Inflation is running hot. Even the Fed cannot deny that.

Now the big debate seems to be whether or not inflation is going to be transitory.

But the real question is: if prices never go down, does it really matter?

Big 🧵👇 [1/22]

Now the big debate seems to be whether or not inflation is going to be transitory.

But the real question is: if prices never go down, does it really matter?

Big 🧵👇 [1/22]

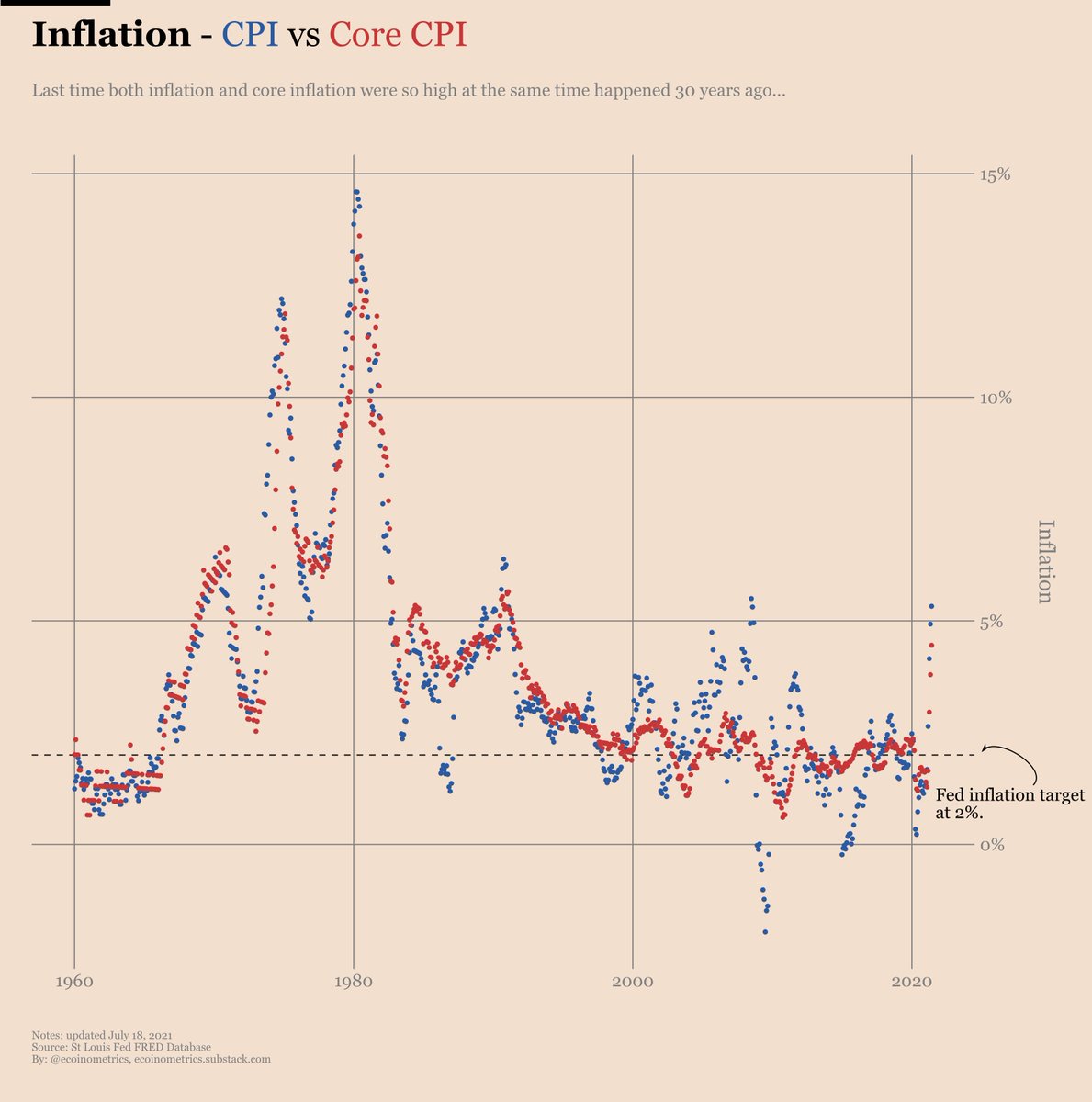

The Fed is aiming for a 2% average inflation rate. But the latest June numbers are:

