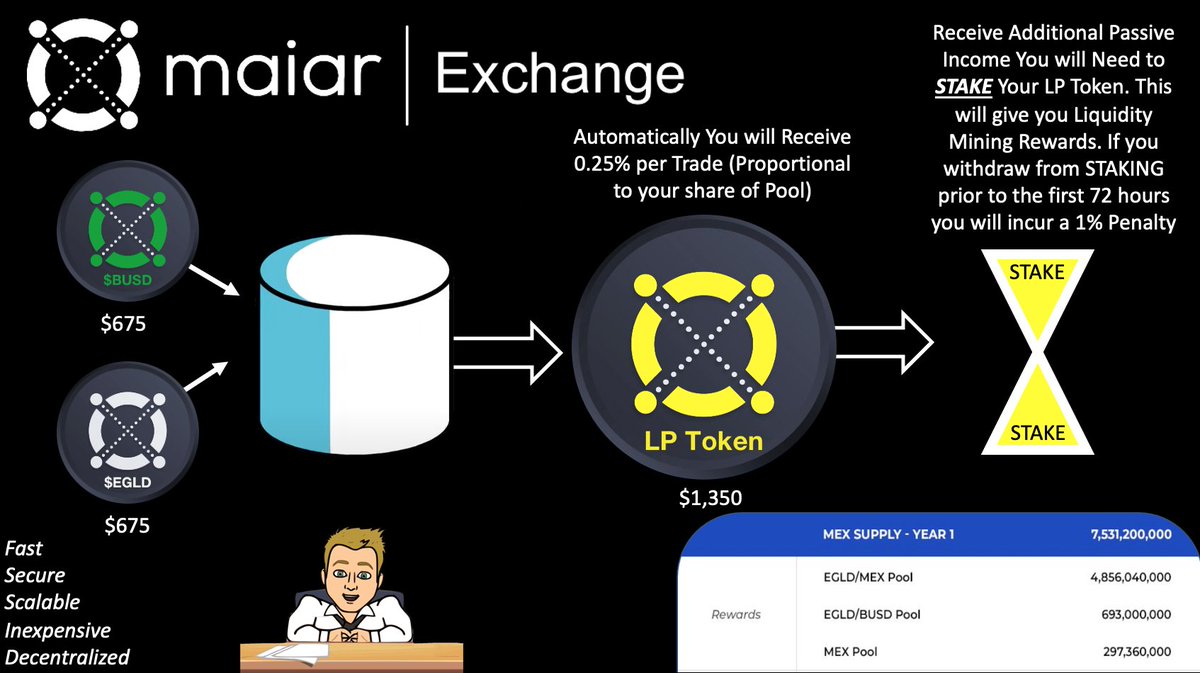

(5/27) 1. Liquidity Pools - Require you to put the exact $USD equivalent of each token. In this case it will be 2 token Pairs. $EGLD & $MEX AND $EGLD & $BUSD. You need 50% USD (6\27) equivalent of each. We don’t know $MEX price yet but we do know $eGLD & $BUSD

(6/27) will always be $1 per unit. So U have 5 $eGLD U want to add to the pool. If $eGLD is $135 U would need $675 $BUSD ($135 * 5 EGLD) to add to the pool. Total Value $1,350 ($675 worth of EGLD & $675 BUSD). You will then be given an LP Token that represents the TOTAL position.

(7\27) This will automatically enroll you in receiving 0.25% per trade (promotional to your share of the pool). For additional passive income you will need to STAKE via Farms.

2. Farms - R where U STAKE in the #MaiarExchange On top of the 0.25% you will receive LIQUIDITY MINING

2. Farms - R where U STAKE in the #MaiarExchange On top of the 0.25% you will receive LIQUIDITY MINING

(8\27) REWARDS the highest amount of rewards will go to the EGLD/MEX pair because it will have the highest divergent opportunity cost/Impermanent Loss due to both tokens being volatile.

(9\27) volatile. I have explained this relationship visually to help those understand better here, remember that it’s more about making less than losing money, unless both tokens fall in value:

https://twitter.com/WesleyBKress/status/1412287174624620545?s=20

(10\27) The next highest rewards goes to the EGLD/BUSD pool. Finally, the MEX pool.

3. Locked $MEX rewards: Is an additional passive income stream or an amplification more precisely of an existing stream. It allows you to earn 2X the $MEX rewards. That is DOUBLE the APR. If you

3. Locked $MEX rewards: Is an additional passive income stream or an amplification more precisely of an existing stream. It allows you to earn 2X the $MEX rewards. That is DOUBLE the APR. If you

(11\27) elect to earn in $LKMEX This is POWERFUL.

