#Bitcoin after the Halving

Jul. 25, 2021

439 days after the 3rd halving

#BTC at $34,043

We are finishing this week with:

🟧 BTC bouncing back on the $30,000 level.

🟧 But still stuck in the 2nd longest drawdown in a post-halving market.

... (1/5)

Jul. 25, 2021

439 days after the 3rd halving

#BTC at $34,043

We are finishing this week with:

🟧 BTC bouncing back on the $30,000 level.

🟧 But still stuck in the 2nd longest drawdown in a post-halving market.

... (1/5)

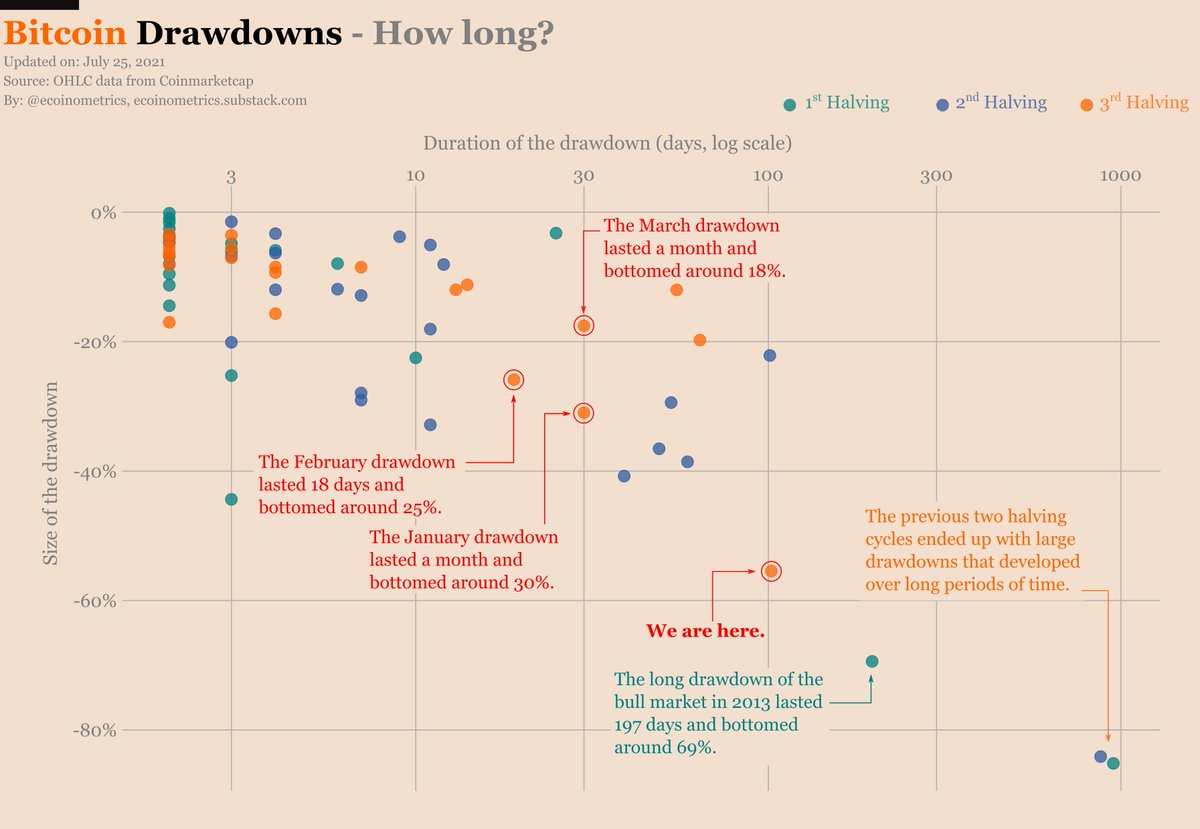

Indeed this #Bitcoin drawdown:

🟧 Now lasted 103 days.

🟧 Bottomed at -55% from the ATH.

🟧 Has been caught in a relatively low volatility environment since then.

... (2/5)

🟧 Now lasted 103 days.

🟧 Bottomed at -55% from the ATH.

🟧 Has been caught in a relatively low volatility environment since then.

... (2/5)

So while it is nice to see #BTC on the uptrend for the last few days it could still take a while for a new parabolic move to develop.

Remember than the massive drawdown of 2013 lasted 200 days... (3/5)

Remember than the massive drawdown of 2013 lasted 200 days... (3/5)

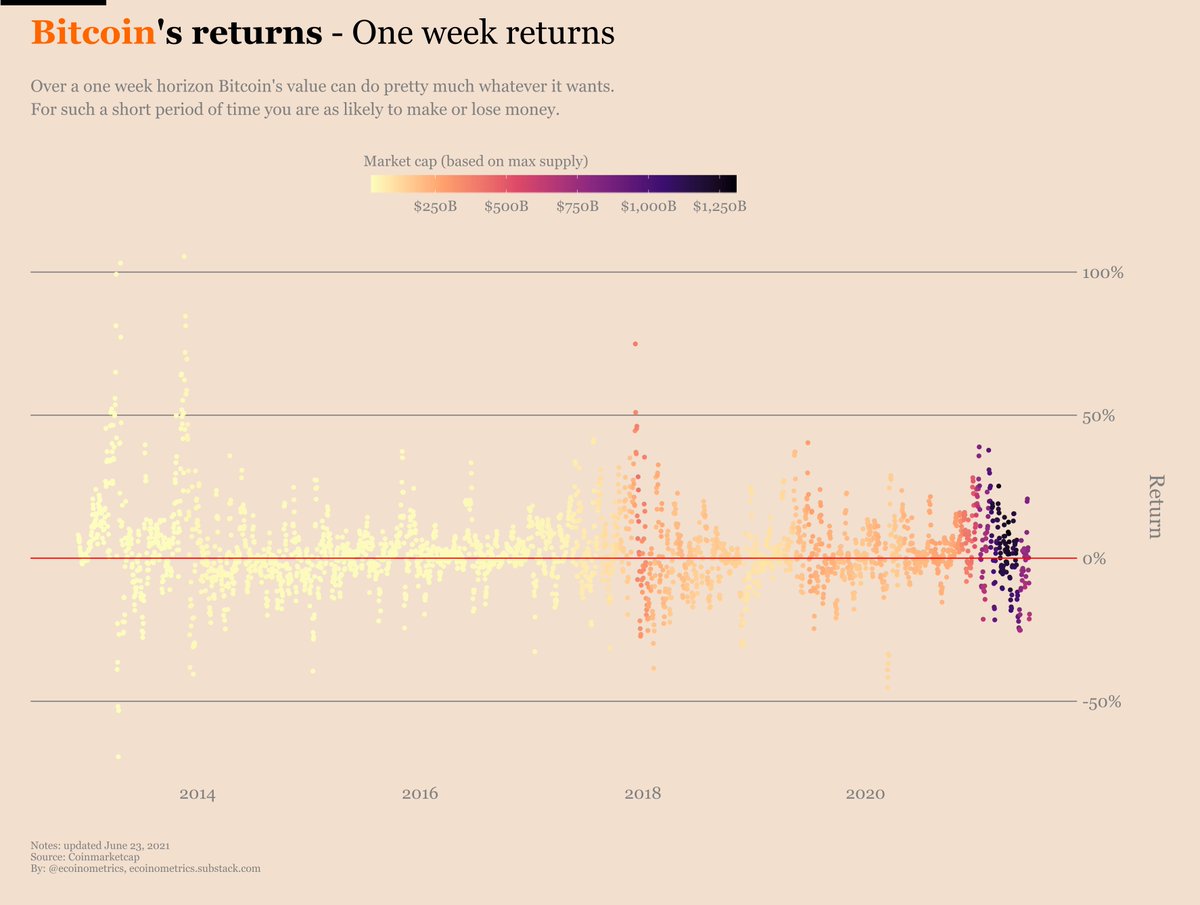

... and with volatility still on the downtrend it is less likely (although not impossible) for the price to jump suddenly... (4/5)

So probably the best thing to do now is do like everyone else: stack sats.

Play the long game and accumulate slowly but surely.

This is what most of people are doing these days according to #Bitcoin on-chain data. (5/5)

Play the long game and accumulate slowly but surely.

This is what most of people are doing these days according to #Bitcoin on-chain data. (5/5)

• • •

Missing some Tweet in this thread? You can try to

force a refresh