🟥 Core inflation +4.5%

🟥 Headline inflation +5.4%

Last time those two were so high together was 30 years ago… [2/22]

🟥 Core inflation +4.5%

🟥 Headline inflation +5.4%

Last time those two were so high together was 30 years ago… [2/22]

As a reminder, core inflation is calculated by removing some of the most volatile components of the CPI.

So when both core inflation and headline inflation are going parabolic together, you know there is an issue... [3/22]

So when both core inflation and headline inflation are going parabolic together, you know there is an issue... [3/22]

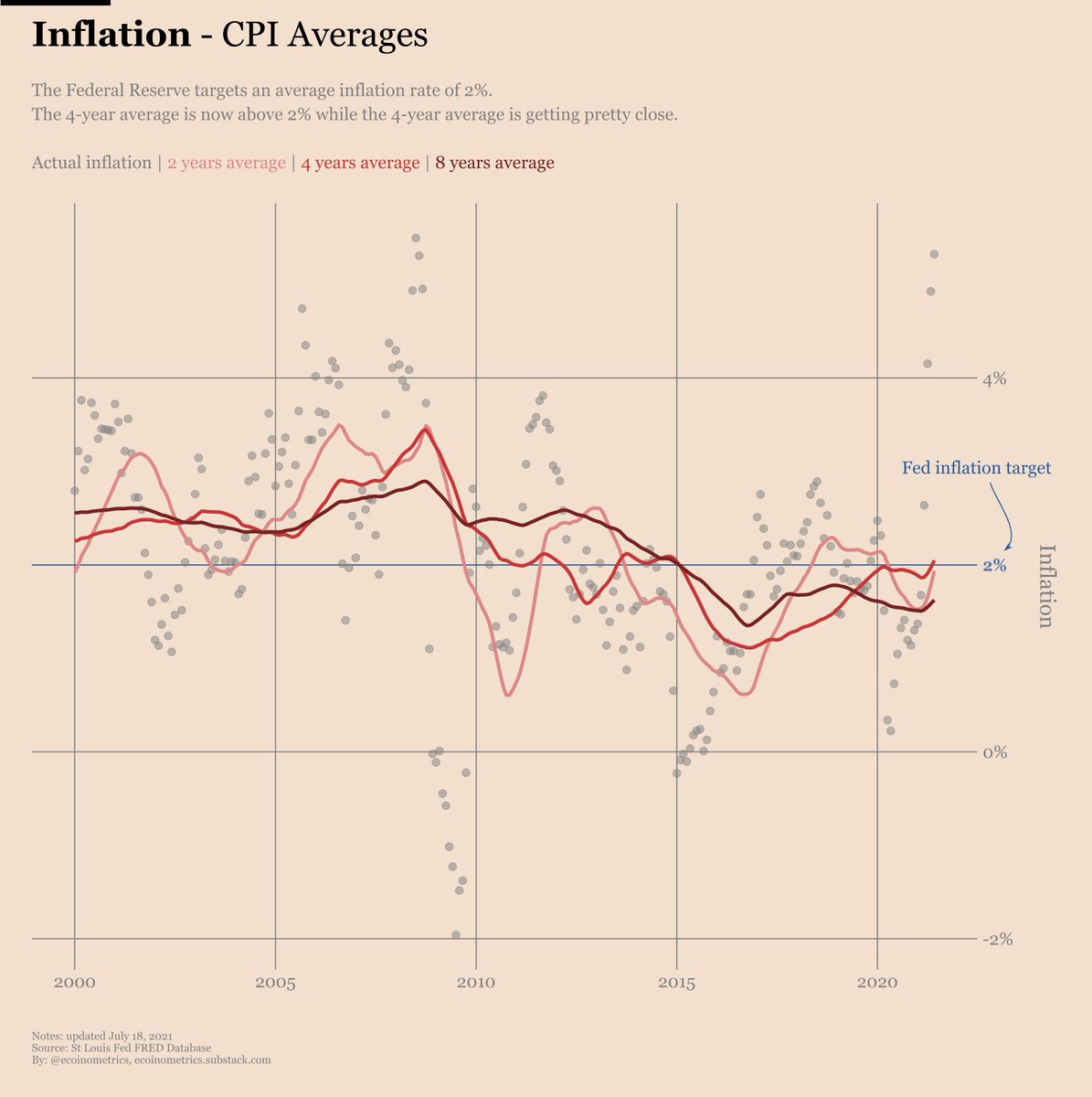

Now with inflation running hot for a while now we are starting to see some effect on those averages the Fed cares about.

For those keeping score at home:

... 👇 [4/22]

For those keeping score at home:

... 👇 [4/22]

🟥 The 2-year average core inflation is above 2%.

🟥 The 4-year average core inflation is above 2%.

🟧 The 8-year average core inflation is just below 2%.

... [5/22]

🟥 The 4-year average core inflation is above 2%.

🟧 The 8-year average core inflation is just below 2%.

... [5/22]

Of course the big debate is whether or not inflation is transitory.

But what do we really mean by that? What does inflation actually measures?

The US Bureau of Labor Statistics tracks the price of a basket of items at regular time intervals... [7/22]👇

But what do we really mean by that? What does inflation actually measures?

The US Bureau of Labor Statistics tracks the price of a basket of items at regular time intervals... [7/22]👇

A weighted average is then assembled from those to form a price index. That’s the CPI and its various sub-categories.

Once you have your price index, the inflation rate is defined to be the year-over-year change of this price index... [8/22]

Once you have your price index, the inflation rate is defined to be the year-over-year change of this price index... [8/22]