Important Tips & Insights (None of this is Financial Advice):

1. Typically if one chooses to provide liquidity it should be done for 6 months-12 months or longer. Withdrawing prematurely or early could mean that the rewards

Important Tips & Insights (None of this is Financial Advice):

1. Typically if one chooses to provide liquidity it should be done for 6 months-12 months or longer. Withdrawing prematurely or early could mean that the rewards

(12\27) don’t compensate you for the impermanent loss or the risk assumed, although this won’t be the case initially due to the rewards being front loaded. This means if one is going to try the Maiar Exchange one should do it from the START to maximize the returns. The rewards

(13\27) from the Liquidity Mining go down gradually over time but the 0.25% trade fee’s Income stays the same unless voted on via governance in the future.

2. Risk that one hears about on most other exchanges deal with networks that don’t have sufficient security & testing of

2. Risk that one hears about on most other exchanges deal with networks that don’t have sufficient security & testing of

(14\27) their Smart Contracts. Please see here for additional details on why the Elrond Network is the most secure network & uses state of the art testing with @rv_inc:

https://twitter.com/WesleyBKress/status/1425670784647786497?s=20Also @rv_inc has the ability to test the

(15\27) design of the economic protocols which is vial.

3. A few reflections on my end on the reason why I will be 100% participating in the Liquidity Pools & FARMS - STAKING. I feel very confident in both the network security & as well as the thorough testing they have done

3. A few reflections on my end on the reason why I will be 100% participating in the Liquidity Pools & FARMS - STAKING. I feel very confident in both the network security & as well as the thorough testing they have done

(16\27) on the Maiar Exchange. Also, more important the design & implementation of the economics is superbly well thought out. The 100% locked $MEX supply for the first 30 days & 90% for the rest of the 1 year period, completely takes away the fear of being RUG PULLED where

(17\27) someone dumps on the market. This can’t happen. Again, Elrond thinking long term & helping to risk manage & protect the community. Also, they greatly incentivize the rewards are paid in Locked MEX by paying DOUBLE THE APR, one would have be outside of their mind not to

(18\27) participate in that, especially considering all the other stabilizing incentives built in. The Maiar Exchange feels & performs like a Fortune 500 company releasing a product not John down the street who just learned coding & has minimal to zero understanding of

(19\27) economics.

4. Risk manage your size of your total position to be allocated to Liquidity Pools. Conservatively speaking I wouldn’t use over 5-10% of my $eGLD that is staked with the network. Some will use more, nothing is wrong with that. I am conservative & highly

4. Risk manage your size of your total position to be allocated to Liquidity Pools. Conservatively speaking I wouldn’t use over 5-10% of my $eGLD that is staked with the network. Some will use more, nothing is wrong with that. I am conservative & highly

(20\27) recommend risk management, protect your downside & the upside will take care of itself. This is especially true when it has built in upside (YIELD) & the power of compound interest. If one wants to be more aggressive they can in theory mitigate their risk by allocating

(21\27) to the EGLD/MEX pool & don’t lock the rewards until you have received minimum of 50% of your initial position & purchased $EGLD to then be restocked with the NETWORK. This would allow you essentially risk freely enjoy the rewards from the LP & staking with now ZERO

(22\27) impermanent loss risk.

The Maiar Exchange is powerful as it allows for the first time small fish or individuals to participate in Liquidity Pools, Yield Farming due to both the low fee’s & world class intuitive & simplistic @getmaiar app. All with the best security,

The Maiar Exchange is powerful as it allows for the first time small fish or individuals to participate in Liquidity Pools, Yield Farming due to both the low fee’s & world class intuitive & simplistic @getmaiar app. All with the best security,

(23\27) economic & well tested Smart Contract eco-system. Also the power of the Maiar Exchange DEX is that it’s a start to allow the everyday person who has been exploited on a continual basis by the entire Financial Industry to have a system designed for your best interest. If

(24\27) one does a simple search they will see the Banks constantly use corruption & exploitation, the cost of doing business is some lawsuits, no big deal.

https://twitter.com/WesleyBKress/status/1419692057052864513?s=20It’s to immediately start to write the wrongs of the

(25\27) #GameStop debacle where the people were exploited by RobinHood & Citadel because for once the HOUSE was losing. Only the insiders win at least without taking insane risk. And congress being able to stop them? HA. See this video:

https://twitter.com/Forbes/status/1362464656590311427?s=20

(26\27) that is all it’s a video of smoke & mirrors. We all saw this same “video” after the Financial Crisis. Nothing has changed. The famous old adage is true: “The Secret of Change Is To Focus All of Your Energy, Not..

(27\27) On Fighting The Old, But On Building The New” - Socrates The @ElrondNetwork $eGLD is leading the way & ready to facilitate crossing the Technological Chasm towards #MassAdoption.

https://twitter.com/WesleyBKress/status/1409144776222396418?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh