1/ In 2021, most investors are unwilling to touch energy companies.

I think this is a big mistake.

Why?

Like it or not, we will be using fossil fuels for decades to come.

How can value investors use this to their advantage?

I think I found a company that can deliver. 🧵 🛢️

I think this is a big mistake.

Why?

Like it or not, we will be using fossil fuels for decades to come.

How can value investors use this to their advantage?

I think I found a company that can deliver. 🧵 🛢️

2/ Quick Disclaimer❗

I am an ardent supporter of green energy, and would love to see fossil fuels phased out.

It is no doubt the future.

I truly think it is the future and that in the long run, electrification and renewables will dominate the energy landscape...eventually.

I am an ardent supporter of green energy, and would love to see fossil fuels phased out.

It is no doubt the future.

I truly think it is the future and that in the long run, electrification and renewables will dominate the energy landscape...eventually.

3/ However, thanks to fossil fuels, we have an abundance of food thanks to gas-produced fertilizers, high/low tech plastic gadgets, and quick and efficient delivery of the goods to your local supermarket.

They are ingrained into our modern lives whether we like it or not.

They are ingrained into our modern lives whether we like it or not.

3/ Let’s looks objectively at the energy sector prospect.

Will oil demand go to zero in a decade or so?

Hardly.

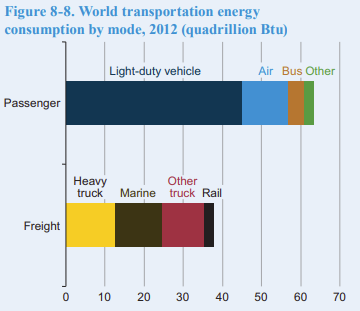

Even in transportation, more than 60% of oil demand is not for cars, but for planes, buses, trucks, ships, or even rail.

Will oil demand go to zero in a decade or so?

Hardly.

Even in transportation, more than 60% of oil demand is not for cars, but for planes, buses, trucks, ships, or even rail.

4/ I cannot cover the discussion about the future of fossil fuels usage in this thread.

But if you want to learn more about this topic, I recommend this excellent report from @LynAldenContact that was part of what triggered my interest on the sector.

lynalden.com/oil-and-gas/

But if you want to learn more about this topic, I recommend this excellent report from @LynAldenContact that was part of what triggered my interest on the sector.

lynalden.com/oil-and-gas/

5/ Energy Sector 🛢️

The energy sector is usually split into three segments: Upstream, Midstream, and Downstream.

The energy sector is usually split into three segments: Upstream, Midstream, and Downstream.

6/ Upstream: these are the oil and gas producers, the ones drilling and producing it

Midstream: transporting the petroleum products, usually in pipelines.

Downstream: the refineries transforming the energy into final products, like gasoline, jet fuel, or plastic components.

Midstream: transporting the petroleum products, usually in pipelines.

Downstream: the refineries transforming the energy into final products, like gasoline, jet fuel, or plastic components.

7/ Midstream companies are different from the rest.

They make their money not from the oil and gas price, but from the volume transiting in their pipelines.

As long as people drive cars and need electricity, they are in business.

Part real estate, part energy.

They make their money not from the oil and gas price, but from the volume transiting in their pipelines.

As long as people drive cars and need electricity, they are in business.

Part real estate, part energy.

8/The more I researched the topic, the more I was convinced of the general idea of the energy sector, and midstream companies in particular.

But this still left me to narrow it down to a specific target.

So here was my list of criteria:

But this still left me to narrow it down to a specific target.

So here was my list of criteria:

9/ US-based to reduce geopolitical risk

Large enough to operate at scale and manage the growing regulatory burden

Manageable debt

History of responsible capital spending and cash distribution to shareholders

Low exposure to crude transportation

Large enough to operate at scale and manage the growing regulatory burden

Manageable debt

History of responsible capital spending and cash distribution to shareholders

Low exposure to crude transportation

10/ $EPD turned out to be the winner.

$EPD manages 50,000 miles of pipeline transport all types of energy products.

These pipelines connect together gas fields, 22 natural gas processing facilities, and 23 fractionators, as well as very large storage facilities.

$EPD manages 50,000 miles of pipeline transport all types of energy products.

These pipelines connect together gas fields, 22 natural gas processing facilities, and 23 fractionators, as well as very large storage facilities.

11/ The bulk of $EPD business is with natural gas and Natural Gas Liquids (NGLs), with the rest is split between petrochemicals (14%) and crude oil (21%).

This is perfect in my opinion, as I am still not sure if shale oil will ever be a really profitable.