So when economists are talking about transitory inflation they don’t mean “prices are rising now but don’t worry they will fall back down later”.

Nope. What they mean is that prices are rising fast now but later they will rise… well… less fast.

Life won't get cheaper! [9/22]

Nope. What they mean is that prices are rising fast now but later they will rise… well… less fast.

Life won't get cheaper! [9/22]

Actually of the 12 main CPI categories tracked by the BLS, 9 are already above their pre-pandemic level! [10/22]

And this is not specific to 2020. Since 2000 almost everything has gotten significantly more expensive, from medical care which more than doubled to food and housing costs which are up more than 50%. [11/22]

Now over the short term some items will surely see their price fall, most likely in commodities and transportation as those tend to be more cyclical.

But categories that are less tied to supply/demand dynamics tend to see only price increases.

Check it out. [12/22]

But categories that are less tied to supply/demand dynamics tend to see only price increases.

Check it out. [12/22]

So keeping that in mind the transitory camp might cry victory sometime in the next few months.

But that won’t mean life is getting cheaper!

Ok, so that’s for the real economy. But what do financial markets think about that? [13/22]

But that won’t mean life is getting cheaper!

Ok, so that’s for the real economy. But what do financial markets think about that? [13/22]

With an inflation rate above 5% (and climbing) you might have guessed that bond investors would be shaking their fist in the air, dumping their 10-year notes and demand higher rates.

But nope… [14/22]

But nope… [14/22]

That means bond holders apparently do not care that the purchasing power of their bonds is melting away with inflation.

