1/7

Got a few DMs I'd like to address as a thread here.

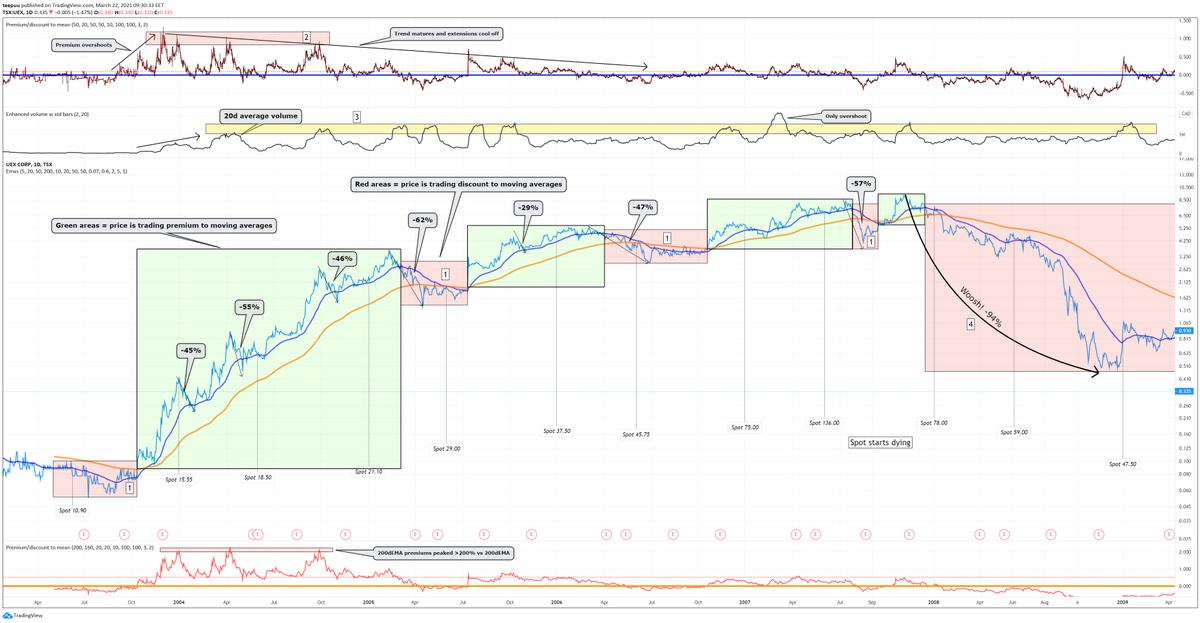

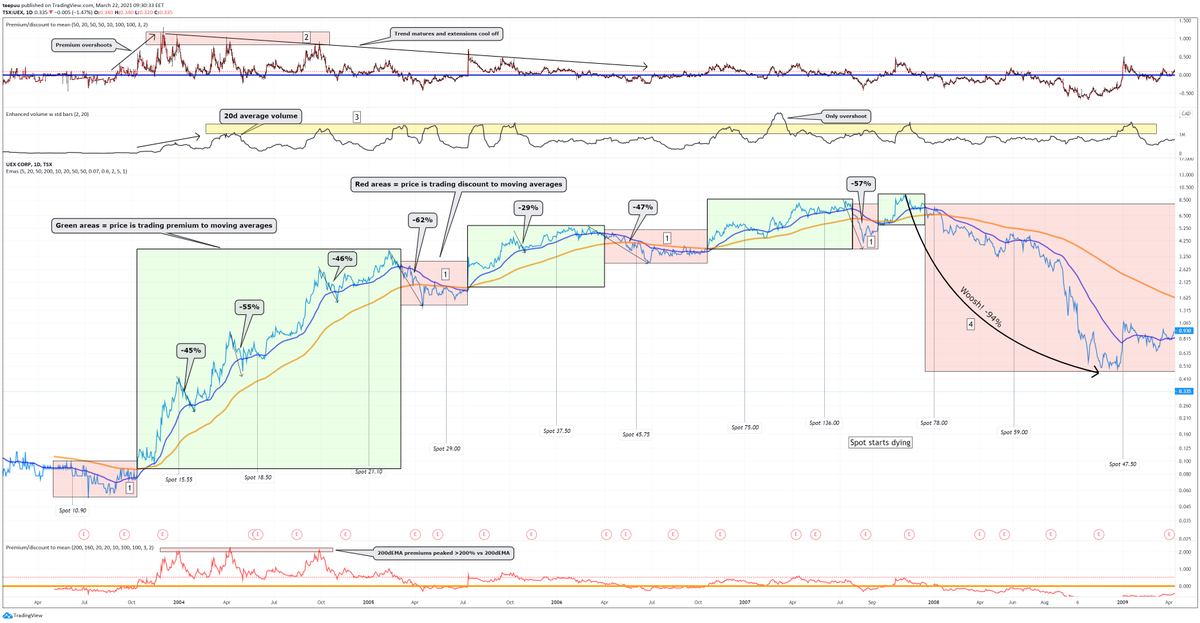

Recent ~30% selloff shaved the valuation base to an average of ~60$/lb. pricing for #uranium equities on average from the +65$/lb pricing. Same kind of shave from here would bring majority to value with the spot.

Got a few DMs I'd like to address as a thread here.

Recent ~30% selloff shaved the valuation base to an average of ~60$/lb. pricing for #uranium equities on average from the +65$/lb pricing. Same kind of shave from here would bring majority to value with the spot.

2/7

Now, it looks obvious that market is anticipating SPUT to buy lbs and thus put pressure on rising the spot. If it doesn't, like soon, the overvaluation on equities continue to level down. Euphoria needs to be fed.

Now, it looks obvious that market is anticipating SPUT to buy lbs and thus put pressure on rising the spot. If it doesn't, like soon, the overvaluation on equities continue to level down. Euphoria needs to be fed.

3/7

SPUT is the flick of the switch here. Broad market direction either dampens or accelerates the following movement.

SPUT is the flick of the switch here. Broad market direction either dampens or accelerates the following movement.

4/7

So basically two scenarios make the next short term scene for uranium sector.

Scenario 1: Sput continues to buy.

The lows are in for equities and recent highs are met swiftly. Equities move on valuing 65-70$/lb pricing.

So basically two scenarios make the next short term scene for uranium sector.

Scenario 1: Sput continues to buy.

The lows are in for equities and recent highs are met swiftly. Equities move on valuing 65-70$/lb pricing.

5/7

Scenario 2: Sput stays put or goes to discount

Today is just going to be a relief rally day in a correction, expected to be 40-50% from highs.

Scenario 2: Sput stays put or goes to discount

Today is just going to be a relief rally day in a correction, expected to be 40-50% from highs.

6/7

Uranium sector is turning into a hot one. Emotion driven decisions make movements more exaggerated. Certain market participants also come in play, providing liquidity, but also making certain events like breakouts or breakdowns more meaningful.

Uranium sector is turning into a hot one. Emotion driven decisions make movements more exaggerated. Certain market participants also come in play, providing liquidity, but also making certain events like breakouts or breakdowns more meaningful.

7/7

I'll probably be a buyer, either one of the scenarios happen, but for me, personally, I keep my lower bids on and see what happens.

I'll probably be a buyer, either one of the scenarios happen, but for me, personally, I keep my lower bids on and see what happens.

• • •

Missing some Tweet in this thread? You can try to

force a refresh