This is perfect in my opinion, as I am still not sure if shale oil will ever be a really profitable.

12/ Management seems top-notch, with many of them in the company for a decade.

The business is simple to operate, as long as management is does not overstretch with debt or acquisitions.

The company keeps collecting fees as long as power plants and refineries need NGLs.

The business is simple to operate, as long as management is does not overstretch with debt or acquisitions.

The company keeps collecting fees as long as power plants and refineries need NGLs.

13/ Historically, the company has expanded with a mix of acquisitions and building new facilities.

It seems that with the sector largely consolidated or in strong private hands like Berkshire Energy, any future growth will come from building.

It seems that with the sector largely consolidated or in strong private hands like Berkshire Energy, any future growth will come from building.

14/ $3B of projects are under construction, most of it in the petrochemical segment.

The sector is only 14% of $EPD's gross margin, so I assume this is the area where there is room to grow.

This is also the least susceptible to disruption from and electrification renewables.

The sector is only 14% of $EPD's gross margin, so I assume this is the area where there is room to grow.

This is also the least susceptible to disruption from and electrification renewables.

15/ $EPD has made $32B in sales in 2020, with a consistently growing gross profit margin over the last 10 years.

Despite that, the stock price has gone nowhere for most of the decade, before being hammered by covid and recovering recently.

Despite that, the stock price has gone nowhere for most of the decade, before being hammered by covid and recovering recently.

16/ This means that the P/E ratio of the company has declined strongly, from 32 in 2012 to just 12-13 today.

17/ $EPD has an impressive track record of cash distribution to its shareholders.

22 years of continuous growth in distribution, mixed between dividends and buybacks.

Buybacks have been smartly used, mostly at the moment the company stock was very depressed.

22 years of continuous growth in distribution, mixed between dividends and buybacks.

Buybacks have been smartly used, mostly at the moment the company stock was very depressed.

18/ Dividends have grown slowly but steadily, and dividend yields have oscillated between 6-15% for the last 10 years.

The possible upside of the stock price is a nice bonus if it happens, but the dividend yield is the base return expected by the shareholders.

The possible upside of the stock price is a nice bonus if it happens, but the dividend yield is the base return expected by the shareholders.

19/ The amount debt is significant, no less than $32B.

Half of $EPD debt is due in >30 years, and 83% of the total debt is due in <10.

The average cost of debt for $EPD has gone down from 5.8% to 4.4%.

All in all, the debt is consequential while not being worrying.

Half of $EPD debt is due in >30 years, and 83% of the total debt is due in <10.

The average cost of debt for $EPD has gone down from 5.8% to 4.4%.

All in all, the debt is consequential while not being worrying.

20/ Risks📉

By being a central piece of the US energy infrastructure, $EPD is at the center of the storm about global warming and ESG.

Here are the main risks:

Stricter energy policy from government

Carbon taxes

Price depression simply due to industry

Operational disaster

By being a central piece of the US energy infrastructure, $EPD is at the center of the storm about global warming and ESG.

Here are the main risks:

Stricter energy policy from government

Carbon taxes

Price depression simply due to industry

Operational disaster

21/ Valuation 📈

FCF has increased at the astonishing level of 28% in the last 10 years.

I took an “only” 10% growth rate and still get an intrinsic value of $26, to compare to the current $22.

FCF has increased at the astonishing level of 28% in the last 10 years.

I took an “only” 10% growth rate and still get an intrinsic value of $26, to compare to the current $22.

22/ By this metric, $EPD is undervalued.

I think this is likely considering how out of favor the whole sector is.

This also explains why #WarrenBuffett was so interested in large acquisitions in the sector.

I think this is likely considering how out of favor the whole sector is.

This also explains why #WarrenBuffett was so interested in large acquisitions in the sector.

23/As a business, I think $EPD offers great value and probably has a good future prospect.

But if the political or judicial landscape changes quicker than expected, I might have to reconsider it.

Just keep that in mind if you decide to invest in $EPD.

But if the political or judicial landscape changes quicker than expected, I might have to reconsider it.

Just keep that in mind if you decide to invest in $EPD.

24/ Tagging those interested in $EPD research.

@LynAldenContact

@DivCultivator

@BusinessFamous

#valueinvesting #oil #dividends #valuestocks #fintwit

@LynAldenContact

@DivCultivator

@BusinessFamous

#valueinvesting #oil #dividends #valuestocks #fintwit

Is $EPD a buy? Let me know what you think!

• • •

Missing some Tweet in this thread? You can try to

force a refresh