This is puzzling… 🤔

Three possibilities... [15/22] 👇

This is puzzling… 🤔

Three possibilities... [15/22] 👇

1⃣Maybe they do care. But the Fed owns a big enough chunk of the bonds market that it distorts what would happen in a more “free” market. [16/22]

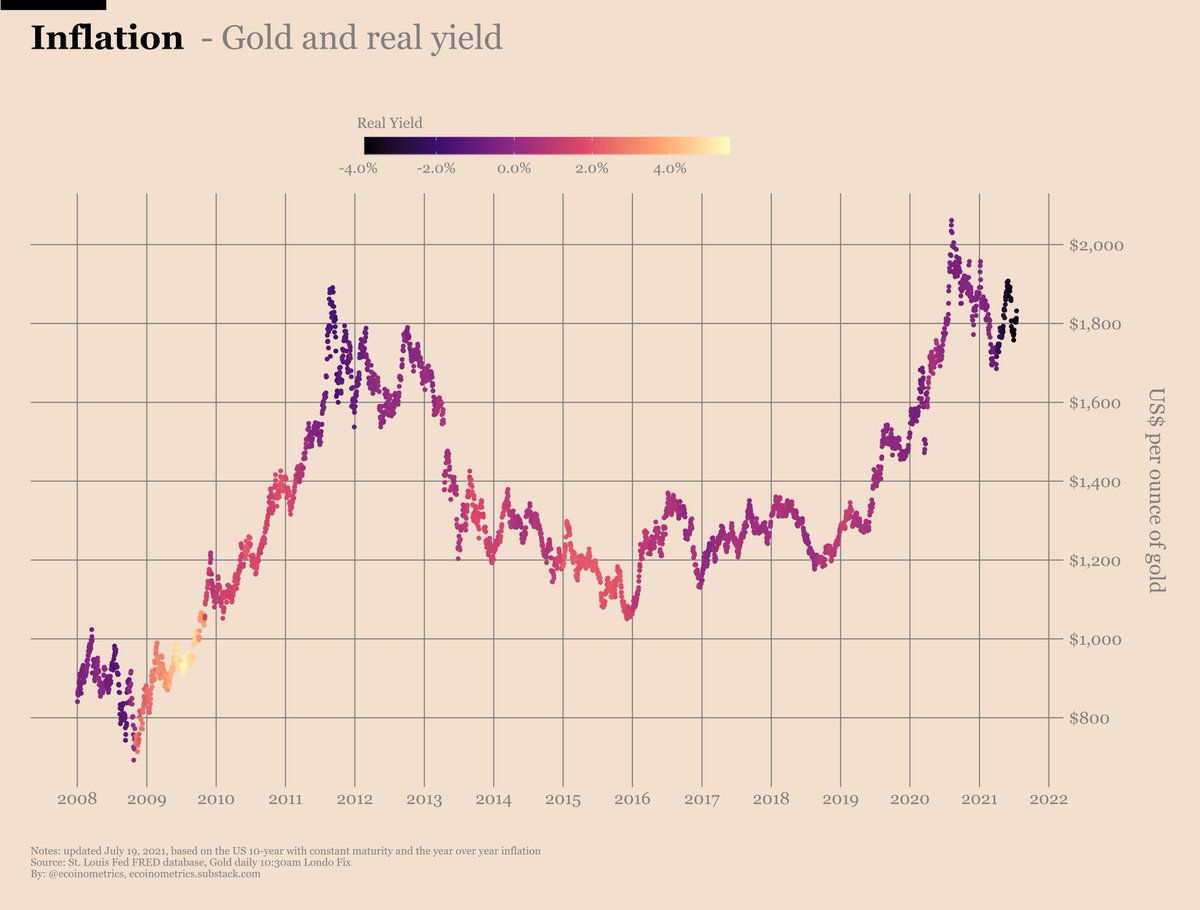

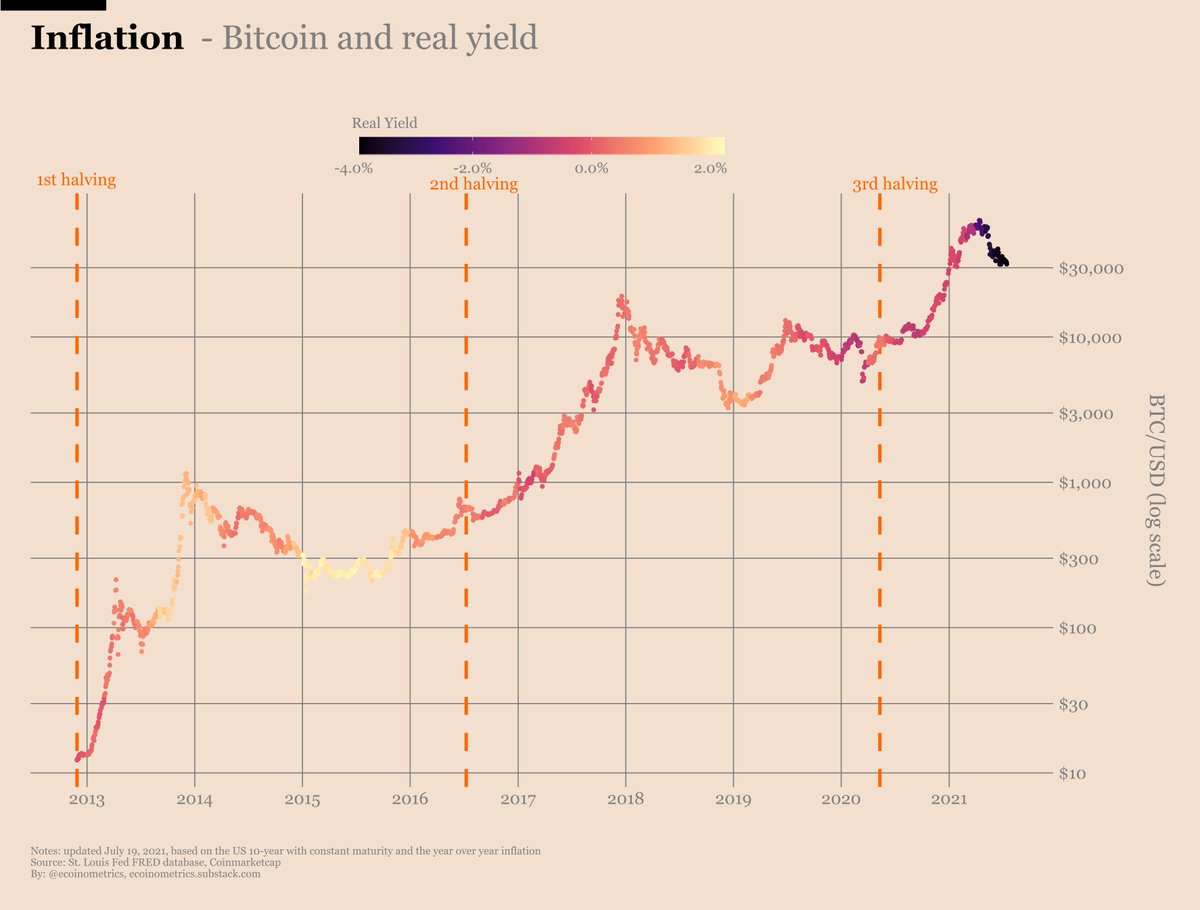

2⃣Maybe they do care. But they see alternatives as more risky. After all, the stock market is very expensive by many measures. And even though negative real yields are attractive for assets like gold and Bitcoin, they could be worried about a market crash. [17/22]

3⃣Maybe they actually don’t care. They might be onboard with the Fed's reasoning. Inflation is transitory, we’ll be back below 2% in no time... [18/22]

Honestly I don’t know which scenario is most plausible. But the risk is rising that at some point inflation could become an issue.

If the divergence between inflation and bond rates continues to be high, betting on gold and #Bitcoin seems like a good idea. [19/22]

If the divergence between inflation and bond rates continues to be high, betting on gold and #Bitcoin seems like a good idea. [19/22]

Historically when the real yield falls to negative territories gold tends to follow with a big rally.

