Now there is almost no production which naturally affects how we should compare the market caps of different eras. The cash flow from #uranium mining itself is almost null. Also, many equities have retraced 20% or more from the peak market valuation already, which has brought...

https://twitter.com/UraniumTrends/status/1439283890296745986

...the market valuation closer to the realized spot price.

Market cap of the sector also reacts in a shape of an S-curve rather than linear line, as the economics of the projects get significantly better at a certain price range. The exponential part of the journey is still...

Market cap of the sector also reacts in a shape of an S-curve rather than linear line, as the economics of the projects get significantly better at a certain price range. The exponential part of the journey is still...

...ahead of us, which seems unbelievable at this point where we can see ten multiples of revaluation in some of the equities already. Which is exactly why #uranium is THE investment opportunity of a life time.

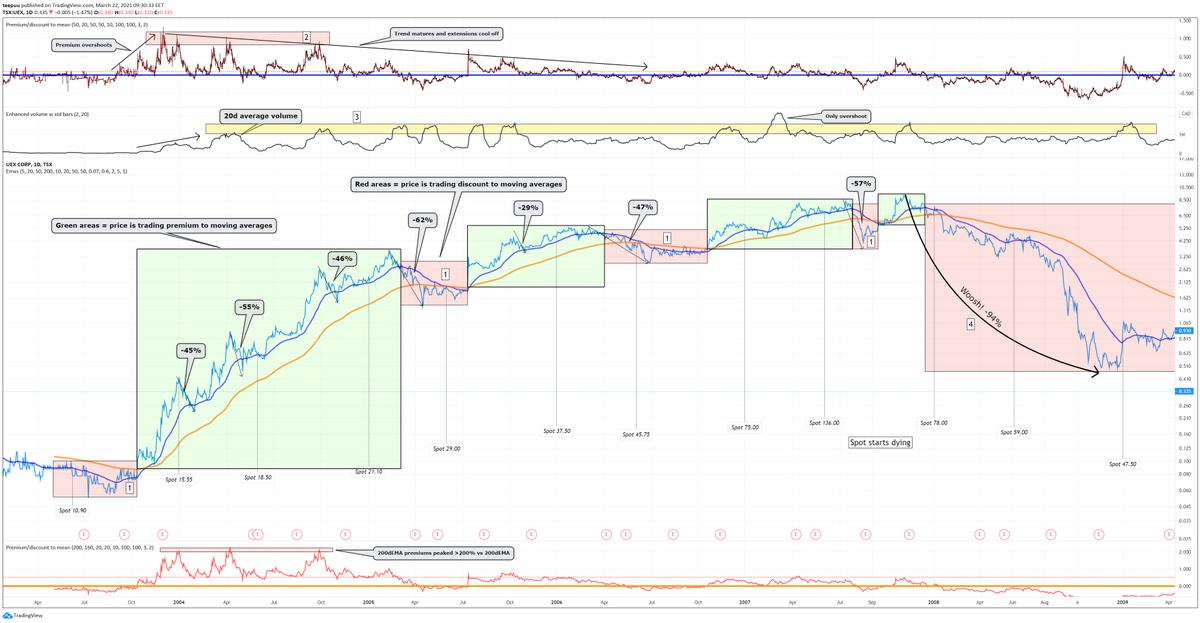

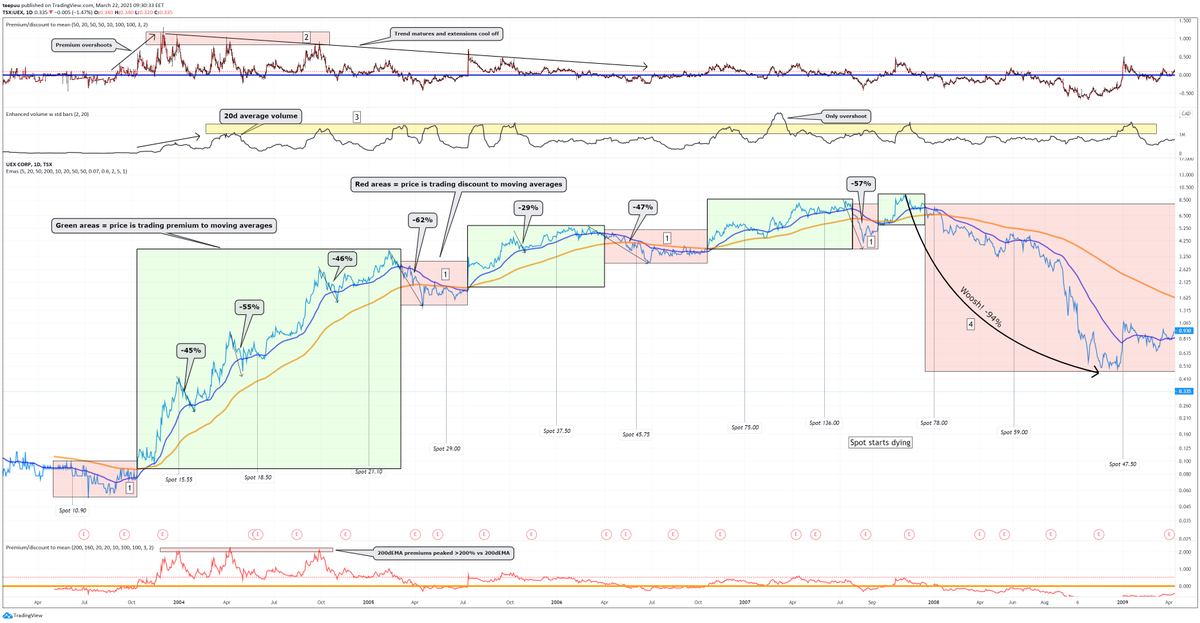

It is reasonable to assume that market values these equities by oscillating between discount and premium to their intrisic value. In a strong bull market, a discount is hard to find as the expectations are very high towards higher prices.

Comparing the NPV and the market cap of a project is very tricky, as if one understands how NPV works, there are serious effects for time and discount rate to NPV. Everyone wants return for the investment aswell, thus target MC < NPV at a given $/lb.

I tend to agree with @BULLReturns that equities have got ahead of the spot price and have now retraced some of the premium. Will it continue? It might or this was it for now. There is no certainty for things that haven't happened yet.

From the peak premium I'd say a 30% pull down could be expected, and if the reverse exaggerates itself, the valuations could push into the discount.

• • •

Missing some Tweet in this thread? You can try to

force a refresh