We have moved into very negative real yield territory but we have yet to see a big rally this year.

So a parabolic move could be in the making. [20/22]

We have moved into very negative real yield territory but we have yet to see a big rally this year.

So a parabolic move could be in the making. [20/22]

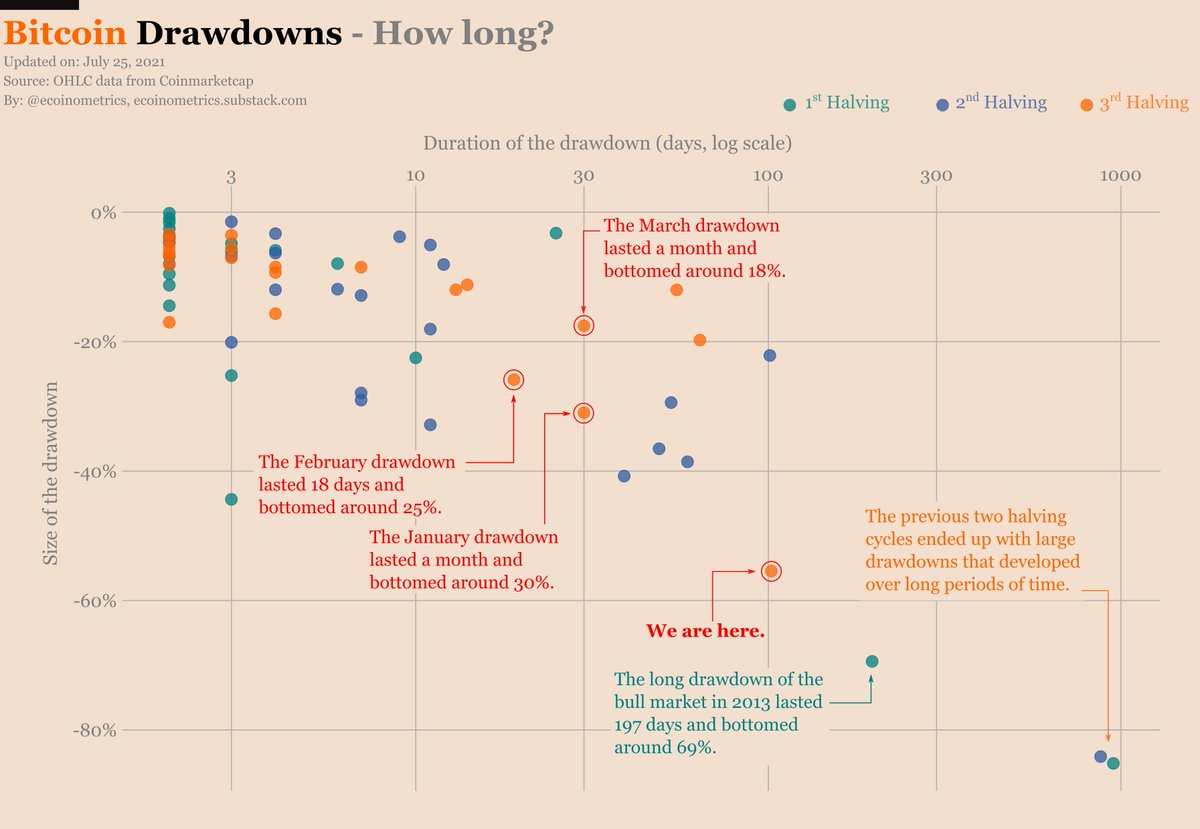

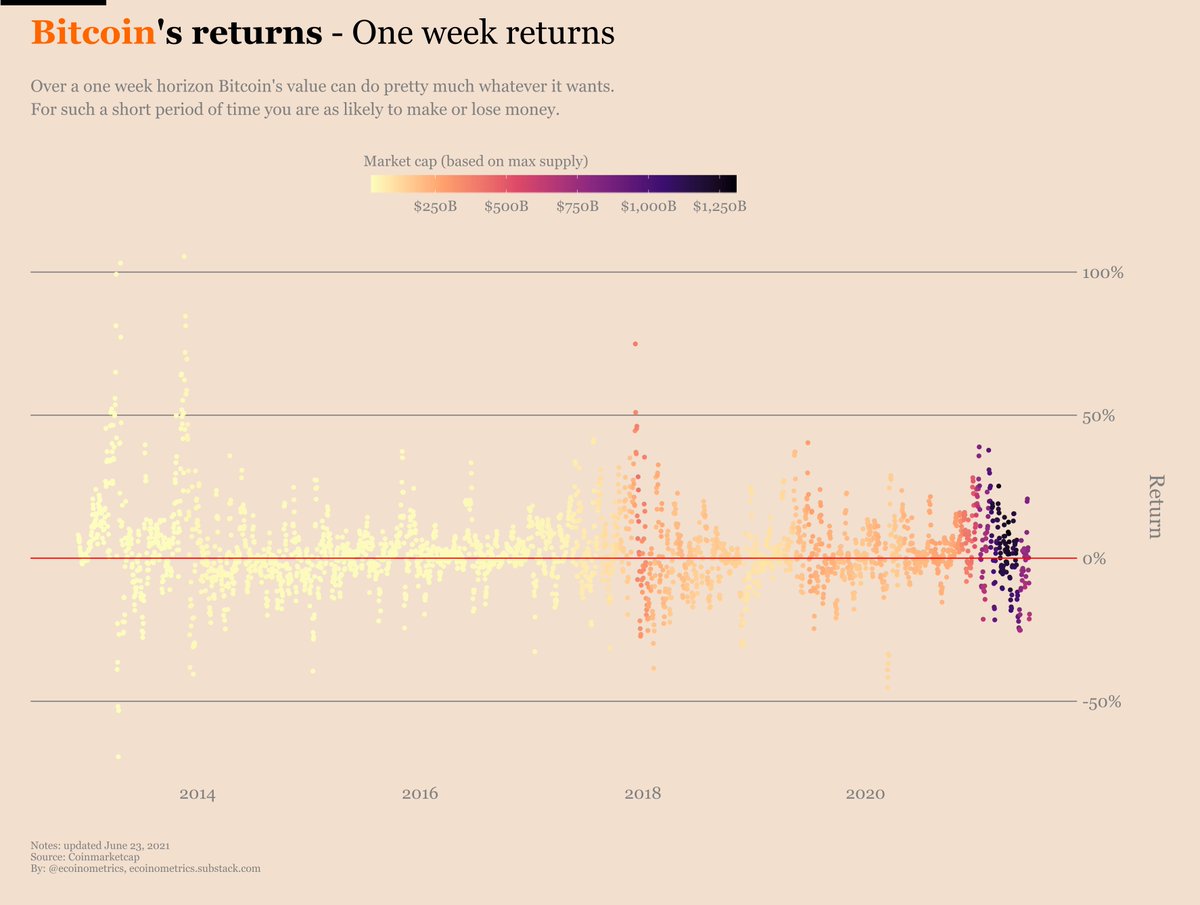

#Bitcoin itself tends to be uncorrelated to the real yield.

But a negative real yield environment created by high inflation is good for the narrative.

With the price already depressed some investors might decide to bet on Bitcoin rather than gold as a store of value. [21/22]

But a negative real yield environment created by high inflation is good for the narrative.

With the price already depressed some investors might decide to bet on Bitcoin rather than gold as a store of value. [21/22]

But all this will depends on how the Federal Reserve decides to deal with rates and inflation. So we'll see. 🤷♂️

Meanwhile if you want to stay up to date on this story there is only one thing to do, subscribe to the Ecoinometrics newsletter. 👇🙏 [22/22]

ecoinometrics.substack.com

Meanwhile if you want to stay up to date on this story there is only one thing to do, subscribe to the Ecoinometrics newsletter. 👇🙏 [22/22]

ecoinometrics.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh